Federal Tax Credit Implications and Monetization Strategies for Utilities

The energy tax credit provisions in the Inflation Reduction Act (IRA) are broad reaching as the legislation extends the lives of the popular Investment Tax Credit (ITC) and the Production Tax Credit (PTC), expands the list of technologies eligible for these credits, and provides opportunities for utilities and project developers to increase the credits’ value by meeting certain criteria.

Renewable resource owners now have significant flexibility to pursue a variety of tax credit and monetization strategy combinations. But this flexibility introduces questions about which strategy combination maximizes value for resource owners. CRA, a leading energy consultancy, explored which factors influence the optimal ITC/PTC monetization strategy under various cost and operating conditions.

At the forefront of the IRA’s provisions are extensions and modifications to the ITC and PTC. The key differentiator between the ITC and PTC is the manner in which each credit is assessed, with the value of the ITC scaling with project capital costs and the value of the PTC scaling with a project’s energy production.

ITC vs PTC under various cost and operating conditions

The IRA extended PTC eligibility to solar projects, which have only been eligible for the ITC in recent years. As a consequence, solar developers now have the option to choose between PTC or ITC for projects.

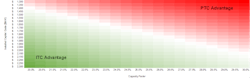

To evaluate the thresholds at which each tax credit is optimal, CRA examined the credits under various scenarios by calculating the levelized cost of electricity (LCOE) for a hypothetical 100 MW solar project, assuming prevailing wage and apprenticeship requirements are met. The results show a clear line of demarcation between the two credits.

While a heat map is useful in determining the threshold for the relative advantage of one credit over the other, translating the results into real-world application requires identifying geographic locales that realistically support the varying levels of capacity factors and installed capital costs. CRA used regional capacity factor data from the National Renewable Energy Laboratory (NREL) and capital cost data from the US Energy Information Administration (EIA) to estimate LCOEs on a geographic basis for the United States (See Figure 2):

The nature of the ITC has the potential to shift the regional economics of the tax credits. For example, the 10% ITC adder reduces a solar project’s LCOE by approximately 10%, while the 10% PTC adder may reduce a solar project’s LCOE by only 3-8%. However, the ITC’s advantage with a 10% bonus is dependent on the underlying capital costs.

The bottom line: solar developers seeking to amplify the value of tax credits by meeting one of the IRA’s bonus conditions will need to pay particularly close attention to each project’s characteristics and evaluate projects on a case-by-case basis.

In addition to the choice of ITC or PTC, resource owners should consider how to monetize the tax credit of their choosing. The IRA has expanded the monetization options available to utilities and independent power producers (IPPs) to include a credit transfer, so that both now have three options, including self-monetization, tax equity partnership and transfer.

The IRA’s tax credit provisions provide strong incentives for further renewable resource penetration. A wide range of resource owners stand to benefit from the extension of the ITC and PTC, and increased investment is likely among the expanded list of technologies. Alongside the credits, expanded monetization methods allow for a broader group of energy providers to leverage benefits and increase investment in renewable resources.

Though the circumstances surrounding every project are unique, there are several broad, key takeaways for resource developers and owners. The ITC becomes more favorable with greater installed capital costs and the PTC becomes more favorable with greater capacity factors, and at full credit value, the PTC is likely to be the most advantageous option for much of the US from an LCOE perspective. Also, the IRA’s bonus adders disproportionately improve the value of the ITC relative to the PTC and lastly, optimal monetization strategies will vary significantly depending upon organizational structures and tax liabilities.

While some generalizations can be made for utilities versus IPPs, the optimal strategy will vary between owners and is likely to require a lot of consideration to make the correct choice for each project.

About the Author

Anant Kumar

Anant Kumar is a Principal at Charles River Associates.

Chris Nagle

Chris Nagle is Associate Principal (Energy) at CRA.