Before FERC Order 1000 There Was Order 679 – $53bn and Counting

One of the hallmarks of President Bush’s 2005 Energy Policy Act was the addition of section 219 of the Federal Power Act mandating support for investment in transmission. Driven by the new policy, the Federal Energy Regulatory Commission’s (FERC) Order-679 was created to incent developers to take on high-risk transmission projects by allowing myriad incentives including; return-on-equity (ROE) adders, full recovery of prudently incurred costs like pre-commercial and abandoned plant costs. The order also allowed for creative capital structures, accelerated depreciation and other incentives to support transmission development. Order 679 was enacted on July 20, 2006, with subsequent revisions in December of that year and again in April of 2007. Reducing congestion and improving reliability was the primary driver behind the controversial Order.

The most debated element of the order was the ROE-adder, which resulted in 200 to 300 basis point increases for many of the early approved filers. Consumer groups argued that the increased ROE incentives weren’t necessary for many projects since they would have been built anyway. One thing that’s undisputed is that Order 679 spurred a tremendous amount of investment.

Based on research I recently conducted for leading power industry intelligence provider Energy Acuity, FERC hearings on applications for incentive rate treatment peaked almost a decade ago in 2008, when FERC held 29 hearings. The commission approved 15 projects that year representing 5,356 miles of new transmission with an estimated cost value of $22bn. In 2009, the number of hearings tapered off to 15 and each subsequent year there were fewer and fewer filings. Over a nine-year period starting in 2006, there were 123 filings with the last coming in mid-September 2014.

Verdict on Order 1000 Still Out

In July 2011, FERC rolled out the first version of Order 1000 to spur competition and innovation in transmission development. There were subsequent revisions released in May and again in October of 2012. One of the key elements in Order 1000 involves a formula for spreading the cost across all companies that benefit from the project. The Order also opened the door for non-traditional development companies to bid on projects deemed as needed by regional transmission groups (RTOs) and independent service operators (ISOs).

Since the Order was introduced nearly six years ago, there have been numerous projects bid on but none that have been built so far. In contrast, we’re still seeing significant investment by companies that filed for Order 679 transmission incentives several years ago. Projects granted FERC investment incentives under Order 679 have totaled more than $37bn since 2008, with an additional $16bn expected to be invested over the next five years.

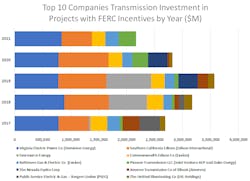

One of the requirements for developers, created as part of Order 679, was the task of filing FERC Form 730 annually. The filing provides an update on future investment and project status. It was created by the commission to measure the effectiveness of its rules and to provide and accurate assessment of the state of transmission investment in the United States. These filings are submitted to FERC in late April each year. The report provides investment projections and a status report on projects that have been granted FERC incentives. After compiling the data, I found 32 companies reporting some level of investment during the next five years. Of the $16.1bn spend forecast, 10 companies account for 90% ($14.4bn). The chart below highlights these 10 companies.

Status of the Top 5 Companies Form-730 Filings

Dominion Energy’s Virginia Electric Power plans to spend over $4bn on Order 679 approved projects during the next 5 years. There are 38 identified projects in some stage of development. Only three are currently under construction including the $180M Surry to Skiffes Creek 500-kV overhead line planned to cross the James River. The project which has been approved by PJM, was originally scheduled for completion early this year. Surry to Skiffes has been controversial since it’s conception back in 2012, because of its proximity to three national historic landmarks. Once the project is given the green light it will take approximately 18 to 20 months to construct.

Southern California Edison plans to spend roughly $3.6bn during the next five years on FERC approved Order 679 projects. The company has 13 projects listed on their Form 730 filing including the completed Tehachapi Renewable Transmission Project (TRTP) segments 3B-11. They currently have two under construction including the LADWP DC electrode replacement (November 2017) and the whirlwind substation expansion project expected online in March but is unconfirmed now. The rest of their projects are either in early development, pre-engineering or still considered conceptual.

Eversource Energy expects to spend over $1.5bn over the next five years on their Northern Pass Transmission Project which involves a 1,090 MW, 300-kV HVDC and 345-kV line, as well as a converter station. According to their filing, the project is on schedule with an operational date of late 2019. Most of the companies spend is expected in the two-year window of 2018-2019.

Exelon’s Commonwealth Edison is planning to spend about $1.3bn on FERC approved projects over the next five years. Out of six listed projects has been completed and two are under construction. The two under construction include the Grand Prairie Gateway 345-kV line. It was expected online late last month but has not been confirmed. The second is the T&S Reliability Enhancements project, also known as the Hegewisch Hardening 138-kV project expected online in January 2018.

Exelon’s Baltimore Gas & Electric plans to spend upwards of $963M on fifteen projects over the next 5 years. Four of those efforts are currently under construction but are relatively small including two 115-kV new build lines expected online in December of 2017 and in June of 2019, and a dedicated facilities 230-kV project due online this later this year. Seven of the projects listed on their filing are in pre-engineering stage while four are conceptual.

Over Past Decade Order 679 Drives Big Investment

Over the past decade, Order 679 has had a profound impact on record growth in transmission investment, with over $53bn in projects expected energized when all is said and done. Meanwhile, investment driven by Order 1000 is still a work in progress. The Order has certainly opened the playing field to competition and the development of innovative projects; and has addressed cost recovery for those benefiting from the investment. But unlike Order 679, there are no direct financial incentives with Order 1000.

Many analysts and industry experts identify the complexity and long process of permitting and gaining right of ways as the number one hindrance to development going forward. Will we see large new projects like those supported with financial incentives from Order 679 in the years to come? Is open competition and shared cost recovery enough to spur needed expensive upgrades to the grid?

Looking back, it’s easy to see that FERC’s Order 679 spurred the construction of a tremendous number of projects that likely wouldn’t have been built without the financial guarantees approved under Order 679.

About the Author

Kent Knutson

Strategic Director

Kent Knutson, Strategic Director of TD World’s Projects in Progress, has more than 30 years of experience designing and developing intelligence products for some of the largest information providers in the power generation and transmission industries. He holds an MBA in marketing from Regis University, an MA degree in geography from the University of Denver, and a BS degree in Biology and Geography from South Dakota State University.

Kent can be reached at [email protected] or at (303) 284-2045.