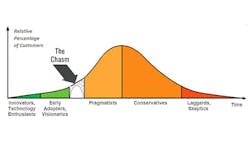

In the strategic marketing world, we often talk about motivating innovators and early adopters sufficiently to catalyze a “crossing of the chasm.”

The concept can be viewed in terms of a product adoption model that breaks up markets into customer segments, as shown below:

It is often assumed that this model, promoted by Geoffrey Moore in Crossing the Chasm, fits our industry’s smart grid and grid-edge efforts. But does it?

Has your transformer’s or circuit breaker’s cost been cut in half while doubling its electric capacity every 18 months? No.

Why do I refer to 18 months? Because the chasm-crossing model is driven not by our industry but by the more rapid pace of change in the IT and semiconductor industries, due to the 18-month “rule” in Moore’s Law. (Moore’s Law — from Intel’s Gordon Moore, not “Crossing the Chasm’s” Geoffrey Moore — says that the number of transistors in a dense integrated circuit doubles approximately every 18 months, and has been born out since the invention of the transistor in the 1950s, with ongoing reductions in associated costs and increases in associated computing power.)

Here are two examples of smart grid "forced fits":

1. We have numerous smart grid programs that take a "focus group” marketing approach, designing different messages to keep each segment “happy,” including a lot of segments that overlap with Geoffrey Moore’s chasm-crossing segments. Is this a forced fit?

2. We have numerous attempts to apply this chasm-crossing model to grid-edge technology uptake as well. The Networked EV: Smart Grids and Electric Vehicles; First Stop, California by Greentech Media (Feb. 2010) is a classic example. The article states that the “chasm” had not yet even been approached for EVs and talks about needs for a greater smart grid infrastructure to support EVs as “a future ‘killer app’ of the smart grid.”

The fundamental assumption of these two examples is that the chasm-crossing model fits — somehow. Isn’t it naïve to think everyone to the right of the chasm — the pragmatists, conservatives, skeptics and laggards — will simply start buying EVs or Nest thermostats like hotcakes once the needs of innovators and early adopters are met?

My question for our IdeaXchange Xperts is this: How well do you think “chasm-crossing” theory fits our industry, and what are the bad consequences of “force-fitting it” where it does not belong?

Don McDonnell

Here are my comments in two parts:

1. Chasm.

Pete, as you point out, the whole "chasm-crossing" model is rooted in an IT software vendor view of the world. The term has also become a "throw away" line to describe any technology or innovation that has yet to gain mainstream market adoption. It's very often misused as you noted.

It is fair to say that in this particular IdeaXchange group, we've probably all been in pilot projects or technology tests that failed to deliver on their premise in specific circumstances. And this happens even with some established technologies that just may not be right for every utility depending on its unique combination of goals for quality, reliability, economy and environmental outcomes. Does this mean they "failed to cross the chasm" at that utility or that solution failed in chasm crossing? Of course not!

To apply these models to individual circumstances is a mistake. Even worse, analysts or researchers contort market abstractions like "smart grid" and then try to plot utilities in this regard using chasm models.

The Chasm model was meant as a generic market model to determine and guide technology vendor strategy and behavior, not a universal truth to model anything and everything!

While applying market models such as the Chasm model can be useful to understand where established markets are at in their relative penetration and development, we all must bear in mind as well the emergence of "Spiral" development methodologies, hosted cloud platforms, and innumerable other changes since Chasm was first published some three decades back, which I'd suggest have rendered it much less useful. This is why the author updated his thinking with his book Inside the Tornado a few years back. It’s a good read.

2. Moore's Law.

The misapplication of Moore's law to other market developments and performance/innovation/cost curves is also very confusing and sometimes humorous to observe. Of course, everyone would love a law named after them so people try. I often see this bear out as more confusing than helpful in practice.

As we see increased penetration of digital meters, digital substation control and relaying and power monitoring (where we have some real application of the effects of Moore's law in utilities) this has become very real to our industry. Chip sizes and associated developments in manufacturing are now such that things that would have been impractical or even stupid 15 to 20 years ago simply because form and power factors have now become much more doable for our industry. Line monitoring technology and strategic metering are areas that have greatly improved. Smart meters no longer require enormous built-up collars to house electronics or a separate communications housing. And we have all seen with our eyes how a lot has "shrunk under glass" and a lot has "shrunk on the pole."

But we still have a distributed "always on" interconnected system making the externalized service and installation costs from any upgrades or changes a critically relevant factor for us to model, when considering Moore's law inside our industry. It's a fairly direct and rapid progression in the consumer electronics market, but as we all know, we don't have the luxury of treating our utility assets as throw-away items after three or four years as we do with computers and smart phones. At least not yet, and probably not for a very long time.

Utility distribution systems and the transmission systems and interconnections and various supply sources that serve them are too complex to be reduced and rendered into simple Chasm thinking. And certainly the idea of having this whole model superimposed over the conceptual framework of smart grid could be akin to the utility industry wrapping a bit of a consumer riddle (digital meter) inside an enigma (power system often without adequate network telemetry but smart meters nonetheless?) and then shrouding it in a big mystery (the term smart grid).

This is something, as an industry, we are often quite fairly accused of doing.

Doug Houseman

Chasm. What Chasm?

I will not argue that the Chasm-crossing model, which we may also call the “Processor Adoption Model,” is unworkable. I will not even argue that it is obsolete. I will just posit that it is not applicable to the utility portion of our industry, and probably is not applicable to the end customers we deal with.

A typical laptop computer in a business is replaced roughly every three years. The Processor Adoption Model (its original name within Intel in the 1990s) applies well in that world.

In any consumer electronic/computing environment, where there is rapid turnover in hardware and software, the model works. Venture capitalists built their fortunes on this model, and if you look at the venture capitalists’ record in energy-related industries, their return on investment has been far lower than in software and computing hardware. Talking to a major venture capitalist, they will tell you they have tried to apply it and failed over the last 15 years. Whether it was thin film solar, or metering or fuel cells, or ... the venture industry has largely walked away from all but software in the energy industry.

In the utility industry, there is a massive pothole in the way of using the model — it is the fact that the utility portion of the industry is REGULATED. We are 20 years into adopting better metering and not all states have yet approved use of communicating meters.

In Europe, the Netherlands is still struggling with privacy and other issues with regard to meters, even though they have only three years left in the 12-year-old European mandate to install meters. Regulation and the lag that it puts in the utility adoption cycle both blows the timeline of the model out of the water and blows up the actual model, because once regulation is approved, installation normally happens on a fairly flat line, rather than the "hump" that the model shows. If you were to change months to years, then the model might apply for the utility industry, since the regulatory process tends to involve an early adopter or two, a few fast movers, then some wider adoption, with some states trailing behind.

The second problem is that the assets in the utility industry tend to have life cycles that are measured in decades, rather than months. A transformer can easily have a 40-year depreciation cycle and a 70-year useful life. No regulator would allow a utility to throw away transformers on a 3- to 5-year cycle, and waste more than 90% of the useful life. Again changing months to years, might make the model apply, but probably not.

On the consumer side, consumers want to update entertainment and productivity devices (e.g., phones, televisions, and laptops), but they want every day of useful life possible from basic appliances (e.g., air conditioning units, refrigerators, stoves, etc.). Only a major remodeling, which happens on a 15- to 20-year cycle on most homes, can shorten the life of a basic appliance. Most consumers don't want to think about a new dryer or refrigerator, because it typically means the old one is failing- and it is a major expense that will get in the way of updating a television or buying a new computer game.

Even on industry software, the life cycle is much longer than it is for consumer apps. Angry Birds is actively used on most phones for a 3- to 6-month period. A billing system in a utility tends to have a 20- to 25-year life cycle. Replacement of an app on a phone is a simple — pick the new one and forget the old one. Replacement of a piece of operational software at a utility is akin to a heart transplant in a high-risk patient. There is a possibility that the patient will die on the table. More than a few executives have found themselves without a job after a failed software project on the operations side of the business.

So, ignore the model, it does not apply. If we want to move faster, we need to do the following:

1. Do a better job of exchanging information with the regulators and other stakeholders. Getting a clear understanding of the changing ecosystem the grid lives in, the changing expectations of customers, and the needs of other stakeholders needs to be clearly and openly understood.

2. Everyone needs to work toward common and transparent goals. It is OK if a solar installation firm is in the game to make money, but they can't act as if they are purely in the game to improve the environment. Everyone needs to make a living, and ALL the customers need to have access to reasonably priced energy.

3. Openly publish results and lessons learned of both successes and failures in grid pilots and projects. Be willing to admit what worked and what did not, open the project to show how the goals, equipment and software changed during the implementation. Admitting failure is highly useful to the whole industry. We learn far more from a failure than from success.

4. Develop a REAL vision for the future, something that is hammered out between all the stakeholders in honest conversation. Don't push a portion of the industry off in a corner and then expect them to enthusiastically commit their money to the vision. Everyone needs a real seat at the table and needs to be heard. If a portion of the industry does not agree, be ready for them to not participate, and also to have an alternative to that portion of the industry.

It is up to all of us to realize that we can't apply a computer-processor adoption model to the industry we work in and realize we need our own model to move forward. If we want our grandchildren to have lights and heat, it will be up to us, now — given asset life cycles — to put the vision in place today.

Rick Bush

Doug, your comments hit home.

I recall that when I worked at the Georgia Power Research Lab (now NEETRAC), we had impulse generators, series resonant test sets, impact and tension machines and vibration spans. Then we started buying computers and data acquisition systems to control the equipment and collect data which were replaced on the order of every three years. Soon we had half our overhead equipment costs made up of obsolete IT systems. Not good as they were not generating any revenue. Lesson learned as I type from a 5-year-old ThinkPad.

Geoff Zeiss

I agree with much that has been said on this thread in the short term. But if we look a little further out, I suspect we will see a utility industry is increasingly consumer-driven. If we look at the UK Ofgem model, or what SMUD is doing, or what is involved with the New York REV regulatory model, the goal is to introduce competition into the retail end and the power generation end of the business. Cheap solar panels are already dramatically changing the generation side of things and power is available in bulk from non-utility sources such as Apple and Google. A casino in Las Vegas with the largest rooftop solar array is going off grid even if forced to pay an astronomical exit fee. I suspect that the Nest thermostat is just the beginning of consumer devices that will increasingly change how consumers use electric power. With storage becoming cheaper and commoditized, microgrids are becoming an economically viable alternative, and not only for casinos.

As has been pointed out, traditional utility infrastructure does not change every three years, but consumer devices do. If you look at the telecom industry in the 1970s, 1980s and 1990s, answering machines, touch-tone phones and cell phones changed the usage patterns of telecommunications infrastructure. In one decade, cell phones went from 1% of the population to more than 50% of the population. Ultimately, this drives changes in the transmission and distribution space. Copper is almost history, being replaced by fiber and wireless. Currently, smart phones, the Internet and machine-to-machine communications are revolutionizing business and consumers' spending patterns. I fully expect a similar pattern to emerge in the power utility business with consumers driving the engine. Consumer devices often do follow the Chasm model. Further to the point of consumerization, Gartner has predicted that by 2020, the largest power utility will be an Uber-like entity that will not own generation, transmission or distribution infrastructure, but will provide IT infrastructure to put energy providers in touch with energy consumers.

Dr. Mani Vadari

Chasm Crossing and Force Fitting, these are powerful terms that if you ask 10 people to define them, we will get more than 20 answers, especially when it has to do with taking lessons learned from one industry and apply it to another. Many times, I am sure you will get one “for” and one “against” from the same person. Why is that?

I have said this before and here is how it goes. The electrical utility has done such a good job that, for the most part, the entire world thinks that the power comes from the two (sometimes three) holes in the wall, and they are generally clueless about what happens anywhere behind that. Our industry has done such a good job that our devices (laptops, lamps, cell phones and most everything) work the same whether they are plugged into the wall at our house, at our office, or at the airport. The utility bill is also, for the most part, a very small portion of the monthly budget for most people (at least in the U.S. and Canada) that most people do not think much of the utility and/or electricity. The cost is so low that when you connect to a plug point at a facility outside of your home, it is free – they don’t even charge you for it.

So, for the most part, most people do not think of electricity or the utility providing it. The only time someone even thinks of the electric utility is when the power is off – and then of course, the electric utility is the devil incarnate. So, am I saying that the electric industry is boring?

Actually, yes, boring, only because it is always there, and the cost is reasonably low. This low cost comes from an unerring derive by utility personnel to deliver a product that is so ubiquitous and most importantly, by the fact that the devices installed by them tends to last for years and years. An example of this is a factoid from DOE – The average life-span of a transformer installed in the U.S. is about 40 years, and the average age of the transformer in the U.S. is 42. If these things change, so will the cost structures for our industry; this means that our power may no longer be as cheap as it is.

This also doesn’t mean that there is no innovation in our industry – remember the early days of ARRA? It was like the Internet days of early to mid-1990s when everything was Internet this and web that. Where are all of those companies? Most of them went the same way as the plethora of companies that showed up around 2009 and so on. However, not all of the work they did went to waste; some of them, products such as the HEM (or the Home Energy Manager), died and probably should have died anyway. But the lessons learned from the user experience from those experiments are showing up in new devices from Nest, Honeywell and some of the energy managing apps on our smartphones. Other products such as volt-Var controller survived and are continuing to deliver value to our industry.

What can we conclude from this?

These points made above are very important to take into consideration as we make comparisons with other industries. Each industry will innovate at its own pace, especially when it is regulated. Our industry will change more when new technologies such as storage and DERs become more ubiquitous (and cheap), allowing the customer to make more decisions independent of the incumbent utility, and other market-based players can jump in and provide more options to them, either independently or bundled with other services.

About the Author

Peter Arvan Manos

Utility Industry Analyst

Peter Manos is Director of Research for Electric Power & Smart Grid, on the Energy Sector team at ARC. He analyzes the latest trends across People, Process, and Technology to uncover business and digital transformation best practices for electric, gas, and water utilities. He can be reached at [email protected]