Arguably, the key transformational trend in the power industry over the last decade has been the integration of distributed generation (DG) in transmission and distribution grids. DG proliferation is impacting planning, engineering, operations, business, regulatory and policy aspects of transmission and distribution grids, and is leading to numerous paradigm shifts.

The industry has experienced significant developments in the area of DG over the last 10 years, and several emerging trends are now shaping transmission and distribution grids.

Early Photovoltaic

The proliferation of DG technologies, particularly photovoltaic (PV) systems on distribution grids, was initially approached by electric utilities only from an engineering analysis standpoint, with an emphasis on identifying localized impacts of utility-scale facilities on feeders and substations. In this early stage, the industry focused on the distribution grid because it had not been designed to integrate generation facilities, and in this regard, DG represented a special and challenging case to address.

Transmission grids, on the other hand, had been designed to accommodate large generation units; therefore, DG integration did not represent a challenge, given the relatively small installed capacity of these facilities when compared to traditional centralized generation.

The initial DG integration studies on distribution grids, many of them conducted eight to 10 years ago, helped to identify limitations in modeling and simulation methodologies as well as software tools, and enabled the industry to determine typical solutions that could be included in a portfolio of mitigation measures to facilitate integration of utility-scale facilities (installed capacity on the order of a few megawatts). Some of the needs identified at the time included going beyond performing steady-state snapshot analyses (for a few specific system loading and DG output conditions) and, instead, evaluating a wide variety of operating conditions, which led to the introduction of time-series analyses.

Furthermore, the industry concluded there was a vital need to study the impact of dynamic and transient phenomena to understand how DG output variability and islanding could affect distribution grid planning and operations. This represented an important challenge from two perspectives. First, utilities did not have enough resources with the required training to conduct this type of specialized studies. And second, most commercial modeling and simulation tools typically used in distribution planning and engineering activities did not have the capabilities to perform this type of analyses.

As a result, the first wave of enhancements to methodologies and software tools was focused on facilitating this type of engineering analyses. It is worth noting these studies approached the subject from a deterministic perspective (that is, DG impact studies at known feeder and substation locations). During this first stage, interest was largely in utility-scale facilities, while small DG, such as residential PV, received little to no attention because its individual relative size (a few kilowatts) did not represent an important problem for distribution grids.

Aggregation Matters

As DG continued proliferating, utilities started paying more attention to the cumulative effect of small-scale DG. While it is true a few residential PV plants do not represent a problem for distribution feeders, the aggregated effect of hundreds or thousands of units could create problems that need to be studied. This need led to the introduction of a second wave of methodological improvements and software tools.

The second wave of improvements included the concept of hosting capacity, that is, the maximum DG capacity that can be integrated into a distribution feeder or substation without causing major deterioration of operation conditions and without the need for major infrastructure improvements. This wave also focused on the industry’s need to move beyond deterministic studies and conduct probabilistic analyses to consider the uncertainty about the future location of residential DG units, which is mostly unknown and difficult to predict with accuracy.

Among others, the need for conducting hosting capacity studies and being able to study a variety of locations and penetration levels led to the introduction or enhancement of scripting capabilities in software tools. These scripting capabilities provided the ability to code instructions and routines using a well-known programming language such as Python or Visual Basic, and to perform hundreds or thousands of analyses of interest such as power flow and short-circuit calculations.

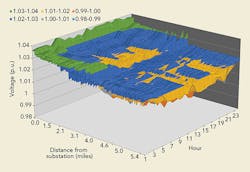

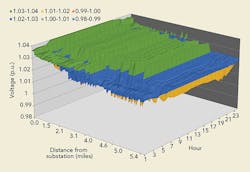

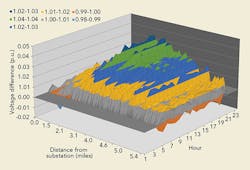

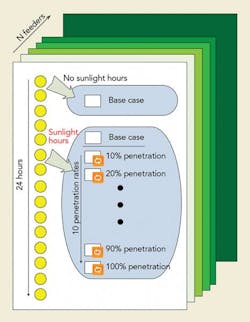

This methodology enabled utilities to evaluate the impacts of residential PV proliferation on distribution feeders by simulating a variety of PV penetration scenarios for a group of feeders for each hour of selected days of interest. The spatial distribution of PV plants along the feeder could be evaluated a statistically significant number of times for each penetration level.

Impacts and Benefits

The aforementioned methodology and software tool improvements are notable and significantly facilitated the industry’s ability to perform DG integration studies. However, some challenges remain today, such as being able to use the same type of computational models for conducting all studies of interest: steady state, time series, dynamic, transient and protection. Currently, some of these studies require using different software tools and building duplicate models. This is an important limitation most North American distribution software developers still need to focus on, but already has been addressed by some of their European counterparts.

The next stage in the DG evolution is growing interest from utilities, regulators and the industry at large in updating processes, standards and overall distribution practices to consider the impacts and potential benefits derived from DG adoption. Moreover, transmission system operators have started to pay attention to the aggregated effect of DG proliferation in distribution grids, previously mostly negligible from a bulk power system point of view. This has led to growing interest in DG being part of a utility’s portfolio of solutions to address transmission and distribution planning needs.

For instance, as requested by state law Assembly Bill 327, the California Public Utilities Commission (CPUC) requested the state’s investor-owned utilities to file distribution resource plans by July 1, 2015, that explain how distributed energy resources (DERs), including DG, are proposed to be used in daily operations and long-range distribution grid and investment plans.

AB 327 defines DERs as “distributed renewable generation resources, energy efficiency, energy storage, electric vehicles and demand-response technologies.” This is leading to the development and introduction of new methodologies and tools to address aspects such as spatial load forecasting and distribution locational marginal pricing.

Standards and Policies

On the standards side, IEEE has been leading the review and expansion of the IEEE 1547 Standard for Interconnecting Distributed Resources with Electric Power Systems, which is used as an engineering reference by several U.S. states and countries around the world. The significant changes in technology, DG proliferation and utility practices urged a revision and update of the standard to address aspects such as distribution voltage regulation and control, smart inverter functionalities and provision of ancillary services using DG.

On the transmission side, the aggregated effect from distribution-level DG has started to become more noticeable and to draw attention from system operators. Perhaps the most well-known example is the effect the infamous “duck curve” is forecasted to have on the grid operated by the California Independent System Operator. This has led to growing interest in studies to address how proliferation of renewables in distribution grids could affect transmission system operations and planning, which in turn has prompted the development and introduction of new techniques to aggregate distribution-level DERs and account for the effects of output variability.

One of the most recent and ongoing stages of this evolution is the significant interest in business, regulatory and policy aspects to incorporate DG pricing adequately, particularly PV, into electricity rate design and existing net energy metering (NEM) programs. The proposals in this area are diverse and, at their core, aim to ensure utilities recover investments required to build, maintain and operate the grid while providing fair pricing to customers and distribution-level DERs. This includes several proposals:

• Review existing NEM rules. During Q3 2015, 19 states — including Massachusetts, New Hampshire, New Jersey and New York, among others — were considering changes and clarifications to NEM rules. Some of the most important developments in 2015 occurred in this area, including the Hawaii PUC’s decision to close Hawaiian Electric Co.’s NEM program to new participants and the introduction of two new tariffs: a grid-supply option and a self-supply option. Lastly, on Jan. 28, 2016, CPUC voted to adopt the proposed NEM successor tariff, known as NEM 2.0, which includes two substantive changes: defining non-bypassable charges (NBCs) and removing incentives for disadvantaged communities. It is expected the NBC leads to reducing the value of energy exported to the grid by approximately 2 cents/kWh to 3 cents/kWh.

• Introduce fixed charges and demand chargers. Fixed charges, in particular, received significant attention in 2015, with 26 open dockets in 18 states — including Missouri, Kansas, Arizona and Wisconsin, among others. States discussing residential demand charges include Arizona, California, Kansas, Oklahoma and Texas. A key development in these last two areas was the Nevada PUC’s decision to establish new NEM rules as contemplated by Senate Bill 374. Over five years, the basic service charge will grow in gradual increments; each one will be accompanied by a related decrease in the energy charge. At the same time, the credit for energy delivered by NEM customers will decrease.

• Determine the “Value of Solar” (VOS). During Q3 2015, 12 states published, proposed or had ongoing regulatory discussions on the proper value of DG. An example of this initiative is a comprehensive study conducted for the Maine Legislature, which looked at 13 cost-benefit factors in five categories, including avoided market costs (avoided energy cost, avoided generation capacity cost, avoided residential generation capacity cost, avoided natural gas pipeline cost, solar integration cost, avoided transmission capacity cost, avoided distribution capacity cost and voltage regulation). The last five are societal benefits or externalized factors, including net social cost of carbon, net social cost of sulfur dioxide, net social cost of nitrogen oxides, market price response and avoided fuel price uncertainty.

• Address solar ownership aspects. Third-party ownership financing of PV was responsible for 72% of all installations in 2014; however, this practice is either not allowed or its legality is unclear in close to 25 states. Delaware, New Hampshire and North Carolina engaged in discussions regarding third-party ownership. An additional trend included efforts from utilities in New York, Georgia, Arizona, Texas and North Carolina to own and operate PV plants. These efforts include operation through unregulated partners and through pilot programs to own solar arrays installed on their customers’ roofs.

Proliferation

Finally, on the emerging trends side, much of the attention has been devoted to two areas: the introduction of new concepts and technologies based on the use of DG and DERs in general, such as microgrids, and the development of new business models that enable customers, utilities and the industry to take advantage of the potential benefits of DERs.

For instance, on the microgrids side, San Diego Gas & Electric implemented a pilot in Borrego Springs, California, that was used successfully several times to provide service to customers during a variety of conditions — including planned maintenance and contingencies (windstorm, flash flood and intense thunderstorms) — for more than 20 hours in the latter case.

Commonwealth Edison was awarded two U.S. Department of Energy grants for $1.2 million and $4 million to develop and test a microgrid controller as well as to build a microgrid in the Bronzeville area of its service territory. Moreover, it has requested funding from the Illinois Legislature to deploy six microgrids to enhance resiliency and provide service to critical customers, including the Chicago Rockford International Airport.

PV proliferation is expected to continue, particularly considering the recent extension of the Investment Tax Credit program, and the historical data and forecasts, which indicate technology prices are projected to continue decreasing. Eventually, this will enable PV to achieve grid parity. In this scenario, concerns regarding the potential for customer load and grid defection have prompted growing interest in new business models that enable utilities to diversify and provide additional services beyond kilowatt-hour sales.

This includes discussions regarding the introduction of the distribution system operator concept and the creation of distribution markets, where prosumers and merchant DER can engage in physical and financial transactions. One of the key proposals in this regard is New York’s Reforming the Energy Vision initiative. Related proposals to redefine the role of DERs are being discussed in California and Texas.

As distribution systems evolve and DG becomes an intrinsic, if not essential, component of modern transmission and distribution grids, the aforementioned challenges are expected to be addressed gradually, and new and likely more complex issues are expected to emerge.

Ensuring the reliable, secure and economic operation of future dynamic and active transmission and distribution grids will require not only technology and engineering solutions, but most importantly, regulatory, policy and business compromises that recognize the pros and cons of adopting new technologies, while providing customers and utilities with attractive business opportunities. This in itself is arguably one of the most complex and challenging problems the industry has faced in the last decades, making it fertile ground for needed innovative proposals and solutions.

Julio Romero Aguero is vice president and executive advisor of strategy and business Innovation for Quanta Technology.