There was a time when the power industry addressed large swings in peak demand by overbuilding generation, transmission and distribution assets. Planners took the grid’s normal peak demand requirements and added their best guess for the mythical hot summer day when every customer would crank up their air conditioning full throttle. This is not the best way to address the task of balancing supply with demand, but it worked.

The expensive downside to this method meant it had to change. Approximately 10% to 20% of the grid’s capacity (that is, generation, transformers, conductors, etc.) was being used for only a few hundred hours per year. In other words, excess capacity was installed to meet a situation that only happened about 1% to 2% of the year.

Given the tools utilities had available to them in those days, this scheme was the only way they had to minimize brownouts and blackouts from extreme summer peaks. The situation began to change as smart grid digital technologies became available, and it really got a shot in the arm when energy storage was added. Technologies such as dynamic rating systems, demand-management systems, microgrids, distributed energy resources (DERs) and demand-response systems had a positive influence on the power delivery system’s operation, but energy storage dialed it up. This is not to say all the problems have been solved. There are still issues with the balancing act of supply and demand, but energy storage is proving to be a powerful tool.

Basic Challenge

Energy storage has been labeled the enabling technology. It also has been called the shock absorber between supply and demand. Granted, energy storage systems are not commonplace yet, but things are changing. Bloomberg New Energy Finance (BNEF) published its forecast for global deployment of energy storage in late 2018. BNEF said, “The global energy storage market will grow to a cumulative 942 GW/2857 GWh by 2040, attracting US$620 billion in investment over the next 22 years.”

The driving force in this forecast is the fact, unlike other commodities, electricity has no shelf life, so it makes sense to find a way to store it. A perfect example of this is the overgeneration of wind and solar resources. Wind and solar generation tend to be plentiful when demand is low or missing entirely when demand is high. Some experts call this the perverse nature of wind and solar, because they do not align well with electric demand.

The 315 MW Hornsdale wind farm has a 100 MW/129 MWh energy storage system referred to as the Hornsdale Power Reserve that provides stability services and emergency backup when needed. Courtesy of Tesla.

GE and Arenko partnered to build a 41 MW grid scale energy storage system in the Midlands, UK. Courtesy of GE.

Wind and solar are being deployed in staggering numbers because regulators are enacting legislation goals for utilities and power producers to install more. The upshot of this is, as more wind and solar assets are installed, their overgeneration exacerbates the challenge of balancing supply vs. demand, and the situation is getting more severe. BNEF reported global wind and solar generation hit 1 trillion W of capacity in 2018.

About 54% of the 1 trillion W was wind, but BNEF estimates solar capacity will surpass wind sometime in early 2020. What is really staggering about this report is the fact BNEF expects the second trillion to happen by 2023. That is only five years, which is not a lot of time to prepare for these enormous amounts of wind and solar resources, and the problems they bring to the table.

The Duck Curve

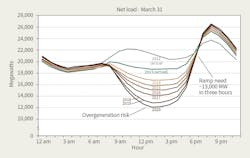

There is a complex problem plaguing wind and solar resources that is not easily understood. One of the best descriptions comes from a report published by the U.S. Department of Energy’s (DOE) Office of Energy Efficiency & Renewable Energy a couple of years ago. The paper reported, “In 2013, the California Independent Service Operator (CAISO) published a chart that is now commonplace in the conversation about large-scale deployment of solar photovoltaic (PV) power. The duck curve — named after its resemblance to a duck — shows the difference in electricity demand and the amount of available solar energy throughout the day.”

According to the DOE report, “The CAISO chart was made for a 24-hour period in California during the springtime when this effect is most extreme because it’s sunny, but the temperatures remain cool, so demand is low.”

The DOE pointed out this chart was a visual representation of the challenge high penetrations of solar place on utilities and grid operators to balance the supply and demand of electricity. Part of the challenge is the need for baseload generators to ramp up electricity production quickly when the sun sets. The second part of the challenge is what to do with the PV-generated electricity midday when the output is at its highest (that is, which resource gets curtailed — solar or baseload generation).

The duck curve shows the challenge of balancing generation with load when solar generation is added to the network. Courtesy of CAISO.

Curtailing thermal baseload could be seen as favoring the environment while curtailing solar could be seen as catering to the utility’s economics, but the DOE said there does not need to be a choice between the two generation resources. The department quantified this as such: “Solar coupled with storage technologies could alleviate, and possibly eliminate, the risk of over-generation. Curtailment isn’t necessary when excess energy can be stored for use during peak electricity demand.”

Stored electricity fed back into the grid flattens the duck curve without ramping up baseload generation or adding peaker power.

Hybrid grid scale energy storage system includes Samsung battery, diesel generator, and grid stabilization system. Courtesy of ABB.

Flattening the Duck

The California duck curve is a global problem. Australia, France, Germany, India and other jurisdictions are reporting similar issues dealing with solar demand imbalances as their solar generation percentage increases. Many mitigation strategies are available. GE, Mitsubishi Hitachi Power Systems and Siemens AG are offering fast-ramping gas turbines combined with Lithium-ion (Li-ion) battery storage as a mitigation strategy. There also are stand-alone battery energy storage systems being offered by Tesla, Fluence, ABB, LG Chem, Toshiba, Primus Power, GE, AES Corp., NEC Energy Solutions, Eos Energy Storage LLC, Aggreko (formerly Younicos) and others.

In 2013, California required its investor-owned utilities (IOUs) Pacific Gas & Electric Co. (PG&E), San Diego Gas & Electric (SDG&E) and Southern California Edison (SCE) to install 1325 MW of energy storage by 2020. In 2016, the California Public Utilities Commission (CPUC) increased the requirement by an additional 500 MW of distributed battery storage systems. In 2018, the three IOUs announced they all will meet the CPUC’s energy storage requirements on or before 2020. Because meeting the storage goal has been so successful, the CPUC said it was considering introducing a new bill for an additional 2000 MW of battery energy storage by 2030.

Other states also have set energy storage capacity targets for their IOUs. Recently, New York’s Public Service Commission (PSC) approved initiatives requiring the state’s IOUs to install 3000 MW of energy storage capacity by 2030, with an interim goal of 1500 MW by 2025. Massachusetts set a goal of 1000 MW of energy storage capacity by 2025, while New Jersey’s legislature passed a state goal of 600 MW of energy storage capacity by 2021 and 2000 MW by 2030. Arizona is studying a proposal to require up to 3000 MW of energy storage to be added to the grid by 2030. In addition, Nevada and Colorado are considering setting storage targets for their utilities.

Solar Grid Storage

According to the Solar Energy Industries Association (SEIA), California has the most solar capacity installed in the U.S. with almost 23 GW, as the state’s IOUs have been aggressive with their storage programs to meet CPUC’s objectives. In January 2018, AES named Fluence, a joint venture between Siemens AG and AES, the supplier for a stand-alone 100-MW/400-MWh battery storage system, which will provide capacity to SCE under a previously signed 20-year purchase power agreement (PPA) between AES and SCE.

This system will be installed as part of a larger repowering project at AES’s Alamitos Energy Center in Long Beach, California. According to Steve Goldman, communications manager for Fluence, “The Alamitos project was one of the first instances of an energy storage asset securing a PPA to provide capacity and remains one of the largest contracted battery-based energy storage projects in the world. Under AES’s PPA with SCE, all of the capacity from the new plant will be sold to the utility in exchange for a fixed monthly capacity fee.”

PG&E appears to be ready for the challenge of increasing its energy storage capacity. The utility received CPUC approval to replace three gas plants with four Li-ion battery energy storage projects totaling 567.5 MW/2270 MWh of capacity. PG&E will own a 300-MW/1200-MWh project from Vistra Energy Corp. and a 182.5-MW/730-MWh project from Tesla Inc. The other projects will be owned by third parties and operated for PG&E, including the 75-MW Hummingbird Energy Storage project and 10-MW MicroNOC Inc. project.

The 49 MW West Burton B Li-ion battery based energy storage system is one of the largest battery storage projects in the UK, which provides enhanced frequency response services to the National Grid transmission system. Courtesy of EDF.

SDG&E announced it will have developed or interconnected more than 330 MW of energy. In keeping with this position, SDG&E has received CPUC approval for five new storage projects totaling 83.5 MW and one demand-response project rated at 4.5 MW.

In addition, the Renewable Energy Systems (RES) 30-MW/120-MWh Li-ion storage facility will be completed by December 2019 along with the Advanced Microgrid Solutions 4-MW/16-MWh Li-ion storage facility. The Fluence 40-MW/160-MWh Li-ion battery storage facility is expected to be completed in March 2021, followed by the Powin Energy Corp. 6.5-MW/26-MWh Li-ion facility in June 2021. The Enel Green Power 3-MW/12-MWh Li-ion facility is expected to be completed by December 2021. SDG&E also has contracted with OhmConnect for a 4.5-MW demand-response project.

Cross Country

California is not the only state adopting energy storage goals. There are energy storage projects from coast to coast and beyond. Hawaiian Electric Companies (HECO) reported it sent seven solar-plus-storage projects totaling 262 MW/1048 MWH to state regulators for approval in early 2019. Four of the projects cost less than $0.10/kWh, two of them reportedly cost $0.10/kWh and one costs $0.12/kWh. HECO reported three projects will be located on Oahu, totaling 127 MW with 508 MWh of storage. Two projects will be on Maui, totaling 75 MW and 300 MWh of storage. The other two projects will be on Hawaii Island, totaling 60 MW with 240 MWh of storage.

A microgrid with an ABB 30 MW li-ion battery based PowerStore energy storage systems is being installed in South Australia on the Electranet transmission system. Courtesy of ABB.

In Arizona, Salt River Project (SRP) has commissioned a 20-MW solar-plus-storage project with a 10-MW/40-MWh Li-ion storage facility. NextEra Energy built the plant and will sell the electricity generated to SRP. The energy storage hardware was provided by Tesla. SRP also announced a contract with AES for a stand-alone 10-MW/40-MWh energy storage facility. The Li-ion battery will be provided by Fluence using its Advancion energy storage technology platform.

Several energy storage projects are getting attention in Massachusetts. ENGIE Storage Services announced a 3-MW/6-MWh energy storage system in late 2018 at the Mt. Tom solar farm in Holyoke, Massachusetts. Also, Bay State Wind reported it has entered into an agreement with NEC Energy Solutions to provide a 55-MW/110-MWh energy storage system for its 800-MW wind farm. These energy storage systems will address the duck curve produced by solar and wind on the Massachusetts grid.

Stockpiling

On a global scale, energy storage projects are gaining importance as more renewables are being integrated into the T&D grids of Europe, Asia, Africa and other locations. The India Energy Storage Alliance (ISEA) reported India has reached 1.5 GWh of storage capacity in the last three years. Recently, the European Energy Storage Association reported the European installed storage capacity increased by 49% in 2017. By the end of 2018, 1.6 GWh were operating across the continent.

German-based EnspireME is a joint venture between the Dutch renewable energy company Eneco and Mitsubishi Corp. A press release stated, “The storage system will store excess wind power for use to compete within the primary reserve market.”

The storage system is currently Europe’s largest battery with a capacity of 48 MW/50 MWh and consists of more 10,000 Li-ion batteries. It is located adjacent to a substation close to Germany’s border with Denmark. The location is strategically important for offshore wind transmission.

China is setting records for shifting away from fossil-fuel-based generation to renewable generation. According to the China Energy Storage Alliance (CNESA), the country’s 2018 newly operational energy storage capacity had achieved growth of 281% compared with 2017’s capacity. More than 340 MW of new energy storage facilities were completed across four provinces or are in development. In Jiangsu province, CNESA said, “Grid-side projects included eight energy storage power stations equipped with lithium-iron-phosphate batteries at a total scale of 101 MW/202 MWh. Providers include ZTT Energy Storage, CLOU, eTrust and other domestic companies.”

Some analysts predict China could surpass all other nations except the U.S. in the next five years.

In Japan, a 240-MW/720-MWh energy storage system is planned for the North Hokkaido Wind Energy Transmission Corp. facility. The engineering company Chiyoda Corp. is designing and constructing the storage system. The 500-MW wind facility is expected to be operational by late 2022 or early 2023. The GS Yuasa Corp. will supply the Li-ion high-capacity storage battery at the Kita Toyotomi substation. Mitsubishi Electric is supplying its BLEnDer energy management system to monitor and control the battery and power conditioners. In a press release, Mitsubishi stated, “The BLEnDer energy management system will help to balance the electric supply with the demand such as power surpluses from renewable energy.”

This is a supply-demand control system to optimize the over-generation issues common with wind and solar.

The Australian grid also is installing a lot of energy storage systems to mitigate the duck curve issues. A Tesla 25-MW/52-MWh energy storage system will be installed at the 278.5-MW Lake Bonney wind farm in South Australia. Also, EnergyAustralia and AusNet Services, the owner and operator of Victoria’s electricity transmission network, are working together on this challenge. A 30-MW/30-MWh Fluence energy storage system is being installed at AusNet’s Ballarat Terminal station. The battery will store excess electricity, feed it back into the network when needed and be used to regulate frequency.

A 30 MW/30 MWh Li-ion battery based energy storage installed at the Ballarat Terminal Station about 100 km west of Melbourne, Australia to regulate frequency and store solar generated electricity as needed. Courtesy of Fluence

The ABB PowerStore is available with a flywheel technology for networks needing fast response energy storage systems. Courtesy of ABB.

Symbiotic Relationship

Energy storage technology is changing the industry as it truly becomes a shock absorber in the struggle to balance supply and demand as solar and wind generation increases. By combining storage with renewable generation, the application has proven to be so effective, the “plus storage” term came about to identify it. Solar plus storage and wind plus storage are making a big difference with taming the duck curve and smoothing out the intermittent nature of these technologies. According to SEIA, “Solar plus storage will have a symbiotic relationship starting now and well into the future. Ultimately, the wide-scale adoption of solar will lead to the wide-scale adoption of storage.”

Wind plus storage is getting the same type of attention in the wind farm world. The symbiotic relationship means the two technologies are creating business opportunities for each other, according to SEIA. Along with addressing the duck curve issues, the plus-storage scheme is becoming a viable alternative to natural-gas-fired peaker plants. Energy storage technology combined with sophisticated software and solar or wind generation is redefining the hybrid generation station. Wood Mackenzie Power & Renewables predicts up to 6.4 GW of future peaker capacity, or about 32%, of the U.S. needed by 2026 could be supplied by energy storage.

This integrated technology is moving the electric power delivery industry closer to the fabled virtual power plant, which is why energy storage has been called the enabling technology. The technology of plus storage is rapidly becoming a force to be reckoned with and only the surface has been scratched.

Editors’ Note: This is the second of three articles in our energy storage update for 2019. The first article appeared in the April issue of T&D World.

About the Author

Gene Wolf

Technical Editor

Gene Wolf has been designing and building substations and other high technology facilities for over 32 years. He received his BSEE from Wichita State University. He received his MSEE from New Mexico State University. He is a registered professional engineer in the states of California and New Mexico. He started his career as a substation engineer for Kansas Gas and Electric, retired as the Principal Engineer of Stations for Public Service Company of New Mexico recently, and founded Lone Wolf Engineering, LLC an engineering consulting company.

Gene is widely recognized as a technical leader in the electric power industry. Gene is a fellow of the IEEE. He is the former Chairman of the IEEE PES T&D Committee. He has held the position of the Chairman of the HVDC & FACTS Subcommittee and membership in many T&D working groups. Gene is also active in renewable energy. He sponsored the formation of the “Integration of Renewable Energy into the Transmission & Distribution Grids” subcommittee and the “Intelligent Grid Transmission and Distribution” subcommittee within the Transmission and Distribution committee.