DSO Models Promise a More Digital, Distributed Grid

It simply does not make financial sense for small energy producers — businesses and homeowners — to invest in distributed energy technologies. A more dynamic model, including a distribution systems operator (DSO) function, is needed to achieve a return on their investments. In Part 2 of this two-part series based on the findings of Black & Veatch's 2020 Strategic Directions: Smart Utilities Report, we will discuss how the DSO function benefits utilities when it comes to managing and coordinating distributed energy resources (DERs) and fast-approaching distribution markets.

The flood of DERs is changing how traditional electric power and consumers interact with the grid and their utility provider. Utilities are facing hundreds of thousands, or even millions of digital assets that require new business models and advanced technologies on the distribution system and behind the meter. New markets are also on the horizon, promising to deliver more efficiency and resiliency while allowing DER market participants to monetize their investments.

For the small energy producer, the current wholesale market provides no incentives or opportunities to participate in supporting local grid needs. Return on investment (ROI) for purchases of solar photovoltaics (PV) and energy storage systems are solely generated through savings because of lowered energy bills, and for many, can take as long as 10 years to achieve. Even as solar and energy storage prices drop and state laws and mandates encourage clean energy adoption, it simply does not make financial sense for most businesses and homeowners to invest in these technologies. What is needed is a more dynamic distribution system — one that provides DER investors with new and transparent governance, new business models, and faster ways to achieve ROI on their investments.

It's time to rethink the utility and wholesale-market-only business models to help ensure that utilities remain relevant and competitive while providing opportunities for faster ROI for DER investments.

Bring in the DSO

Utilities, regulators, and independent system operators (ISOs) are studying the concept of creating a DSO model. A DSO would have two responsibilities: operate the distribution system marketplace and manage DERs in coordination with other distribution grid assets, regardless of who owns them. To achieve the true value of DERs and new distribution markets, the DSO will require close coordination between historically siloed utility organizations — grid operations, market operations, short- and long-term planners — all working together to address the new two-way flows in the power markets, while ensuring the regulatory and customer expectations for resilience, reliability, and safety.

Establishing new DSO functions that include an open and transparent distribution market is the next step required to create a "new energy economy" that animates new distribution markets and empowers utilities, consumers, producers, third-party aggregators, technologists, and new business models. This market would incentivize the adoption of DERs and create opportunities for innovation, changing the way the grid operates and how consumers, producers, and machines interact with it, resulting in cleaner, cheaper power, greater efficiencies, and improved reliability and resilience.

DSO conversations have been ongoing for a couple of years now but no DSOs have been established yet. One of the key issues has been the natural assumption that if New York establishes a DSO that leverages the market experience of the NYISO, that same model will work everywhere else. But the idea of a one-size-fits-all approach, regardless of local conditions, doesn't make sense and has confused utilities, ISOs, regulators, and industry consultants. The optimal DSO model in New York very likely won't translate to California and the optimal model in California likely isn't the best model for Texas. DSO models should be designed for each location based on local conditions, politics, regulatory environments, distribution grid conditions, transmission operations, relevant wholesale markets, and other local considerations.

Six Models and Counting

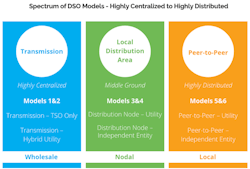

The reality is that there is a spectrum of DSO organizational models. The following models represent examples of that spectrum — from highly-centralized transmission wholesale models, to distribution nodal models, to highly-decentralized peer-to-peer (PtP) models.

1. Model 1 — Transmission system operator (TSO) only: A highly centralized model where the ISO/TSO is responsible for the distribution market operator (DMO) and distributed energy resource manager (DERM) within its jurisdiction, including all DERs on the utility's distribution networks.

2. Model 2 — TSO/hybrid utility: A highly centralized model where the DMO is managed by the ISO, but the utility managed and coordinated the DERM.

3. Model 3 — Distribution node/utility: A nodal model that uses locational marginal pricing (LMP) at a physical distribution constraint location (for example, a substation or feeder). The utility is responsible for both the DMO and the DERM.

4. Model 4 — Distribution node/independent entity: A nodal model that uses LMP at a physical distribution constraint location, while an independent organization operates the DMO and DERM on the distribution grid.

5. Model 5 — PtP/utility: A highly distributed PtP market where the utility owns the DMO role and DER dispatch is performed automatically (by the customer and third-party traders) based on market activity.

6. Model 6 — PtP/independent entity: A highly distributed PtP market where an independent organization manages the DMO and DER dispatch is performed automatically based on market activity.

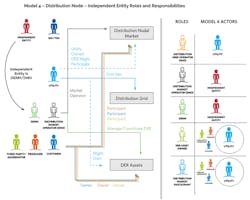

These models are based on a set cast of actors that assume different roles based on the desired operations centralization/decentralization and market structures.

| Roles: | Actors: |

| Distribution grid operator | Independent system operator/transmission system operator |

| Distributed energy resource manager | Utility |

| Distribution market operator | Customer |

| Short-term distribution planner | Producer |

| Long-term distribution planner | Third-party aggregator |

| Distribution market participant | Independent entity |

| DER asset owner |

To illustrate, in Model 4 (distribution node/independent entity), the utility actor performs the role of distribution grid operator and an independent entity actor performs the roles of DERM and DMO, as shown in Figure 2 below.

The mixing of actors to roles has many different potential model outcomes, again with the overarching idea that there is not a one-size-fits-all solution, but rather a spectrum of model opportunities that can be fine-tuned based on local conditions and constraints.

Implementing a DSO

Utilities, ISO/TSOs, and regulatory organizations should begin having the DSO discussion today. Every utility with DER penetration in the 20% range ought to be seriously thinking about how a DSO can help manage and optimize DERs within their territory. They should decide which DSO roles they want to assume, begin developing an organizational and regulatory strategy, and coordinate with other regional utilities to jointly determine the most appropriate DSO model within their territory. Enthusiasm for a DSO capability is high and utilities are eager for what's next. California, New York, and Texas (Electric Reliability Council of Texas) are already leading the charge, with other regions expected to follow. Based on conversations with utilities and ISO/TSOs, DSOs are likely to emerge in the next two to three years, followed by rapid adoption, with wide-scale DSO presence within the next decade.

But that's not to say challenges don't exist; there are still many questions that need answers. From the regulatory perspective, this is a big switch and regulators will be critical in helping to define the optimal DSO model for their states. Key stakeholders are asking themselves certain questions: what markets are needed? What systems are needed to manage the markets and distribution operations? Do vendor solutions exist to support these new capabilities? When it comes to market participation, what is the minimum capacity required? Who is the provider of last resort? And how does that provider get compensated?

The DSO conversation is occurring at utilities across the country. To design and develop a strategy for implementing a DSO, utilities must take a collaborative approach and include stakeholders from across the organization, including architecture, grid modernization, IT, operations, planning, regulatory, and strategy. These cross-functional teams can then determine the local factors, for example, the physical location, political and regulatory environment, any applicable grid constraints, customer expectations, and other pertinent conditions that will help narrow DSO model selection.

Once the utility has defined the optimal organizational structure and related roles, the next step is to develop a strategy, roadmap, and plan. Keep in mind that selecting a DSO model won't lock the utility in; as the regulations, governance, and technologies continue to evolve, markets that aren't viable today may come to life tomorrow. Nonetheless, a strong organizational model and strategy will ensure that the utility can remain relevant and evolve along with them.

About the Author

Stuart McCafferty

Stuart McCafferty is a managing director focused on DER integration for Black & Veatch Management Consulting. He is a National Institute of Standards Technology (NIST) fellow for community resilience, an industry expert for Energy Central, and vice-chair for Open Field Message Bus (OpenFMB) Users Group.