The Role of Electric Vehicles in Grid Resilience and Flexibility

The integration of electric vehicles (EVs) into the U.S. power grid is vital for a sustainable energy future, especially as EV adoption in the U.S. is projected to reach 27 million vehicles by 2030. This surge necessitates substantial infrastructural investment as industry leaders and utilities redefine electric vehicle charging infrastructure (EVCI) not just as a facilitator of transportation, but as a strategic asset essential for supporting grid reliability, flexibility, and resilience. Key advances in bidirectional charging and battery energy storage systems (BESS) are enabling EVs to function as distributed energy resources (DERs), with the National Renewable Energy Laboratory (NREL) noting that they will become the primary source of demand-side flexibility in a system increasingly dominated by renewables.

To this end, utilities across the US are piloting Vehicle-to-Grid (V2G) programs in collaboration with fleet operators, with companies like Nuvve and Dominion Energy pioneering innovative business models that utilize EV fleets for managing peak loads, demand response and peak shaving. Data from Power Technology Research indicates V2G adoption is set to expand considerably, reaching an installed base of nearly 300,000 V2G-capable chargers in the U.S. by 2035. This trend reflects the dual value proposition of leveraging EVCI across both transportation and energy domains.

Evolving legislative and technical foundations for V2G, DER integration

On April 4, 2024, Maryland became the first U.S. state to mandate utility support for vehicle-to-grid systems. The Distributed Renewable Integration and Vehicle Electrification (DRIVE) Act requires utilities to submit interconnection and virtual power plant (VPP) plans by 2025, with implementation deadlines set through 2028. PTR’s analysis suggests that legislation such as the DRIVE Act can help defer costly grid expansions while enhancing resilience against electrical outages. The Act required utilities to submit V2G charging plans to the Maryland Public Service Commission by 1st April 2025 and virtual power plant plans by 1st July 2025, with a deadline of 1st September 2028 for implementation of time-of-use rates.

Shortly following Maryland's initiative, Colorado enacted similar legislation in May 2024, requiring Xcel Energy, the state's largest electric utility, to establish a virtual power plant program with a performance-based compensation tariff by 2025. This legislation calls to streamline grid interconnection processes and distribution network upgrades. Further, in August, the California Senate also passed legislation requiring all EVs of all weight classes to support future V2G capabilities. These state-level legislative moves are laying the groundwork for widespread V2G integration and utility participation.

Private sector efforts are also accelerating in collaboration with state programs. In the past, Nuvve has partnered with various bus fleets, including NRT Bus in Massachusetts, and deployed 25 bi-directional DC charging stations for electric school buses. The initiative received major funding through the Environmental Protection Agency's Clean School Bus Grant. Recently in February 2025, Nuvve secured a $400 million Statewide Price Agreement in New Mexico for V2G charging infrastructure deployments across the state over the next four years.

Texas remains a leader in V2G integration, with the Electric Reliability Council of Texas (ERCOT) and the Public Utility Commission supporting multiple pilot projects, including the Aggregate DER (ADER) pilot in Houston and Oncor Electric's VPP. The state has endorsed several pilot programs aimed at evaluating the impact of V2G technology on grid stability and efficiency, underpinned by its regulatory framework and grid modernization initiatives.

On the technical standards front, 19th February 2025 marked a major milestone with the release of the Electric Vehicle Supply Equipment (EVSE) Power Export Permitting Standard by the National Electrical Manufacturers Association (NEMA). This standard streamlines the permitting process for bidirectional charging and provides a foundational framework for developing compensation mechanisms for Vehicle-to-Grid (V2G) participants. It offers validation for ongoing pilot projects and helps accelerate future deployments by enabling aggregators to build scalable business models. Additionally, local governments benefit from having a vetted reference standard, which reduces administrative delays and promotes consistency in permitting practices.

Canada is also taking initial steps toward V2G charging as of 2024 to support its local distribution and bulk electricity systems and inviting integrations of vehicles fleets as grid assets. Ontario's Independent Electricity System Operator (IESO) announced $9.5 million in V2G funding in 2024 for demand-side electrification projects focused on EVs and grid flexibility. The program includes funds for managed charging (V1G), Vehicle-to-Home (V2H), Vehicle-to-Building (V2B), and bidirectional V2G energy exports.

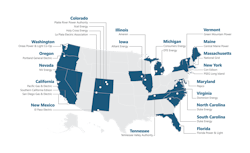

Vehicle-to-Grid (V2G): Turning electric school buses into grid assets

One of the most promising applications of V2G technology in North America has been the deployment of electric school buses (ESBs). With fixed schedules and long idle periods, ESBs offer a consistent opportunity to support grid needs. As of 2024, over 300 V2G-enabled electric school buses are in operation across at least 19 states, collectively delivering an estimated 15,000 kWh back to the grid during peak summer demand, according to reports from utility pilot programs in Virginia and California. Unlike passenger EVs or commercial trucks, school buses operate on fixed routes and experience extended idle periods, making them particularly well-suited for bidirectional charging.

Key players in these deployments include electric bus fleets such as North Reading Transportation (NRT) Bus alongside charging infrastructure providers like Nuvve and its subsidiary Fermata Energy. With V2G standards gaining traction, site compliance is on the rise. V2G sites are now capable of allowing heavy-duty bidirectional-capable EVs to function as grid-tied generators, particularly while charging via AC. Nuvve has been central to these deployments with 12 (5 DC and 7 AC) V2G-capable chargers installed in New Mexico for electric school buses. Nuvve has also rolled out AC V2G installations in Delaware which enables Ford Mach-E electric trucks to deliver grid services while parked, showcasing the benefits of AC bidirectional power flow.

Dominion Energy’s Electric School Bus Program, initiated in 2019, in collaboration with Thomas Built Buses and Sonny Merryman has surpassed 1.5 million electric miles with over 135 buses in 25 districts, establishing it as the largest utility-led electric school bus initiative in the U.S. As of 2023, Dominion Energy deployed over 50 electric school buses equipped with V2G capabilities in Virginia. Each bus is fitted with a 226 kWh battery capable of discharging up to 60 kW back to the grid, collectively providing up to 3 MW during peak demand periods. The initiative not only bolsters grid stability but also offers environmental benefits, having mitigated approximately 1,632 short tons of greenhouse gas emissions to date. [6]

Moreover, in California, San Diego Gas & Electric (SDG&E) has been administrating a five-year V2G pilot project since 2022, involving six 60 kW bidirectional chargers. Under the SDG&E’s Emergency Load Reduction Program (ELRP), Nuvve has partnered with the San Diego Unified School District to equip 10 electric school buses with Vehicle-to-Grid (V2G) charging capabilities, enabling compensation of $2 per kWh for energy supplied during peak demand or emergency events. This initiative demonstrates the viability of V2G as a revenue-generating model for school districts, with potential savings of up to $7,200 per bus annually.

While questions arise regarding the application of V2G technology in the heavy-duty trucking sector, logistical challenges have hindered deployments in this segment. However, depot-based use cases, particularly in school transportation, have proven viable with numerous bidirectional buses already contributing significant kilowatt-hours to local grids. V2G applications remain less prevalent for heavy-duty electric trucks, such as Class 8 vehicles, due to unpredictable routes and stringent logistics schedules, which complicate the reliable discharge of energy without disrupting operations.

Strategic integration and grid resilience

The U.S. EV and EVCI sectors are entering a new era of technological maturity. Bidirectional charging and vehicle-to-grid (V2G) capabilities are transitioning from pilot phases into early commercialization. Over the next decade, V2G-capable chargers are forecast to grow at a CAGR of 70% from 2025 to 2035,[8] driven by fleet electrification and school bus deployments. Utilities in California and New York are piloting real-time pricing models by 2026, with broader regulatory adoption expected by 2028 as managed charging and distributed energy resource (DER) frameworks mature.

One of the most critical enablers of this transformation is cross-sector collaboration. Nuvve’s V2G platform partnerships with OEMs such as Thomas Built Buses, Blue Bird, Lion Electric, and IC Bus have already supported over 20 commercial deployments across the U.S. since 2022. These collaborations demonstrate a scalable blueprint for integrating EVs into grid services while delivering total cost of ownership (TCO) savings of 30–40% for fleet operators leveraging energy arbitrage and grid incentives. As BESS and smart inverters continue to evolve, EVs will no longer be passive loads but active, dispatchable grid assets—playing a central role in enhancing grid resilience, load balancing, and renewable integration by 2030 and beyond.

About the Author

Zainab Shah

Zainab Shah is Lead EVCI Analyst - Americas specializing in electric vehicles and charging infrastructure at PTR Inc. She brings a robust technical background of automotive industry knowledge, having past experience in product development and vehicle localization at Toyota. Zainab offers insightful, data-driven analysis of evolving new energy markets, with a strong focus on North America. She holds a bachelor’s degree in Electrical Engineering from the National University of Sciences and Technology (NUST.)

Mike Sheppard

Mike Sheppard has 20 years of market research experience designing numerous research practices from scratch while leading over 100 bespoke projects with Fortune-500 companies. In 2016 he co-founded Power Technology Research (PTR) and has since launched new research practices in solar, storage, battery, and e-mobility. In 2020, he co-founded Matos, an intelligence automation company focused on providing powerful AI-driven tools for the market research sector. In 2023, this business was acquired by PTR. Prior to founding PTR, he spent 8 years with iSuppli/IHS Markit in various analyst and consulting roles where he covered a broad range of sectors including mobile, renewable power and electricity transmission and distribution (T&D). In his last role, he led the power technology consulting group. He is an expert on the PV industry and having performed numerous competitive dynamics and opportunity assessment projects, covering upstream, downstream, and supply chain topics. In 2008, he obtained two Bachelor’s of Science in both Financial Services and Corporate Finance from San Francisco State University.