Will DSOs Embrace Deeper Digitalization?

In Europe, distribution system operators (DSOs) are in charge of operating, maintaining, and developing the distribution network to ensure that electricity is delivered to end-users in a secure, reliable, and efficient manner. This article spells out what DSOs need to do to take full advantage of digitalization technologies and processes to make them fit for a rapidly transforming energy system.

The global energy landscape is changing. This is particularly true in EU countries that are preparing to implement the Clean Energy Package. DSOs have historically had an important role in connecting low carbon generation, but with the pace of decarbonization and electrification of the energy system, they have to adapt quickly in order to manage:

- Vastly more connection requests that need to be assessed, approved, and implemented.

- More diversity of technologies requiring access to the network.

- Customers using the network in new and less predictable ways.

- More need for real-time network visibility and analytics.

- Demands to make that network data consistent, transparent, and accessible to third parties.

In order to meet these challenges, DSOs have to make significant improvements to their digital and data capabilities. It is tempting to talk about the digital future of DSOs as a vision for the distant future — that of 2030 and beyond. But these changes will not take the form of a single 'big bang' transformation but, rather, a journey of increasing maturity that delivers value at each step along the way. So while the final destination is uncertain, the journey needs to start now.

The reaction from regulators and policymakers has been to push digitalization as a missing piece of the puzzle for decarbonization and customer affordability. At times, it is even proffered as a criticism aimed at businesses that have failed to adapt to the modern world. Technology change takes time; those prior investments of the last 2 or 5 years can still be delivering value to the business and should not be undermined. Similarly, culture change is not an overnight process, typically needing a number of years to truly embed and sustain cultural shifts. A phased plan, pointing toward a clear "end-state" vision is required. Too often everything ends up on the left-hand side of this plan, with little on the right.

While many regulators can demonstrate a commendable level of digital understanding, their position as policy experts and economists often does not afford them the context and practical understanding of the DSO business. Information asymmetry so far is working in reverse, making regulators consider digitalization as a once and done, easy answer. It is not — it is definitely a necessity, catalyzing the societal wave of energy transition.

Why Is the DSO World Changing: Three Factors

There are three interdependent factors that are driving the need for DSO evolution to an end-state:

- Decarbonization and electrification: Carbon reduction targets, such as those within the EU's Clean Energy Package and the forthcoming Green Deal, necessitate the electrification and decarbonization of the electricity system. This not only means more renewable generation but also a significant increase in electrical transport and heating loads. In some regions, data centers are also placing additional demands on, in particular, low voltage networks (for example, in the Netherlands alone, 200 data centers with 4 TWh of annual demand have been connected in recent years contributing to low voltage grid congestion). This is placing increased pressure on electricity networks and creating particular challenges at lower voltage levels.

- Focus on network capex efficiency: DSOs are under pressure to reduce their capital expenditure where opex solutions (such as the use of flexibility arrangements) are more economic (in many instances this is reflected in 'totex' regulatory accounting). As the rate of new connections increases, this becomes not only an economic issue but also a practical one — there is simply neither the time nor the resource to build out the network to accommodate the additional load.

- Evolving customer expectations: Network customers (both generators and consumers) and their agents (for example, suppliers and aggregators) are increasingly looking for faster and cheaper connections, more flexible network access arrangements, and the ability to participate in local and national flexibility markets.

What Changes Might DSOs Have to Make?

So Why Is ‘Digital’ Key?

The ask for DSOs is large but achievable. One of the biggest gaps is in joining up the understanding of an evolving ecosystem (with focus on the consumer) and consequentially designing the digital capabilities that will enable an affordable transition that is embarked upon using methods and approaches that inherently adapt to uncertainty and the need to iterate rapidly.

DSOs have a significant journey to travel to change their strategy, culture, and outcomes to reflect the needs of the new future energy system customer. But before accelerating through a digital journey, DSOs need to reconsider the future ecosystem, its participants, and the commercial interactions between parties. With this refreshed understanding, the DSO's role in the future digital energy system can be fully defined, and, in turn, the required digital capabilities of the business can be understood, funded, and grown.

Culturally, excellence in risk identification and mitigation is held in the highest esteem. Planning and building for the future with no false steps has been the desired approach. There is limited appetite to rapidly test and learn, and despite consistent under-delivery of promised benefits, internal change activity persists under a waterfall methodology. As a result of these cultural and historic norms, DSOs' digital capabilities are not at a maturity that is creating value for the consumer or the DSO business.

In many organizations, the value of digital is not fully understood at any level and, most importantly, not within leadership. It is too often dismissed or assumed to refer to website functionality or rolling out lower-cost SCADA assets. In our Baringa experience, digital value for DSOs as the local heart of the energy transition is created if:

- Digital business models enable a shift from traditional linear income streams, enabling new exchanges of value.

- Digital proposition enables true customer centricity and the ability to delight and adapt to each segment of customers' changing needs in a tailored way.

- Digitalization of your processes moves them from disconnected activities to an integrated data-rich value stream.

- Digitization of your organization moves away from large siloed departments to smaller, end-to-end multi-disciplinary skills delivered by empowered employees.

What Might a Mature DSO Look Like?

Only recently have DSOs begun to operate differently. Many now evidence the base capability of digital organizations, albeit fewer manifest the cultural traits.

The majority of DSO operations still assume predominately demand connections, firm capacity allocation, constraint management via reinforcement, focus on capacity, asset health, and reactive outage management. Variance or unique requirements break the machine.

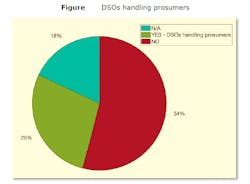

However, we are seeing DSOs starting to develop digital strategies and share with stakeholders. Based on an informal Chatham house survey across senior stakeholders in European distribution, we have observed that out of nearly 200 biggest DSOs in Europe, only a few DSOs from Austria, Finland, Netherlands, Portugal, and the United Kingdom lead the way in digital and have a digital customer-centric strategy and senior leadership driving that strategy. Another recent survey published by the European Commission echoes the limited uptake of explicit digital strategies. For example, that survey shows only 28% of European DSOs are ready to handle prosumers:

As an example of what triggers a digital strategy to come about, in the United Kingdom, regulatory requirements by the regulator Ofgem in late 2019 forced all DSOs to publish their digitalization strategies, yielding a broad-ranging interpretation of scope and ambition. Through this window of learning in the United Kingdom, we can learn lessons for the benefit of wider Europe as EU DSO harmonization unfolds, with a focus on demand side response, platforms for flexibility, and European open data strategy (which has parallels with the United Kingdom's Open Banking and Energy Data Taskforce).

Properly delivered, far from being a potential barrier to delivering the desired future, DSOs should be able to facilitate and indeed drive the change needed to empower consumers.

Quo Vadis for DSOs: How to Be a Hero in Digital?

- This means spending time learning from stakeholders to inform a vision of a future ecosystem and understanding the options available to each DSO, then engaging customers and shareholders so that the DSO's role (and return) in this ecosystem can be captured. The vision should leave room for uncertainty and optionality but be clear on how this will be managed.

- It means rethinking or adopting agile work management operating models, embedding AI and optionality into asset management strategy, and embracing automation and enterprise digitalization across the back office.

- Yes to digitalization means more telemetry, IoT, and so forth, but we knew that five years ago.

- What has worked historically is in many cases hitting the glass ceiling of performance and efficiency. The industry needs to look further afield to other sectors that have already realized significant value, such as telecom, water, and even oil and gas, where data and analytics are starting to transform exploration activity driven by digital tools and data available.

- Data and analytics must be a core competency for DSOs and at the heart of business strategy.

- DSOs must evolve to focus on delivering value early and often aggregating this toward delivering network investment plans that are efficient over 40 years but flexible over five.

Quo Vadis for DSOs: How to Be a Hero in Energy Transition?

- As surveys have shown, most of EU DSOs have not yet prioritized building out market-led business strategies.

- They do excel at focusing on secure energy supply and developing network development strategies (with relevant stakeholder input to some degree).

- With a fixed and predictable revenue stream and historic network usage being highly predictable, there has been little need to look over the horizon or understand wider consumer behaviors and commercial interactions that exist or will emerge within the energy ecosystem.

- The energy transition breaks this habit and requires improved customer centricity and increased commercial maturity to enable a true ecosystem of partners.

- Growth on the networks has in the past been reasonably predictable, allowing planning to be based on a narrow set of growth projections. But while decarbonization has forced more probabilistic thinking about the future, events such as COVID-19 remind us that the future is always uncertain even if the source of that uncertainty is unknown and unseen.

- A digitally-orientated business strategy considers and learns from the new way of doing business in the energy market and open data space.

- Hence, a hero's 'strategy' elements would include:

- Customer-led platform-based proposition (for example, cooperation with TSOs or across gas/power/heat in flexibility, services),

- Deep, insight-led understanding of customers, driven by data and analytics as a core competency, and

- Servant leadership within an agile org. This is a critical factor to reinforce the first two elements.

Final Words Opening the Debate

Successful digital businesses have leadership teams that 'get it.' Each DSO will need to navigate its own education and learning path to be heroes of the energy transition and the digital space nexus in Europe — and some will fail to do so. The winners in the process though may be reaping fruits of new services and new revenues, assuming at least the Clean Energy Package framework is there to reward the helping DSOs for empowering consumers for the energy transition.

And, the champion role for DSOs in energy transition is about to become mainstream in 2021, with European entity for Euro DSOs being set up under the Clean Energy Package alongside now more known ENTSO-E. So watch those thousands of heroes of clean energy transition emerge and enter the debate on how digital and ecosystem should interact externally and within DSO organizations.

About the Author

Erik Rakhou

Erik Rakhou is a management consultant in international energy market regulation and policy development with nearly 20 years of experience in European markets in both commercial and regulatory roles at the national and EU level. Rakhou is an alternate member of the Board of Appeal of the European regulatory agency ACER (2016 to 2021). He is also senior manager, Baringa Partners LLP, a Limited Liability Partnership registered in England and Wales.

Chris Collins

Chris Collins is a senior manager within Baringa's Energy Practice, where he specializes in smart grids, market design, and commercial analysis. He has worked across the energy industry, including independent generators, vertically integrated utilities, gas storage projects, regulated networks, and government policy.

Harry Taylor

Harry Taylor is a director in Baringa's Networks Practice. He has worked across the United Kingdom's regulated electricity and gas networks, shaping and delivering innovation and helping to drive efficiency and outperformance using digital and operational excellence.