AEP, Algonquin Call Off Kentucky Power Deal

The leaders of American Electric Power Co. Inc. and Algonquin Power & Utilities Corp. have spiked their agreement to have the latter’s Liberty Utilities Co. buy AEP’s Kentucky Power Co. business for about $2.6 billion.

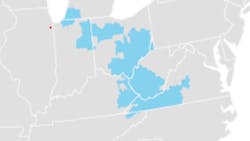

Algonquin agreed in October 2021 to buy Kentucky Power, which serves about 165,000 customers in 20 counties in the eastern part of the Bluegrass State. Kentucky and West Virginia regulators approved the purchase plan last May and July, respectively, but the Federal Energy Regulatory Commission said in December that Algonquin had provided inadequate assurances that its buy wouldn’t result in higher transmission rates. AEP and Algonquin filed a new application with the body in February and set April 26 as the deadline at which either company could call off the deal.

As it turns out, both companies agreed to walk away (and neither will owe the other a termination fee) as the deadline neared, with Algonquin President and CEO Arun Banskota also citing “the evolving macro environment” as a factor.

For their part, AEP President and CEO Julie Sloat and her team said they are “implementing a refreshed long-term strategy” for Kentucky Power—suggesting they will not soon bring the subsidiary back to market—and will in June file a new base rate case that, if approved, would take effect in January.

“We are working diligently to reimagine our strategy with the goal of not just supporting Kentucky but being an essential part of its economic and energy future,” Sloat said in a statement. “We believe there are opportunities ahead for our Kentucky operations, and we will focus our efforts on economic development, reliability and controlling cost impacts to customers.”

Leading those efforts will be Cindy Wiseman, Kentucky Power’s newly named president and COO. Wiseman has been with AEP since 2008 and has moved from communications into senior external affairs and customer service roles. She joined the Kentucky Power team about five years ago.

Shares of AEP (Ticker: AEP) didn’t move much on the news and closed the day at $93.29, up nearly 1% from Friday’s last trade. Algonquin shares (Ticker: AQN) fell 1.5% to $8.50 April 17; they have lost about 20% of their value over the past six months.

Word that AEP and Algonquin are moving on from their transaction plans comes just days after PNM Resources Inc. and Avangrid Inc. extended the deadline for Avangrid to buy its New Mexico-based peer in a deal valued at more than $8 billion. The hangup there is approval by the New Mexico Public Regulation Commission: The previous members of that body turned away the transaction’s proposed benefits agreement and the New Mexico Supreme Court still needs to send the companies’ appeal back to a reconstituted commission for another hearing.

About the Author

Geert De Lombaerde

Senior Editor

A native of Belgium, Geert De Lombaerde has more than two decades of business journalism experience and writes about markets and economic trends for Endeavor Business Media publications T&D World, Healthcare Innovation, IndustryWeek, FleetOwner and Oil & Gas Journal. With a degree in journalism from the University of Missouri, he began his reporting career at the Business Courier in Cincinnati and later was managing editor and editor of the Nashville Business Journal. Most recently, he oversaw the online and print products of the Nashville Post and reported primarily on Middle Tennessee’s finance sector as well as many of its publicly traded companies.