The Vehicle-to-Grid Battlefield

There are no vehicle-to-grid specific regulations in the United States (at the federal level) and Europe, as the technology is currently largely in the pilot phase. Still, there are regulations that have created an enabling environment for the widespread integration of EVs with the grid (specifically, the regulations that seek wider participation in the electricity market). As mentioned earlier, CCS is expected to support V2G integration by 2025, whereas NACS may also support V2G in coming years as pressure mounts from the adopters of Tesla’s charging standard. Once these standards, specifically CCS, begin to support integration with the grid, it is expected that V2G-specific regulations will be introduced.

(The regulations and legislations discussed in this section are not exhaustive. We have only discussed the most relevant ones.)

United States

The Federal Energy Regulatory Commission (FERC) revised section 206 of the Federal Power Act in order to remove the discriminatory practices in the wholesale electric markets so that providers of frequency regulation receive a just rate. Through FERC Order 755, a separate compensation structure has been mandated for fast-acting resources to incentivize the use of batteries for frequency regulation. A range of independent system operators and regional transmission operators have adopted the rule, including PJM, MISO, NYISO, and CAISO.

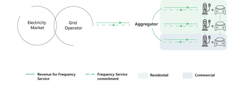

On the other hand, FERC Order 2222 requires RTOs and ISOs to allow distributed energy resource (DER) aggregators to participate directly in the wholesale electricity markets and establish a new category of market participants referred to as DER aggregators. Both these orders are crucial as they provide an enabling environment for widespread V2G integration in the future, be it FERC Order 755, which seeks a separate compensation structure for fast-acting resources (no resource is more fast-acting than batteries) or FERC Order 2222, which requires operators to allow market participation of DERs.

Furthermore, recently, it has been observed that the state of California’s Senate has approved legislation that requires all the electric vehicles sold in the state to be equipped with bidirectional charging by 2030. Though the national charging standard does not support bidirectional charging, there are still many electric vehicles in California that are already equipped with bidirectional charging, for instance, Nissan Leaf.

Europe

In Europe, the Clean Energy for All Europeans Package, which includes eight legislative acts on the energy performance of buildings, renewable energy, energy efficiency, and electricity market design, has enabled the restructuring of the electricity market by seeking further liberalization of the electricity market especially the (EU) 2019/943 Electricity Regulation and the (EU) 2019/944 Electricity Directives which will allow aggregators as independent stakeholders to participate in the European electricity market [3]. It is noteworthy that market restructuring is a prerequisite for vehicle-to-grid integration. Unless and until it is done effectively, widespread integration, in the long run, cannot be achieved.

V2G Integration in Practice

Vehicle-to-grid integration has the potential to provide a range of benefits that will facilitate the energy transition by enabling widespread deployment of renewable energy resources through a reduction in the curtailment of renewable energy resources and provision of capacity firming. Capacity firming is an act of maintaining intermittent renewable power to a level that is committed in the electricity market.

There is a system operator at the top of a power system whose main job is maintaining the balance of demand and supply of electricity. For this, it requires assistance from conventional power plants and utility-scale batteries but will need support from batteries in electric vehicles in the future. Electric vehicles are portable batteries spread over large geographical areas that can provide services similar to a utility-scale battery to the grid.

The services extended to the electricity grid through an aggregator include black start capability, frequency regulation, and ramp rate control (detail of frequency regulation and ramp rate control is given below). Furthermore, the technology also allows for capacity investment deferral and transmission congestion relief.

Optimized Renewable Integration

During periods of low demand, especially where the share of baseload generation (generation that cannot quickly change power output) is higher, excess renewable generation needs to be curtailed to maintain the grid parameters within specified limits. In case there is widespread deployment of electric vehicles that are integrated with the electricity grid, excess renewable generation can be stored in the electric vehicle batteries, which will defer the need to curtail renewable energy. This is especially useful for deregulated electricity markets like Europe and the US, where excess supply reduces the spot price of electricity, a price signal that will, in turn, push EV owners to opt for charging. In the absence of vehicles to grid integration and utility-scale batteries, renewable generation has to be curtailed, which is not desirable from the standpoint of not only renewable developers but the environment as well.

Firming Up Renewable Energy

As we all know, renewable energy is an intermittent source that requires a support mechanism, for instance, batteries, to manage their uncertainty and maintain the output power to a level that is committed. The situation gets far more complicated in a deregulated electricity market where generators face penalties if they fail to provide the power at the level that is committed after bidding. In order to manage the intermittency of renewable generation and the financial cost that it may incur on the generator in the form of lost revenue or penalty, vehicle-to-grid integration can play a significant role as electric vehicle batteries through an aggregator can be used to provide capacity firming.

Grid Revival

Black start is the capability to re-start generators, but generators themselves require power to start after a grid failure. Usually, this power is provided by diesel generators, which are co-located with power plants. V2G technology through batteries in electric vehicles has the potential to provide black start services to the electricity grid in case of grid failure in the long run. At the time of this research, the power flow control technology needed to realize this use case was unavailable.

Improved Frequency Regulation

Whenever there is an imbalance between the load and the supply in the electricity grid, system frequency either increases or decreases, but when the deviation is beyond the limit specified by the regulator for safe operations, it leads to a breakdown, which is not desirable. Historically speaking, these frequency control services were provided by fossil fuel-fired power plants, which can be highly inefficient and costly, as at times, these plants need to be kept either on standby or at power levels that are not efficient, in turn increasing the average cost of electricity. Thermal power plants cost differently at different power levels. Contrary to conventional power plants, which require seconds to minutes to act, battery storage has the capacity to respond to the requirements of the grid within milliseconds, which is why system operators love batteries.

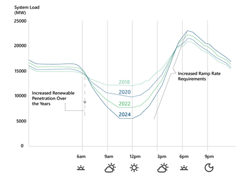

Fast Ramping Redefined

As the penetration of renewable energy resources, specifically solar PV, increases beyond a certain point, the demand for electricity during the day when there is enough solar PV reduces radically. But as the sunsets, the demand for electricity quickly rises because now consumers have reverted back to the grid instead of relying on their rooftop solar. In order to meet the sudden rise in the demand for electricity, system operators need resources that can rapidly increase the supply of power in order to keep the overall power system stable. EV batteries can facilitate the integration of renewable energy with the electricity grid as they can provide fast ramp rates.

Peaker Plant Economics

The capacity reserve is the backup power generation that can be called on by the system operator in case a power plant fails. Thousands of electric vehicles housing batteries connected to the electricity grid are capable of providing much-needed capacity reserves to the grid and supplying power whenever required, especially during peak hours. This will, in turn, reduce the need for peaker plants and postpone investment in them. Peaker plants are quite expensive as compared to baseload plants as they are installed to run for a very small amount of time in a year, mostly during periods of high demand. On the other hand, baseload plants have a much higher utilization rate as they provide power almost throughout the year.

Grid Congestion Relief

Transmission lines are like highways through which power is transmitted from one point to another, and just like highways, these lines get congested, too, which needs to be managed. It is observed that during the peak demand hours, excess power flows through the transmission network, which is beyond the capacity of the transmission lines, causing congestion. This congestion, if it persists for a long time, can also lead to the failure of the transmission line.

Historically, congestion in the transmission network has been relieved through investments in the transmission assets, which increases the load-carrying capability. At times, congestion occurs in the network at a particular node for a small amount of time, so it makes much more sense to opt for other solutions to relieve congestion than investing millions of dollars in building new transmission infrastructure. In case there is significant deployment of electric vehicles that are integrated with the electricity grid, it is expected that demand and supply imbalances will be catered locally. In case the majority of the imbalances are sorted at the local level, the need for system operators to dispatch power through transmission lines will reduce, in turn reducing the congestion at critical nodes and saving millions of dollars.

Though the use cases appear to benefit only the utility, other players in the V2G space, including charge point operators and automobile OEMs, are also expected to leverage the technology and market dynamics to generate revenue. More on players in V2G space and the current status quo in the following section.

The Present Tapestry

Recently, there were indications that the Biden administration would enforce the combined charging standard in the same manner as the European Union did, which was expected to affect Tesla in a number of ways. Firstly, all the public funding worth billions of dollars would have been diverted towards the CCS. Biden administration has committed nearly USD 24 billion for public charging infrastructure in the country through 2030. Secondly, Tesla had already invested billions of dollars in building a fast-charging network in the US. Still, the chargers have a utilization rate lower than what it requires to recover the cost in the first place and make profits in the long run. The low utilization rate is not unique to Tesla’s charging infrastructure only. This led them to have afterthoughts about their decision to limit access for automobile OEMs other than Tesla to charge at their charging stations.

After Tesla’s charging standard (now referred to as North American Charging Standard) was opened to the public, a range of automobile OEMs, charge point operators, and charger manufacturers moved to adopt the standard one after the other. Recently, NACS has gained momentum to the extent that automobile OEMs in the US, with a market share in excess of 70%, have adopted it. This essentially means that regardless of the US government officially declaring it a standard, in all practicality, it is the standard and is most likely to have access to public funding.

In order to understand the relationship between recent developments and V2G, we need to start seeing Tesla for what it is (a vertically integrated energy company) rather than what it appears to be (an automobile OEM).

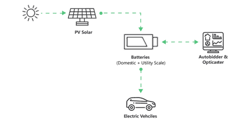

Tesla is a vertically integrated energy company that offers solar roofs, electric vehicle chargers, Powerwall (home-use batteries), and utility-scale batteries and is equipped with state-of-the-art bidding and forecasting platforms like Autobidder and Opticaster.

Additionally, three years ago, Tesla applied for a generation license to the energy regulator for Great Britain. The license was granted by The Office of Gas and Electricity Markets (Ofgem) in June 2020. A generation license in the UK allows aggregation of customers all over the country and the formation of a virtual power plant.

This level of vertical integration has set the stage for a much greater role and wider participation in the electricity market down the road. Keeping in mind the use cases of EV batteries, V2G integration is the route through which players in the market, including automobile OEMs, CPOs, and utilities, will move to tap into the electricity market and the revenues it has to offer, which were inaccessible before.

Utilities in the US, especially, are offering subsidies on smart chargers, which cover the capital cost of the charger and installation (offers vary from utility to utility). Installation of smart chargers enables demand response provided that the consumers have consented for their load to be controlled by the utility. This, in turn, allows the utility to balance the grid at the local level, which reduces the infrastructure development cost for the grid. One of the reasons behind supporting smart chargers through subsidies is that the utilities in the future intend to establish (through a regulation) or at least enable control over the charging process.

The best space for V2G in the future

With regards to V2G space in the future, several scenarios can be proposed and simulated, but for the sake of simplicity, we will be discussing only three possible scenarios that too in Part 2 of this series.

Kamil Maqsood is a Senior Technical Research Writer at PTR Inc., a United States/Germany-based power grid equipment and infrastructure market research firm. He has a Bachelor’s Degree in Electrical Engineering from the University of Engineering and Technology Lahore and is currently pursuing a Master's in Electrical Engineering from Lahore University of Management Sciences with a focus on Power System Planning, Electricity Markets, Power System Operations and Control, Smart Grids and Battery Energy Storage Systems. He also has experience working with The World Bank (energy team) on electricity distribution sector reforms as an STT Consultant and is part of the research group (funded under the China-Pakistan Economic Corridor) working on Pakistan’s transition to sustainable mobility.

Michael Sheppard is the CEO of PTR Inc. In 2016, he left IHS Markit to co-found a company to address a lack of in-depth market research on the power grid. Since then, he has overseen the growth of the company from 3 founders to 50 employees across the US, Germany, Japan, and Pakistan. Mike is an expert on the PV industry and has performed numerous competitive dynamics and opportunity assessment projects, covering upstream, downstream, and supply chain aspects. Prior to founding PTR in 2016, Mike spent eight years with iSuppli/IHS Markit, where he covered a broad range of sectors, including mobile, renewable power, and electricity transmission and distribution (T&D), while managing the power & energy technology consulting practice. Mike has a background in both Financial Services and Corporate Finance from San Francisco State University.

Hassan Zaheer is the Chief Commercial Officer at PTR Inc. After starting in the power sector around a decade ago, Hassan has been working for various Fortune-500, FTSE-100, DAX-30 and NIKKEI-225 clients, assisting them with global market studies in the energy sector. In his current role at PTR, he works with clients to support their research requirements, both through custom consulting work and tailored research reports within the Power Grid and New Energy segments. Hassan is also a Member of the Advisory Board for CWIEME Berlin and an advisor to the educational non-profit UsmanRamay.Org. Hassan has a tech background with a Master's in Power Engineering from the Technical University of Munich (TUM) and a BS in Electrical Engineering from the Lahore University of Management Sciences (LUMS). Additionally, he is also an alumnus of the Center for Digital Technology & Management (CDTM).

Saqib Saeed is an accomplished market research professional and a data storyteller in the international energy industry. With over a decade of experience in the field, he serves as the Chief Research Officer at PTR Inc. His expertise lies in the power grid and e-mobility equipment sectors. Throughout his career, Saqib has overseen numerous global market research studies and provided valuable insights to key decision-makers at various Fortune 500 companies. He is a member of the editorial board for Transformers Magazine and a member of the Advisory board of CWIEME Berlin. In addition to his market research career, Saqib has also worked in the manufacturing sector. Saqib holds a Master's degree in Electrical Power Engineering from the Technical University of Munich.

About the Author

Kamil Maqsood, Michael Sheppard, Hassan Zaheer, and Saqib Saeed

Kamil Maqsood is a Senior Technical Research Writer at PTR Inc., a United States/Germany-based power grid equipment and infrastructure market research firm. He has a Bachelor’s Degree in Electrical Engineering from the University of Engineering and Technology Lahore and is currently pursuing a Master's in Electrical Engineering from Lahore University of Management Sciences with a focus on Power System Planning, Electricity Markets, Power System Operations and Control, Smart Grids and Battery Energy Storage Systems. He also has experience working with The World Bank (energy team) on electricity distribution sector reforms as an STT Consultant and is part of the research group (funded under the China-Pakistan Economic Corridor) working on Pakistan’s transition to sustainable mobility.

Michael Sheppard is the CEO of PTR Inc. In 2016, he left IHS Markit to co-found a company to address a lack of in-depth market research on the power grid. Since then, he has overseen the growth of the company from 3 founders to 50 employees across the US, Germany, Japan, and Pakistan. Mike is an expert on the PV industry and has performed numerous competitive dynamics and opportunity assessment projects, covering upstream, downstream, and supply chain aspects. Prior to founding PTR in 2016, Mike spent eight years with iSuppli/IHS Markit, where he covered a broad range of sectors, including mobile, renewable power, and electricity transmission and distribution (T&D), while managing the power & energy technology consulting practice. Mike has a background in both Financial Services and Corporate Finance from San Francisco State University.

Hassan Zaheer is the Chief Commercial Officer at PTR Inc. After starting in the power sector around a decade ago, Hassan has been working for various Fortune-500, FTSE-100, DAX-30 and NIKKEI-225 clients, assisting them with global market studies in the energy sector. In his current role at PTR, he works with clients to support their research requirements, both through custom consulting work and tailored research reports within the Power Grid and New Energy segments. Hassan is also a Member of the Advisory Board for CWIEME Berlin and an advisor to the educational non-profit UsmanRamay.Org. Hassan has a tech background with a Master's in Power Engineering from the Technical University of Munich (TUM) and a BS in Electrical Engineering from the Lahore University of Management Sciences (LUMS). Additionally, he is also an alumnus of the Center for Digital Technology & Management (CDTM).

Saqib Saeed is an accomplished market research professional and a data storyteller in the international energy industry. With over a decade of experience in the field, he serves as the Chief Research Officer at PTR Inc. His expertise lies in the power grid and e-mobility equipment sectors. Throughout his career, Saqib has overseen numerous global market research studies and provided valuable insights to key decision-makers at various Fortune 500 companies. He is a member of the editorial board for Transformers Magazine and a member of the Advisory board of CWIEME Berlin. In addition to his market research career, Saqib has also worked in the manufacturing sector. Saqib holds a Master's degree in Electrical Power Engineering from the Technical University of Munich.