Overall Satisfaction Is Up, Yet Electric Providers Lag Behind Others in Customer Satisfaction

Although customer-reported monthly electric bills have fallen to their lowest levels in 10 years and overall satisfaction is on the rise, electric utility providers continue to struggle to match other industries in customer satisfaction, according to the J.D. Power 2016 Electric Utility Residential Customer Satisfaction Study, released today.

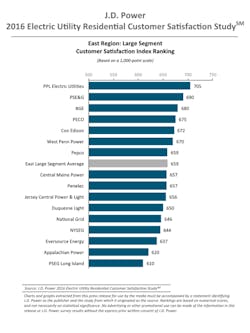

The study, now in its 18th year, measures customer satisfaction with electric utility companies by examining six factors: power quality & reliability; price; billing & payment; corporate citizenship; communications; and customer service. Satisfaction is calculated on a 1,000-point scale.

Overall satisfaction has improved for the fourth consecutive year, averaging 680, up by 12 points from 2015. However, the industry continues to trail far behind many of the other industries J.D. Power tracks, including auto insurance (averaging 811 in 2016), retail banking (793), and airline (726).[1] In fact, only 11 of the 137 utility brands included the study outperform the airline industry average.

“The lesson that utilities can learn from other high-performing service providers is that to excel you need a culture that puts customers and employees first,” said John Hazen, senior director of the utility practice at J.D. Power. “And because customer expectations continue to increase, you need to have a mindset of continuous improvement to keep up.”

Following are some of the key findings of the study:

• Average monthly bill: Customer-reported monthly electric bills are the lowest in 10 years, averaging $129 in 2016, down from $132 in 2015. Satisfaction in the price factor improves the most this year, increasing by 16 points from 2015.

• Satisfaction by state: Satisfaction is highest among customers in Georgia, Alabama and Oregon, and lowest in West Virginia, Connecticut and New Hampshire.

• Power reliability: The average frequency of brief power interruptions (outages of 5 minutes or less) reported by customers has continued to decline since 2010. Further, 41% of customers experience “perfect power,” or no brief or long interruptions, up from 37% in 2010. While lengthy interruptions have remained fairly constant, the length of the longest outage has fallen to an average of 6.4 hours in 2016 from 7.0 hours in 2015.

The study finds that utilities are improving in terms of informing customers about scheduled utility work, with 73% of customers indicating they were notified ahead of time, up from 71% in 2015. However, only 40% of customers say they were informed about an outage this year, down from 42% in 2015.

“It’s hard to overstate how important consistent and proactive communications are to alleviate the frustration customers feel when they experience any kind of power interruption,” said Hazen. “People rely so heavily on electric power, which is why providers are under such intense scrutiny when something goes wrong. Improving the accuracy and the amount of outage information provided to customers requires an investment by providers, but it’s one with measurable benefits.”

Study Rankings

The Electric Utility Residential Customer Satisfaction Study ranks midsize and large utility companies in four geographic regions: East, Midwest, South and West. Companies in the midsize utility segment serve between 100,000 and 499,999 residential customers, while companies in the large utility segment serve 500,000 or more residential customers. For the first time, the study also includes a new segment that includes brands serving cooperative residential customers, which were previously included in regional segments.

East Region

PPL Electric Utilities ranks highest among large utilities in the East region for a fifth consecutive year, with a score of 705. PSE&G (690) ranks second, followed by BGE (680), PECO (675) and Con Edison (672).

Among midsize utilities in the East region, Green Mountain Power ranks highest with a score of 681. Following in the rankings are Met-Ed (672), Delmarva Power and Rochester Gas & Electric in a tie (670 each), and Penn Power (664).

Midwest Region

MidAmerican Energy ranks highest in the large utility segment in the Midwest region for a ninth consecutive year, with a score of 713. DTE Energy (703) ranks second, followed by Xcel-Energy Midwest (692) and Alliant Energy and We Energies in a tie (687 each).

Kentucky Utilities ranks highest in the midsize segment in the Midwest region with a score of 712. Following Kentucky Utilities are Otter Tail Power Company (703), Omaha Public Power District (700), Louisville Gas & Electric (696) and Lincoln Electric System (694).

South Region

Florida Power & Light (FPL) ranks highest in the large utility segment in the South region with a score of 724. Following in the rankings are Alabama Power (721), Georgia Power (712), OG&E (711) and CPS Energy and Entergy Arkansas in a tie (707 each).

EPB ranks highest in the midsize utility segment in the South region with a score of 737. Following EPB are Entergy Texas (715), Entergy Mississippi (714) and Gulf Power (711).

West Region

Salt River Project (SRP) ranks highest in the large utility segment in the West region for a 15th consecutive year, with a score of 730. SMUD (719) ranks second, followed by Portland General Electric (710), Pacific Power (698) and APS (691).

Clark Public Utilities ranks highest in the midsize utility segment in the West region for a ninth consecutive year, with a score of 743. Colorado Springs Utilities ranks second (712), followed by Idaho Power (704) and Imperial Irrigation District and Seattle City Light in a tie (699 each).

Cooperatives Segment

SECO Energy ranks highest in the newly designated cooperatives segment with a score of 769. Following SECO Energy are Jackson EMC (763), NOVEC (748), Sawnee EMC (741) and Walton EMC (740).

The 2016 Electric Utility Residential Customer Satisfaction Study is based on responses from 101,138 online interviews conducted July 2015 through May 2016 among residential customers of 137 electric utility brands across the United States, which collectively represent more than 97.7 million households.