New Zealand's Two-Tiered Investment Approach

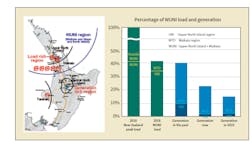

Like many other countries, New Zealand is in the midst of retiring its thermal generation as a result of greater social and political awareness of climate change, market volatility and the falling cost of renewable resources. Most of the reduction in thermal generation is concentrated in a region where one-third of the country’s population resides in the Waikato and Upper North Island (WUNI).

In 2015, two of the largest thermal generation plants in the WUN I region were decommissioned within a three-month period. Furthermore, it was estimated the planned retirement of large thermal generation units located in WUNI potentially would result by 2022 in a cumulative loss of 65% of the generation capacity installed in the region, which would represent 15% of New Zealand’s total installed generation. Analysis indicated if those units were retired, New Zealand’s power system would not be able to maintain its N-1 (with “-1” being the tripping of the most critical component) level of security for the WUNI region, thereby breaching the grid reliability standards (GRS) for dynamic and static voltage stability limits.

A higher load than the voltage stability limit and the failure of one critical transmission asset could cause voltage collapse in the WUNI region and the rest of New Zealand’s North Island. Without further investments in generation or transmission assets, the demand in the WUNI region would need to be constrained for the regional power system to operate within the specified voltage stability limits. To manage this risk effectively, Transpower NZ Ltd. has been exploring a combination of transmission and non-transmission options that will meet the GRS and provide the lowest-cost investment path into the future.

New Zealand’s Electricity Industry

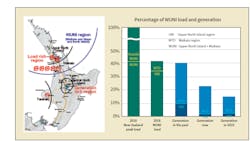

Since the mid-1990s, with the introduction of the wholesale market, New Zealand’s electricity industry moved toward privatization and transitioned away from centralized generation and transmission planning and operation. Transpower was appointed as the national grid owner and system operator, with responsibilities for operating, maintaining and developing the national grid. Additionally, it was given responsibility for the wholesale electricity market in real time. The segregation of the industry into different entities owning and operating generation and transmission assets means Transpower is not involved in the decision-making process for the capacity, location, technology or timing of generation commissioning and decommissioning.

New Zealand’s transmission system is long and stringy, as the largest urban load center—in Auckland, New Zealand—is located at the opposite end of the country from the majority of the generation resources. Energy is transported north from South Island by a high-voltag dc interconnector to supply the load on North Island. The WUNI region accounts for approximately 40% of the national peak load, which includes Auckland, the country’s largest metropolitan city.

Since 2015, this region has experienced the decommissioning of large thermal generation plants driven by multiple factors:

- Aging generation assets

- Changing market conditions

- Expectations over the response to climate change.

An abundance of renewable energy resources (geothermal, wind and solar) exist in New Zealand. However, the WUNI region currently relies mostly on gas and coal to meet its energy needs. In the absence of committed new investment in generation capacity to satisfy the growing demand for energy, it is anticipated the energy transfer from South Island into WUNI will continue to increase as further thermal generation is retired in the region.

Standards and Regulation

New Zealand’s electricity industry is regulated and decision making relies largely on the decentralized vertical integration that exists between generators and retailers on a large scale. The T&D networks are owned by independent utilities and regulated as natural monopolies.

The New Zealand’s Electricity Industry Participation Code (EIPC) specifies the GRS. The standards consist of two sections, namely, an economic requirement and a deterministic N-1 security criterion for assets on the core grid that, for transmission, applies to assets used in the bulk transfer of power. In practice, this means an investment may proceed if it is considered economic—that is, the benefits of the investment outweigh the costs—or the core grid assets fail to meet an N-1 security standard.

The security criterion is applicable for assessing the voltage stability. For the WUNI region, the N-1 security standard is applicable as the assets supplying this region are classified as a core grid. Investments proposed to meet a more conservative criterion than N-1 must be subject to a robust economic test and sensitivity analysis that results in a positive expected net electricity market benefit.

Future Uncertainties

A fast-changing environment and increasing uncertainty gives rise to long-term planning challenges. The largest challenge confronting Transpower’s system planning engineers for the immediate future is the variety of possible electricity generation developments, their associated connection location and, to a lesser degree, forecasting future load on the power system. Broadly, concerns over climate change and the rapid emergence of new technologies also will influence the country’s future energy choices and add to this uncertainty.

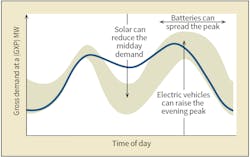

For example, distributed nondispatchable electricity generation—primarily solar photovoltaic (PV) generation—has grown rapidly in most regions around the world in recent years, though its uptake remains relatively low in New Zealand. Other emerging technologies such as energy storage devices, home energy management systems, electric vehicles and smart appliances also will play a role in shaping the future of the country’s power system. From a long-term perspective, the uptake of emerging technologies such as solar PV, batteries and electric vehicles will affect the way in which transmission assets are used and managed.

In New Zealand, the intermittent nature of solar PV generation means distributed small-scale installations are unlikely to supply sufficient energy to meet the system evening peak, even as battery technology improves and prices fall. Therefore, most consumers will retain access to the distribution network to meet their electricity needs.

Grid-connected battery installations may revolutionize the present generation supply-and-demand model, and the flexibility and controllability of battery charging/discharging to behave as either generation or load will maximize the use of existing transmission assets and consequently influence transmission asset investment decisions. Transpower sees this game-changing future, but not for some time.

Transpower’s Approach

Transpower must demonstrate a proposed transmission investment meets the requirements of the GRS. The security criterion applicable for assessing the voltage stability in the WUNI region is the N-1 security standard.

A generating unit or any asset cannot be expected to maintain 100% availability as a forced outage and planned maintenance can result in significant outage periods. In this situation, the security standard being considered is N-G-1, which is when the power system remains in a satisfactory state with an outage of the largest generating unit plus one other grid asset. The “G” in N-G-1 also is a proxy for slightly less severe transmission equipment contingencies.

Planning the power system to meet the N-G-1 security level is subject to the economic test and requires the investment to have a positive net benefit. Because of the uncertainties in how demand and generation will evolve, Transpower has considered a combination of both transmission and non-transmission investment options to account for these uncertainties while ensuring voltage stability criteria are met in the WUNI region.

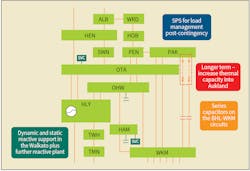

Transmission solutions, including reactive power components such as static volt-ampere-reactive compensators, static synchronous compensators, synchronous condensers, shunt capacitors and series capacitors, were considered as part of the possible components. For the longer term, Transpower considered building a new transmission line from where generation is located into the WUNI region or converting an existing 400-kV capable transmission line from 220 kV to 400 kV.

An assessment by Transpower showed investment to meet the N-G-1 security standard could not be economically justified using traditional transmission system components. A development plan built to the N-G-1 security standard would require significant additional transmission assets above N-1, adding significant cost to consumers.

The expected additional capital cost over an N-1 solution to meet what was likely to be an infrequent occurrence would be costly and difficult to justify economically, as the probability of asset outages was low. Transpower sought to find a lower-cost development plan that covered N-G-1 security risks but reduced some of the high capital expenditure required to achieve this, to ensure the benefits of the investment would exceed the cost.

Therefore, Transpower opted to cover specific extreme contingencies to achieve a grid system security level equivalent to N-G-1 for the region but with a build cost similar to that of N-1 through a post-contingency demand management scheme.

Special Protection Scheme

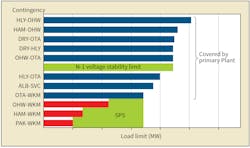

This challenge led to the investigation of a special protection scheme (SPS) using a two-tiered standard to cover most asset outages with primary plant investment and a small number of lower-probability but high-consequence transmission asset contingencies with post-contingency load management to meet an N-G-1 security level. The first tier of the standard is known as N-G-(OTA-WKM), which refers to the two 220-kV circuits between the Otahuhu (OTA) substation in Auckland and the Whakamaru (WKM) substation in the central North Island. OTA and WKM are two major substations on the North Island core grid, supplying bulk power transfer into the WUNI region. The second tier of the standard uses SPS to manage load post-contingency, facilitating higher pre-contingency load transfers. This covers the difference between N-G-(OTA-WKM) and N-G-1.

N-G-(OTA-WKM) covers the loss of the largest generator (400-MW combined cycle gas turbines) in the WUNI region and an OTA-WKM transmission circuit. This standard can be justified economically without requiring load management, as the OTA-WKM circuit has a historically high rate of tripping. Primary plant investments such as shunt static capacitors and dynamic reactive support would be used to provide this level of security. A few particularly severe yet lower probability transmission asset contingencies would further reduce the voltage stability limit in the WUNI region. Transpower is proposing to manage these transmission asset contingencies through post-contingent load management, giving an equivalent N-G-1 security level.

Using an SPS to shed load for a voltage stability constraint is not common in New Zealand, especially to prevent voltage collapse in a large urban center. While the risks of an SPS are not inconsequential, there are key reasons for considering such a scheme. Load management would only occur if a combination of low-probability events occurred simultaneously, and the deferment of costly capital expenditure is possible while retaining most of the system security offered by primary asset investments. The latter particularly is valuable when considering the risk of asset stranding in an uncertain generation and demand future.

Transpower also could partially or completely solve the voltage stability issue through non-transmission solutions by putting in place contractual agreements with market participants to provide grid support services. Some examples include reactive power support and demand-side responses. Transpower is actively investigating non-transmission solution options. A single non-transmission solution, a combination of non-transmission solutions, or a combination of transmission and non-transmission solutions may be considered by Transpower if they prove to be the most economic outcome to meet the need.

Two-Tiered Standard

Transpower has put forward a regulatory submission based on the two-tiered standard of using a primary plant to cover the more likely yet lower-impact contingencies and incorporating load management to cover some less likely but higher-impact contingencies. By doing this, Transpower can achieve a grid security level equivalent to N-G-1 for the WUNI region at a build cost similar to that of the N-1 security level. This will enable Transpower to manage future uncertainties and defer capital expenditure to reduce the cost of transmission services to customers.

Achieving this modified security standard may require the use of an SPS to shed load post-contingency to keep the power system within voltage stability limits. Using this technology in a region that encompasses New Zealand’s largest city, Auckland, has risks and benefits. Transpower will monitor and assess the state of the power system to ensure voltage stability is maintained and continue to refine its proposed post-contingency load management scheme.

Acknowledgement

The authors would like to acknowledge the Waikato and Upper North Island voltage management investigation team members for their work on this Transpower project.

Si Kuok Ting ([email protected]) obtained bachelor’s and master’s degrees electrical and electronics engineering from the University of Canterbury. He is a chartered professional engineer and a senior system planning engineer at Transpower.

Julia Ting ([email protected]) obtained a bachelor’s degree in electrical and electronics engineering from the University of Canterbury. She is a senior system planning engineer at Transpower.

Anna Li ([email protected]) obtained a bachelor’s degree in electrical and electronics engineering from the University of Canterbury. She is a senior power system engineer at Transpower.

About the Author

Si Kuok Ting

Si Kuok Ting ([email protected]) obtained bachelor’s and master’s degrees electrical and electronics engineering from the University of Canterbury. He is a chartered professional engineer and a senior system planning engineer at Transpower.

Julia Ting

Julia Ting ([email protected]) obtained a bachelor’s degree in electrical and electronics engineering from the University of Canterbury. She is a senior system planning engineer at Transpower.

Anna Li

Anna Li ([email protected]) obtained a bachelor’s degree in electrical and electronics engineering from the University of Canterbury. She is a senior power system engineer at Transpower.