How Will EV Adoption Trends Impact State Utility Regulators?

According to a new study by Deloitte, nearly 30% of U.S. car buyers expect their next car to be electric. Over the next decade EV adoption is expected to add 18 million vehicles to American roads. The World Resources Institute stated that “EV sales exceeded expectations in 2020, increasing 67% from 2019 levels, as calculated from BNEF data. This is particularly notable when compared to overall car sales, which contracted 16% — likely due to the coronavirus pandemic.”

Despite this phenomenal growth and interest in electric vehicles the deployment of charging stations has woefully lagged. Varying estimates indicate that while we will need almost 10 million charging stations, approximately only 100,000 are in service today. That is a difference of 1000 orders of magnitude.

To begin to address the deficit of charging stations, coalitions of utilities are adopting policies to encourage deployment, and recently the federal government passed the Infrastructure Investment and Jobs Act in addition to on-going state efforts.

In September of 2020, the first of these utility coalitions emerged, known as the Midwest EV Charging Infrastructure Collaboration, when Ameren Illinois Co., Ameren Missouri, Consumers Energy Co., DTE Energy Co., Evergy Inc., and OGE Energy Corp. subsidiary Oklahoma Gas and Electric Co. committed to build a network of charging stations by the end of 2022. In March of 2021, another 4 utilities joined the Midwest initiative. The Midwest EV Charging Infrastructure Collaboration now stretches 1200 miles and crosses 10 state lines.

That same month, the Electric Highway Coalition was announced as a group of Duke Energy, American Electric Power (AEP), Dominion Energy, Entergy Corporation, Southern Company and the Tennessee Valley Authority (TVA).

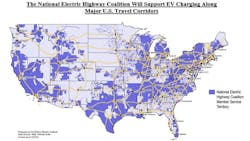

Most recently, in December 2021, Edison Electric Institute announced the formation of the National Electric Highway Coalition, officially merging the original Midwest Electric Vehicle Charging Collaboration and the Electric Highway Coalition while adding additional investor-owned electric utilities. This new commitment announced plans to provide DC Fast charging ports along major U.S. corridors by the end of 2023.Members include over 50 regulated investor-owned utilities, across 47 states and serving 120 million customers.

At the Federal level, President Biden’s Infrastructure Investment and Jobs Act includes US$ 7.5 billion for a national network of EV chargers that will support the President’s goal of building a nationwide network of 500,000 EV chargers.

Besides utility MOUs, most recently, the US DOE and US DOT announced its memorandum of understanding in working jointly to facilitate deployment of US$ 7.5 billion for corridor charging. At the recent 2022 NARUC Winter Summit, members of the Joint Office joined State Commissioners for a listening session to answer questions regarding funding and deployment considerations.

In addition, NASEO (National Association of State Energy Offices), AASHTO (American Association of State Highway and Transportation Officials) and the Joint Office of Energy and Transportation signed an MOU to ensure coordination in electric vehicle investment.

In the regulatory context, the job of reconciling these efforts and managing the impact on ratepayers and demands on the electrical grid falls to state public utility commissioners who will need to balance the range of stakeholder interests, the costs and impact of short and long term distribution investments, the need to maintain reliability and resiliency, ensure market competition and oversee rate designs, all while managing the intersection of bold and sometimes conflicting policies at the local, state and federal levels.

Both a challenge and opportunity, the need to facilitate collaboration among very diverse stakeholders to find solutions that are in the public interest will be substantial, and may challenge traditional regulatory standards including the prudency of utility investments required to enable cross jurisdictional interconnection, fair rate designs, energy equity, state rights and seams issues.

In addition, although perceived benefits can include things like standardization (e.g.plugs, ports, networks, rates, reliability and resiliency), there are also perceived challenges to confront, such as monopolistic behavior, utility participation in unregulated activities, lack of market competition and affordability, to name a few.

Despite these much-needed commitments to collaborate, where does this leave state regulators? Here we look at a few novel considerations that may be on the horizon.

Sealing the Gaps Amongst “Seams”

Patching “seams” across Regional Transmission Organizations (RTOs) stems from the need to increase interconnectivity across the country’s electricity networks. In the context of electric vehicle charging, the concept takes on a new meaning -- exploring whether we are looking or should be looking at “seams” at service territories and/or state lines and/or highway corridors.

The ability to merge regional concerns while providing the seamless (no pun intended) experience for the average EV driver will largely depend on exploring shared costs of demand on the networks, cost allocation and interconnection costs. How ratepayers in different states are affected by these corridor and highway investments will depend on regulatory oversight that ensures prudency, reliability and resiliency.

Smart Rate Design

While the benefits of corridor networks are clear, they need to be balanced with ensuring equitable rates for charging across different states and utilities with different mandates. Regarding rates, the Joint Electric Vehicle Office between the DOE and DOT call for, among other things, transparent pricing as part of its US$ 7.5 billion EVSE initiative. But state regulators know that despite smart or equitable utility rate design, rate “re-pricing” is likely beyond jurisdictional reach.

Achieving the need for transparent pricing no doubt requires the coordinated efforts across state lines, service territories and corridors, which must consider appropriate pricing mechanisms, structures and objectives across networks.

Such considerations can include evaluating whether all charging is or should be equal, whether customers or users will face dynamic pricing at stations, and larger questions of how utilities manage and leverage opportunities and challenges for shared costs.

Notions of equitable rate design may come up where one rate design or pricing structure is “cheaper” for an EV driver just across a state line or service territory if pricing structures are different enough to induce different decision making/choice/behavior, potentially resulting in underutilized investments/assets.

Transportation Electrification Plans

A very dominant and typical feature of electric utility investments in the transportation electrification space include the regular filing and review of transportation electrification plans (TEPs) before state public utility commissions. It is against this new paradigm of corridor collaboration that TEPs may take on new novel considerations that include greater scrutiny over regional issues that can be equity-based, economic and geographic in nature.

For instance, an investment in service territory A in a more rural area may be of great benefit to a neighboring service territory B yet uneconomical to ratepayers in service territory A. Here, some of us may be thinking of transmission issues and for the lawyers who remember property law, this may be giving you servient estate and dominant estate vibes.

Portfolio investment considerations around demand and load forecasting may be another area that sees changes as collaboration necessarily requires evaluating data sets well beyond one service territory.

Finally, depending on state priorities, plans may also evolve to include greater focus on small business opportunities along major U.S. highway corridors, ushering in additional economic opportunities for states.

The data is clear that electric vehicle sales are increasing, and we are witnessing multiple collaborative efforts that will require regulators to rise to the occasion.

As regulators consider the interstate implications of these MOUs to states and to ratepayers, commissions would benefit from joint committees and taskforces between Commissions, the U.S. Department of Energy, U.S. Department of Transportation and the Joint Offices of the DOE and DOT.

Likewise, leveraging existing regional state commission organizations may be an opportunity to offer technical assistance, train and collaborate in smaller groups. Whatever the mechanism, to achieve prudent and reasonable corridor charging investments, state regulators too need a seat at the collaboration table.

About the Author

Maria S. Bocanegra

Maria S. Bocanegra is a commissioner with the Illinois Commerce Commission (ICC), where she regulates public utilities, transportation, railroad, and telecommunications entities in complex and technical matters. Bocanegra is actively involved with the National Association of Regulatory Utility Commissioners (NARUC), where she serves both as the chair of NARUC's Committee on Water and NARUC's Electric Vehicles (EV) Working Group, in the latter advancing the understanding of transportation electrification among public utility commissions. Bocanegra is the second Latina appointed to the Commission and has been recognized by Fortnightly, Negocios Now, and the Chicago City Council Latino Caucus for her work.