Energy Policy and the Impact of Renewables and New Market Participants

The Nation is Moving Rapidly to Renewable Energy Sources

Renewable energy is playing a more important role in the U.S. mix of electricity generation resources each year. Overall, low-carbon sources (renewables and nuclear) accounted for 52.8% of the total generation in 2018. The renewables share of the generation accounted for 37.1% in Q4 2018 — a 7% increase from the same period, the previous year. Even better, 36.5% of grid electricity was zero carbon in June 2017 versus 31.7% a year earlier. Coal-fired generation was down to 30.4% of total generation components.

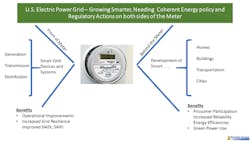

What this means is that the nation must develop the requisite energy policies and regulatory actions at the federal and state levels to ensure that our 21st century grid will indeed be resilient, reliable, efficient, and flexible. Grid modernization, centered on an increase in both resilience and reliability, is increasingly dependent upon distributed renewable energy resources. Furthermore, this development is proceeding with the involvement of multiple non-utility organizations as partners in this migration process. Far-sighted energy policy development together with well thought out regulatory directives will help pave the way toward a nationwide smart grid.

As seen in Fig. 1, the electric power industry, together with enabling technologies and communications capabilities can meet the demands of the evolving marketplace, sharing as they do, common interests and objectives (reliability, security, efficiency, resilience, green power) together with partnerships and optional market participation among consumers as "prosumers."

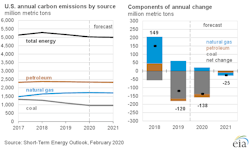

Declines in Energy-Related Emissions

After decreasing by 2.3% in 2019, Energy Information Administration (EIA) forecasts that energy-related carbon dioxide (CO2) emissions will decrease a further 2.7% in 2020 and by an additional 0.5% in 2021. Declining emissions in 2020 reflect forecast declines in total U.S. energy consumption because of increases in energy efficiency and weather effects, particularly as a result of warmer-than-normal January temperatures. A forecast return to normal temperatures in 2021 results in a slowing decline in emissions. Energy-related CO2 emissions are sensitive to changes in weather, economic growth, energy prices, and fuel mix. See Fig. 2.

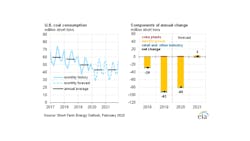

What About Coal in Our Future?

Each year, coal has become less critical to the nation's energy fuel supply. The EIA forecasts this trend to continue, so that by 2021, coal will represent less than 20% of electricity generation fuel resources. Following is the newly released chart (February 2020) of the recent history and near-term outlook for coal consumption. The right-hand portion of Fig. 3 indicates that overall decrease in reliance on coal is the most important factor driving down total consumption levels.

DOE Announces US$30 Million for Transformational Carbon Capture Technologies

In September 2018, the U.S. Department of Energy (DOE) announced the availability of up to US$30 million in federal funding for cost-shared research and development (R&D) under the second closing of the Office of Fossil Energy’s (FE’s) Novel and Enabling Carbon Capture Transformational Technologies funding opportunity announcement. Selected projects will support the development of solvent, sorbent, and membrane technologies to address scientific challenges and knowledge gaps associated with reducing the cost of carbon capture, supporting the DOE’s goal to develop technologies that can significantly reduce the cost of CO2 capture from coal-fired power plants.

EIA Annual Energy Outlook 2020: Key Takeaways from the EIA's Annual Report

Increasing energy efficiency across end-use sectors keeps U.S. energy consumption relatively flat, even as the U.S. economy continues to expand. Importantly, the United States is expected to become a net energy exporter in 2020 because of large increases in crude oil and natural gas production, and the expectation that natural gas prices will remain low.

EIA Outlook summary for 2020 electric power generation fuels Indicates the following key takeaways:

- The share of U.S. utility-scale electricity generation from natural gas-fired power plants will remain relatively steady. It was 37% in 2019 and the EIA forecasts it to be 38% in 2020 and 37% in 2021.

- Electricity generation from renewable energy sources will rise from a share of 17% last year to 20% in 2020 and 21% in 2021. The increase in the renewables share is the result of the expected use of additions to wind and solar generating capacity.

- Coal's predicted share of electricity generation will fall from 24% in 2019 to 21% in both 2020 and 2021.

- The nuclear share of generation, which averaged slightly more than 20% in 2019, will be slightly lower than 20% by 2021, consistent with upcoming reactor retirements.

DOE Grid Modernization Initiative

In September, 2017, the DOE announced awards of up to US$50 million to its National Laboratories for R&D supporting infrastructure resilience — seven resilient distribution systems projects: microgrids, distributed energy resources (DERs), emerging grid technologies; 20 cybersecurity projects; partnering with companies like NRECA, SoCal Ed, Tesla, UC Berkeley, Vermont EC, Siemens, Duke, GE, and hundreds more.

Energy Storage Policies

According to the IHS, the energy storage market is set to "explode" from an annual installation size of 6 GW in 2017 to more than 40 GW by 2022 — from an initial base of only 0.34 GW installed in 2012 and 2013. Flywheel and battery energy storage systems are operating today in the competitive ancillary services power market — providing a 10 times faster and more accurate response to a power dispatcher's signals compared with power turbine generators. PJM Interconnection projects that just a 10-20% reduction in its frequency regulation capacity procurement — made possible by additional storage projects — could result in US$25-50 million in savings to residential, commercial, and industrial consumers.

FERC and Energy Storage

On Feb. 15, 2018, the Federal Energy Regulatory Commission (FERC) announced the following, "FERC today voted to remove barriers to the participation of electric storage resources in the capacity, energy, and ancillary services markets operated by regional transmission organizations and independent system operators. This order will enhance competition and promote greater efficiency in the nation's electric wholesale markets and will help support the resilience of the bulk power system."

The trade association for energy storage is the Energy Storage Association (ESA). Among its several objectives are these:

- Coordinating the introduction of bipartisan STORAGE Investment Tax Credit legislation introduced in both Senate and House

- Ensuring that energy storage is included in the bipartisan Master Limited Partnership Parity Act in both Senate and House.

FERC Streamlines Processes for Market-Based Rate Sellers (July 2019)

The first final rule for market-based rate sellers, which was recently issued, concerns the horizontal market power analysis required for market-based rate sellers. The FERC is eliminating the obligation to submit indicative screens in order to obtain or retain market-based rate authority in certain organized wholesale power markets. Those sellers no longer will be required to submit the pivotal supplier screen and the wholesale market share screen in any organized wholesale power market that administers energy, ancillary services, and capacity markets subject to commission-approved monitoring and mitigation.

The FERC's second final rule will improve the commission's monitoring of wholesale power markets by streamlining the way it collects certain data for market-based rate purposes, specifically collecting this information in a database. The approved changes will eliminate duplication, minimize compliance burdens, modernize data collections, and make information collected through its programs more usable and accessible for the FERC, its staff, and the public.

FERC Transmission Initiatives

The FERC hosted a dynamic line rating (DLR) conference in September 2019. This conference was held to boost knowledge of, and interest among, transmission owners to move ahead with DLR applications. Also known as real-time thermal rating (RTTR), DLR is an electric power transmission operation philosophy aiming at maximizing load when environmental conditions allow it, without compromising safety. DLR expansion is one major component of the FERC's advanced transmission applications push to U.S. electric utilities. Properly applied, DLR will be an enabling function for the integration of DERs into the grid at transmission voltages.

Electric Grid and Communications Policy

Interdependencies mean that federal regulations and policies can, and do, affect both electricity and communications. For example, on November 30, 2018, the UTC reported the following — Utility Communications and How the FCC Decisions Impact the Industry. According to Joy Ditto, president, UTC, "Some of the most impactful regulatory decisions affecting the industry are coming not from the FERC but from the Federal Communications Commission (FCC)."

Other Relevant Policy Changes

EPA Revocation on Emission Standards: California's ability to set its own auto emissions standards has been recently revoked by the EPA. 13 other states follow CA standards. California leads the country in shaping policies to reduce emissions. The revocation may impact development of electric vehicles (EVs) and EV charging infrastructure. Second is an EPA call for a rollback of New Source Performance Standards (NSPS), lifting greenhouse gas restrictions on fossil fuel plants. Both of these policy changes are setbacks to the move to grid modernization.

Nuclear Power Policy: There is a petition to develop new nuclear technologies with the DOE, including small modular reactors on the table at this time. The petitions further request that the DOE promulgate rules and establish programs that would allow states to develop collaborative nuclear and non-nuclear laboratories with the DOE on currently licensed or formerly licensed nuclear facility grounds, and allow for the construction of collaborative nuclear experimentation containment facility testing platforms. For more information, visit here.

NARUC: Committee on Electricity

The Electricity Committee within the National Association of Regulatory Utility Commissions develops and advances policies that promote reliable, adequate, and affordable supply of electricity. Through strong collaboration with the FERC and related federal agencies, the committee also seeks ways to improve the quality and effectiveness of regulation through education, cooperation, and exchange of information. There are six major electric power-related subcommittees operated by NARUC. These include:

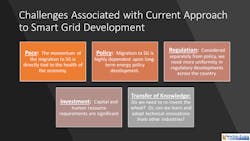

Grid Modernization Status

Pace, policy, regulation, investment, and knowledge transfer all impact the efforts applied to grid modernization in the United States, as shown in Fig. 4. The momentum of the migration to a modernized or smart grid is directly tied to the health of the economy. Migration to a modern grid is highly dependent upon long-term energy policy development. Considered separately from policy, we need more uniformity in regulatory developments across the country. Capital and human resource requirements are significant — in the multiple billions of dollars. Do we need to reinvent the wheel? Or can we learn from, and adopt, technical innovations and policies driving other industries forward?

Effect of Recent Regulatory Activity and Uncertainty on Policy Direction for Newer Market Participants

Grid modernization continues to gain momentum across the world. Every phase of operations and engineering including generation, transmission, and distribution is involved in the grid modernization effort. Recent Newton-Evans studies, along with many other published research studies have found no slowdown in grid modernization efforts. On the other hand, increased investments in key facets of operational technology usage, in parallel with availability of high bandwidth, low latency communications capabilities have been identified, further providing impetus to, and investments in, periodic upgrades and replacements of key grid infrastructure equipment. The newer generation of smarter field equipment, monitoring, and controlling devices is largely "smart grid" ready. The bigger question is this: "Are the various regulatory bodies at the federal and state levels keeping up with rapidly evolving and changing business practices, especially as these regard newer electric power market participants and future partners in smart grid development?"

By 2019, U.S. smart grid investments made by electric utilities and consumers of all types had exceeded US$42 billion, of which only about US$12 billion was by utilities directly and the three consumer groupings (residential, commercial, and industrial) together invested nearly US$30 billion (in energy management systems for homes, offices, and manufacturing facilities; purchase of EVs; and their own DERs).

Rapid development of new and revised utility business practices in front of the customer meter, and proficient commercial and industrial firms behind the customer meter, makes it incumbent on policymakers to speed up migration to a more flexible, more reliable, more resilient, and more robust 21st century grid. The development of a truly smart grid will involve not only utilities but also a wide range of commercial and industrial partners, as well as the commitment of residential, commercial, and industrial electricity customers. See Fig. 5.

Wth the appropriate development and enactment of forward-looking energy policies and regulations, grid modernization will become a reality and the nation will have a 21st century grid by mid-century.

About the Author

Charles W. Newton

President

Charles W. Newton is the president of Newton-Evans Research Co. He has been a 40-year career-long electric power industry researcher of information technology and infrastructure products, markets, and trends.