Editor’s Note: This article is a summary of an Endeavor Business Intelligence Report titled “Utility Plans and Preparedness for Commercial Electric Vehicle Adoption.” T&D World deployed a 25-question survey to only its utility subscribers to determine where the industry stands on charging infrastructure roll-out for commercial electric vehicles. The full report, including graphs and charts, is available at no cost to qualified readers at https://tdworld.com/21257787.

Even with the disruptions of the last two years, electric vehicle sales have been growing. Most of the growth has occurred with electric passenger vehicles. Commercial electric vehicles (CEVs) are still a small portion of vehicle sales. Still, according to the International Energy Agency’s Global EV Outlook 2022, electric truck sales in the United States and Europe have begun to rise rapidly in the past few years, driven by an increase in available models in those markets, policy support, rapidly improving technical viability and economic competitiveness of electric trucks in certain applications.

Fleet owners are taking a closer look at purchasing electric vehicles. Operating costs are becoming more important as fleets plan for future vehicle turnover. Higher gas prices, at least for now, are drawing attention to the lower cost of electricity as fuel. Then there is the total cost of ownership (TCO) of CEVs. According to the North American Council for Freight Efficiency (NACFE), early adopters of CEVs are validating an acceptable TCO in urban medium-duty vans and trucks, terminal tractors and short regional haul applications.

An uptick in the adoption of CEVs in the United States is noted in Endeavor’s 2022 Commercial Vehicle Adoption Report. Only 8% of fleets reported operating even a single electric truck in 2021. In 2022, that percentage doubled to 16%. The top motivation for fleet owners’ consideration of CEVs is in researching future vehicle needs.

Fleet owners do have concerns about purchasing CEVs. Does the TCO (upfront costs and operating expenses) make sense? Will there be sufficient charging infrastructure to handle trip cycles without reducing margins on fleet assets? Are the stranded costs of early replacement of internal combustion engine vehicles acceptable? Utilities will play a role in addressing these questions.

EV Momentum is Building

According to the International Energy Agency’s (IEA) Global EV Outlook 2022, electric truck sales in the U.S. and Europe have begun to rise rapidly in the past few years, driven by an increase in available models in those markets, policy support, rapidly improving technical viability and economic competitiveness of electric trucks in certain applications. EV network service providers – companies that operate charging stations for users for a fee – are becoming more active in servicing fleets.

Local, state and federal governments are adding to the momentum with decarbonization goals and policies. For example in 2020, California adopted an Advanced Clean Truck rule requiring minimum sales targets for zero emission vehicles. Since then, four other states have adopted this rule.

Also of note is a memorandum of understanding (MOU), signed by 17 U.S. states, the District of Columbia and Quebec. The MOU advances the market for electric MHDVs, including large pickup trucks and vans, delivery trucks, box trucks, school and transit buses, and long-haul delivery trucks. Signatory states encourage utilities to act on CEV-focused electric distribution system planning, beneficial rate design and investment in “make-ready” charging infrastructure. Make-ready programs are intended to jump start adoption of CEVs by covering some of the costs of utility- and/or customer-side CEV infrastructure.

In 2021, a group of utilities joined together to form the National Electric Highway Coalition (NEHC). The NEHC is committed to providing EV fast charging infrastructure. Fast charging infrastructure benefits both personal and commercial vehicles. There are currently more than 60 investor-owned and municipal electric companies and cooperatives that have joined the NEHC.

Still, it is early days. There is a lot of regulatory activity related to passenger vehicles. However, policy makers and regulators are just beginning to address CEV adoption. Of importance are incentives that support charging infrastructure deployment, EV-related utility grid investments and rate design. As of February 2021, only 6 states have utilities that are offering best practice incentives for commercial fleet charging.

Local Fleets Are Coming First

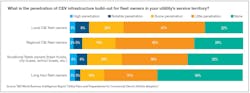

Most utilities have not seen substantial build-out of CEV infrastructure for fleets in their service territories. Utility respondents were asked to give their view on the rate of penetration of CEV by vehicle usage class – local, regional, and long-haul trips, as well as vocational usage (construction, waste hauling, landscaping, agriculture, municipal services).

Utility respondents’ perceptions are in line with how fleet owners perceive the roll-out. According to the 2022 Commercial Electric Vehicle Adoption Report conducted and compiled by Fleet Owner magazine, “Of those fleets open to CEV adoption in the next one to five years, 79% see them deployed in local service applications and 43% in regional applications. Only 6% expect to launch long haul CEV operations, most likely reflecting the unsuitability of battery-only trucks in that application and the early development stage of fuel cell truck systems.”

It is not surprising that utilities think that the grid is readier for local fleets than other usage types, although penetration rates are low for all. Eleven percent of utility respondents reported that local fleets have notable and high penetration rates in their service territories. Local usage vehicles, like delivery trucks, can charge overnight or at publicly available at direct current fast charging (DCFC) stations during the day. Similarly, 10% of utilities report that vocational trucks have notable and high penetration charging build-out.

Long haul charging infrastructure build-out is extremely low. Eighty one percent of long haul fleets have little or no infrastructure. Miles per charge is still low and charging time too long to make economic sense for long haul trucks. The jury is still out on whether electric batteries or fuel cell electric vehicles will emerge as the

leading technology for this class. Respondents were evenly split on whether hydrogen/fuel cells will become the better source of clean fuel for vehicles in the future.

Utilities are Receptive to CEV Build-Out

The utility industry has more experience with public, home and workplace charging than with fleet charging. Survey results

reveal that 44% of utilities have built charging infrastructure in their service territories but not necessarily for CEVs. EV infrastructure has largely been at the distribution level with minimal investments in distribution lines and transformers.

Most of the survey respondents are receptive to enabling CEV vehicles in their service territories. Utilities have a positive view of the reliability benefits of CEVs and believe that CEV growth will not disrupt utility operations.

There is not general agreement about what role utilities should play, however. While 47% of respondents believe that utilities should collaborate with fleet owners to develop infrastructure, 37% believe utilities should be responsive to EV charging infrastructure needs, but not a collaborator involved in the EV transition decision.

Beyond collaboration, 29% of respondents believe that utilities should promote the transition to EVs by providing financial incentives to fleet owners. The Large group is more interested in providing incentives than smaller utilities. In addition to the make-ready programs mentioned above, utilities may provide rebates for Level 2 (L2) and DCFC chargers.

Funding for Required Infrastructure is the Most Critical

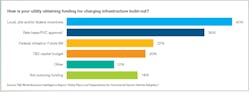

Required infrastructure (57%) and who will fund it (54%) are the most critical challenges utilities expect to face when building out CEV infrastructure. However, not all of the resources utilities are pursuing will cover CEV infrastructure.

Utilities are seeking funding from government sources, utility customers, and bond initiatives. Funding is also being used to help cover upfront costs for fleet owners, either directly through incentive payments for chargers and other equipment, or indirectly through bill credits.

Local, state and federal programs are the most sought-after source of funding. Forty-two percent of utilities are looking to government resources to fund EV infrastructure. Governments offer tax credits, grants, rebates, and/or loans for chargers and EV infrastructure. According to the American Council for an Energy Efficient Economy (ACEEE), 17 states offer incentives for L2 and DCFC chargers. While these funds may not move from utilities to fleet owners, CEV technical assistance programs run by utilities can be instrumental in helping fleet owners/operators identify state or federal incentives for L2 or DCFC chargers and related equipment.

Utilities likely will not obtain Federal Infrastructure Investment and Jobs Act funds to cover private fleets. Twenty-two percent of respondents indicated that they will be pursuing this funding. The act provides an estimated $5 billion for EV infrastructure over 5 years. However, the lion’s share of the funding is allocated to charging that is accessible to the public.

Charging Pattern Information

In planning for CEVs, fleet owners will need to be prepared for questions from utilities. Utilities use this information, along with grid data, to assess where the existing lines may need upgrades to serve EV charging load. Take the example of a company proposing to build a warehouse that has a charging depot for medium duty electric trucks. Ten medium-duty trucks charging overnight would require 70 kW. To charge those same trucks in nine minutes with DCFCs would take 1.75 MW and the need for an upgrade.

Utilities are most interested in fleet charging patterns – when will vehicles charge, will charging happen at centralized depots, how many vehicles will be charging, what are the best locations for charging along CEV routes.

The time of day vehicles will charge is the most critical information. Over half of utility respondents (53%) said that time of charge is very or extremely important; 28% found that data to be important. Utilities need this information to assess whether the existing capacity of distribution is sufficient to accommodate EV charging when there is major other load on lines feeding the area.

Fleet Planning

Charging patterns are critical for fleet owners to understand as well. This information will help fleet owners evaluate the TCO and return on investment. In addition to the capital expense (vehicle purchase, the charging infrastructure in front and/or behind the meter), there are operating costs, which are particularly sensitive to energy price.

Commercial billing rates typically include demand charges. Demand charges are calculated based on the highest level of electricity used in a period of time. Utility demand charges are often assessed at different rates depending on the time of day and/or season in which electricity is used. For example, a medium duty charging depot serving a dozen vehicles could have demand charges of over $2,500 per month in some jurisdictions. It will be important for fleet owners to understand the impact of demand charges on operating expenses.

Depot charging – where vehicles return to the station to charge at the end of the workday – is an area where managed charging makes sense. Iterative charging vehicles are programmed to charge at different times, which can reduce charging peaks.

The more CEVs that charge at the depot, the higher the annual energy charge. Some utilities offer time-of-use (TOU) rates for energy consumption to encourage charging at times of the day when there is excess electricity supply, such as wind and solar. There are also managed charging programs that allow the utility to control charging in return for lower rates or other incentives.

Ramp-Up Will Require More Outreach

Over three quarters of utilities are involved in activities to promote build-out of CEV infrastructure. A majority of utilities have at least started conversations with fleet owners in their service territory.

Surprisingly, less than a quarter of utility respondents report that C&I customers have contacted their company to discuss electrifying their fleets. It may be that respondents to the survey were unaware that C&I customers have attempted to find out more about electrification. At early stages of any program, it is possible that account representatives have been contacted by C&I customers about a topic, but systems are not in place to record and report those contacts.

With a few exceptions, utilities do not have business units or cross-unit collaborations dedicated to planning and implementation of CEV charging. The roles and tiles of respondents of this survey may be reflective of an early state of maturity. Eighty-four percent of respondents are individual contributors or manager/supervisor level. Engineering and design personnel make up the largest group of utility respondents.

Looking Toward the Future

Utilities and fleet owners, along with EV network service providers have a better chance of understanding the potential impact of fleet charging when they collaborate, especially if fleet owners are considering deploying clusters of depots or using publicly available DCFC charging stations in the utility service territory. The good news is that 36% of respondents say that their utility is already coordinating with other entities that plan to install charging stations.

In preparing for the future, forward looking utilities and fleet owners are discussing the question of who pays for major infrastructure investments. At issue is whether early adopters of fleet charging depots should bear the cost for utility side infrastructure, while later depot installations on the same feeders will benefit from those grid improvements at lesser cost. From the utility perspective, it would be less expensive to build capacity that accurately anticipates increased demand on feeders, rather than having to incur additional costs associated with capacity expansion on the same feeder at a later date. From the early fleet owner adopters’ perspective, it would be better to share the cost of infrastructure with fleet owners who, in the future, wish to develop depot charging that is connected to the grid in that location.

Editor’s Note: This article is a summary of an Endeavor Business Intelligence Report titled “Utility Plans and Preparedness for Commercial Electric Vehicle Adoption.” T&D World deployed a 25-question survey to only its utility subscribers to determine where the industry stands on charging infrastructure roll-out for commercial electric vehicles. The full report, including graphs and charts, is available at no cost to qualified readers at https://tdworld.com/21257787.

About the Author

T&D World Staff

Content Team

Nikki Chandler

Group Editorial Director, Energy

[email protected]

Jeff Postelwait

Managing Editor

[email protected]

Christina Marsh

Senior Editor

[email protected]

Ryan Baker

Associate Editor

[email protected]

Amy Fischbach

Electric Utility Operations

[email protected]

Rich Maxwell

Community Editor

[email protected]

Gene Wolf

Technical Editor

[email protected]