Why Thomas Edison Was Both Right—and Wrong—about Direct Current Distribution Networks

The fledgling electric utility companies that emerged after Thomas Edison opened his small Pearl Street, New York City power station in 1882 originally focused on distributed generation operating within direct current (DC) microgrids. Edison envisioned that the electric utility industry would involve small firms generating DC power for individual businesses through DC distribution networks. By 1886, Edison’s firm installed 58 DC microgrids and some 500 isolated DC lighting plants in the Unites States, Russia, Chile, and Australia.

These early DC microgrids, which often served a mix of commercial and residential customers, were not a sustainable business opportunity. In 1896, the first alternating current (AC) power flowed from a hydroelectric plant at Niagara Falls, New York to serve Buffalo, New York, some 15 miles away. This event established the trend of moving away from DC-based microgrids (that served immediate onsite loads) to AC long-distance transmission, which transports power to customers from distant generating sources. Meanwhile, regulation of electricity shifted from local to state control, reflecting the shift from localized sources to centralized power plants feeding into a power network.

Rapid technological changes and the adoption of AC transmission and steam-turbine power plants allowed small but growing utilities to copy the economies of scale business models that dominated thinking in the early 20th century—the railroad’s rail grid is perhaps the best example of the model. New transformers spurred on the large transmission grids now so common in the industrialized world. Prices for electric service dropped consistently until the 1970s, when the energy crisis hit and the dominant business model first came under attack as fossil fuel prices spiked, and utilities raised rates for their ratepayer base. Upward pressure on rates was also fueled by cost overruns at nuclear power facilities.

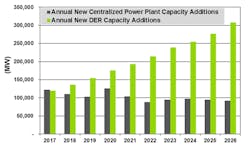

For the first time in 2018 distribution level resources will surpass centralized generation annual capacity additions for the first time. The gap between distributed and centralized generation—historically dominated by coal and nuclear plants—only grows wider over time as shown in Chart 1.1. Microgrids and other forms of distributed energy resources (DER) aggregation and optimization are attracting investments from elite industrial electric infrastructure powerhouses including ABB, General Electric, Schneider Electric, and Siemens AG, etc. A growing number of companies are resurrecting Edison’s arguments about the virtues of DC.

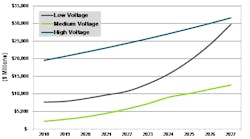

The market for direct current (DC) distribution networks today is not a single, cohesive market. Rather, it encompasses several disparate opportunities that revolve around different market assumptions, dynamics, and drivers. Most of the progress in developing DC-based technologies has occurred at either high voltage (more than 1,000 V) or low voltage (less than 100 V) levels of electricity service, with off-grid cell towers being the largest low voltage (48 V) DC market today. Since many microgrids and building-scale nanogrids typically operate at voltage ranges between those extremes (roughly 240 V-400 V), a range DC advocates have defined as medium voltage, much work needs to be done to bridge this voltage innovation gap if DC is to make a major comeback.

The core challenge facing DC distribution networks lies with the need for standards and open grid architectures that can help integrate the increasing diversity of resources being plugged into distribution grids. At the medium voltage level, DC advocates claim efficiency gains as high as 46.5% at the facility level—if all available DC products linked to lighting, computers, wiring, and power generation are integrated. To date, however, these theoretical savings have yet to be fully realized in commercial deployments.

High Voltage Direct Current Is the Largest Market Today

High voltage DC (HVDC) allows the interconnection of regional systems that operate asynchronously, which mitigates many instability issues that otherwise would cause outages in AC transmission. Line loss in long-distance transmission is another problem that HVDC addresses. HVDC transmission can be twice as efficient as AC transmission and requires narrower corridors (i.e., less land) than its AC equivalent. In addition, HVDC undersea cables can transmit low loss energy over long distances, which is one limitation of AC cables without additional compensation.

Yet, AC transmission leads the transmission industry overall in both existing and new capacity. The significant resources required to deploy a traditional line commutated-converter HVDC station often prove too much for many utilities to seriously consider. And even though voltage source converter (VSC) technology offers additional benefits, HVDC currently represents approximately 20% of overall transmission investment. VSC systems can be operated independently of any faulted or deenergized grids downstream, help start a blacked-out system, or energize an offshore platform from onshore generators.

Key enabling technologies in the HVDC market that offer parallels to distribution networking advantages are converters and hybrid breakers. Hybrid breakers elegantly addresses the century-old protection engineering problem of quenching DC fault currents before the temporary overload causes damage. Vendors are developing different solutions, but they all have the same target in mind—to stop DC fault currents in 5 milliseconds. It could be argued that DC distribution networks face similar advantages—and challenges—at the distribution level of power service.

The Advantages of Medium Voltage Direct Current

Unlike AC systems, DC systems provide a constant, noninverting power source and synchronization is not an issue. Inverting DC power to AC power involves the use of an inverter where the inverter automatically (and easily) synchronizes with AC power without the need for careful adjustments. Thus, if grid connection is lost frequently the use of a DC system can substantially reduce synchronization efforts. A variety of technology trends are converging to create promising markets for DC distribution networks as follows:

- The declining costs and increased efficiency of solar PV and wind turbines are both natively DC generation sources.

- A surge in grid penetration of energy storage devices, also natively DC, due to steeply declining costs.

- The rapid increase in DC loads in buildings, ranging from electronic devices to lighting.

- An increase in functionality attached to cell phone, tablet, and related personal communication devices, all of which are natively DC.

- An investment in new distribution network hardware and software controls by a cadre of major industry participants (e.g., ABB, Schweitzer Engineering Laboratories, Bosch, and Vertiv).

- A growing army of smaller technology innovators that bring fresh approaches and technology solutions online (Moixa, Nextek Power, Pika Energy, Inc., and VoltServer).

- The fundamental argument on behalf of DC distribution networks is that the reliability and efficiency of such networks can be improved by limiting the number of power conversions.

Perhaps the most astounding market for medium voltage DC is DC EV fast charging. While likely to remain a subcomponent to DC distribution networks, DC EV fast charging could also serve as the basis for DC microgrids at many gas stations. Such installations create hybrid systems and further commercialize the overall portfolio of DC products and services. This is by far the largest DC capacity market—both today and well into the future—reaching 100 GW annually by 2027.

Conclusion

Because utility monopolies have been limited to AC networks over the past 100 years, their only investments flowing into DC have been at the transmission levels of service. If HVDC technologies are included in the tally, the market for DC is surprisingly large. It is expected to grow from $29.4 billion in 2018 to $73.7 billion by 2027. HVDC leads today’s market at 66.6%, capturing $19.6 billion out of the $29.4 billion total in 2018. By 2027, HVDC likely still ranks No. 1, but low voltage applications come in at a close No. 2 ($31.6 versus $29.7 billion annually). Note that medium-voltage applications may be the fastest growing—aided significantly by DC EV fast charging—but likely reaches just $12.5 billion by 2027, a 16.9% market share. Other segments included in the medium-voltage category are commercial buildings and data centers.

One microgrid pioneer and professor of engineering put it this way “if we started from scratch today, a DC distribution network may make sense. But many of the same advantages touted by DC advocates can also be achieved through adjustable high frequency AC drives. Even if both generation and loads are DC, one still needs DC-DC converters since DC is difficult to control.” He also maintained that different DC voltage levels within a distribution network increased—rather than reduced—complexity in architecture and controls.

The fundamental architecture of today’s electricity grid technologies, which is based on the idea of a top-down radial transmission system predicated on unidirectional energy flows from large centralized power plants, is becoming obsolete. If, indeed, the electricity grid begins to resemble the internet due to the proliferation of DER, then new forms of aggregation and distribution will become vital. This evolution creates room for new DC architectures, especially at the building level of development for grid-tied applications. Among the most compelling value proposition today, however, is for remote off-grid applications where there is no incumbent AC grid, hence no need to convert DC sources to AC via an inverter.

About the Author

Peter Asmus

Research Director

Peter Asmus is a research director contributing to Navigant Research’s Energy Technologies program. In one of his most recent reports, he analyzes the global market for DC distribution networks.