During the last newsletter, we covered the top six utility investors in transmission based on their in-service transmission additions during the three-year window from 2013-15. This article overviews the next five companies in the sequence. Pacific Gas and Electric ($2.4billion), Fortis’s ITC Holdings ($2.3 billion), Eversource ($2.1 billion), Duke Energy ($2.0 billion) and Southern Company ($1.9 billion) reported transmission in service additions totaling $10.7 billion during the three-year period. Based on earnings reports and shareholder presentations, the companies are planning to continue their investment in both new and needed upgrades to their transmission infrastructure.

Pacific Gas & Electric outlined at its May 2, 2017 earnings presentation its planned Capex forecast, which roughly calls for $1.0bn to $1.1 billion in spend for electric transmission from 2017 through 2019. In 2016, PG&E reported transmission in-service investments valued at $1.06 billion had started operation. Of that total, $534.6 million was for station equipment, $262 million for towers, poles and fixtures including overhead conductors and devices and $179 million for underground related infrastructure. Some of the new projects PG&E is promoting include the Central California Power Connect, a roughly 70 to 100 mile, 230 kV line that involves a new substation near Santa Maria, California. The project also involves a new 115-kV line. Currently the project has been delayed pending CPUC review.

Pacific Gas & Electric Capital Investment Forecast

Fortis Inc. presented first quarter 2017 earnings on May 2, 2017. The presentation highlighted its newly acquired independent transmission company ITC Holdings' plan to invest $958 million this year and $3.0 billion to $4.0 billion over the next five years. Fortis completed the ITC acquisition on Oct. 14, 2016, at a cost of $11.8 billion. ITC is the nation’s largest regulated independent transmission company. The company has projects in seven states and since its formation in 1999, has invested more than $6.2 billion in transmission projects.

The ITC investment forecast is part of an overall capital spending plan by Fortis expected to top $13 billion over the next five years. Fortis’s report cited progress on major capital projects including ITC’s multi-value regional projects and a conversion of several 34.5-kV to 69-kV projects. Also, subject to meeting milestones, ITC is moving along nicely with the 1,100 MW bi-directional 320-kV HVDC underwater Lake Erie Connecter project. The project is expected to be operational in late 2020.

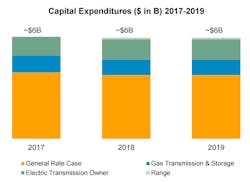

Fortis Capital Expenditures

According to the Eversource Energy May, 21-22 presentation at the AGA Financial Forum, overall investment in transmission over the next four years is expected to be a robust $3.9 billion. According to the report, Eversource invested $897 million in 2016 – most on reliability projects and new substations and associated lines in the Boston area. Eversource’s largest planned project is Northern Pass, a $1.6 billion HVDC line with associated terminals and AC facilities. The international project when complete will span over 190 miles from Quebec to New Hampshire. Evidentiary hearings are scheduled between now and early August with a New Hampshire Site and Evaluation Committee decision by Sept. 30 of this year. If the project is given the go ahead, most of the projects investment will happen in 2018-19 period. Eversource is bullish on transmission investment resulting in higher earnings and expects it to become a growing share of their rate base. In 2016, transmission accounted for 36% of the estimated $15.7 billion rate base. By 2020, transmission is forecast to account for 42% of the $19.7 billion rate base.

Eversource Energy’s Robust Capital Plan Supports 5% to 7% EPS Growth

According to Duke Energy’s fourth quarter earnings review on Feb. 17, 2017, transmission capital investment is forecast at $3.58 billon during the five-year period from 2017-21. Actual spend in 2016 was $641 millio with investment over the next two years forecast at $725 million per year. Given the overall size and market reach of Duke Energy, with 7.5 million customers spread over six southeastern and Midwestern states, transmission investment during the period accounts for only 12.1% of its electric utility infrastructure growth capital budget. In contrast, Duke plans to spend $13.3 billion on distribution projects and $8.3 billion on generation projects during the five-year period.

The breakdown in transmission spend over the next five years for Duke’s subsidiary companies is as follows; Duke Energy Carolinas ($325M), Duke Energy Progress ($350M), Duke Energy Florida ($1.25bn), Duke Energy Indiana ($800M) and Duke Energy OH/KY ($600M). In a company news release on April 12, 2017, Duke outlined a 10-year initiative to strengthen North Carolina’s energy grid at a cost of $13bn. The project is called Power/Forward Carolinas and is expected to strengthen the grid against storms, cyber threats and help expand renewable energy in the state.

Duke Energy Capital Expenditures

During their Q4 2016 earnings call, Southern Company provided insight into their plan to spend $3.8 billion on electric transmission over the next five years –12.9% of its total capital budget of $22.5 billion during the period. Development of new transmission infrastructure accounts for only $900 million while maintenance accounts for $2.9 billion.

Southern’s ongoing larger projects include the Plant Vogtle Network Improvement Project which is approximately 50 miles of new single circuit 500-kV between the Vogtle and Thomson substations. The project is expected to be energized later this year at an estimated cost of $133 million. The Tuscaloosa Area Solution involves several stretches of new single circuit 115-kV and 230-kV line and new substations in the Tuscaloosa area. The project’s planned operational date is the summer of 2019, at an estimated cost of $119 million.