Evolution of Li-ion Batteries: From the Garage to the Grid

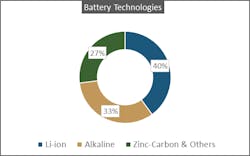

Li-ion with all its variants is the most used battery type today. It has a commanding 40% share among different battery types and this number is expected to grow even more because of increased use in EVs and consumer electronics.

Recent technical advancements and market trends

Because of its ever-increasing importance in e-mobility, consumer electronics and special applications like marine and defense, a lot of research is being done on this technology. The following are some recent advancements and trends in Li-ion battery technology that are expected to have a significant impact on market dynamics:

Solid-state batteries

One of the most actively discussed topics in the energy storage industry today is the solid-state Li-ion battery. It is a variant of Li-ion technology in which solid electrolytes are used instead of liquid/polymer electrolytes. Solid-state batteries offer some key advantages over conventional Li-ion. This includes a very high energy density, compact cell size between 3 and 4 microns (instead of 20 and 30microns), and a possibility of quick charging without the risk of dendrites formation. All this makes the technology lucrative for the automotive industry, which is looking for batteries that are able to withstand very high charging rates, thus reducing charging time for EV owners, and reduce space requirements in a car. This is the reason why some key manufacturers are already looking into using these batteries. BMW is considering the use of solid-state batteries for their newer models and Toyota is planning to produce vehicles with solid-state batteries by 2022. Going forward, these are the batteries that will be on our roads and parked in our garages in massive numbers.

Non-Copper anodes

Another recent advancement is the non-copper anodes for the battery. Since the 1990s, primarily graphite-coated Copper has been used as an anode in Li-Ion batteries. Two anode types have the potential to replace copper anodes:

Lithium Titanate (LTO) anode: LTO anodes have a higher power density and can afford a higher number of charging/discharging cycles than copper ones. These anodes operate on lower voltages and provide low energy density. This makes them ideal for applications with less space constraint but need for high charge/discharge rate. An example could be grid applications that require high power density (frequency regulation, renewable integration) where multiple batteries can be combined in a system without strict space-saving requirements. Recently, Toshiba announced its 50Ah prototype of this type of battery. The company claims it will retain 90% of its capacity after 5000 cycles.

Silicon anode: Another type being researched is a silicon anode coated with graphite. This anode technology offers high energy density and power rating potential while at the same time promising a lower cost. Samsung SDI and Panasonic are already working with this technology. However, this technology is still in its early stages and would need a longer time-to-market than LTO anodes.

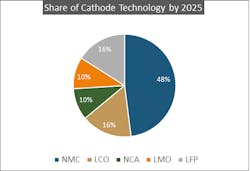

NMC-811 cathode to dominate Li-ion market

Nickel Manganese Cobalt (NMC)-based cathodes will increasingly replace Lithium Iron Phosphate (LFP) and Lithium Cobalt Oxide (LCO) cathodes. So far, the reluctance regarding using this blend of cathode material was stemming from the higher Cobalt requirement. However, NMC-811 (8 parts Nickel, 1 Manganese, 1 Cobalt) with its reduced dependency on Cobalt is offering a strong advantage to the manufacturers. Many companies are now making a switch towards NMC-811. For example, LG Chem and SK Innovation are ramping up their NMC-811 production capacity, while Tesla is already using this cathode technology in its Tesla Powerwall.

Use of nanomaterials (Graphene)

Graphene, a nanomaterial, is being increasingly researched for use in battery cells. Some properties of Graphene, like hardness, flexibility and very high thermal and electrical conductivity, make it suitable for use in battery cells. Recently, Samsung SDI had a breakthrough with their “Graphene Ball Technology”, in which both the anode and cathode were covered with Graphene-silica protective layer. Samsung SDI claims that using this technology increased the battery capacity by around 45% with a 5x quicker charging time. Toyohashi University in Japan has proposed Phosphorous encapsulated nano-tube electrodes. The claim is that they have doubled charging capacity during experimentation and the cells maintained high structural integrity after repeat charges.

Custom cells and modules

A recent emerging niche in the market is the design and manufacture of customized Li-ion cells and modules for special applications. Li-ion used in e-mobility and consumer electronics is just one piece of the market. There is a whole range of applications, from robotics to marine and defense, where standard Li-ion batteries do not suffice. Some manufacturers like Customcells and Cell-con are focusing on this growing niche and working with customers to produce application-specific battery modules from the prototype to manufacture stage.

Raw material supply

Another constraint being faced by battery manufacturers is raw material sourcing. Primary raw materials used in Li-ion batteries are Lithium, Cobalt, Graphite, Nickel and Aluminum. Out of these, Lithium and Cobalt are considered scarce. But is this concern really warranted?

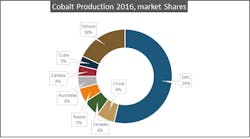

Cobalt: Nearly all Cobalt is mined as a byproduct of other more abundant metals, such as Nickel or Copper. This means production is driven primarily by the markets for the principal metals, not by the need for Cobalt. This situation limits producers’ flexibility in adjusting the amount of Cobalt mined in response to changes in demand and can result in periods of oversupply or shortage. From 2009 to 2015, global Cobalt production was higher than consumption as production from new projects and from expansions to existing operations added to global supply. This, however, changed and by the middle of 2016, as rising battery demand created a supply-constrained market. The situation did not change in early 2018. The forecast by industry observers is that this will continue through 2020.

The main supplier of Cobalt globally is the Democratic Republic of Congo (DRC), which has a commanding 51-53% of supply, based on EU or US data. It is followed by countries like China, Russia, Canada and Australia with 5-6% each.

Price of Cobalt has skyrocketed since the middle of 2016, reaching over $80K per metric ton (MT). Looking back a bit further, the situation was similar in 2008, when DRC had placed a moratorium on exports and prices went up to $115K/MT before the ban was lifted. The country continues to yank the prices around. The latest instance being the royalty hike from 2% to 10% in January 2018. However, the price of Cobalt is diminishing in importance to many EVs. This can be confirmed as China, the main user of LCO in EV applications, is now switching to ternary cells, consisting of LMO, NCA, and NMC. Within the NMC class of batteries, the 811 blend, with 50% less Co required than the 622, is becoming mainstream with LG Chem and NK Innovation setting up new production lines in the last six months.

Lithium: Lithium has been listed as one of the critical or near-critical elements in various recent and not-so-recent studies. Between 1975 and 2005, world lithium production increased by a factor of about five, and more growth in the supply base is anticipated. Although produced largely in Australia, the lithium triangle (Argentina, Chile and Bolivia) hosts 75% of the worlds Lithium resource with Chile being the leader in extraction from brine.

PTR does not believe the element to be rare or scarce as worldwide resources of Lithium are estimated to be more than 39 million metric tons, which is enough to meet projected demand till the year 2100. Additionally, various attempts are being made to find innovative ways to cater to increasing Lithium requirements by looking at alternatives like recovering Lithium from recycled batteries and using Sodium instead of Lithium to produce Na-ion batteries. Sodium is much more readily available than Lithium in most parts of the world.

End-of-life Recycling

An important trend worth mentioning here is the increasing focus on end-of-life battery recycling. The growth of electric vehicles could leave us with a lot of batteries to recycle. It is estimated that globally there would be 11 million tons of Li-Ion batteries to be recycled by 2030. Regulations have been introduced in the EU that make battery recycling a high priority by requiring battery manufacturers to finance the costs of collecting, treating and recycling batteries. As of now, only 5% of the total batteries are being recycled in the EU. There are multiple ways recycled batteries can be utilized. In some cases, sweltering is carried out to recover precious metals, including Cobalt and Nickel, and further processing is done to recover Lithium. In other cases, batteries are refurbished/remanufactured after use in one application to be reused in another. For example, according to the EV industry, the “degraded” battery from the car is still at around 80% of its capacity. These batteries can be used directly with minimum processing in other applications for home energy storage or UPS. Nissan has already partnered with Eaton to reuse their car batteries for home energy storage applications.

Who is leading the R&D? (Learnings for Grid Sector)

The major portion of R&D expenditure in the battery market (around 90%) is being driven by the mobility sector, which is making a big shift towards electric vehicles. Being a fast-moving industry with design cycles of four to five years, automotive generally tends to use the latest and greatest with a focus on reduced cost. In this case, as most of the batteries are being manufactured externally, these battery manufacturers are spending significant money on R&D to develop and improve the technology further. These advances can also be utilized by other end-applications by working with these battery manufacturers.

For example, the power grid industry can capitalize on advances in the automotive sector, or as we describe it, from the garage to the grid. Companies working in the grid sector need to collaborate more with the automotive industry to utilize battery technology for the grid. Especially with increasing e-mobility, the overlap between grid and automotive sectors is increasing. More and more pilots of V2G based solutions are being installed, focusing on applications like frequency regulation and peak shaving e.g. Oxygen Initiative in California and the Tennet-Vandebron partnership in the Netherlands.

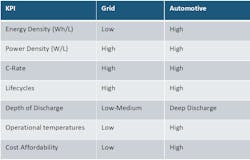

The table below is a comparison of the battery requirements of the grid and the automotive sectors. In almost all cases, the automotive has stricter requirements to be fulfilled than the grid. This is an indication that the same technology can be used in the grid sector too, avoiding billions in R&D costs working from scratch.

In some cases, this collaboration is already happening. Tesla EV also supplies its Powerwall for energy storage. In the future, there is potential of more automotive OEMs offering similar solutions or partnering with grid focused companies to provide solutions for alternative markets. We believe, at the end, market winners would be those with maximum collaboration and multiple partnerships, and not just the ones with the best technology.

Battery Market Overview - Supply Lens

Capacity utilization

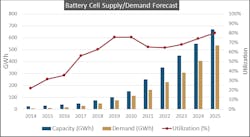

Despite the increasing demand for batteries, utilization of battery cell manufacturing capacity is relatively low. Globally, these manufacturing plants are running at 60-70% utilization. This is expected to become better in the future given increased demand of EVs and grid storage. However, considering multiple new giga factories being announced, maximum utilization is expected to still stay below 80% as shown in the graph below.

Supplier market shares

From a supply point of view, Asian manufacturers are dominating with LG Chem (South Korea), Panasonic (Japan), Samsung SDI (South Korea), AESC (Japan), BYD (China) and CATL (China) having around two-thirds of the market share. However, there is an increasing push to locate battery manufacturing in Europe to reduce reliance on Asian manufacturers. Companies like BMZ group in Germany and Northvolt in Sweden are setting up new or expanding existing manufacturing facilities to meet the growing demand of Li-Ion storage solutions in Europe. The graph below represents the market share of various manufacturers in 2017:

About the Author

Hassan Zaheer

Hassan Zaheer is a co-founder and principal consultant at Power Technology Research. As part of his current role, he works with clients on market data analysis and market entry strategies in the Power Grid sector, particularly focusing on grid equipment and trends such as integration of Distributed Energy Resources (DERs), advances in Digital Asset Management Systems and impact of increased electric vehicles (EVs) on Power Grid. He has assisted clients in Fortune 500 companies with global market studies and market entry strategy for new products. After starting his work in the power transmission & distribution sector in early 2014, he has developed expertise working on bespoke projects for power equipment manufacturers in the United States, Europe and Asia. He holds an M.Sc. Power Engineering from Technical University of Munich.