Deloitte Report: AI Data Center Power Demand to Surge 30x by 2035

- Significant growth in AI is spurring unprecedented demand for new AI data centers. Power demand from AI data centers could grow more than thirtyfold by 2035.

- AI’s exponential growth should include collaboration from energy, power, manufacturing, and construction companies to support data center infrastructure development.

- Both data center and power executives surveyed share the view that power and grid capacity constraints in meeting load growth is very or extremely challenging for data center infrastructure buildout (72% of overall respondents).

- Technical innovation, regulatory innovation, and funding can help close the gaps in powering AI, according to both power and data center executive respondents.

As AI continues to proliferate, planned expansion of U.S. data centers may move more rapidly than new power generation can be brought online, creating a gap in infrastructure development to meet demand. Energy requirements and AI hinge on the rapid buildout of data centers, the grid capacity to power them, and a manufacturing base to support both. In a new report, “Can U.S. Infrastructure Keep Up With the U.S. Economy?,” Deloitte explores the importance of staking an infrastructural lead in powering AI, and the challenges and opportunities present as industries look to do so.

The anticipated surge in electricity demand from AI includes additive scope, scale and speed of infrastructure development across data center, power, manufacturing and construction assets.

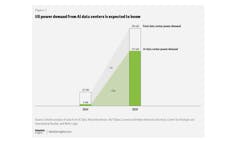

- AI data center power demand is expected to grow more than thirtyfold by 2035, according to Deloitte estimates, from 4 GW in 2024 to 123 GW in 2035.

- While AI accounted for only 12% of the 33 GW in data center power demand in 2024, that could increase to 70% of the 176 GW in data center power demand expected by 2035, according to Deloitte analysis.

- The impact of AI data centers on the industries needed to support them — from utilities and renewables to construction and manufacturing — is becoming more common in investment discussions. According to investor earnings call transcripts in both the manufacturing and energy sectors, mentions of “data center” grew fivefold to a record high in 2024 (from 997 in 2023 to 5,402 in 2024).

- US utility and hyperscaler annual capex is expected to reach $1 trillion by 2032

- Capex is expected to surpass $1 trillion within the next 5 years for energy utilities and within the next 3 years for hyperscalers

- The tech industry plans to invest $1 trillion in US manufacturing of AI supercomputers, chips, and servers over the next 4 years.

- The scale of AI data centers and their power needs is also growing exponentially. Deloitte found that data centers built or under construction by hyperscalers draw hundreds of megawatts (MW) of power, while their largest committed and early-stage projects are gigawatt (GW) sized.

- Adding to the rising stakes is increased power demand. Among data centers and companies surveyed, 79% believe that AI will increase power demand through 2035 due to widespread adoption. Power respondents were especially confident that AI could stabilize demand through greater efficiency.

Both data center and power companies surveyed agree there are several challenges to powering AI infrastructure, along with unique concerns for each.

- Data center and power companies surveyed share the view that power and grid capacity constraints in meeting load growth is their top challenge.

- Resource competition, especially for power capacity, poses a challenge for most data center operators and power companies. Data centers feel this more acutely (80%) than power companies (57%). In addition, 92% of data center respondents see power capacity as a key point of resource competition, versus 71% of power companies.

- Beyond power and grid capacity, companies surveyed express concern for data center infrastructure buildouts over supply chain disruptions (65%) and security (64%); meanwhile, data centers cite timeline mismatches as a top challenge)

- Concerns over power and grid capacity constraints reflect trends impacting infrastructure including grid stress, operational inflexibility, peak growth, baseload erosion, interconnection queues, and the affordability crunch. However, affordability concerns vary: While 60% of power companies surveyed believe residential affordability concerns will not constrain data center development, only 47% of data center operators share this view.

Innovation, both technological and regulatory, stands out as an approach to help close the gaps companies face as they tackle AI infrastructure. Specifically, both data center and power companies surveyed are looking to develop additive infrastructure that can bring efficiency, capacity, and flexibility to powering AI.

- Power and data center companies surveyed agree on the most important levers to help overcome these challenges — technological and regulatory changes.

- Data center companies surveyed point to increasing technological innovation to boost efficiency (90% said it was “very or extremely important”), making infrastructure more intelligent (81%), and integrating renewable energy sources (66%) as their top priorities for strengthening infrastructure. To do this, many are looking to tap new resources and transmit power in chips and on the grid in new ways using new transformer and transmission technologies.

- Deloitte developed a framework for streamlining load and generation interconnection: expose the process, expel speculative projects, and expedite prioritized projects.

- Looking at the need for regulatory changes, power and data center companies surveyed agree partnership is key, but there is a question of effectiveness: 78% of data center and 67% of utility respondents believe that cooperation between the two on infrastructure development and cost allocation is effective, but only 15% of data center respondents and 8% of power companies describe it as highly effective.

- Investment could pose a bigger opportunity for power companies, as data centers already benefit from investment momentum. While private investments in data centers in the U.S. reached a record high in 2024, power companies are still balancing how to innovate funding mechanisms to support faster capacity and new technology deployment while shielding households from rate increases.

Martin Stansbury, principal, Deloitte & Touche LLP said, “There is an opportunity in infrastructure development to support the national strategic priorities of AI and energy dominance. However, it is a complex undertaking, and analysis reveals certain gaps are creating some challenges. Collaboration will be critical, as will an understanding of the promise of additive infrastructure which builds upon the existing resources to bring efficiency, capacity and flexibility to power AI.”

Deloitte’s report, “Can U.S. Infrastructure Keep Up With the U.S. Economy?,” draws on insights from Deloitte’s 2025 AI Infrastructure survey of power companies and data centers. The survey interviewed 60 data center and 60 power company executives in April 2025 to identify U.S. data center and power company challenges opportunities and strategies, and to benchmark their infrastructure development. data center and power company challenges opportunities and strategies, and to benchmark their infrastructure development.