Electric Vehicle Trends in India

Electric vehicles (EVs) in India are playing a vital role in coping with the challenges of air pollution and greenhouse gas (GHG) emissions. 5 of the 10 most polluted cities worldwide are in India.

In winter 2020, India’s capital New Delhi rolled out an Odd-Even selection scheme according to license plate number to minimize driving of personal cars, explicitly to prevent the pollution of air quality because of the presence of smog (The Economic Times, 2019). The transportation sector is one of the major contributors to GHG emissions worldwide. Almost 15% of the global GHG and more than 20% of energy-related CO2 emissions are produced by the transportation sector (The Our World in Data, 2020). Recently, EVs have been emerging as a viable solution to clean and sustainable mobility, aiming to boost the city's economy, reduce pollution levels, and generate employment in the transportation sector.

In 2019, sales of EVs grew by 15% compared to 2018, driven by EV sales in Europe — Germany, France, the United Kingdom, and Spain (93%), followed by China (17%), and the other countries (22%) (Deloitte, 2020). The number of electric cars worldwide climbed to 10.9 million in 2020, up by more than three million from the previous year. China remains the undisputed leader with more than five million EVs in its fleet, followed by the United States with 1.77 million (Automotive World Report, 2020).

Despite the challenging fiscal year 2020, the EV industry posted a 20% rise over 2019 in domestic sales in India at 156,000 units (Livemint, 2020), whereas the internal combustion (IC) engine-powered vehicle segment registered an approximate decline of 34% against the same period in last year (Society of Manufacturers of Electric Vehicles, 2020). This unprecedented growth brings important challenges in terms of charging infrastructure coalition among developers with significant impact on electricity distribution networks.

India's Transition to EVs

Road transportation and fossil fuels have been indistinguishably related to the past with EVs succeeding only in a few niche markets. In recent studies, it has been seen that the world outside Europe, China, and the United States is lagging behind in terms of EV market exploration for various reasons like lack of government commitment, insufficient/unsuitable charging infrastructure, and cultural differences regarding mobility models, etc. (Deloitte, 2020). Meanwhile, the difference of road transport mobility demand characteristics of India compared to other developed countries may be understood from the fact that two-wheelers contribute to almost 79% of total vehicle demand in India (NITI Aayog Report, 2020), as shown in Fig. 1. Utilities from RE infrastructure firms and government agencies are optimistic on the EV future and are working on ground level to create affinity toward EVs in the near future as demand soars. State governments are introducing electric mini buses for intracity commuters.

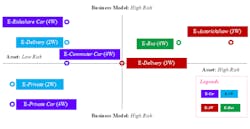

However, the industry was beset with economic uncertainty, the challenges of the transition to BS-VI norms, the COVID-19 pandemic, nationwide lockdown, supply-chain constraints, and labor migration, which further impacted vehicle sales across the world. The key investment aspects toward seamless implementation of EV technology, government regulations, CapEx and OpEx models are referred to in Fig. 2 (NITI Aayog, 2021).

Charging Stations

High-level fast charging stations are being built on important routes throughout India. Considering charging station security, governments may consider installation beneath the hotspots for charging stations. These stations will minimize right of way (RoW) issues as flyovers are especially built at the junctions of national and state highways. Hence, overall establishment cost will be significantly reduced with wide access to consumers. The Bihar government has targeted 400 charging stations in the state on special routes and tourist spots. Focus is around areas where a consumer generally spends an average of one hour during transit for food and rest.

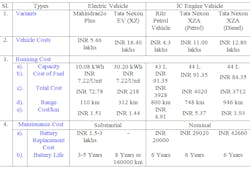

India has established its own EV market to meet its unique mobility demand, keeping up with global trends. India's fledgling EV market accounted for only 5000 out of a total 2.4 million cars sold in the country last year (The Hindu, 2021). A lack of local production of components and batteries, negligible charging infrastructure, and the high cost of EVs mean there have been few takers in the price-conscious market (refer to Table 1 below) (AutoTech Review, 2020). Thus, EV users still consider an EV as an optional car for a planned trip rather than relying on it.

However, EV sales have mostly been restricted to slow-moving two-wheelers and three-wheelers (passenger and goods) that do not require registration or licenses. This has certainly been a good step to disown the polluting emitting vehicles. To boost demand and meet the government target for EVs, NITI Aayog has devised a long-term proposal that incorporates the following phases:

- Phase-I (Action Plan for 2017 to 2019): The initial action plan focuses on influencing the government's position, business growth, economic opportunities, and the initial setup.

- Phase-II (Action Plan for 2020 to 2024): Focuses on capturing business opportunities as they arise, assembling and implementing solutions through a broader geography package and creating initial setup. In order to meet these objectives, coalition among strategic participants will be pivotal with continuous technological advancements.

- Phase-III (Action Plan for 2025 to 2032): Bringing all economically feasible options together to achieve national goals.

The Government of India (GoI) initiated the Faster Adoption and Manufacturing of (Hybrid &) Electric Vehicles in India (FAME-India) Scheme to promote the gradual introduction of reliable, affordable, and effective electric and hybrid vehicles in line with this action plan (GoI, 2019). The scheme's first phase was initially approved for a two-year term, beginning on April 1, 2015. From time to time, the scheme has been expanded, with the last extension allowed for a period up to March 31, 2019. The GoI approved the FAME-II scheme in February 2019, with a fund requirement of INR 10,000 crores (US$1.3 billion) for the fiscal years 2020 to 2022 (The Economic Times, 2019).

Public Charging Infrastructure

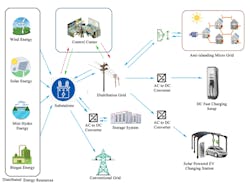

Installation of EV public charging stations may alleviate anxiety among drivers while looking for similar performances as IC engine vehicles by maintaining their existing activities. Thus, charging infrastructure needs to focus on high-transit routes with thorough survey, considering a vehicle driver's safety, ease of access to a location, malls or restaurants at walk-in distance. One such example has been portrayed in Fig. 3 (EESL, 2021).

At least one charging station should be available in most Indian cities in a grid of 4 km x 4 km, which will boost a user's confidence (Livemint, 2020). Software companies are developing smart apps that can locate nearby available charging stations through the transit to avoid charging queues, including dynamic tariff notifications to avoid peak hour burden. Uncoordinated charging of EVs, however, can have a negative impact (for example, overloading of transformers and feeders, voltage deviations, and other imbalances) on the distribution network. Eventually, investments for charging infrastructure with revenue share mechanism can be obtained with coalition of major players like:

- Technological partner (that is, charging stations)

- Land for charging spots

- Power distribution companies

Effective Charging Approach

Lack of fast charging stations can be a hurdle to the inclusion of EVs into the automobile industry. The time required to fully charge an EV is quite high on a conventional ac bus, whereas dc fast charging stations on the go require investment for infrastructure. Unifying charging station ports and parameters for different car manufacturers and categories is also a major challenge.

EV charging networks in remote areas can be exclusively supported with renewable energy resources accompanying micro- and macro-grid, as and when available, as portrayed in Fig. 4. The infrastructure required to install a fast charging station for 5 to 10 EVs can be accommodated with distributed generations. The choice of renewable sources shall be dependent on the topographical condition.

Independent EV charging infrastructure when connected with the grid network with renewable sources makes it more sustainable. The ac bus scheme is generally preferred because ac components have well-defined standards and ac technologies and products are already available in the market. However, a dc-bus based system provides a more convenient way to integrate renewable energy sources and also higher energy efficiency.

Vehicle-to-grid (V2G) strategies may help improve the reliability and efficiency of the distribution system and account revenue to EV users and charging station operators if properly implemented energy and ancillary services markets are in place. Some of the services that V2G strategies can provide to the grid includes: frequency regulation, virtual inertia, reactive power compensation, peak load management, and integrating variable distributed energy resources (DERs).

Conclusion

While EVs are trending with ease in taxation, people are not comfortable enough with EV technology yet. This will be overcome with time, as the world moves toward EV highway coalitions. Distribution companies are also venturing with technology partners to provide charging stations and a charge-per-unit basis. State transports are inducing EVs into mass transit of people at special places like railway stations, airports, and major civic body buildings. These areas are much more structured and their infrastructure can be transformed into charging stations with ease of installation — from parking lot to EV charging station cum parking lot.

An increase in the number of charging stations will also allow a low-capacity battery car to charge at a shorter range as the cost of the battery is still one-third of the car. With increase in their numbers, assumptions are made for shortage of batteries because the recycling of Li-ion batteries is still costlier than mining for lithium.

Earthing protection within electrical infrastructure is not always adequate in India. 230 VAC level charging points of homes, parking lots, and restaurants may not have proper earthing, leading to charging errors because of safety provision and therefore, vehicles cannot be charged. Emphasis on good earthing system infrastructure is still needed to run EVs over the diversified market.

Unified ac/dc fast charging stations at regular intervals, connecting major cities and driving way infrastructure shall make EVs more promising. In India, CO2 emissions per electric car will be 2% to 16% lower in 2030 depending on renewable energy penetration in the grid (Council on Energy, Environment and Water, 2019). Hence, EVs will reduce pollution and allied problems if we adopt more renewable means of energy generation.

References

- https://economictimes.indiatimes.com/defaultinterstitial.cms

- https://ourworldindata.org/blog

- https://www2.deloitte.com/global/en/pages/about-deloitte/articles/global-report-home.html

- https://www.automotiveworld.com/research/the-worlds-new-vehicle-market-outlook-for-2020/

- https://www.livemint.com/companies/news/electric-vehicle-sales-in-india-up-20-in-2019-20-11587370389230.html

- https://www.smev.in/

- NITI Aayog and Rocky Mountain Institute, Report on Mobilizing Finance for EVs in India, 2021

- https://www.thehindu.com/

- https://autotechreview.com/

- https://www.india.gov.in/

- https://eeslindia.org/en/home/

- https://www.ceew.in/

About the Author

Sushri Mukherjee

Sushri Mukherjee is pursuing master of technology in Power System at Indian Institute of Technology Delhi, India. Previously, she was working as a research and development engineer at Supreme & Co. Pvt. Ltd., India.

Sumana Chattaraj

Sumana Chattaraj is pursuing master of technology in sensors and internet of things at Indian Institute of Technology Jodhpur, India. Previously, she was working as a planning and operation engineer at Supreme & Co. Pvt. Ltd., India.

Dharmbir Prasad

Dr. Dharmbir Prasad is an assistant professor at Asansol Engineering College, India.

Rudra Pratap Singh

Dr. Rudra Pratap Singh is assistant professor at Asansol Engineering College, India.

Md. Irfan Khan

Md. Irfan Khan is regional manager-South Asia for Supreme & Co. Pvt. Ltd., India. Previously, he was a regional manager for Supreme T&D Co. Ltd., Thailand.

Rakesh Pratap Yadav

Rakesh Pratap Yadav is regional head-Bihar for Energy Efficiency Services Ltd., India.