Germany's Evolving Grid Infrastructure Market: Challenges and Opportunities

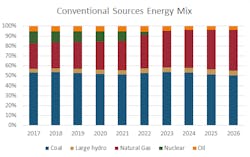

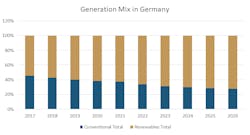

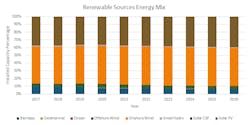

In the pursuit of achieving a complete nuclear phase-out — a policy launched in 2017 and scheduled to end in 2022 — and reducing carbon dioxide (CO2) emissions to a significantly low level, Germany is looking at new challenges in terms of maintaining stable grid infrastructure. With this ongoing decommissioning of nuclear power plants, Germany’s main source of generation is moving toward dependence on renewable energy resources. As a result of this new energy mix policy, the contribution of energy through renewables rose to 46% in 2019. However, German utilities now require constant investment in grid infrastructure to effectively integrate the various sources of renewables, in order to achieve its quest of realizing 100% clean energy in the future. This will require a challenging range of technological advancements.

HVDC transmission lines

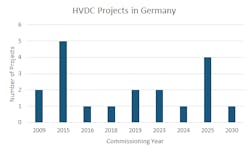

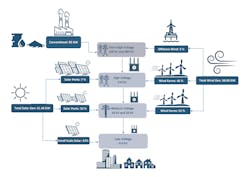

Unlocking the grid from location-based constraints and making it available for cross-country power connections is one of the biggest challenges faced by the German government. The wind energy generation hub is in the North Sea, off the coast of Northern Germany, remote from the area where the demand for energy is greatest. The energy has to be transported to Southern Germany, the center of large industrial and high-density residential customers. To achieve this, several highly-efficient new transmission lines based on high voltage direct current (HVDC) technology have already been constructed and energized. Other similar large-scale projects are scheduled for commissioning by 2030.

The successful commissioning of offshore HVDC grid connection projects like BorWin, DolWin, HelWin, and SylWin connecting the wind farm clusters from the North Sea to the mainland and consumption-intensive regions in Germany are the most popular HVDC projects in the country. A couple of other similar projects in the pipeline have increased the government's confidence in its capability to improve and increase the power transfer capacity via the HVDC interconnections from Northern to Southern Germany.

The main problem associated with the construction of these flexible grid solutions is the need to add resilience to existing infrastructure by providing the capability to withstand intermittent energy supply. The fluctuations caused in long-distance transmission inflict additional stress on the interconnected grid system.

Distributed energy resource management

The increasing deployments of large-capacity offshore wind farms and decentralized photovoltaic (PV) plants require a distribution network that offers two-way power flow capability. The intermittent feed-in of renewable energy in the network leads to the three most common issues encountered by distribution networks — overload, critical voltage variations, and power quality. However, the operational characteristics associated with bidirectional power flow provides enhanced control over these distribution network abnormalities, thereby making it both the primary concern and player to foster and create a need for distributed energy resource management.

Need for state-of-the-art monitoring and control technologies

Germany, in general, has a relatively more reliable power system infrastructure than rest of Europe in terms of security of supply, but it is important to categorize these above-mentioned challenges on the transmission system and distribution network.

Depending on the generating capacity of the DER they are connected to, the transmission system and distribution networks operate at different voltages. Consequently, the measures taken by utilities to connect DERs at different network levels vary from one another throughout Germany.

Extra high voltage (EHV) overhead transmission lines are already equipped with state-of-the-art monitoring and control systems. However, large-scale integration of fluctuating renewable energy sources (RES) such as the varying output from wind generators into the 380-kV/220-kV transmission system has prompted power system engineers to adopt more sophisticated forecasts of the generation cycle to maintain the frequency of 50 Hz to remain within its acceptable tolerance range. On high voltage (HV) overhead transmission lines, operating at 110 kV, real-time monitoring, bidirectional flow and control are deployed, as the large power input from a DER must be transferred to a higher voltage level to avoid any reduction in generation of additional power. At medium voltage (MV) level, continuous load monitoring is undertaken for customers with consumption above a pre-determined level. This action is imposed in order to compute specific load profiles and avoid any power quality issues because of fluctuation of distributed energy sources (DES).

Smart meter technology with long-term impacts

Smart meters use the information obtained on energy production and consumption, enabling network operators to respond in a more efficient manner to various scenarios. To provide for the need for real-time data and control of power in a decentralized grid like Germany, deployment of advanced metering technologies is undertaken on a large-scale basis across the country, not only to balance demand and supply but also to establish a secure communication infrastructure. This technology is a huge step forward not only in terms of digitalization of the distribution grid but also for optimization of grid operations and asset planning processes. While Germany has pioneered a rapid acceptance of many technologies under the umbrella of Energiewende, it has had its fair share of problems with the adoption of smart meters.

Until 2016, Germany was hesitant in deploying smart meters on a massive scale, fearing economic viability and data security. But as things progressed toward a new energy mix along with the new legislation, Germany started to opt for smart meters in 2017, initially targeting large power consumers to cope with issues arising because of decentralized power supply infrastructure. Owing to serious data security concerns within the EU, the rollout of smart meters was initially slow until the manufacturers of the technology were certified by the Federal Office for Information Security (BSI). Also, guidelines have been produced to address the concerns regarding data security with a clear emphasis on transparent monitoring along with strict instructions on encryption, restriction, and use of data. In 2020, Germany has embarked on a journey of mass deployment of about 2.3 million smart meters. These installations were targeted to take place starting in the states of Schleswig-Holstein, Brandenburg, and Bavaria.

By 2032, Germany is targeting a complete rollout of smart meters including to residential customers which clearly illustrates Germany's readiness in building a technological arsenal to cope with the challenges as a result of fundamental restructuring of power generation and supply. Once Germany has achieved its target of catering to 80% of its energy demand with renewables by 2050, smart meters will play a major role in monitoring and control of bidirectional power flow ensuring power quality standards are maintained.

Impact of transportation electrification

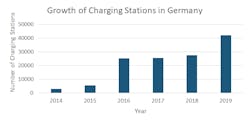

In order to realize an infrastructure running on reduced carbon footprint, transportation electrification is indispensable. The country is also giving attention to discontinuing the use of gasoline vehicles by 2030. As a result, the rapid growth of the electric vehicle (EV) market has led to an increase in the number of charging points. This has amounted to more than 35,000 publicly available charging ports as of October 2019, which also happens to be 23 times more than that in 2012.

A significant challenge of EVs is the need to establish easily accessible and reliable ultra-fast charging infrastructure. German automotive OEMs have been active in the rollout of fast EV charging infrastructure. For example, a joint venture named Unity, led by Daimler, Ford, Volkswagen, and BMW in Germany, has been working to build a network of fast charging stations across Europe with an installed base of about 100 stations. Unity has become a widely recognized brand for its successful deployment in Europe, with a target of installing 400 fast charging stations in Europe by end of 2020.

This increase is not a concern for energy policy makers as of now since energy demand of an EV fleet is between 0.1% and 0.2% of net power consumption. However, these stations are a source of short-term peak loads on the distribution network and with an increasing number of stations this impact will become even more significant.

Opportunities for T&D market players

With Germany committed to implementing its new energy policy, it presents a huge opportunity for power transmission and distribution (T&D) equipment manufacturers. New technologies that are more compact, flexible, and reliable are going to be in demand not only in Germany but also across Europe. A major portion of this market share will be owned by HV and MV switchgear. Flexible ac transmission (FACT) devices are also faced with major issues associated with control, protection, and power quality. Manufacturers around the world are producing more smart switchgear technologies to counter the challenges of space, flexibility, and reliability. To cope with power quality related issues, a rapid trend has been observed in static synchronous compensators (STATCOM) replacing static VAR compensators (SVC), because STATCOM technology offers better dynamic characteristics, voltage profile improvement, and fast response, helping in flicker mitigation of industrial loads. The benefits of STATCOM are not limited to stabilization of grid and industry loads.

To satisfy grid code requirements, wind farms can use the reactive output of their own turbines, a STATCOM, and additional shunt compensation from either switched or fixed capacitor, or reactor banks can be installed in order to meet the reactive capability. To coordinate all these reactive sources and meet overall grid code requirement at the point of common coupling (PCC), an overall master controller with flexible controls is needed. In keeping with this requirement, STATCOM OEMs have installed hundreds of STATCOM systems for wind farms all around the globe including Germany. Compliance with these requirements supports the need for a STATCOM for wind farm applications, leading to a rise in STATCOM sales in Germany.

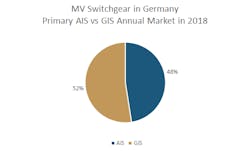

Although Germany's T&D markets are already dominated by gas-insulated switchgear (GIS), the rapid increase in renewable energy footprint, HVDC systems, and demand of substations having compact sizes will further boost the GIS market.

Annual market share of MV GIS versus air-insulated switchgear (AIS) for 2018 indicates the growth in the use of a strong market for GIS in the coming years. The large European switchgear manufacturers are already seizing the opportunity and are in the process of supplying new equipment to revamp existing infrastructures. ABB, Switzerland, is already working on a multi-million-dollar project of a substation upgrade where the existing AIS is being replaced by GIS, because it offers higher transmission capability, up to 70% space saving, and lower maintenance requirements.

Siemens is also providing a turnkey solution of new technology of GIS in which SF6 operation has been replaced by a more environment-friendly mechanism at one of the largest substations in Germany owned by TransnetBW. This new technology of GIS will be replacing the existing AIS infrastructure in the substation. The goal of this project is similar to the ABB project — namely, utilization of space and expansion in power transmission capability.

Summary

With an aim to rely on 80% renewable energy and achieve a status of an economy having low carbon emission, many nations with the same mission will have their eyes on Germany's Energiewende to observe and learn from its experience. Reshaping the energy market as a whole comes with a cost and unforeseen risk factors that had to be addressed in Germany. Since the decentralization of the power system, the country has been faced with building offshore wind farms, constructing long-distance HVDC transmission interconnectors, the introduction of smart grids, coming up with a plan to cater to data privacy requirements, and the list continues.

Today, countries like Australia and Denmark are following the footprints of Germany to achieve their climate goals. As Germany has set the pace for the deployment of RES, its best practices are being adopted in the rest of the world. This has opened doors for market players who have the capability to offer manufacturing and supply services in various power domains. In this journey, more challenges will keep arising, leading to new technological advancements and opportunities to create new markets.

About the Author

Qutab Baig

Qutab Baig has been involved in transmission and distribution (T&D) equipment market research. He is product manager of the Flexible AC Transmission Systems (FACTS) and HVDC projects (off-shelf and customized) in Power Technology Research (PTR), Germany. The focus of his current research is reactive power equipment markets across different regions and verticals around the globe. He has an MS in electrical engineering from the Lahore University of Management Sciences and a BSc in electrical engineering from Bahria University.