Flexibility Services: How Utilities Can Capture the Market

As utilities are exposed to the sizable risks of supply-and-demand imbalance fueled by unpredictable, intermittent generation sources, they are searching for flexibility solutions to offset their open positions. Energy aggregators have emerged to play an increasingly important role by providing the needed flexibility to optimize electricity generation and demand volatility. Meanwhile, multiple traditional (integrated) utilities have developed similar demand-side response (DSR) solutions, and some have even acquired aggregators.

Catching the inherent value in these services is becoming part of the core business of utilities. However, being in this game requires speed, specific skills, agility, and differentiators. Utilities therefore need to adapt to capture the opportunity.

There are three reasons that traditional utilities are adding flexibility services to their commercial offerings:

Benefit 1: Additional Source of Stable Revenues within the Rapidly Growing Flexible-Capacity Market

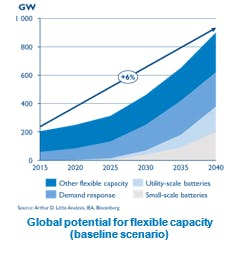

Underlying market drivers for flexibility (that is, the rise of intermittent generation and the expected shutdown of conventional generation assets) are gaining strength. Consequently, the global market for flexible capacity is expected to experience significant growth to reach 900 GW by 2040, at a compound annual growth rate (CAGR) of 6% over that timeframe. While the forecasted growth rates and figures vary across the different types of flexible capacity under consideration, they present welcome compensation for integrated utilities with other earnings that stagnate (for example, retail energy) or decline (for example, merchant generation). In addition, flexibility usage enables cost avoidance for utilities’ imbalance penalty charges.

Benefit 2: Strengthen the Relationship with Prosumers

Unlike aggregators, utilities have access to portfolios of existing B2B and B2C customers, with insight into their current energy consumption patterns. On the one hand, they can use this information to create flexibility services designed to help customers save money by lowering their energy bills, while also monetizing newly acquired assets such as residential batteries and providing related subscription-based services such as maintenance contracts. The real goal is to change customer consumption behavior (for example, shifting consumption away from peak periods) or optimize asset use of prosumers (for example, releasing energy from residential batteries when it is most valuable).

On the other hand, a utility can leverage the flexible capacity provided by consumers to optimize its own operations across the value chain. It can then improve its asset management, for instance, by choosing to activate or deactivate a virtual power plant instead of using a traditional generation asset.

Benefit 3: Protect the Local Market Position While Achieving Growth in New Regions

Multiple utilities have secured solid positions as large DSR aggregators, including Centrica, Enel, and Engie. This combination of “retain” (local market) and “gain” (new geographies) creates two sources of return for such initiatives.

Domestically, utilities can access flexibility income streams and fend off the rising numbers of aggregators — which pose a threat not only by exploiting new revenue streams, but also by developing strong relationships with consumers and other ecosystem firms.

Internationally, there is additional upside for market entry: a strategy based on flexibility services is very asset light, avoiding expensive fixed-asset investments compared with energy generation and supply.

The most important factors when evaluating DSR market opportunities are the level of competition, level of regulation, and degree of industrialization. Utilities considering international expansion through flexibility services will need to clearly define their entry strategies, consider local specifics, and ensure their international portfolios are well balanced.

Key Success Factor: Value Proposition

To be successful in a crowded flexibility market, utilities will need to differentiate themselves from other players that may be more agile and innovative. They should create compelling value propositions based on:

- Strong presence and in-depth knowledge of the energy value chain and ecosystem that allows them to provide a full range of services. This includes load and supply aggregation, as well as energy management services.

- Ability to offer a “one-stop-shop” approach: a combination of energy (electricity, with or without gas), flexibility, assets (photovoltaic panels, batteries, electric vehicle chargers, and so forth), maintenance services, and energy management advisory. Whether through in-house capabilities or using specific partnerships, the key element is that the utility must be in the lead. This paves the way for contracts that cover more advanced service offerings in the future, such as smart-home services.

- Flexibility service offerings must be attractive to customers, but the margin earned for the provided flexibility services should outweigh the opportunity cost. Although this seems obvious, the business case is often not clear, given the current market design and offerings.

Providing “flexibility services” is becoming mission critical for utilities — and the time to seize market opportunities is now.

About the Author

Kurt Baes

Kurt Baes is a partner at Arthur D. Little.

Florence Carlot

Florence Carlot is a principal at Arthur D Little.