Can Community Initiatives And Demand Flexibility Save the California Grid?

As states like California accelerate toward aggressive decarbonization and clean energy goals, they are increasingly experiencing costly challenges transitioning to a new distributed model. Greenhouse gas reduction targets are no longer just coastal and progressive. In fact, 71% of US utility customers buy power from a utility with a carbon goal in place already.

Existing grid resources and supply-side solutions are insufficient to cover the growing flexibility gap as solar and wind continue to accelerate.

To both meet ambitious decarbonization goals and adapt to the growing impacts of climate change, utilities are engaging an increasing range of distributed resources, many behind their customer’s meters, to shift demand to periods where generation is clean and low cost, and to help their customers manage their costs during the coming clean energy transition.

Last summer’s blackouts in California and the winter grid crisis in Texas only highlighted the urgent need for more dynamic and flexible approaches to managing demand.

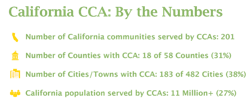

Community Choice Aggregation allows communities to pool their electricity load to purchase clean energy and develop local projects and programs on behalf of their residents and businesses. Community choice aggregators (CCAs), like Northern California's MCE are ideally positioned to help solve these emerging grid challenges. CCAs have over 11 million customers in California, representing 50 GW of load, including 3.9 GW of solar generation and 1.1 GW of storage. Because CCAs are designed to offer more local control over energy, they are close to their communities and therefore more responsive to their customers’ demand flexibility, needs and desires.

MCE, which serves 36 communities in four Bay Area counties, was Recurve’s first partner. The San Rafael-based non-profit has reinvested over US$180 million back into its communities through customer programs and renewable energy projects since 2010 while eliminating almost 500 kt of GHG emissions and investing US$1.6 billion into new California renewable energy projects.

MCE has supported the innovation of open-source tools and new market models that turn traditional energy efficiency and demand response on their heads, breaking down barriers and driving toward scale.

Given MCE’s history of innovation and mission to address the challenges of decarbonization and climate adaptation in California, they are leading the state through its collaboration with Recurve to procure local market-based demand flexibility to help hedge exposure to costly energy market peak prices, while creating local jobs and helping customers reduce costs.

Learning from the August 2020 Blackouts

In August 2020, an extreme heat storm stressed the California grid, creating statewide blackouts. In an emergency bid to enhance supply, California Independent System Operators (CAISO), a non-profit Independent System Operator (ISO) serving California, called for behind-the-meter demand response resources to reduce demand.

However, because the day-ahead locational marginal pricing (LMPs) did not reach the price cap during the rolling blackouts and measurement rules meant dispatching would negatively affect their future baselines and DR value, many third-party demand response providers did not dispatch their resources.

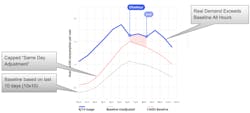

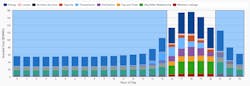

The following is an example of the hourly impact from OhmConnect, a demand response company that provides a way for California homeowners to get paid for responding to demand response events.

Under current rules, the amount of savings that OhmConnect provided were calculated relative to the traditional "10-in-10 baseline", which is simply calculated using an average of the past 10-days' consumption, with a capped “same-day adjustment”, to attempt to account for the fact that the event day was a heatwave, not an average day. Because of this, there were no savings shown or paid to OhmConnect, even though reductions rather clearly occurred.

Those like OhmConnect that chose to dispatch during the blackout lost hundreds of thousands of dollars doing it.

In other words, the California system stacks the cards against the very players it needs in the market and then blames them when these private companies follow the rules and make rational economic decisions that do not align with the public good or regulators’ priorities.

Building on a Revenue-Grade Market Platform

Working with MCE and NREL, Recurve solved this problem by conducting an independent revenue-grade analysis of how OhmConnect’s virtual power plant performed in MCE’s territory on August 14th.

This analysis is revenue-grade in that it uses only open-source methods and code that can be verified for each asset. This results in the net impact to load based on the sophisticated open-source CalTRACK methods and Linux Foundation Energy OpenEEmeter, after adjusting for population effects such as extreme heat and flex alerts on the radio, using the open-source GRIDmeter.

Contrary to current baseline approaches, Recurve’s analysis demonstrated that by putting a call out to its customers, OhmConnect reduced the net hourly demand impact of the customers in MCE’s territory by 19.3% through the entire three-hour event window.

In 2021 the Stakes Are Even Higher

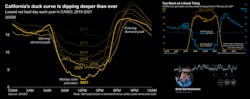

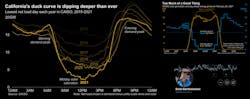

The summer of 2021 is shaping up to be a significant grid challenge. Even with substantial solar curtailment, California's duck curve has evolved into something that looks more like a halfpipe than a duck, with lower-than-ever midday demand slamming into a near-vertical evening ramp.

On the heels of last August's black-outs (and ratcheted up by the recent blackouts in Texas), regulators and utilities in California are urgently trying to muster enough resources to prevent similar grid issues this year — with only months left before summer.

Building new infrastructure simply takes too long. Current approaches to deploying existing flexibility are wrapped around the axle of outdated regulation and historical norms that create massive barriers to deployment.

Revenue-Grade Open Market Access

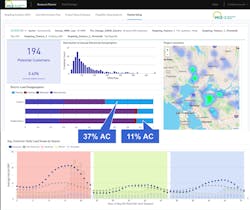

To meet these challenges, MCE recently partnered with Recurve to launch a new Demand FLEXmarket to reducing demand during the costly summer peak hours most likely to contribute to blackouts.

By offering vendors payments for load shifting to non-peak hours and event-based response to support grid reliability and resiliency, the FLEXmarket effectively integrates energy efficiency measures and demand response to create a truly flexible resource that can manage both extreme events and the long-term load-shaping needs of a decarbonizing grid.

The program aims to drive 20 MW of peak reductions this summer, with 100% clean and local energy sources. This new market is focused on preventing blackouts. It will send both a summer peak hour price signal and a day ahead resilience incentive that can be deployed during grid events.

Vicken Kasarjian, MCE COO, said: “This program will help MCE better serve our customers by diversifying the services we can offer, and lowering bill costs. It will help our customers reduce their carbon footprint by shifting usage toward hours of the day where renewable energy is affordable and abundant.”

The Demand FLEXmarket is technology agnostic and is designed with minimal barriers to participation. Using the FLEXmarket model, MCE will open its doors to a wide range of behind-the-meter flexibility providers to balance load or respond to a day-ahead demand response signal. As calculated at the meter, vendors are paid on performance through a transparent and accountable payment structure. This less prescriptive approach opens the program to increased technological innovation and a broader group of vendors who can deliver value.

Cisco DeVries, CEO of OhmConnect, explained: "In addition to integrating all behind-the-meter resources into a single price signal, the FLEXmarket uses comparison group baselines that accurately and fairly represent the actual value the companies like ours provide. This will allow us to dispatch peak savings during extreme events."

MCE's expansion of the Demand FLEXmarket into both EE (long-term) and DR (dispatchable) builds on its Commercial Efficiency Market, which compensates energy efficiency vendors for their projects’ hourly grid impact as determined by California's Avoided Cost Calculator (ACC) and incentivizes peak savings with CPUC ratepayer efficiency funding. MCE pays only for realized results at an incentive rate that is guaranteed to be cost-effective. It will also help MCE hedge against energy market exposure by utilizing procurement to incentivize flexibility providers for reductions in peak consumption.

Delivering an open, integrated market and a price signal that unifies energy efficiency and demand response enables MCE to acquire demand flexibility that costs less than other sources of peak energy in the market, emits zero GHGs and provides local economic development and customer bill savings.

Recently, CAISO engaged in a study with Recurve to expand the analysis initially conducted with MCE and OhmConnect to provide a more comprehensive accounting for the impact of flexibility resources that responded to the rotating power outages of last summer. California CCAs, investor-owned utilities and demand response providers will participate in the study to inform market progress for further integration of distributed energy resources.

In a letter to stakeholders, the CAISO stated that “as a result of this effort, the CAISO hopes a DR provider or resource(s) can use this methodology as a performance methodology for settlement of market dispatches in summer 2021, conditional to the methodology’s compliance with the CAISO tariff. Following this, the CAISO hopes the methodology will be applied broadly amongst the DR community to measure performance."

This study is designed to provide a basis for revenue-grade measurement going forward. It will also offer telemetry to CCAs and other load-serving entities and Flex Providers to enable more accurate forecasting into flexibility's impact on the grid.

In Conclusion

The launch of MCE's FLEXmarket represents a potentially transformative moment for the future of integrated demand flexibility and behind-the-meter distributed energy resources. It also demonstrates how innovative market solutions and community choice aggregators can play a critical role in deploying local resources to support grid decarbonization and help customers manage energy costs.

As the utilities accelerate towards clean energy goals, the need for low-cost flexibility resources will only increase. Demand flexibility represents one of the largest potential resource categories that not only supports a balanced grid but delivers benefits directly to end customers.

With the collection of measurements and other data at remote or inaccessible points and their automatic transmission to receiving equipment for monitoring how distributed flexibility responds to both MCE and supply-side market signals, the Demand FLEXmarket also allows MCE to more accurately forecast demand. Vendors chosen will receive support with customer targeting and acquisition to improve overall program cost-effectiveness, provide more targeted grid benefits and reach those who need to save energy the most.

About the Author

Matt Golden

Matt Golden is CEO of Recurve, which provides platforms that measure demand flexibility to utilities and aggregators, based on the open-source OpenEEmeter. He also led the Investor Confidence Project at Green Building Certification Inc. (GBCI) and was previously the founder of an energy-auditing software startup and retrofit contractor, which was also called Recurve.