Green Hydrogen: A Rising Star

As coal's use in power generation continues to fall out of favor, decarbonization-minded providers, more than ever, are turning to technologies to address their many vexing challenges.

The growing migration to energy drawn from the sun and wind bears that out. But it's the simplest element on the planet — and the most abundant — that's grabbing outsized attention for its promise in reshaping the landscape of an energy sector in transformation. Its name is hydrogen, a zero-emission fuel enjoying a rapid ascendancy in both curiosity and potential as utilities try to balance their energy portfolios and lessen their carbon footprints.

Not surprisingly, according to Black & Veatch's latest Strategic Directions: Electric Report, based on a survey of more than 600 industry stakeholders, utilities over the next decade expect solar (79%) and wind (67%) power to help them meet their clean energy goals or cut their emissions and carbon output. That's presumably because those renewables are readily deployable with established, matured technology and competitive costs.

But looking past 2030, those numbers drop into the 40th percentiles, segueing to more deployments of hydrogen (58%) — an energy-dense alternative fuel that emits only water — and battery energy storage (48%) as the leading, more favored options as they evolve.

So why all the talk about hydrogen — the only renewable energy that can be exported, mind you — as the new big thing? In short, it's elemental.

Already used in industrial processes, "gray hydrogen" — derived from fossil fuels such as oil, natural gas, and coal — is slowly giving way to "green hydrogen" — produced when electricity from clean solar or wind generation is used to power the electrolysis process that separates hydrogen and oxygen atoms in a water molecule. That hydrogen gas can then be stored in a tank or cavern before being funneled into a fuel cell, creating clean, emissions-free electricity.

To many industry experts, hydrogen could be a part of the generation mix of most investor-owned electric utilities within a few years and may be more cost-effective than battery storage to deal with the variability — the intermittency — of renewable power.

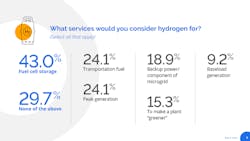

According to Black & Veatch's survey, nearly one-quarter of respondents said they would consider hydrogen as a source of peak generation, while 9% said they would contemplate using the gas for baseload generation. Some 19% would consider hydrogen for backup power or as a microgrid component (Fig. 1)

Next-Generation Power Delivery

With hydrogen as the industry's next big potential player, the electric sector undeniably is an industry in flux. Grid modernization efforts are accelerating and infrastructure is being hardened against the rising threat of cyberattacks. The use of drones, artificial intelligence (AI), machine learning, and digital twins is gaining momentum by the day as the industry evolves in a market that is driven by demands for enhanced efficiency, reliability, and cleaner power supply.

Such migration to new or advancing technologies to ensure the lights stay on and factory machines continue humming comes as the industry grapples with decades-old issues — most visibly, the aging of infrastructure and workforce — that just don't seem to go away.

A shift to increased distributed generation, efforts to modernize the U.S. grid, and a transition to reducing harmful emissions through decarbonization are posing the greatest challenges for the power sector.

Responses to Black & Veatch's survey strikingly reflect these circumstances, as the power sector breaks free from century-old concepts and responds to changing consumer behaviors and unpredictable load patterns. All of this is against the backdrop of an increasing use of distributed energy resources (DERs) and other customer-driven, emerging technologies.

The bottom line: amid the prospect of a continued shift to decentralized, digital grids and the broadening appeal of increasingly affordable solar power systems, electricity suppliers no longer have the luxury of resisting change or delaying the adoption of next-generation power delivery.

Adapting to the Growth of DERs

Having served its original purpose, the infrastructure on which utilities rely requires an upgrade or replacement in many places to accommodate rising customer-driven renewable power and interconnected DERs. The latest survey amplifies that, with one-third of respondents listing aging infrastructure — entrenched among the top five industry concerns cited in the survey for years — as still their top worry. Roughly one-quarter each cited renewable energy and an aging workforce, with 22% pointing to grid modernization (Fig. 2).

Centralized power generation is losing more relevance in a world with a preference for cleaner, more distributed generation. Many commercial and industrial customers are generating their own power locally, and the power they produce from DERs can be an extra revenue source for them when interconnected to the grid.

Nearly one-third of those surveyed said distributed/renewable generation is among the services their company provides and industry observers expect that number to grow significantly.

Additionally, the use of distributed generators is on the rise in areas where storms are more frequent and severe. The key question: how are utilities going to tap into this source of power production and sufficiently compensate consumers for use of those assets?

Digital Twins

As the analogy goes, it's tough to change the wheels on a moving train. It's a perspective that unquestionably applies to the complex arena of power generation. High-tech modeling, sometimes compared to a bridge between the real and virtual worlds, is increasingly making a difference.

Meet "digital twins," integrated digital representations of physical assets that provide historical, current, and predictive analysis in near real time. By combining information technology (IT) and operations technology (OT), users can simulate scenario options before actioning them in the real world, helping enhance customer experience by optimizing performance of existing assets.

Creating a digital twin of power plants or electric grids can be expensive, but the return on investment can be significant because it informs power system operators. And, it appears to be gaining mindshare. Some 15% of respondents said they are considering the use of digital twins to enhance power plant operations, with an additional 16% saying they're open to the idea of exploring such technology. These numbers are likely to grow as education about the technology grows, given that nearly half of the respondents were not familiar with the meaning of digital twins (Fig. 3).

At the same time, machine learning and AI, more than ever, are proving effective in power generation to predict malfunctions, detect human error, and optimize power plant scheduling — all the while eliminating unnecessary costs related to fixing an error and getting the system back online. To that end, more than 4 in 10 respondents said they have considered or are weighing the addition of AI and/or machine learning to operations, with roughly one-fifth saying it's not on their radar.

As the industry evolves, the digital realm of the information and communication technology (ICT) sector appears to be at the heart of the makeover, promoting the unifying of higher-bandwidth communications technology with distributed computing, advanced analytics, machine learning, and audio-visual systems to enable users to access, store, transmit, and better manage information. Innovation in the industry is increasingly based on digital ICT that includes AI, augmented and virtual reality (AR/VR), blockchain technology, and robotics.

Many utilities are being proactive, pushing to harden and modernize their grids and cybersecurity to boost efficiency, safety, reliability, and resilience. Others are being prodded by industry overseers. Regulators in nearly every state are considering major proposals to require upgraded systems as utilities prepare to spend billions to create a grid capable of accommodating new digital technologies and increasing amounts of variable power generation originating from the wind or sun.

Drone Technology Taking Flight

Utilities are also awakening to options off the ground, given the applications of unmanned aerial vehicles (UAVs). In short, drones.

For decades, since utility poles were first conceived, it's been the lasting image — an electric company's lineman meticulously scales the slender, rounded tower of wood to get a look at transmission lines and their hardware that only eagles could otherwise enjoy. With UAVs, known colloquially as drones, such labor-intensive, potentially perilous work is rapidly turning more obsolete as airborne application of technology widens.

Utilities have increasingly turned to UAVs as a relatively inexpensive way to inspect power lines, get to hard-to-reach places, and capture high-definition images or videos of insulators and other key assets. This method spares a worker from their livelihood's underlying dangers of ascending a pole, boiler, or a smokestack or requiring the use of pricey helicopters or planes for such a peek.

The upshots are quicker responses, an enhanced safety record, increased frequency of inspections, real-time assessments of replacement needs, and more data that can be analyzed for the clearest possible picture of risk management.

According to Black & Veatch’s latest survey, more than half of the respondents have considered using drones in operations, while 1 in 5 respondents said they are actively mulling UAV use. 14% said they may consider using the technology in operations.

Reprioritizing Investments

Asked how investment in new and existing assets will be reprioritized because of the impact of the COVID-19 pandemic, one-quarter of respondents said investments will be reprioritized to existing assets. Nearly half insisted their investments won't be reprioritized.

The respondents may be underestimating the need for rethinking their business, given that a major shift in utility investment is already underway in response to the pandemic. For example, Dominion Energy sold its natural gas transmission business and is shifting its capital investments to offshore wind power and other forms of renewable energy, recognizing that continued investment in gas transmission would result in a lower return on equity versus investments in renewable power.

At the turn of this century, more than half of the nation's power was produced with coal. The prospects of renewable power and energy storage playing a starring role in U.S. power generation were quickly dismissed. The technologies were too expensive, unproven, and difficult to integrate into a grid built around coal.

But now, the playing field clearly has changed — reflected in the abundance of opportunities for collaboration between centralized and distributed power providers. The surge in DERs is undeniable, and many utilities and states are progressing in modifying their business models to capture the increasing value of DERs and cleaner, renewable energy supply.

And in many ways, the growing embrace of technology is demonstrating what's possible.

Parts 1 and 2 of this three-part series discussed integrating planning teams and the urgency among utility companies for distributed renewable energy — a carbon-neutral footprint.

About the Author

Rob Wilhite

Rob Wilhite is a senior vice president and leads Black & Veatch's Global Distributed Energy business line.