Pacific Gas & Electric Co.’s Sustainability Leadership Council challenged its Substation Asset Strategy department to come up with a plan to phase out the use of sulfur hexafluoride in all high-voltage gas-insulated equipment. Like carbon dioxide, SF6 is a greenhouse gas. While CO2 has a global warming potential (GWP) of one, SF6 has a GWP of 23,500. Although PG&E reduced its SF6 leak rate to nearly 1%, this came with an extreme operating cost. Eliminating the use of SF6 would eliminate future leaks and result in reduced operating cost. Fixing a single SF6 leak has an average cost of US$25,000.

Ten percent of the installed dead tank circuit breakers (DTCBs) were leaking SF6 in excess of the manufacturer certified leak rate and the probability of leakage was increasing with the aging of the DTCBs. Operating costs were forecasted to increase as a result of future increased SF6 leaks. Therefore, PG&E evaluated alternative technologies to replace SF6. In addition, as part of a pilot project, a non-SF6 72-kV DTCB was purchased and installed prior to Jan. 1, 2010.

Supplier Options

PG&E’s Sourcing department completed a strategic supplier evaluation to identify SF6 alternative suppliers for gas-insulated switchgear (GIS) and gas-insulated DTCBs. The utility identified 15 potential suppliers from a worldwide search of GIS and DTCB suppliers. Of those 15 suppliers, 10 were invited to participate in a request for information (RFI) based on their commercially installed products and ability to meet California requirements for SF6 alternatives.

Six suppliers responded to the RFI with three competing technologies. The three technologies were as follows:

1. Novec 5110 insulating gas.

2. Novec 4710 insulating gas.

3. Dry air/vacuum.

All three technologies are capable in applications of high-voltage GIS and DTCB.

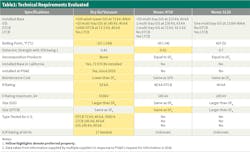

PG&E’s Standards Engineering, Projects Engineering and Sourcing Quality evaluated the technical merits of each technology. This evaluation was technical in nature and independent of alternative costs. The technical evaluation also included input from other California utilities, including the Sacramento Municipal Utility District, Southern California Edison, and San Diego Gas & Electric as well as the Electric Power Research Institute. The California utilities recognized the acceptance of multiple alternative gases to SF6 would lead to increased gas management risk. A single alternative to SF6 was preferred.

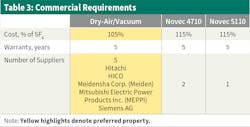

PG&E Sourcing then issued a request for proposal (RFP) to five of the suppliers selling an alternative to SF6 for DTCB and GIS. The RFP enabled the utility to evaluate the commercial availability and cost of the three technologies. PG&E’s final evaluation of the three alternative technologies to replace SF6 included three major categories: technical, regulatory and commercial.

Cost and Availability

PG&E ET&D Material Sourcing issued a Request for Proposal (RFP) to the suppliers that were actively offering an alternative technology to SF6 for DTCB and GIS. This RFP allowed PG&E to evaluate the commercial viability and relative costs for the three alternative technologies. PG&E’s final evaluation of the three technologies to replace SF6 included three major categories: technical, regulatory, and commercial.

Based on the results of the RFP, PG&E ET&D Material Sourcing traveled to Germany, France and Switzerland to review in person each supplier’s manufacturing facilities and R&D tech centers to correlate what was presented within the RFP. Reviewing the technology and manufacturing in person afforded ET&D Material Sourcing the ability to further understand the different cost drivers not only from a material and manufacturing aspect, but more importantly from a technological aspect.

Each supplier was given a comprehensive agenda in advance of the in-person assessments to create presentations that would concentrate specifically on technology and manufacturing, including design for manufacturability, business continuity planning, cost structures, lean process efficiencies, quality program and metrics, continuous improvement maturity, capacity planning and use, and skilled workforce. These presentations were detailed and provided significant insight into the different technologies and manufacturing processes.

During this trip ET&D Material Sourcing was able to physically visit and walk through Non SF6 GIS installations that were actively running in Germany, France and Switzerland. These visits gave even a greater insight into the technology and afforded PG&E the ability to ask questions that would have never been considered from simply reviewing answers provided to an RFP.

Final Evaluation

The final combined evaluation was made by a multidiscipline team. Engineering and Quality evaluated the technical merits of the three alternatives. A specialist from Sourcing evaluated the commercial merits, and personnel from Regulatory Affairs evaluated the three alternatives against pending California greenhouse gases regulations. All three groups had the same objective of reducing future operating costs while maintaining grid safety and reliability.

Based on the results of the evaluation, the most cost-effective option was for PG&E to adopt a single alternative technology to replace SF6: dry air/vacuum. PG&E concluded this technology has more preferred properties than the other alternatives based on the following reasons:

• Dry air/vacuum is the most extensively available commercial product with thousands of DTCB and hundreds of GIS installed around the world.

• Dry air/vacuum has zero GWP and no toxic byproducts.

• Dry air/vacuum will meet the California Air Resources Board (CARB) phaseout schedule as outlined in a proposed regulation amendment.

• The leak rate from dry air/vacuum technology is exempt from California state mandatory annual reporting, which would be a significant cost savings.

• Dry air/vacuum technology is available from multiple suppliers.

• Dry air/vacuum currently is the lowest-cost life-cycle option.

• Dry air/vacuum has been tested up to 65-kA interrupting current and 550-kV rated voltage.

This combination of merits makes dry air/vacuum the most cost-effective replacement option for SF6 at this time.

Dry Air/Vacuum Pilot

In 2006 PG&E chose to evaluate dry air/vacuum technology as an alternative to SF6 by first testing the technology in an inexpensive DTCB application. In 2009, the utility purchased a Hitachi 72-kV, 31-kA, 2000-A dry air/vacuum breakers for the pilot at Borden substation outside of Madera CA. This was the first utility HV dry-air vacuum DTCB installation in California. The procurement process included an ISO 9001 quality audit of the Hitachi Ltd. factory and a design review of the breaker. There also was a review of the breaker-type testing data and factory acceptance testing (FAT) of the breakers. All these reviews found acceptable results.

While no intrusive maintenance was completed on the breakers, routine inspections were completed for the next six years. The PG&E maintenance crews were fully trained by the factory in classroom setting and in the field. Initially, the substation personnel were skeptical of the technology and had concerns about the vacuum bottle failure mode due to loss of vacuum and arc-flash potential. The breakers were originally ordered with a vacuum bottle monitor device to detect loss of vacuum, however, after several false annunciations the monitor device was removed as it was too sensitive and it was picking up noise levels from the surrounding environment. PG&E decided to evaluate this pilot breakers for three years while creating maintenance specifications and procedures, then in 2011 ordered three additional vacuum breakers for inventory. It took time before the field got comfortable with the new technology. PG&E has purchased an additional 25 Dry-Air/Vacuum DTCB since then and none were purchased with the vacuum bottle monitoring device. Other utilities in California have purchased Dry-Air/Vacuum DTCBs and currently 72 are installed in California and more than 550 are installed in the United States and Canada. At least six other California utilities are now using this technology: Turlock Irrigation District, City of Danville, Vandenberg Air Force Base, Modesto Irrigation District, Covanta Energy and Southern California Edison.

Phaseout Dates

In November 2017, CARB held a public workshop to present a proposed regulatory amendment that would phase out new purchases of GIS equipment containing SF6. The following were target dates for various equipment classes in the strawman regulation:

• Equipment using SF6 at a rated voltage of 72kV or less on Dec. 31, 2024

• Equipment using SF6 at a rated voltage of 145kV or less on Dec. 31, 2026

• Equipment using SF6 at a rated voltage of 245kV or less on Dec. 31, 2028

• Equipment using SF6 at a rated voltage of 550kV or less on Dec. 31, 2030.

Looking Ahead

The PG&E Sustainability Leadership Council has established clear SF6 goals and areas for improvement for Electric Operation Division. PG&E will maintain the SF6 leak rate below 1% (with a stretch goal of 0.7% leak rate). PG&E will evaluate and purchase addition pilot alternatives to SF6 high-voltage equipment while meeting the established SF6 phase out dates. PG&E will maintain the SF6-free status on our medium-voltage equipment. All equipment currently installed on the distribution system is SF6 free. PG&E had stopped purchasing SF6 equipment for the distribution grid approximately 15 years ago. Today PG&E maintains an SF6-free distribution grid.

The areas for improvement included betterment of operation procedures for SF6 gas handling, better record-keeping and shorter SF6 leak repair times. The Sourcing, Standards Engineering and Sourcing Quality departments were given a goal to purchase SF6 equipment that was less prone to leaks. This was done through tighter specifications, design reviews of vendors equipment flange seals, factory audits and analysis of historical SF6 leakage data sorted by vendor/model/age. The historical leakage data from PG&E’s 1200 installed DTCBs and 6 GIS showed that one vendor’s equipment leaked SF6 more frequently than the other two. PG&E bench marked the SF6 equipment findings with six other electric utilities and received supportive agreement. While all suppliers of SF6 equipment certify to leak rates equal to or less than 0.1%, the field leakage data over the past 15 years shows an actual SF6 equipment have a much higher leak rate than that. The average SF6 leak rate in California is approximately 2%, which is significantly higher than the certified leak rate of 0.1%

In 2020, PG&E will install three pilot DTCBs at the 145 kV 40 kA and three pilot DTCBs at the 145 kV 65 kA. The plan is to test these pilot DTCBs over a 3-year period before integrating more of them into the fleet.

Presently approximately 32 utilities in the United States are using Dry-Air/Vacuum DTCBs.

PG&E will continue to share information and experience with alternatives to SF6 in HV applications. PG&E’s long-term goal is to maintain a safe and reliable high-voltage grid while reducing maintenance cost and reducing worker’s exposures to the by-products of SF6 by phasing out its use.

About the Author

Thomas Rak

Thomas Rak ([email protected]) is a manager of Substation and Transmission-Line Standards Engineering at PG&E. He graduated from New Jersey Institute of Technology with a BSEE (power concentration). He earned his Master of Engineering from Portland State University and earned his Professional Engineering license in California. Tom has experience in distribution, substation and generation design engineering.