A Researcher’s Perspective on the North American Protective Relay Marketplace

Fifty-five electric utilities weighed in on topics related to protective relay communication, purchasing trends, and applications for a recent survey. This paper summaries a few key observations from a recent study of the North American Protective Relay Marketplace conducted by Newton Evans Research Company - Worldwide Study of the Protective Relay Marketplace: 2019-2022 (Volume 1; the North American Market).

Here are a few observations gleaned from the survey:

1. Companies are even more hesitant than they were in 2016 to combine networks for operational technology with networks used for IT business processes. Survey participants were asked, "Does your company manage operational technology (OT) protection, control, and automation Ethernet networks separate from your information technology (IT) business process Ethernet networks?" This question is one of several that were asked previously on a 2016 survey of the protective relay marketplace.

In 2019, 69% percent of North American utilities responded that they manage OT networks separately from IT business process Ethernet networks. In 2016, 55% said they manage the networks separately.

Trends toward IT/OT convergence vary by industry. There are potential benefits of sharing real-time operational data with business intelligence and/or resource planning solutions that include improvements in decision making and system automation, however, expanding OT networks to include IT networks introduces new security threats as well. For industries like electric power T&D it is evident that IT/OT convergence isn't a priority at the moment.

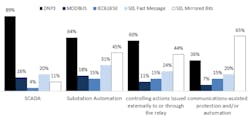

2. DNP3 is commonly used for SCADA, Substation Automation, controlling actions issued externally to relays. For communications-assisted protection, SEL Mirrored Bits is more widely used than DNP3.

Electric utilities were asked, "Which of the following relay protocols are you using for SCADA, Substation Automation, controlling actions issued externally to or through the relay, and for communications-assisted protection and/or automation?"

Eighty-nine percent of North American utilities surveyed indicated the use of DNP3 for SCADA, and roughly two-thirds said they use DNP3 for either substation automation or for controlling actions issued externally to or through the relay. Only 36% indicated the use of DNP3 for communications-assisted protection, while 65% of the sample said they use SEL Mirrored Bits.

3. On average, 44% of relays in the utilities surveyed have been in service for more than 15 years. The average percent of relays older than 15 years among Canadian utilities surveyed was 61%; the average among U.S. Cooperatives was 25%.

Survey respondents were asked, "Approximately what % of your relays have been in service for more than 15 years? (Best guess estimate)" Thirty-five percent of respondents indicated that more than half of the relays on their system have been in service for more than 15 years. This is lower than what was reported in 2016, when 55% said more than half of their relays had been in service for more than 15 years.

The Worldwide Study of the Protective Relay Marketplace in Electric Utilities: 2019-2022 measures current market sizes and contains projections on a world region basis for the next few years. More than 35 topics are covered in the utility survey portion of this study. The entire research program will define the product and market requirements which suppliers must meet in order to successfully participate in one or more of these diverse world market regions.

Newton-Evans Research Company estimates from our earlier 2016 relay market study indicate that the North American protective relay market stood at $660 million for both utility and industrial applications. It will be important for the P&C community to learn how changes in the world market conditions since 2016 will affect the outlook for 2019-2022.

The Newton Evans Study, a four-volume market report, also includes surveys of P&C consultants and relay manufacturers. The observations of both groups will be reported in the market assessment report (Volume Three).

About the Author

Charles W. Newton

President

Charles W. Newton is the president of Newton-Evans Research Co. He has been a 40-year career-long electric power industry researcher of information technology and infrastructure products, markets, and trends.