The Coal 'Ecosystem' and Good Regulations

Many of our efforts at optimizing how we run our T&D systems depend upon the value of the underlying electric energy and capacity our generating facilities provide. And when it comes to coal in this regard, earlier this month, some highly placed conservatives proposed A Conservative Case for Climate Action as highlighted in this Feb. 8, 2017 New York Times piece editorial. The editorial references the Carbon Dividends Plan put forth by James A. Baker, George P. Schultz, and others.

It is undeniable that we owe coal the fact that it brought us the industrial revolution. But the forward progression has been driven primarily by efforts by businesses and regulators to make wise economic choices. Loyalties to specific fuels played second fiddle to an informed debate about the best available options at the time.

There is a narrative that was debunked many times but which still emerges at times like this in our industry. It is a narrative about how free market forces alone can lead us to the right energy choices (per this USA Today piece). It states that whale oil was replaced by better forms of light solely due to technological and economic forces. In reality, per this PBS Newshour piece, legislation was also involved.

In any case, you’ll probably agree with the idea that lighting a home via electricity from coal may have been better environmentally than lighting it with lamps burning whale oil, camphor, turpentine, or kerosene. And whichever side of the spectrum you are on, you’ll also likely agree it helps us to make better decisions if we start with the reality that our dependency on coal is still very strong.

Our current coal ecosystem

Between the 1990s and the midpoint of our current decade, U.S. electric generation from coal went from 54% down to a bit below the 40% mark. If electricity generation from coal went to zero, the carbon footprint of the electric utility industry would certainly decrease significantly from its current 2 billion metric ton annual CO2 emissions level. But the carbon footprint of some common everyday products could increase, depending on how we address alternatives (and depending on how we account for those changes).

If the last statement makes you cast a quizzical glance in one or another direction, whether you happen to be indoors or outdoors, consider why it is likely you looked at a surface or structure made with some coal by-products in it:

- Due to Clean Air Act (CAA) emission standards, at least 30% of wallboard (sheet rock or gypsum) manufactured in the U.S. comes from power plant gypsum. CAA standards led utilities to install flue gas desulfurization (FGD) equipment and related systems to reduce emissions of sulfur compounds. In the absence of coal combustion products, if 30% more gypsum needs to be mined, there would be an increase in the energy and carbon footprint of that sector of the mining industry. (Whether it is a net increase overall is another question.)

- Approximately 40% of the residue from combustion of coal in U.S. coal-fired power plants is recycled in cinder blocks (hence the “cinder” in their name).

- Portland cement contains a portion of coal ash, replacing natural materials which would otherwise have to be mined.

- Coal fill materials are also utilized in roofing tiles and shingles, as well as road base materials and structural fills.

When estimates are discussed regarding additional coal related R&D and associated economic benefits, it is important to look at the propositions with an “ecosystem” point of view economically.

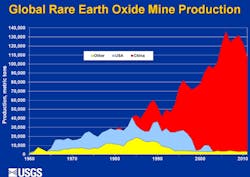

A coal ecosystem case study—Rare Earth Elements

Research highlighted in a January 24, 2017 DOE National Energy Technology Laboratory piece shows the benefits from extraction of vital Rare Earth Elements (REEs) from coal ash. Titled Coal Ash Recovery Could Pump the Domestic Rare Earth Metals Supply, it involves a University of Kentucky project will pilot processing facility for recovering rare earth metals, to be built in September 2017 for testing in 2018.

One evaluation approach is to claim that coal ash would have to be disposed of anyway, so as long as we are utilizing coal, there may be incremental benefits to getting more economic value from the ash and reducing its environmental disposal costs.

But couldn’t this approach be splitting hairs? Consider, size-wise in rough numbers, how small the annual U.S. spend currently is in rare earth elements, versus the current utility industry coal spend. The U.S. annual rare earth element spend is about $170 million—a tiny fraction of the tens of billions U.S. electric utilities spend annually on coal supplies. And it is a smaller fraction still of the hundreds of billions in capital investment represented by our existing coal-fired power plants. (Even just one carbon capture plant costs many times more than the $170 million annual U.S. rare earth spend. (See A January 25, 2017 Energy Times piece, Largest Carbon Capture Complex Complete--NRG Partners with JX Nippon on $1 billion Deal ).

So it is only when we take a big picture view that we can put these various elements into the right context for decision-making. And, hopefully, for good regulation-making.

About the Author

Peter Arvan Manos

Utility Industry Analyst

Peter Manos is Director of Research for Electric Power & Smart Grid, on the Energy Sector team at ARC. He analyzes the latest trends across People, Process, and Technology to uncover business and digital transformation best practices for electric, gas, and water utilities. He can be reached at [email protected]