New Zealand Takes A New Approach To Overhead Line Planning

As New Zealand’s largest distribution network operator in terms of total network length, Powerco manages 28,000 km (17,400 miles) of cables and lines and supplies communities in the regional and rural areas of New Zealand's North Island. Its 33-kV, 11-kV and 400-V overhead line networks were built mainly during a period of intense development in the 1950s, when many New Zealand rural communities were supplied with electricity for the first time. The networks are supported by a mix of aged structures, dominated mostly by concrete poles and a smaller proportion of wood poles in remote rural areas.

Identifying and prioritizing the replacement of overhead line assets is not a straightforward task. Renewal need is only loosely based on the installed life; more importantly, it is highly dependent on other factors such as material quality, environment, maintenance practices and fault history. The large-asset footprint combined with a vast quantity of information from diverse and sometimes sparsely populated sources was recorded through visual inspections of ground patrols conducted every five years. This has made it difficult to determine where investment is urgently required and how remedial works should be packaged to create projects of efficient scale. Such difficulties can lead to subjectivity and inefficiency in identifying and scoping projects. To avoid this, Powerco developed a new approach to overhead line planning.

Powerco’s Approach

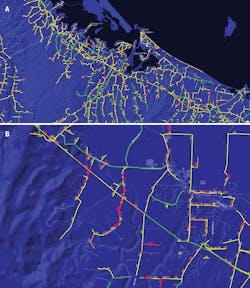

The utility developed a suite of planning models that combine the diverse sources of available data to produce visualizations that identify where urgent network renewal is needed. This approach uses hexagon-shaped areas that are 2 sq km (0.77 sq miles), 0.5 sq km (0.19 sq miles) and 0.25 sq km (0.1 sq miles) in area. The largest area is most used to provide an overview, with the smallest area used when greater detail is required.

Each hexagon-shaped area is assigned a score based on the weighted combinations of inputs. This includes fault records, overhead line inspection reports, asset age and known problems linked to asset types. The resulting scores enable visualization of the network condition as a heat map, providing rapid and compelling insight on where renewal is required. Differing-sized hexagon areas enable the higher resolution needed when moving from a macro network view to a localized project view.

Asset condition is not the sole criteria for renewal, so a further layer of hexagon-shaped areas was produced, this time with scores characterizing the potential consequences of asset failure. Information from diverse sources had to be combined to produce the visualization. The number of connected customers provided a measure of the consequences of service interruptions and census-based population density maps provided a measure of potential public safety consequences. The condition and consequence layers were then combined to produce a third layer visualizing asset risk.

By visualizing the abstract quantity risk, engineers can balance trade-offs and target investments where they provide the greatest benefit through better service levels for customers and improved safety for the community. This insight is used to shape and scope efficient renewal projects that target resources where they provide the greatest cost benefit.

Overhead Line Health Model

Overhead line conductors are one of the more difficult asset types for which to assess condition and plan for renewal. This is because reliable condition information is best obtained by removal of samples for laboratory tests, which is both expensive and causes service interruptions. Therefore, these difficulties severely limit the amount of information available for planning. In the past, this limitation has favored renewal planning methods that focus on replacing conductors based on a combination of age and known problematic types that have demonstrably high failure rates.

This approach may not be the most efficient in identifying the highest priority sections of overhead line for renewal when multiple problematic conductor types are present in widely varying environmental conditions. Therefore, a predictive health model was developed to overcome this problem and provide additional insight. The model calculates the health of each conductor based on knowledge of expected life, corrosion environment, historical failures and visual observations of condition.

Visualizations of predicted current and future conductor health then are used to identify target areas for more intensive testing. This requires each linear segment of the overhead conductor to be assigned a calculated health score based on a modeling methodology known as the Ofgem Common Network Asset Indices Methodology (CNAIM). This was developed by six distribution network operators for Ofgem, the UK’s regulator, to provide a common methodology for assessing condition-based risk for electricity distribution networks. Following calibration, this model was found to be sufficiently accurate for prioritizing specific sections of known problem types of overhead line for renewal.

While free to use, the Ofgem CNAIM methodology is most often implemented using an enterprise asset management system, with the output being tabular data and summary statistics. For this project, a different approach was taken by implementing the CNAIM algorithms within a geospatial information system (GIS) — using GIS-enabled modeling to be entirely contained within a single environment and leveraging geospatial analysis capabilities to improve the way the modeling was implemented.

As an example, the modeling used spatial maps of corrosion environment and wind speeds made available from New Zealand’s National Institute of Water and Atmospheric Research (NIWA) as an input to provide location-specific information for the model. The resulting calculations were then converted to the New Zealand Electricity Engineers Association’s asset heath indicator scale, which is intended to provide a common framework for describing asset condition within the New Zealand electricity supply industry. The scale is based on qualitative descriptive criteria for a range of observable condition and non-condition factors (termed drivers) that relate to end-of-asset life. The asset health indicator scale used for the presentation and communication with stakeholders was as follows:

- H5 = As-new condition, no drivers for replacement

- H4 = Asset serviceable, no drivers for replacement, normal in-service deterioration

- H3 = End-of-life drivers for replacement present, asset-related risk

- H2 = End-of-life drivers for replacement present, high asset risk

- H1 = Asset replacement recommended.

Model Calibration

To calibrate and continually improve the accuracy of the modeling, a visual condition assessment program was implemented using a mobile data collection application that integrates with the GIS. This enabled field-based visual observations of condition to be integrated seamlessly with the modeling. While field-based visual observations are not as accurate as laboratory assessments, the high volume and low cost provided by the mobile data collection application nevertheless is useful for verifying and improving the model. Finally, a business intelligence application was used to produce a dashboard of summary statistics. These statistics were used for both tuning the modeling and presenting high-level statistics on renewal needs to stakeholders.

The project made extensive use of the integrated Esri ArcGIS mapping and analytics platform software application and tools. All models were developed in ArcGIS Pro and scripted using Python to add customizations and the development of features specific to the modeling required. A Python toolbox also was created that enables end users to run and tune the models by editing parameters in the application and through parameter files. Models also are configured to publish feature services automatically and write to a database for business use after validation.

ArcGIS Insights was used to produce summary statistics and visualizations to aid in summarizing, calibrating and navigating the models. General dissemination of results is done by sharing projects in Powerco’s operations dashboard. Finally, the ArcGIS Collector application provides a feedback loop that enables field observations to be cost effectively incorporated into the modeling for verification and continual improvement.

Improved Asset Management

Powerco recently upgraded its overhead line inspection standards to include aerial photography, so it can obtain high-resolution top-down images to assess the condition of cross arms, insulators, other hardware and, to a limited extent, the ingress of trees and vegetation in close vicinity to the overhead line conductors.

Included in this project was a detailed sample-based inspection of some 500 sites where selected spans are being inspected using acoustic detection and close-up photography by a drone.

Renewal Program Expenditure

Powerco implemented its new renewal planning approach in 2019 for the 33-kV and 11-kvV overhead line networks. It currently is extending the model to include 400-V overhead lines. Initially, Powerco was required to submit a customized price quality path application to the Commerce Commission in New Zealand, whereby it received approval for renewal capital expenditure (CAPEX). As a result, its renewal CAPEX for overhead lines was increased to NZ$30.1 million (US$19.66 million) in 2019, with approval to progressively increase to a planned peak of NZ$57.5 million (US$37.38 million) in 2023.

The ability to virtually look down on the network and see previously disparate sources of data combined to produce views of asset condition and risk has transformed the way Powerco planning engineers identify and package overhead network renewal projects. A task that previously took months and involved a large degree of subjective judgment can now be performed in days based on logical and consistent rules driven transparently from available data.

This new efficiency has enabled renewal planning engineers to prepare a significantly larger portfolio of planned renewal projects with longer forward lead times. This larger backlog of scoped projects has assisted in achieving procurement and delivery efficiencies. In the future, the pool of scoped renewal projects — with their costs and benefits quantified — will be further optimized using a project portfolio optimization tool.

Acknowledgement

The author would like to acknowledge the efforts of the project team that realized this solution: Andrea Galliegue, business relationship manager who promoted the project within Powerco and managed the project as agile scrum master; David Haberkorn, GIS specialist who led the technical implementation; and Ken Pattie and Waseem Awan, Powerco overhead line renewal engineers responsible for overhead line asset condition and conductor health modeling.

Dr. Paul Blackmore ([email protected]) is an asset management advisor responsible for shaping initiatives to improve Powerco's asset performance. He has held a variety of roles associated with T&D asset management, including Powerco's electricity asset fleet manager, director of consulting for EA Technology Australia and engineering roles at Energex in Queensland, Australia. Blackmore was awarded a Ph.D. for developing novel condition monitoring techniques for polymer composite insulators in 1998.