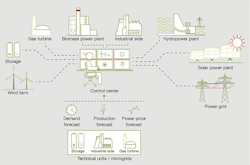

Potential VPP power generation assets encompass almost the entire spectrum of power-producing technology: biogas, biomass, combined heat and power (CHP), microCHP, wind, solar, hydro, power-to heat, diesel engines and fossil-fuel. Typically, VPPs will pool production from hundreds of small- and medium-sized renewable energy plants into a large-scale VPP that has the size and flexibility to participate in the electricity market – especially in lucrative ancillary grid services.

In addition, a VPP can make use of many kinds of energy storage solutions – like batteries, thermal storage, compressed air or pumped storage. Finally, some consumers can also become a part of the VPP topology – by, for example, varying their processes to suit prevailing power economics or by timeshifting production loading ➔ 1.

Broadly stated, the goals of a VPP are threefold: to attain better prices for produced energy on the spot and derivatives markets, to participate in the power balancing market and to optimize internal production and consumption.

Markets

One of the main challenges involved in operating a VPP is to place available power on the different energy markets to maximize returns.

The first step in accomplishing this is to establish the available power capacities in the VPP, the renewable production forecast, the foreseen load demand and the long-term obligations. These are then passed to a market optimization system that distributes available power generation capacities from the VPP to the different energy markets.

Energy trading takes place in three different markets: the balancing market, the spot market and the derivatives market. Additionally, there are over-thecounter (OTC) trades in which partners trade energy bilaterally. This article deals with the opportunities that arise for VPPs in the liberalized energy market and uses the German energy market and the European Energy Exchange as references. The concepts, however, apply to most international power grids and energy markets.

The balancing power market

The prerequisite for stable operation of the power grid is a balance between power generation and power consumption. So-called balancing power is injected if any difference between the two should arise. The goals of balancing power are to ensure that the frequency stays, within a defined tolerance, at 50 Hz and to compensate for regional differences in power generation and power consumption.

To achieve these goals, three types of balancing power interact dynamically: primary balancing power, secondary balancing power and minute reserve.

Balancing power is obtained from ancillary grid service providers responding to offers to tender issued by the transmission system operators (TSOs). Before the VPP operator can bid on this balancing power market, each of his power generation units has to undergo TSO prequalification.

Traditionally, conventional power plants were the only source of balancing energy. Now, however, a VPP can interconnect multiple smaller power generation units to reach the minimum offer size for placing bids in the balancing power market. Generally, the VPP operators proffer a certain amount of balancing power and market agents place these bids in the energy market.

The European spot market

The European spot market, EPEX, offers two opportunities for short-term trading of energy: the Day-Ahead market and the Intraday market. In the former, electricity is traded for delivery the following day in hourly blocks or blocks of hours. The daily auction takes place at noon, seven days a week, all year round, including statutory holidays. In the latter, electricity is traded for delivery on the same day or on the following day in single hours, 15-minute periods or in blocks of hours.

Power derivatives market

The third market is the European Energy Exchange (EEX) power derivatives market. In this market, the broker can financially settle power futures and options on these.

The derivatives market is often used to hedge against the price fluctuations on the spot market.

Optimal operation of VPPs

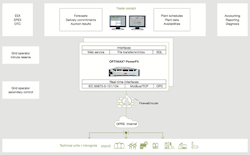

As can be inferred from the above discussion, a VPP operator not only has to have a clear overview and control of his power generation assets, but also a means of managing the commercial side of the enterprise in a cost-effective way ➔ 1. ABB’s central control and optimization system provides the foundation for the VPP to accomplish both these aims. It connects the decentralized assets and optimizes the operation, planning and commercial considerations ➔ 2.

The control system needs to have high availability to comply with the strict requirements for providing grid services and all operational optimization results must be available in real time.

VPP operators often face the challenge of a rapidly growing installed base. Therefore, it is essential that the central control and optimization system is highly scalable so it can be grown from a few units to a few thousand in a short time. In one of ABB’s installations, the customer installed base grew from 20 to over 2,800 units in under three years. As all hardware and software additions were hot-swappable, ABB was able to add all the units without interrupting operations.

Connections to the decentralized assets are wireless-based. Therefore, it is crucial to meet the highest cyber security standards for transmitting set points and balancing power release calls from the control system to the units in the field. This is achieved by equipping the assets – or pools of local assets – with remote terminal units that employ VPN tunnels to transmit signals using private GSM or encrypted Internet connections ➔ 2.

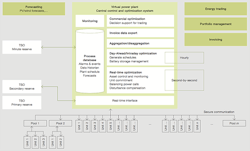

In the optimization on the commercial side of the control system, the forecasts for renewable power generation requirements, the committed long-term obligations, the load demand and the available capacities of the assets are aggregated. In this way, the VPP operator gets an overview of the available capacities and the marginal costs. Based on this information, optimal bidding strategies for the different electricity markets are proposed to the trading department, which then submits offers to the energy markets. Successful bids – ie, power deliveries and grid service commitments – are returned to the control and optimization system, which generates the necessary schedules for the power-producing units, taking all current restrictions and disturbances into account ➔ 3.

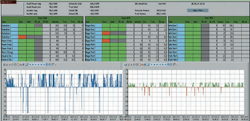

Further, instant-by-instant incoming balancing power calls are also incorporated into the individual schedules to provide the optimal set points for all relevant units ➔ 4.

The standardized open interfaces supplied by ABB make it easy for the VPP operator to integrate the control system into the IT landscape and automate the information and signal flow from the field level to the energy management level ➔ 2.

The ABB solution utilizes a mathematical optimization program to distribute the optimal set points in real time. Plant properties such as power limits, disturbances or schedule deviations are measured online and directly factored into the control of the assets. In this way, the optimization program ensures that the VPP is always run in the best possible configuration.

With its solution portfolio, ABB covers all aspects and requirements for the optimal operation of VPPs. In particular, the central control and optimization system runs redundantly on servers that are located in geographically dispersed data centers. In this way, ABB can ensure the high availability that is an essential characteristic of a control system running in such a high-criticality environment.

As the world introduces ever more renewable energy sources, the role of the VPP in sustainable power generation will increase in significance. The growing complexity of generating power in the most optimal way, matching it with demand and marketing it in the most cost-effective way means that ABB’s central control and optimization system will continue to be a crucial tool for the VPP operator.

Sleman Saliba

ABB Power Systems, Power Generation

Mannheim, Germany

[email protected]