As power utilities shift to regarding end-users as “consumers” rather than “ratepayers,” we enter a new world of possibilities. A changing marketplace for electric power offers utilities an opportunity to engage and retain both traditional customers – those responsible for the household electric bill – and all consumers, generally. This new world also comes with potential pitfalls that need to be addressed with a sense of urgency.

Let’s begin with a glance at the potential pitfalls and then turn to research that suggests solutions.

A Shifting Market

Deregulation is introducing competition among power providers, alternative providers are entering the market and digitally savvy consumers’ expectations are rising. And some consumers are forging ahead on their own. In some areas of the country, for example, policy-driven, consumer adoption of rooftop solar power is cutting into utilities’ volumetric sales.

Though once-dire predictions of a resulting “death spiral” for the local power utility have yet to materialize, the trends I just cited do not support a business-as-usual approach. As a result, power utilities must engage their consumers with new service options and value propositions tailored to consumers’ needs.

Active Engagement

Engagement in this context means understanding general principles in consumer marketing as well as consumers’ attitudes and needs for their electric service. General marketing principles can be found elsewhere. Fortunately, scientifically valid research has examined various aspects of consumer attitudes and needs related to electric service.

As a founding board member of the Smart Energy Consumer Collaborative (SECC), I and many of my colleagues have participated in the direction and dissemination of this valuable research. Why rely on outdated hunches when hard data is available?

The SECC’s research program, now in its ninth year, is broad and deep and I invite you to become a member or simply explore its publicly available reports. The SECC’s three-fold agenda is to listen to consumers via primary consumer research, collaborate with industry stakeholders via hosted events and shared best practices, and educate consumers via outreach and messaging toolkits.

For the purposes of this article, I’d like to share five key SECC research findings about consumer engagement to stimulate your thinking about the new, consumer-centric power utility business landscape.

Your utility, its service territory and customer base is unique, and the SECC offers templates on how to apply the national research findings that follow to meet your specific needs. But a few key principles of consumer engagement tend to be useful to all.

Consumer Segmentation

The fundamental concept of consumer segmentation has long been applied in marketing. The application of this concept to understand consumers’ attitudes and preferences regarding electric power service, however, is relatively new. Pioneered by the SECC, past research had established five consumer segments based on psychographics – those attitudes and preferences – rather than more traditional demographics, such as age, gender, income, etc. (Though, as we’ll see, demographics still have a role to play.)

New research results, released by the SECC in June 2019, now reveal four basic segments among power consumers. This multi-phase research included an online survey in March-April 2019 of 2,451 residential energy consumers in the United States. These are household decisionmakers that align with U.S. Census demographics – i.e., a representative sample of U.S. energy consumers.

As this research demonstrates, power consumer segments are not isolated, discrete groups with exclusive interests. Instead, these segments are best understood as definable segments on a continuum where they share, to a degree, various sentiments with related cohorts. The SECC refers to this new model as “The Segment Favorability Continuum,” depicted in Figure 1.

Figure 1: The Segment Favorability Continuum (Courtesy: SECC)

The Continuum figure emphasizes the extremes in attitudes in order to draw distinctions. But it’s important to realize that utilities can develop discrete messaging to engage each of the four segments on the basis of each segment’s motivations and preferences. As the figure suggests, consumer segments at left are more knowledgeable and engaged with energy choices – and favorable to utility messaging – than those at right. Some segments clearly will require greater investment and effort than others.

The following are merely synopses of each segment. I’d urge you to read the publicly available details of this new, ground-breaking SECC study for more insights. It contains granular data of practical market value for many energy industry stakeholders.

The potentially most receptive consumers, Green Innovators, live at the left end of Figure 1. This segment comprises 20 percent of the general population. They think about their energy use, how that affects the environment and society and lead the way in energy conservation. Their finances – the highest among the four segments – enable a willingness to pay for new technology and services. They tend to live a self-acknowledged digital lifestyle that depends on reliable, quality power. They do not see barriers to utility engagement and are likely to be in contact with their energy provider. They are likely to already have selected alternative rate structures. Demographically, they trend younger, higher income and tend to live in the Western U.S.

According to the new SECC segmentation study, 70 percent of Green Innovators are interested in receiving bill credits when they reduce usage during peak times – an immediately relevant and practical program that utilities can offer this segment. Other SECC guidance on this point: include this segment in new pilot programs, give them the first look at new technologies and listen to them. Convening a focus group composed of this segment gives a stakeholder an opportunity to understand their energy aspirations.

Tech-savvy Proteges, 25 percent of all consumers, are related to Green Innovators in their concern for environmental quality. Unlike Green Innovators, their interest in energy efficiency is motivated by potential savings. They currently do not leverage technology for energy-related applications, but are likely future technology buyers. These factors suggest an opportunity for engagement. However, Tech-savvy Proteges currently value technology for comfort and see barriers to using technology for other goals. They are less willing to participate, for instance, in demand response programs than Green Innovators. They have no strong preferences for rate structures. They are willing to allow their energy use data to be shared. Their demographics are more male than female, and slightly younger than average. This group is most likely to own a home and tends to have the highest electricity bills. This last factor also suggests a potential path to engagement.

This segment needs guidance on overcoming attitudinal barriers and a nudge to motivate them. Programs that will appeal to this segment should feature minimal upfront costs and encourage confidence that their subsequent actions will benefit them and others.

The Movable Middle, at 29 percent, the largest of four consumer segments, does not exhibit sharp contrasts in attitudes that clearly define their segment; they are neither tuned-out or fully engaged. Yet opportunities for engaging this important segment suggest themselves. They have some concern for the environment. Those with smart home technologies are satisfied with them. Yet barriers to engagement remain. This segment is not tech savvy and exhibits little to no interest in using technology to manage energy use. Energy efficiency measures draw little interest from the Movable Middle. Demographically, this segment is slightly older and likely to stay put in current homes.

Though this segment tends to lag the general population in terms of interest in energy efficiency or technology offers, the data reveals a certain level of interest that can be leveraged for engagement. Clear, simple offers that encourage energy saving measures that benefit this segment may be the motivator that this large, middle-of-the-road segment needs to take action.

Finally, the Energy Indifferent – 26 percent of all consumers – are likely to be the most challenging segment to engage. Thinking and acting on energy-related matters is simply not a priority for this segment; in fact, they prefer to be left alone. Engaging them on the subject of energy draws concern about higher costs and complexity. Investing money in energy efficiency for savings does not motivate them. They simply want electric service; they do not want to pay for smart home services. In demographic terms, this segment is likely retired, lower income and thus cost conscious, less educated and tech savvy and slightly older than other segments. They often live in older, less efficient homes, but with fewer appliances, their bills are relatively low.

Engaging the Energy Indifferent may require soft measures such as paper bill inserts with simple energy use tips – this segment shies away from online billing. Spell out immediate benefits in simple language. Peak shifting offers may catch on, as this largely retired segment has the flexibility to adjust their schedules to save money.

Addressing the Segments

Engagement requires understanding each consumer segment and meeting it on its own terms. Power utilities need to identify messaging opportunities based on the known attributes of each segment and avoid messaging that runs counter to each segment’s stated barriers.

That’s the concept, but what about specific steps?

SECC research offers concrete actions that provide a broad-based approach to engaging all four consumer segments. Green Innovators may be the most receptive and Energy Indifferent may tend to be hostile, and require more time and effort. A utility investment in reaching at least some consumers in each segment, however, has the potential to spread awareness and influence across the continuum over time. Frankly, either utilities make this existential effort or in a rapidly changing energy marketplace, they will cede their role as energy provider and advisor to new, more nimble competitors who grasp this point.

Target the Selectively Engaged

Current and past SECC research reflects that each of the four consumer segments exhibit different levels of engagement with their utility. Fortunately, a majority of consumers across the continuum are likely to be consistently or selectively engaged at some level.

If consumers are consistently engaged, you already have an opportunity to educate them and garner their participation in utility programs. Thus, a utility would be well-advised to invest in messaging the selectively engaged to create a beachhead for further influence.

Messaging to the selectively engaged would appeal to their stated interests and motivations while also addressing and assuaging their professed barriers. SECC has resources for developing such messages and supporting programs.

Segment-Specific Messaging Channels

Generally speaking, consumers use most modes of communication, including in-person, telephone, and digital means. The latter includes text, email, and social media.

The use of an all-of-the-above strategy enables a utility to assess which channels are preferred by specific consumer segments. This is an instance where traditional demographics can provide a cross-segment means to guide engagement strategies.

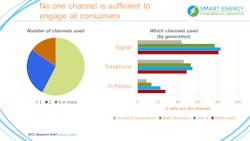

SECC research shows that more than half of all consumers predominantly use only one channel, though more than a quarter use two. One-fifth use three or more channels. Whether those channels are digital, telephone, or in-person tends to be defined by generation.

Figure 2: Use Multiple Communication Channels (Courtesy: SECC)

Baby Boomers (ages 55 to 73), Gen Xers (ages 38 to 54) and Millennials (ages 19 to 37) tend to favor digital channels. Greatest Generation (ages 74 and older) uses digital channels only about half as much as the other groups. Telephone use is relatively common across all four generations.

In-person contact as a communication channel lags other channels and decreases with age. Interestingly, Millennials make the most in-person contact; only 10 percent of Greatest Generation do so.

Online Energy Use Data is Popular

Another path to engagement relies on an SECC research finding that enabling consumers to track their energy use online is broadly popular. For many consumers, this is a major, welcome shift from receiving an end-of-month bill that can surprise the recipient. Near-real time monitoring of energy use has been found to lead to more active management of energy use and a subsequent degree of energy and financial savings.

Inviting consumers to monitor and manage their energy use translates to direct engagement and offers the opportunity to further that engagement through messaging about other program offers, such as online billing.

Online Billing Leads to Engagement

Obviously, online billing is less expensive for both utility and consumer, as it replaces paper and postage for both parties. By definition, online billing also moves both parties to a digital communication channel used by more than 75 percent of all generational groups.

More than one-third of consumers across the board use online billing today. Another one-third are interested in adopting it. Thus, it represents a potential means of engaging consumers in each segment described earlier, regardless of their various, specific preferences and barriers.

Another popular aspect of online energy use tracking and billing is that it enables comparisons of a consumer’s past and present usage as well as between a consumer and his or her neighbors.

The Takeaway

Research also shows that consumer engagement with a utility leads to greater satisfaction with utility service, the relationship and increases “stickiness,” or retention. Once utilities engage their billing customers and the broader consumer base, they should already have figured out an array of service options, value propositions and program pitches ready to roll out to each segment.

The SECC mantra is useful here: listen, engage, educate, collaborate. Invite consumers to participate in achieving their own aspirational goals in line with utility goals. Knowing that your unique service territory and set of consumers likely fall into the consumer segmentation continuum, and using bona fide research as a guide, you can fine tune value propositions and messaging to reach and retain them. Cooperative and municipal utilities may have a leg up on investor-owned utilities when it comes to consumer retention based on their business models, but every utility faces constraints on the availability and cost of power and its environmental impacts. Persuading consumers to participate in meeting those limits is clearly beneficial to all utilities.

With sound research on consumers’ attitudes and behaviors around energy use and related issues, utilities can begin to figure out what motivates consumers in their service territory, what appeals to them, how to align utility and consumer interests and goals and strengthen the relationship. In an age in which solid data confers an advantage, factual insights into consumers and power can lead to attractive value propositions that can sustain the power utility business into the future, while increasing consumer satisfaction and engagement.

About the Author

John D. McDonald

SmartGrid Business Development Leader

John D. McDonald, P.E., is Smart Grid Business Development Leader for GE’s Grid Solutions business. John has 45 years of experience in the electric utility industry. John joined GE on December 3, 2007 as General Manager, Marketing for GE Energy’s Transmission and Distribution business. In 2010 John accepted the new role of Director, Technical Strategy and Policy Development for GE Digital Energy. In January 2016 John assumed his present role with the integration of Alstom Grid and GE Digital Energy to form GE Grid Solutions.

John was elected to the Board of Governors of the IEEE-SA (Standards Association), focusing on long term IEEE Smart Grid standards strategy. John was the Chair of the Smart Grid Interoperability Panel (SGIP) Governing Board for 2010-2015 (end of 1Q) coordinating Smart Grid standards development in the US and global harmonization of the standards. John is a member of the NIST Smart Grid Advisory Committee and Chair of its Technical Subcommittee.

John is Past President of the IEEE Power & Energy Society (PES), Finance Committee Chair of the Smart Energy Consumer Collaborative (SECC) Board, the VP for Technical Activities for the US National Committee (USNC) of CIGRE, and the Past Chair of the IEEE PES Substations Committee. He was on the IEEE Board of Directors as the IEEE Division VII Director. John is a member of the Advisory Committee for the annual DistribuTECH Conference, on the Board of Directors and Executive Committee of the GridWise Alliance and Finance Chair, Vice Chair of the Texas A&M University Smart Grid Center Advisory Board, and member of the Purdue University Strategic Research Advisory Council. John received the 2009 Outstanding Electrical and Computer Engineer Award from Purdue University.

John teaches a Smart Grid course at the Georgia Institute of Technology, a Smart Grid course for GE, and substation automation, distribution SCADA and communications courses for various IEEE PES local chapters as an IEEE PES Distinguished Lecturer (since 1999). John has published 100 papers and articles in the areas of SCADA, SCADA/EMS, SCADA/DMS and communications, and is a registered Professional Engineer (Electrical) in California, Pennsylvania and Georgia.

John received his B.S.E.E. and M.S.E.E. (Power Engineering) degrees from Purdue University, and an M.B.A. (Finance) degree from the University of California-Berkeley. John is a member of Eta Kappa Nu (Electrical Engineering Honorary) and Tau Beta Pi (Engineering Honorary), a Life Fellow of IEEE (member for 48 years), and was awarded the IEEE Millennium Medal in 2000, the IEEE PES Excellence in Power Distribution Engineering Award in 2002, the IEEE PES Substations Committee Distinguished Service Award in 2003, the IEEE PES Meritorious Service Award in 2015, the 2015 CIGRE Distinguished Member Award and the 2015 CIGRE USNC Attwood Associate Award.

John has co-authored five books and has one US Patent: Automating a Distribution Cooperative from A to Z: A Primer on Employing Technology (National Rural Electric Cooperative Association – 1999); Electric Power Substations Engineering (Third Edition) (CRC Press – 2012); Power System SCADA and Smart Grids (CRC Press – 2015); Big Data Application in Power Systems (Elsevier - 2017); Smart Grids: Advanced Technologies and Solutions (Second Edition) (CRC Press – 2018); and US Patent (9,853,448) on Systems and Methods for Coordinating Electrical Network Optimization (December 26, 2017).