Chile was the pioneer country to deregulate and privatize the electricity industry after the enactment of the electricity law in 1982. The Chilean electricity market was restructured in generation and distribution utilities that were successfully privatized by the end of the 1980s. Market and transmission system operator Centro de Despacho Económico de Carga (CDEC) was created in 1985. Now, more than 30 years later, the Chilean electricity industry must balance the security of supply, economic efficiency and sustainability.

Chilean Electricity System

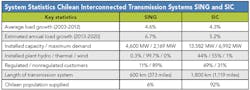

Chile is a long and narrow country — 4,300 km (2,672 miles) in length — located along a coastal strip in South America. It has two main transmission systems: the northern interconnected system (SING) and the central interconnected system (SIC). The SIC electricity generation matrix is composed of large hydro and thermoelectric power plants, mainly coal-fired and liquefied natural gas (LNG). SING is almost 100% thermoelectric, with coal-fired, LNG and diesel power plants. The demand for electrical energy is expected to continually increase along with the economic growth in Chile.

The transmission systems SING and SIC are not electrically interconnected, so CDEC has two control systems: CDEC-SING and CDEC-SIC.

The demand forecast from 2013 to 2020 corresponds to the projections established by the Chilean energy regulatory entity, Comision Nacional de Energia (CNE). The most significant change in the evolution of energy sources employed for generation in SIC and SING was the introduction of Argentinian natural gas between 1997 and 2005, which later had to be substituted by LNG in 2008 because of shortages in the Argentinian export volumes after an energy price crisis in the country.

Renewable Energy Plants

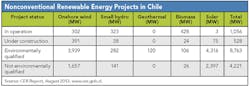

The Chilean electricity law was modified in 2008 to foster the integration of nonconventional renewable energy (NCRE) into the electricity market. This law defines NCRE as the generation produced by nonconventional sources connected to the grid, such as wind, solar, geothermal, biomass, tidal and small hydro plants up to 20 MW. The law requires power suppliers to certify that at least 5% of electricity traded in new contracts every month — from 2010 to 2014 — comes from renewable energy sources, either self-produced or bought from other producers. From 2015 onward, the requirement was supposed to increase by 0.5% annually until 10% in 2024. However, on Oct. 22, 2013, Chile doubled its renewable energy target to 20% by 2025, as published in the Official Gazette after its approval in the national congress. Now utilities must get 20% of their power from renewable sources by 2025.

Of the NCRE generation projects included in the national environmental impact evaluation system, wind power presents the highest penetration when compared with renewable energy projects arising from small hydro, geothermal and biomass plants. The capacity of the projected wind energy plants will significantly increase the need to expand the existing capacity of the transmission grid. However, energy contribution from wind power plants will be low because of the expected plant factor (around 25% to 30%).

Impact of Renewables

The planning and expansion of the main transmission system is a cooperative regulated scheme that includes the participation of all electricity market agents. A trunk transmission study is undertaken every four years, which includes the development of a planning study to determine a preferential expansion plan with the transmission projects to be initiated in the following four years.

Annually, CDEC revises the transmission expansion plan according to current market conditions, particularly demand and effective generation development. CDEC recommends the corresponding transmission projects to CNE. Tendering of the proposed projects has to start within 12 months.

To date, connection of the majority of existing onshore wind farms has been through overhead line links to the existing 220-kV transmission system. The only exception was the need to construct a 220-kV sectioning substation to accommodate the interconnection of two wind farm projects.

In Chile, a natural barrier for entry of new generation utilities exists because of the long and radial design characteristics of the transmission system. It was developed and adapted economically for conventional generation plants to satisfy local demand. However, in the northern territory of SIC, the high wind power potential will push the need for expansion of the existing transmission system. Up until 2012, the wind power capacity installed and in operation totaled 302 MW. In the SING territory, the high solar potential concentrated in the Atacama Desert currently totals 75 MW under construction.

The intermittency of NCRE is another issue that requires consideration, as the daily dispatch and generation reserves criteria require revision by the CDEC. On the monthly and weekly energy storage framework, SIC has preferential rights because of the amount of hydro reservoirs that provide an existing energy storage capability. There are long distances — greater than 700 km (435 miles) — between the wind farms located in the north and the hydro reservoirs located in the south, but the development of a transmission system with increased load transfer capacity should allow for the use of this beneficial renewable energy supply.

New wind farms and mini-hydro plants can be constructed within 24 months of obtaining approval of the environmental impact study, but, currently, the development of a new transmission line requires at least 60 months. The construction of new transmission lines is subjected to high risks such as landowner opposition, long legal assessments and fierce opposition from local communities due to environmental concerns, all of which have a negative impact on the commissioning date.

Main Regulatory Challenges

Several regulatory topics must be reviewed to ensure economic development of the existing transmission systems required for the continual integration of conventional and renewable generation facilities. The main issue requiring revision is the anticipation of defining new transmission projects to facilitate competition and interconnection of new power plants and large customers. An issue of debate is the responsibility of the state in facilitating easement strips, currently under private negotiations, for new transmission lines that should be evaluated and negotiated several years ahead in anticipation of the tendering process.

Another issue is the design of new transmission assets. For example, the economic evaluation of a new transmission line with two tower options includes either a single-circuit line today and another single line constructed in the future, or a double-circuit line today with only one circuit constructed and the second overhead line conductor circuit constructed in the future. On transmission systems that have such demand growth as in Chile, the economic evaluation based on present values concludes the double-circuit option would be best.

However, for generators, the transmission tolls will be higher in the short term because of the higher cost of a double-circuit line compared to a single-circuit line. This paradox has meant a lot of discussion and opposition from generators to new transmission lines, although, for sustainable development, it is essential to minimize the number of new corridors, especially in a narrow country like Chile.

In a competitive generation market, projects may change or be postponed, or new ones may arise in a short period of time, requiring flexible planning methods to decide new transmission system expansions. This flexibility results in incremental solutions to satisfy the generation market, but it does not represent the most efficient options in the long term. A way forward may be to adopt new and smart network technologies:

• Upgrading transmission lines, increasing the distance to ground of existing overhead lines or replacing them with high-capacity cables

• Grid dynamic rating to optimize the use of transmission lines under different ambient temperatures and wind velocity

• Fast voltage support through flexible AC transmission system (FACTS) devices, like static volt-ampere reactive compensators (SVCs) or static synchronous compensators (STATCOMs), installed in the SIC in recent years.

Looking Forward

Difficulties to build up new transmission installations require changes in regulatory involvement to anticipate transmission investment decisions as a way to provide certainty to new entrants, particularly renewable energy. This is a big issue for the transmission systems that have been developed and adapted to generation and demand requirements, as the Chilean operators now face challenges to comply with security of supply criteria and establish adequate load-transfer capacity to accommodate renewable energy projects.

Juan C. Araneda ([email protected]) is the system development manager at Transelec. He has worked in the Chilean electricity sector for 29 years for generation, transmission and distribution utilities, focusing on regulatory and planning issues. Araneda is an electrical engineer with a postgraduate degree from Manchester University in the UK. He is also a member of CIGRÉ and a senior member of IEEE.

Raúl Valpuesta ([email protected]) is the deputy regulation manager at Transelec. He has worked in the Chilean electricity sector for 36 years, focusing on regulatory and commercial issues. Valpuesta is an electrical engineer with a MBA degree and is a member of CIGRÉ.

Companies mentioned:

Centro de Despacho Económico de Carga | www.cdec.cl

Comision Nacional de Energia | www.cne.cl

Transelec | www.transelec.cl