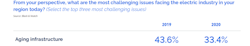

Aging infrastructure is not a new concern for leaders in and around the electricity business. In fact, aging infrastructure is consistently among the top four concerns, if not the top concern, of those surveyed each year by Black & Veatch for its Strategic Directions Report on the electricity industry.

Aging infrastructure: A perennial leading concern for electricity industry

Credit: Black & Veatch, Strategic Directions Reports: Electricity

The nation’s electric infrastructure faced enormous challenges in 2020, as wildfires swept across California, Oregon, Washington state and Colorado, destroying poles, wires and transformers. This was also the nation’s most active hurricane season on record, with 11 named hurricanes making landfall and upending electric infrastructure in Texas, Louisiana and North Carolina, among other areas.

And 2020 was the deadliest year for tornadoes in the U.S. since 2011, with at least 873 confirmed events and 78 confirmed dead. As is often the case, states in “Tornado Alley,” including Oklahoma and Texas, had their lives and property upended with tornadoes in 2020. And, like the homes, barns and businesses that were destroyed by tornadoes, electric wires, poles and transformers electric infrastructure didn’t escape damage.

The traditional “Tornado Alley” states, as well as Colorado, Ohio, Alabama and Georgia, also suffered from an active U.S. tornado season in 2019.

Severe weather and natural disasters across the U.S. in 2020 likely will increase the need for various electrical equipment, including medium-to-large transformers (41-200 mega-volt amperes, or MVA). On a normal year, that’s a $1 billion market, with each medium-to-large transformer costing $1.5 million to $2 million. But there are good reasons to expect a surge in U.S. demand, above the typical demand of 500-650 units per year.

Image of JSHP medium-to-large transformer

Credit: JSHP

A growing number of commercial, industrial and institutional customers have ever-rising higher power-quality needs. A momentary electric blip causes more havoc, and greater costs, than ever before.

Each year, U.S. utilities and cooperatives prepare a long-term plan for replacing and upgrading portions of their electric infrastructure. Transformers, like most parts of the electric infrastructure, need to be replaced as they approach or exceed their 30-year expected lifespan.

Utilities, mindful that price increases are unpopular with regulators and customers, understand the imperative to keep capital expenditures low in order to minimize price increases.

At a time when signs point to rising U.S. demand for medium-to-large transformers, domestic suppliers are in tumult. Mitsubishi sold its transformer manufacturing site in Memphis, Tennessee, at the end of 2019, less than a decade after it opened. ABB, undergoing a strategic transformation, sold its U.S. power grid business to Hitachi in 2020. General Electric, a longtime leader in manufacturing electrical equipment, continues to struggle with reinventing itself.

In the dynamic U.S. power market, JSHP is looking to gain market share. The world’s largest manufacturer of 41-200 MVA medium-to-large transformers, China-based JSHP produces over 500 transformers a year for customers around the world.

JSHP counts numerous satisfied customers across the U.S., including Bechtel, Fluor, Florida Power & Light, PacifiCorp, Iberdrola, BC Hydro, Fortis, Public Service Company of New Mexico (PNM), NV Energy, the New York Power Authority and the Sacramento Municipal Utility District (SMUD).

A JSHP generator step-up (GSU) transformer kept the lights on in notoriously tight Texas during the summer of 2020 after another company’s transformer failed. Michael Tulk, facility manager for P.H. Robinson, said, “I was impressed with the JSHP’s smooth design and fabrication. The unit arrived in Houston six months after we ordered it, and JSHP has provided prompt on-site service in Houston.”

Some years back, when Massachusetts’ Braintree Electric Light Department (BELD) issued a request for proposal (RFP) for two GSUs, Joseph Morley, engineering and operations manager, said he expected to buy something made in North America.

“Delivery of the GSUs by truck directly from the factory was an important consideration. BELD’s last two large substation transformer purchases came on trucks from Canada and Mississippi without incident. I guess that set the stage for my bias. What a surprise when the bids were opened and reviewed. I was quickly introduced to the concept of a global economy.”

For another client, Siemens, JSHP was able to build a 240kV, 318MVA GSU transformer in 83 days – much faster than other providers.

Because JSHP’s manufacturing site, the largest in the world, is located in China, its transformers have been subject to the 25% import tariff imposed by President Trump in 2017 under section 301 of the Trade Act of 1974. While that did make JSHP’s products more expensive, the competitive disadvantage was offset because domestic manufacturers had to pay a similarly sized tariff to import the specialized steel to manufacture their transformers.

JSHP has been selling medium-to-large transformers in North America since 2006. Over that time, it has installed about 250 units across the continent.

Image of JSHP Step-Up TransformerJSHP’s medium-to large electric transformers have been chosen by leading power utilities and EPC firms across North America, including in Vancouver, British Columbia, Las Vegas, Nevada, and Houston, Texas.

Credit: JSHP

“We have made investments in engineering and manufacturing to capture ongoing efficiency gains,” he continued. “China’s skilled labor pool is much bigger than in the U.S., and as customized products, transformers are very labor intensive. Our competitive advantages have helped us succeed in the North American market despite the costs to ship one of our units, which weigh 100 metric tons, on average.”

Despite the Section 301 tariffs and the shipping costs, Cai said JSHP is growing its share of the North American market, and he looks forward to further gains in 2021.

Sponsored by: