The electric utility I worked for in the 1990s made an amazingly bold decision for the time when it responded to deregulation by selling its generation fleet. While it is easy to second guess a company’s strategic decisions after the fact, history has revealed that the decision probably was premature as the generation portfolio doubled in value by the time the original purchaser resold the portfolio a few years later. However, today those same generation assets are mostly retired or worth a fraction of what they originally sold for. Many utilities in regions with wholesale competition and across the country have retained their generation assets where permitted by law. In this time of distributed energy resources (DERs) and virtual power plants (VPPs), should utilities be reevaluating their generation-ownership position?

This issue is ripe for consideration. A large portion of the U.S. electric market is not deregulated. Consequently, utilities in regulated regions have not experienced the full brunt of direct wholesale competition as have the deregulated areas. In markets that allow retail electric choice, buyers such as large commercial and industrial customers, and even retail customers working with independent retail providers can enter into a power purchase agreement (PPA) with entities other than the host utility. The main prerequisite for such a transaction is that the buyer and generator must be in the same wholesale electric market because the transaction involves a physical transfer of the power.

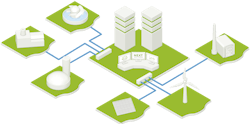

The newest challenges to traditional utility ownership of power plants are the VPP and the virtual PPA (VPPA). A VPP is a cloud-based or other synthetic aggregation of DERs, which might include demand side and storage resources as well as conventional and renewable power sources. Instead of memorializing a direct physical transfer of power, the VPPA documents a financial transaction such as a contract-for-differences or hedge which firms the buyer’s power price and may also include a transfer of renewable energy credits (RECs). The fundamental difference, financial transaction versus physical transfer of power, opens the whole country — including areas not deregulated — for possible business transactions. That said, VPPAs are easiest to document when the buyer and seller are in the same market region.

PPAs and VPPAs either directly or indirectly open electricity price competition to a large segment of industrial, commercial, and residential customers that do not have the space or resources or geographic conditions to develop competitive generation on-site. Because of rapidly improving technologies, the on-site generation option also is available for a growing segment of the electricity marketplace. That brings us to the opening question, what is the argument for staying in the generation business? Traditionally, there have been two primary reasons: reliability and cost. Utilities long believed it essential to control the entire electricity production and delivery process in order to ensure the very high level of reliability to which we have become accustomed in the United States. That included not only the generation resources, but also fuel supplies, fuel delivery resources as well as electric transmission and distribution. Utility ownership of power generation and fuel resources also helped ensure stable power prices because of long-term fuel agreements and equipment depreciation under a monopoly market setting.

In this time of more self-generation and virtual market opportunities, it may be more difficult to construct a convincing argument for utility generation ownership. The rapid pace of innovation and cost reduction in the renewables and distributed generation sectors increases the risk that utility assets will become prematurely obsolete or socially "out of style." Witness the huge increase in retirement of previously baseload nuclear, coal, and even gas combined cycle plants we’ve experienced in the last 5 to 10 years. Someone is paying for the write-off of that infrastructure. Can utilities tolerate taking on that risk with new assets?

There are also risks, both for the utilities that give up generation control and for consumers, when new providers enter the generation market. Look at the example of the four wind projects in Australia now being sued by the state’s energy regulator for actions contributing to a statewide blackout in South Australia in 2016. There is no totally risk-free means for securing power or operating in the power generation sector today. The brave organizations that remain committed to competing in the generation sector of the future will need intestinal strength, considerable vision for deciphering all the varied forms the new competition may take, and of course, an unerring commitment to meet or exceed the expectations of increasingly sophisticated customers.

About the Author

David Shadle

Grid Optimization Editor

Dave joined the T&D World team as the editor of the Grid Optimization Center of Excellence website in January 2016.

Dave is a power industry veteran with a history of leading environmental and development organizations, championing crucial projects, managing major acquisitions and implementing change. Dave is currently a principal at Power Advance, LLC, an independent consulting firm specializing in power project development, research and analysis, due diligence and valuation support. Dave is also a contributing consultant for Transmission & Distribution World. Prior to Power Advance, Dave held business and power project development positions with The Louis Berger Group, Iberdrola Renewables, FPL Energy and General Public Utilities. He is a graduate of Pennsylvania State University, the New Jersey Institute of Technology and Purdue University.