Evergy Cuts Profit Growth Target After Kansas Rate Case Deal

Evergy Inc. executives have lowered the company’s projected earnings growth rate through 2026 on the heels of a disappointing Kansas rate case result and the need to absorb higher interest rates.

Along with reporting Evergy’s third-quarter results Nov. 7, President and CEO David Campbell and his team said they now expect the Kansas City-based utility to grow its adjusted earnings per share by 4% to 6% through 2026, a two-point drop from the range they were forecasting during the summer.

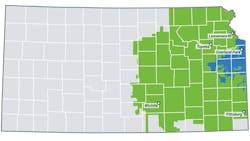

The major driver of that weaker outlook was the rate case settlement Evergy’s leaders and the Kansas Corporation Commission agreed to in late September (and which the regulators are expected to formalize next month). The rate case was the first for Evergy since its 2018 creation from the merger of Westar Energy and KCP&L and calls for revenues from its Kansas Central region to rise $74 million but for its Kansas Metro revenues to drop nearly $33 million.

Speaking to analysts on a conference call, Campbell said the agreement also calls for a 9.4% return on equity for Evergy and noted that its negotiation came after the Corporation Commission took up “a challenging position.” The settlement, he added, means Kansas rate increases have been just 1% since 2017 while peer utilities in nearby states have been able to raise rates by an average of nearly 13%.

As a result of the rate case settlement, Campbell said the Evergy team will need to narrow its capital spending plans somewhat in the Sunflower State. That may end up being at odds with Kansas leaders’ goals to bring more businesses to the state—or it could open the door to conversations about rate mechanisms.

“That backdrop of economic development potential is a positive one to help advance the discussions,” Campbell said. “But there’s no question that we’ve got work to do on the capital structure front and on the insurance that we have the opportunity for competitive returns.”

Evergy’s situation in Kansas stands in stark contrast to Texas, where utility executives showered lawmakers with praise this year for passing a package of bills to reduce regulatory lag. The leadership teams of several companies doing business in the Lone Star state said the measures will let them ramp up investment plans.

Campbell and CFO Kirk Andrews said they will detail Evergy’s capital spending plans for 2024 through 2028 in three months. Three months ago, they expected infrastructure investments from 2023 to 2027 to total $11.6 billion.

Evergy posted a third-quarter net profit of $352 million, down from $428 million in the same period of 2022. Weather-normalized total retail sales fell 0.8% year over year, with residential demand rising 1.1% but industrial falling 5.3% and commercial slipping 0.4%.

Shares of Evergy (Ticker: EVRG) fell nearly 3% to $48.05 Nov. 13 and have lost nearly 6% of their value since Campbell and Andrews reported earnings. The company’s market capitalization is now about $11 billion.

About the Author

Geert De Lombaerde

Senior Editor

A native of Belgium, Geert De Lombaerde has more than two decades of business journalism experience and writes about markets and economic trends for Endeavor Business Media publications T&D World, Healthcare Innovation, IndustryWeek, FleetOwner and Oil & Gas Journal. With a degree in journalism from the University of Missouri, he began his reporting career at the Business Courier in Cincinnati and later was managing editor and editor of the Nashville Business Journal. Most recently, he oversaw the online and print products of the Nashville Post and reported primarily on Middle Tennessee’s finance sector as well as many of its publicly traded companies.