This past year has been an exciting time for the commercialization of drone technology. These amazing unmanned flying cyber-physical systems are making their presence known far and wide, and that has to be good for utilities everywhere.

The popularity of drone utilization has been driven by a relaxation of regulatory restrictions and the combination of maturing payload technologies intermixed with falling drone prices. This has fueled a growing demand for aerial imagery, remote sensing and the unique data that can only be generated from drones, or unmanned aircraft systems (UASs). Accordingly, the interest of electric utilities has grown dramatically, and the number of UAS startup service providers offering drones-as-a-service applications has increased, as well.

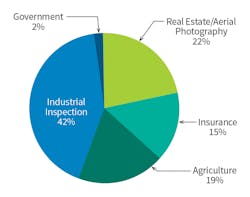

The most popular UAS applications have been for inspection, mapping and surveying. The research firm KPCB (Kleiner Perkins Caufield Byers) reports that, globally, the U.S. is the largest marketplace for drones, accounting for about 35% of the market. The European Union (EU) is in second place with roughly 30% of the market, followed by China with 15% and the rest of the world making up the remainder.

Commoditization

The use of drones for delivery of merchandise may skew future percentages, but as drone market strategies develop, it looks like an exciting — if not turbulent — ride.

- Amazon has partnered with the British government to run tests exploring the viability of small-package delivery by UASs. Amazon’s first delivery order via a drone was on Dec. 7, 2016, near Cambridge, England.

- Dominos is already delivering pizza via drones in New Zealand.

- On Dec. 20, 2016, Flirtey announced it had completed the first month of routine commercial drone deliveries with 77 autonomous drone deliveries to homes in the U.S. for 7-Eleven.

- DHL made 130 UAS deliveries in the first three months of 2016 to two small villages in the Swiss Alps.

- CNN reported that in October 2016, a Silicon Valley drone startup named Zipline launched the world’s first commercial regular drone delivery service across rural western Rwanda. It is a beyond-visual-line-of-sight (BVLOS) autonomous drone system that drops medical supplies via parachute in remote areas without roads. The use of a parachute allows the drone to fly round-trip without landing.

Drone delivery systems may sound fanciful, but the technology is proven and available. Commercialization of drones has proven to be a melting pot of technologies that has moved UASs from a curious niche contrivance to a mainstream business category with rich economic potential. A Goldman Sachs analysis released in early 2016 predicts drones will present a $100 billion market opportunity over the next five years. And India’s RNR Market Research estimates drones will be a $37 billion annual global business in the next six years.

Supporting these projections, the Federal Aviation Administration (FAA) expects sales of commercial drones to grow from the approximate 600,000 sold in 2016 to about 2.7 million by 2020. Using them for beneficial purposes helps reduce the image problems they have been operating under, which improves acceptance. According to Black & Veatch’s 2016 Strategic Directions: Smart City/Smart Utility Report, more than 60% of survey participants view drones as providing value for their construction, maintenance and operating programs.

The Odds Are with the Users

With companies such as Amazon, DHL and Zipline pushing the envelope, regulatory agencies are feeling a great deal of positive pressure. As a result, the regulation process for commercial UAS applications is slowly moving toward being more streamlined and user-friendly for utilities in the U.S.

Initially, the FAA took the position that, for all intents and purposes, the continental U.S. was a no-fly zone for any type of drone vehicle and application, and it aggregated all civilian use of drones into one category. This began to fall apart when commercial users took the FAA to court, and the court ruled that the FAA had overstepped its authority. The FAA didn’t let go easily, but began issuing exemptions under Section 333 of the FAA Modernization and Reform Act of 2012 to allow for more commercial applications.

By the end of September 2016, the FAA had granted 5551 Section 333 petitions, but there’s more. In August 2016, the FAA offered an option known as Part 107 (the Small UAS Rule), which provides the first national uniform regulations for commercial operation of UASs weighing less than 55 pounds. Part 107 has a lot of restrictions, with the biggest issue being that it still does not allow for BVLOS flights. Additionally, all UAS flights must be performed during daylight hours, and there are several other key points restricting commercial drones.

Part 107 makes a lot of sense, and there are other revisions in the regulatory pipeline. Interestingly, the EU has been used as an example for how to integrate drones into commercial applications by many U.S. businesses working for a more user-friendly commercial drone marketplace. The FAA anticipates its hassle-free regulations could generate more than $82 billion for the U.S. economy and create more than 100,000 new jobs over the next 10 years.

Industry Interest

In Europe, the SESAR (Single European Sky ATM Research) European Drones Outlook Study reported, “The growing drone marketplace shows significant potential with European demand suggestive of a valuation in excess of 10 billion euros annually, in nominal terms, by 2035 and over 15 billion euros annually by 2050.”

The study also stated, “The drone market has started bringing significant benefits all over Europe, and the continuation of that growth appears to be a matter of not if, but when. Europe has the opportunity to obtain a significant role in this rapidly evolving global marketplace.”

GE has expressed its interest in the use of drones for maintaining energy infrastructure. GE provides hardware and software compatible with UAS platforms to make it easier for utilities dealing with massive amounts of data produced by drone surveys. And Siemens is also investing in inspection systems using drones with 3-D image analysis to monitor critical distribution circuits.

Burns & McDonnell was one of the first architectural engineering firms to receive certification from the FAA and Transport Canada to fly drones commercially in both the U.S. and Canada. The firm has been so successful using drones that it is increasing its investment in its UAS fleet used for transmission line construction data gathering in rough terrain.

Drone Testing

Although the number of authorized drone operators is growing, EPRI warns more research is needed. EPRI began testing UAS platforms and sensor devices several years ago to determine exactly what UASs are capable of doing and what limitations need to be addressed when piloting these devices around energized transmission and distribution facilities.

The first series of tests took place in 2014 at Hydro One’s Kleinburg Training Centre in Toronto, Canada. UAS vendors piloted several different types of UAS platforms around five de-energized transmission towers with intentionally modified defects (missing hardware, worn conductors and chipped insulators). These tests were successful with all the flaws being located quickly.

In 2015, EPRI and its utility partners followed up with a series of evaluations of UAS service providers on one of the New York Power Authority’s 345-kV transmission lines. In 2016, the testing program moved to EPRI’s high-voltage facility in Lenox, Massachusetts, to evaluate UASs working close to energized transmission lines. The tests looked at the effects of arcing, sparking, and electric and magnetic fields on the aircraft’s operation. The EPRI-sponsored investigation determined safe flying distances from energized lines, and evaluated the effectiveness of infrared and UV cameras and other sensors in this environment.

Drone Power

The successful testing combined with an improved regulatory environment has had a huge impact on drones and their applications. Utilities worldwide have initiated programs to enhance their maintenance and operation inspections of the electrical infrastructure making up their transmission and distribution systems.

For example, Pacific Gas & Electric (PG&E) has been working under an FAA exemption to conduct test flights over its Balch Powerhouse in the Sierra Mountains outside of Fresno, California. With more than 100 reservoirs, 65 powerhouses and 16 river basins, PG&E has the largest hydroelectric system of any investor-owned utility in the U.S. Because of the treacherous terrain, the Balch Powerhouse requires employees to use fall-restraint equipment to inspect the facility’s equipment, which is dangerous and time-consuming. However, drones can perform the visual inspections quickly and without safety risks to employees.

Sterlite Power, a leading power transmission company in India, formed a partnership with Sharper Shape to provide drone inspection services for the utility’s assets. The partnership is awaiting approvals from India’s Directorate General of Civil Aviation for large-scale, long-distance flights to inspect Sterlite Power’s transmission system. The partnership also will conduct vegetation management on transmission assets.

Utilities have long been interested in the use of UASs for assessing storm damage to their infrastructure. Recently, PPL Electric Utilities, which serves eastern Pennsylvania, received authorization from the FAA to do just that. PPL was given permission to perform post-storm- related damage assessment to its transmission system when needed. The post-storm-assessment approval will allow PPL to expand the scope of drone activities within the company. The traditional method of determining storm damage involves workers either driving or walking the service area to identify the damage. The use of UAS technology to assess damage to power lines after storms is expected to speed up the repair and recovery process. It is reported that approximately a dozen utility and service companies have also sought permission to use drones for purposes like PPL’s storm-related assessments.

UASs are also finding indoor applications at many utilities. Con Edison in New York City is inspecting the insides of its huge boilers that produce electricity and steam for Manhattan. Westar Energy and Kansas State Polytechnic have also collaborated on a program to inspect boilers. Both companies have found that by using traditional methods of inspection, employees must build scaffolding up to 10 stories high inside the boilers. This requires the use of fall-restraint equipment and requires workers to go through confined-space training. UASs with video and thermal technology speed up the process, increase safety and improve working conditions. The drones also reduce outages, which saves money and resources.

Xcel Energy has been stretching the boundaries for drone applications as the technology matures. In 2016, Xcel announced its latest UAS project in North Dakota. Xcel Energy has formed a team that includes the North Dakota Department of Commerce, Elbit Systems of America, GE Grid Solutions and Waypoint Global Strategies. The team will fly both large-scale and small UASs over Xcel’s transmission system, simulating flights responding to natural disasters that had impacted the infrastructure. Data collected from the flights will be put through advanced data modeling and analysis that could help lead to better damage-assessment estimates and quicker restoration times following a disaster.

Dominion Virginia Power started using UASs full time in August 2015, working with Virginia Tech and HAZON Solutions. In the first year, the drones reportedly flew 144 miles. The flights inspected more than 1200 structures and found six critical issues that were quickly corrected. Dominion has decided to expand the program based on these results. The report said the drones’ activities have been limited by visual-line-of-sight (VLOS) restrictions, but BVLOS is coming, and it will open up many opportunities for improved cost efficiencies.

Drones are performing valuable indoor inspections, relieving personnel from dangerous working conditions that typically require scaffolding and climbing harnesses. Courtesy of UAS Tech.

BVLOS Changes Everything

There is a lot of drama taking place over the adoption of UAS commercial BVLOS flights. VLOS is the norm right now, meaning that the pilot must be able to see the drone at all times while it is in the air. Drone VLOS flights can fly between 400-ft and 1500-ft missions to meet that limitation. A BVLOS flight can travel, on average, about 20 miles, which is subject to the average fuel range of small drones. This basic difference is the largest impediment for economical commercial UAS applications. The good news is that positive pressure is making BVLOS happen today; the bad news is it is happening very slowly.

Early in 2016, Xcel Energy and its partners Environmental Consultants Inc. and FLoT Systems received an FAA Section 333 exemption to fly a drone using BVLOS as part of a research and development project. The partnership surveyed approximately 20 miles of a 69-kV transmission line northwest of Amarillo, Texas. The flight was successful, the data was impressive, and Xcel is planning to increase the scope of its UAS operations. With more than 7000 miles of transmission lines in its Texas-New Mexico service area alone, the UAS is proving to be a valuable tool.

In July 2016, the Empire District Electric in Missouri performed UAS BVLOS testing on 22 miles of one of its 345-kV lines for vegetation management. Empire worked with NM Group (Network Mapping Inc.) and Phoenix Air Unmanned to perform the BVLOS flights using light detection and ranging (LiDAR).

Edison Electric Institute (EEI) members have been experimenting with drones for asset inspection for several years. One function EEI thinks is needed to take full advantage of UAS applications is the ability to fly BVLOS. As a result, EEI and Sharper Shape formed the EEI/Sharper Utility Partnership and have applied for BVLOS flight permission under the new FAA Part 107 rule. The application was filed on Aug. 29, 2016, the day the regulations went into effect. The partnership is currently waiting for the FAA to respond to this waiver request, which will allow EEI member companies to begin wide-scale BVLOS UAS operation within their service territories. Several other companies and organizations are also pursuing BVLOS operations, including Xcel Energy, Montana-Dakota Utilities Co., Minnkota Power Cooperative, Houston Engineering, Northern Plains Railroad and the University of North Dakota.

Drones Are Here to Stay

A great deal has been happening with drones in the past 12 months. The electrical power industry is expanding the use of UASs for high-risk tasks and the drone-as-a-service marketplace. VLOS flights are becoming more common every day for the inspection of transmission towers and power lines. One industry leader said they would not be surprised to see each line truck having a drone as part of its standard tool issue in the future. But for utilities to fully take advantage of UAS technology, they need to be able to operate drones with BVLOS flight capability.

Maintaining the transmission and distribution system is our industry’s top priority. For the electric utility industry, the drone market is in its early stages, but initial uses show amazing results. The technology has the potential to reduce operating and maintenance costs, improve personal safety and increase response times when storms hit. Like it or not, drones are here to stay.

Editor’s note: To see an interesting video on drone testing, visit www.youtube.com/watch?v=pMqDUv2BF9Q).

About the Author

Gene Wolf

Technical Editor

Gene Wolf has been designing and building substations and other high technology facilities for over 32 years. He received his BSEE from Wichita State University. He received his MSEE from New Mexico State University. He is a registered professional engineer in the states of California and New Mexico. He started his career as a substation engineer for Kansas Gas and Electric, retired as the Principal Engineer of Stations for Public Service Company of New Mexico recently, and founded Lone Wolf Engineering, LLC an engineering consulting company.

Gene is widely recognized as a technical leader in the electric power industry. Gene is a fellow of the IEEE. He is the former Chairman of the IEEE PES T&D Committee. He has held the position of the Chairman of the HVDC & FACTS Subcommittee and membership in many T&D working groups. Gene is also active in renewable energy. He sponsored the formation of the “Integration of Renewable Energy into the Transmission & Distribution Grids” subcommittee and the “Intelligent Grid Transmission and Distribution” subcommittee within the Transmission and Distribution committee.