The Internet of Things is reaching into many industrial areas including the electric power segment. Some utilities are already deploying the same emerging technologies that are driving the fourth industrial revolution in the manufacturing sector. The Industrial Internet of Things, (IIoT), machine learning, and cloud computing together are among the new technologies being called Industry 4.0 and they are already being used by a few electric companies around the globe for asset monitoring [1], smart metering [2] [3], predictive maintenance [4] and the operations of distributed energy resources, (DER) [5]. Some industry experts have started calling this trend Energy 4.0, to highlight the magnitude of the transformation they expect it will bring to the electric power industry. However, given the traditional slow rate of adoption of new technologies as well as the high reliability standards in this sector, it is not unreasonable to doubt the massive adoption of these technologies to the point of calling it a revolution. On the other hand, the electric energy market in developed countries is at the verge of experiencing dramatic changes that will affect the capacity of utilities to be self sustainable. The emerging technologies that are making possible Industry 4.0 in the manufacturing market, can be a lifesaver for electric companies, helping them adapt to what may be soon the new normal in the electric energy market.

Maximizing Profits while the Market Slows Down

The continuous demand for electricity that fueled the growth of the electric industry during the 20th century seems to be coming to an end. Despite the increase in population and the fact that we are living in a time when most activities depend 100% on electricity, its demand in developed countries is plateauing [6], mostly due to more energy efficient appliances and buildings, as well as the off-shoring of power-intense industries [7]. Electric companies have felt the impact of this decline in their revenues, which have not increased for the past 10 years, as shown in Figure 1 [8].

Figure 1. Revenue of the electric power industry in the United States from 1970 to 2017 (in billion U.S. dollars) [8]

Businesses that are high electricity consumers are also leveraging Industry 4.0 technologies to minimize their energy costs. Energy management systems based on Artificial Intelligence, (AI), analyze the electricity market, the global electricity consumption and the business’ energy needs to automatically decide when it is a good time to buy electricity from the distribution company, and when it is better to get it from an alternative source of energy, like storage devices or solar panels. In jurisdictions where the annual cost of electricity for businesses is based on their contribution to the major global peaks of consumption during the year, AI systems can provide up to 30% reduction in energy costs [9]. As the use of these solutions becomes more popular, the global consumption of electricity among businesses during a year will eventually flatten out, reducing even more the revenue of utilities and leaving them with under utilized assets.

With decreasing consumption, and since it is not easy to increase electricity rates in regulated markets, electric companies are left with only one option in the short and medium term to maintain their current profits: reduce their operations and capital expenses. Something very difficult to achieve in the coming years given the reliability demands from customers and regulatory bodies, and the fact that many assets in the grid are reaching their end of life and will soon need to be replaced. Many utilities have implemented preventive maintenance plans, based on manufacturer recommendations of each equipment, in an effort to maximize the lifetime of their assets, reducing this way their capital expenses and the losses from asset downtime; however the labour costs involved in these plans can easily offset the savings in capital. It is here that the emerging technologies of Industry 4.0 can provide a solution.

Figure 2. Using Industry 4.0 technologies to enable predictive maintenance in the electric industry.

Electric companies can use IIoT sensors to gather behavioural information about their assets that can then be analyzed together with the data from the rest of the power network using machine learning algorithms and big data techniques, to predict issues and help operations managers decide the right time to maintain or replace an asset. The approach of predicting the time when equipment will need maintenance not only maximizes its lifetime, but also reduces the amount of truck rolls, personnel deployed in the field and material stock, which all translates into savings for the utility (Figure 2).

It is important to note that the use of sensing devices to monitor assets is not a novelty for electric companies. They have been using sensors in their operations for decades already. These sensors are used to monitor load, voltage, phase, temperature and oil viscosity among other parameters, and provide SCADA operators an early warning of the malfunction of specific equipment. There are however two main differences between the existing sensing and actuating devices in the power grid and IIoT devices proposed in Industry 4.0: First, the smaller size as well as lower power requirements and price of IIoT devices, compared to incumbent technologies, make them much easier to deploy in larger quantities in any equipment or at any point in the network. Given that most legacy equipment does not have embedded sensing devices, IIoT sensors are the best solution to acquire the data needed for predictive maintenance plans for older assets, as well as areas in the network that were not previously monitored.

The second main difference is the use of the Internet for communication instead of private networks to bring the data from the sensors. This characteristic is crucial to deploy these devices in a fast and cost-effective way all over the power grid. It is estimated that in order to manage the number of sensors and amount of data needed for an application like this one, the investment required to upgrade an existing communication network will be at least 60% its initial cost [10]. By relying on Internet Service Providers, (ISP), to manage the communications, utilities are diverging the enormous cost involved in building up, upgrading and maintaining a private communication network, to a third-party company whose core competency is communications, and therefore can provide a better service at a lower price.

Emerging technologies like IIoT and machine learning are thus the best options electric companies have when they migrate to predictive maintenance plans. No legacy technology can match what these technologies can offer today at the same cost, reliability and time of implementation.

Dealing with The Democratization of Energy

The electric energy market, that has been an oligopoly for the past hundred years, might soon resemble a perfect competition with multiple buyers and sellers, exponentially increasing the complexity of operating and maintaining the grid to levels beyond the capabilities of the current monitoring and control systems. This shift in the market means that utilities will have to look for faster and more efficient ways to operate their power networks.

Physical constraints for electricity transmission as well as the high amount of capital required for infrastructure and operations, limited the number of sellers in the market since the beginning of the electric industry. However, technological developments in recent years have resulted in cost reductions and increase in efficiency in the technologies involved in the use of, Distributed Energy Resources, (DER), favouring the adoption not only in utility and industrial sites, but also in commercial and residential buildings. Many of these buildings and houses can now generate and store electricity and can decide when to consume the electricity they generate and when to consume electricity from the power grid. Sometimes they will generate more electricity than they can consume, which means they have the potential to become sellers of electricity. Although the current regulatory environment in most countries will not allow individuals to become sellers of electricity at their will, at least not using the power grid, the political support for an open market of electricity is gaining momentum as it is seen as the only way to achieve the commitments made regarding climate change [11].

A democratization of energy will create enormous challenges for electrical companies, as the distribution grid was never conceived or designed to convey power in two directions, as it is required for the incorporation of DER into the grid. Therefore, overvoltage problems and power quality issues will be introduced to the grid when the use of DER starts scaling. The growing popularity of electric vehicles, (EV), adds another level of complexity to the topology of a future electric grid with multiple sellers of electricity. EV can use their batteries to buy or sell electricity from the grid or a building, depending on their energy needs and the electricity rates, and behave as a mobile DER, transforming the topology of the grid from a static to a dynamic one [12]. Electric companies will then have to monitor and control voltage and power flow at every potential point of connection with DER’s to eliminate their impact to the reliability of the grid, creating a wave of petabytes of data that must be stored and processed.

Utilities will have to rely on better technological tools than the ones currently in use, to adapt their operations to the new power grid. The capital and maintenance cost involved in deploying sensors all over the grid and building a communication infrastructure to support them can be extremely high, so it is a dead-end road for many companies. As previously mentioned, IIoT technology would be the perfect solution to monitor the entire grid at almost an atomic level while minimizing costs and deployment time. IIoT sensors and actuators, designed to consume very low power and using the Internet for communication, can be deployed very fast, most of the time without causing any disruption to the grid, and without having to build a communication infrastructure to support them.

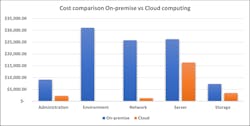

Electric companies will also have to deal with the constant petabytes of data generated from these devices, a task that will require a computational power that most of these companies can’t support. Some of the operations needed for data analysis use peaks of computational power, meaning a utility will have to own expensive hardware that will probably be under utilized most of the time. The best solution would be to share this resource with other companies in the same situation, something difficult to do with in-house servers and computers, but easily done with cloud computing. After accounting for hardware, software and maintenance, the cost of sharing a computing resource on the cloud can be around 20% of the cost of owning it on-premise, as shown in Figure 3 [13]. Reputable providers of cloud computing services, like Google, Microsoft or Amazon, have secure facilities with many reliable and powerful computers that can be used on demand by people, businesses and institutions to process high amounts of data at a fast speed. The several distributed locations of these facilities and the use of the Internet to receive and transmit data, ensures the availability of the service. The high-tech cybersecurity tools and strict physical security policies guarantees the integrity and anonymity of the data. Cloud computing also allows for easy and cost-effective scalability and technology upgrades, making it the best option to deal with the processing requirements of managing the new grid, from a technical and economic view.

Figure 3. Cost comparison exercise between On-premise and Cloud computing. The cost of accessory hardware and space required for On-premise service (Environment) as well as the Network makes this option the most expensive [13].

What’s Next

The previous paragraphs provided arguments to support the adoption of Industry 4.0 technologies by the electric industry. There is enough evidence to believe that the revolution some people are calling Energy 4.0 is happening. It is not just about the implementation of novel, nice to have technologies, but it is a response to real changes in the electric market, to which electric companies will have to adapt if they want to remain self sustainable. It is now clear why some electric companies around the world have already started to try these technologies in their operations, despite the risks involved.

The applications of Industry 4.0 technologies shown previously (i.e. IIoT and Cloud computing) are just two examples of how these new technologies can become extremely valuable for electric companies in the coming years. However, there are still some very important issues regarding the implementation of these technologies that must be addressed before they will be adopted massively within this industry. Issues like cybersecurity, service availability, reliability and data ownership are among the common concerns raised by operations and information technology stakeholders in utilities. While these issues have been accounted for and accepted by most other industries and by some in the electric power industry, it may take a while longer before Energy 4.0 becomes widely accepted.

Sponsored by:

References

BIBLIOGRAPHY

[1] M. Rebolini, A. Valant and F. Pepe, "Terna's approach for on-line monitoring system Intelligent management of Assets in a large scale infrastructures," in AEIT International Annual Conference (AEIT), Cagliari, ITALY, 2017.

[2] P. Gordon, "Swedish telco to connect 900,000 IoT-enabled smart meters," 25 04 2019. [Online]. Available: https://www.smart-energy.com/industry-sectors/smart-meters/swedish-telco-to-connect-900000-iot-enabled-smart-meters/.

[3] T&DWorld, "Ameren Missouri to Deploy 1.4 Million Advanced Meters," 30 04 2019. [Online]. Available: https://www.iotworldtoday.com/2019/04/30/ameren-missouri-to-deploy-1-4-million-advanced-meters/.

[4] ECG, Inc., "TEPCO to Implement ECG's Predict-It™ Analytics Solution," 24 04 2019. [Online]. Available: https://www.prnewswire.com/news-releases/tepco-to-implement-ecgs-predict-it-analytics-solution-300836700.html.

[5] P. Darrell, "Innovative Microgrid Will Power Finnish Distribution Center," 01 01 2019. [Online]. Available: https://www.powermag.com/innovative-microgrid-will-power-finnish-distribution-center/.

[6] J. Fox, "Americans Keep Using Less Electricity," 01 03 2018. [Online]. Available: https://www.bloomberg.com/opinion/articles/2018-03-01/americans-electricity-use-just-keeps-falling.

[7] W. Richter and W. Street, "Demand for electricity is dropping — and that could shake the power industry to its core," 4 December 2017. [Online]. Available: https://www.businessinsider.com/electricity-demand-dropping-power-industry-negative-impact-2017-12.

[8] U.S. Energy Information Administration, "Electric Power Annual," EIA, 2018.

[9] Stem Inc., "Reduce Global Adjustment charges with the world leader in energy storage," Stem Inc., 2019. [Online]. Available: https://www.stem.com/canada/.

[10] F. Grijpink, A. Ménard, H. Sigurdsson and N. Vucevic, "The road to 5G: The inevitable growth of infrastructure cost," 02 2018. [Online]. Available: https://www.mckinsey.com/industries/telecommunications/our-insights/the-road-to-5g-the-inevitable-growth-of-infrastructure-cost. [Accessed 21 05 2019].

[11] C. Hubbuch, "As utilities embrace clean energy, some lobby for a more democratic solution," 20 05 2019. [Online]. Available: https://madison.com/wsj/news/local/environment/as-utilities-embrace-clean-energy-some-lobby-for-a-more/article_e8aaeed5-eb89-5896-b272-1aa988be4abe.html.

[12] P. Dzikiy, "Honda, GM blockchain project to examine how EV owners could earn revenue from smart grids," 20 05 2019. [Online]. Available: https://electrek.co/2019/05/20/honda-gm-blockchain-smart-grids/.

[13] R. Vidhyalakshmi and V. Kumar, "Determinants of cloud computing adoption by SMEs," International Journal of Business Information Systems, vol. 22, no. 3, pp. 375-395, 2016.