Transportation Electrification: Who’s on First?

Which comes first? The electric vehicles or the electric vehicle charging infrastructure? It’s the classic problem, but it does not involve chickens or eggs. The problem took a big step toward being solved with the formation of the Electric Highway Coalition that was announced by six major electric utilities in March. The Coalition hopes to serve travelers driving all-electric vehicles along interstates spanning the Southwest to the Middle Atlantic and the Gulf of Mexico to the Great Lakes.

Electric Highway Coalition

As Lang Reynolds put it, “the Coalition is committed to the buildout of fast charging to give EV owners the confidence to drive long distances.” Lang is the director for electric transportation at Duke Energy, which is one of the six partner utilities. The others are American Electric Power (AEP), Dominion Energy, Entergy, the Southern Company and the Tennessee Valley Authority (TVA).

Reynolds went on to say that while the coverage of the new coalition in the press has been welcome, there have been some misunderstandings. The Coalition is not meant to replace private investment in EV charging infrastructure. Instead, Lang said that basic issues such as common signage will help customers for the DC fast-charging stations to become familiar with what to expect along the way and thus recognize that venturing far from home in a battery electric car will no longer be a bridge to nowhere.

Another purpose of the coalition is for the electric utilities to put their investment muscle behind installing next-generation fast-charging stations. This means not being limited to 50 kW DC chargers, which was the traditional standard for early networks based on the small EV fleet currently on the roads.

As Reynolds explained: “We are at the tip of the iceberg in terms of electric vehicle models and battery size. By the next decade, millions of long-range vehicles will roll off the assembly lines of all the major manufactures and a few startups. And then there is freight. Long-haul trucks cannot be serviced without commitment to much higher capacity charging infrastructure.”

There are two types of organizations that large investor-owned utilities bring to EV charging infrastructure buildout. These are classified as “regulated” or “unregulated” companies. Duke Energy has both types of EV charging programs, but perhaps the breakthrough the coalition represents is that it is led by the regulated operating companies of the partnered investor-owned utilities. This is significant because it represents the growing agreement among state regulators that it is in the public interest to include EV charging infrastructure in the rate base.

Duke’s EV Initiatives

For Duke Energy, this means three announced programs. One approved in Florida and well along in its implementation, and two approved in North and South Carolina that were launched in the first quarter of 2021. And it is from Duke’s Florida program that key new data about what can drive EV adoption is coming from. Branded as “Park and Plug”, under the pilot program Duke Energy has installed 576 EV charging stations and of those, 40 are DC fast charging with the balance being public Level 2 AC chargers.

A welcome thing was noted by Duke when they did the data analytics, according to Reynolds. In 2019, the number of new EV registrations increased faster than the average rate in Florida in the areas served by the pilot program’s new chargers. The effect of adding public charging infrastructure on EV adoption rates has been speculated upon, and debated, for some time. But this new data indicates that charging infrastructure is the egg that will produce more chickens in the form of consumers feeling comfortable switching to all-electric cars.

If this glimpse into consumer behavior holds true for the nation, then the Coalition’s plans will be well-validated by nudging along the transition to cleaner, lower-carbon-emitting electric transportation.

Cleaner Air

When it comes to cleaner, let us not forget that reducing emissions is not only about carbon. In fact, for all the clamor to reduce the emissions of carbon dioxide by the global energy economy, we should not forget that there are vulnerable members of the population that will benefit from reducing, and perhaps eliminating, mobile sources of traditional air pollutants.

Sushama Masemore is the acting assistant secretary for environment in the NC Department of Environmental Quality. She is also a noted expert in air quality. Her take is that transportation electrification can eliminate one major source of respiratory disease by converting urban fleets using heavy diesel engines to electric drives.

Masemore explains that “according to the American Lung Association, poor and disadvantaged communities bear a disproportionate share of the health effects caused by transportation-related emissions because depots and air and sea ports are often located near their neighborhoods.” While she acknowledges that these depots support essential services such as buses for public transportation and delivery trucks for grocery stores and other food outlets; she concludes that “the social justice issues in low-income neighborhoods arising from exposure to diesel emissions can be addressed through fleet electrification while simultaneously transitioning the electric power sector to clean energy resources.”

Cost Factor

Fleet electrification is a goal that will be realized as soon as the acceptable total cost of ownership is realizable. Reynolds remarked that the cost of buying everything “shiny and new” from the vehicles to the depot electric charging infrastructure is holding back the TCO decision.

For now, the gap is often made up by federal grants. The Charlotte Area Transit System (CATS) announced in June 2020 that it had been selected for a US$3.7 million federal grant to buy all-electric buses. CATS plans to use the funds to procure battery-electric buses and upgrade a depot with DC fast chargers. With technical support from Duke Energy and Dominion Energy, a team led by Dr. Linquan Bai at the University of North Carolina Charlotte and Dr. Johan Enslin at Clemson University are studying the impact on distribution feeders to form broader recommendations for future integrated resource planning. The project is funded by the Center for Advanced Power Engineering Research (CAPER).

The Linchpin – Circuit Breakers

One company that has a plan to put a major dent in the cost of the electric-recharging infrastructure is Atom Power, Inc. Founded by Ryan Kennedy, an electrical engineering alumnus of the University of North Carolina at Charlotte. Kennedy earned his new career as a licensed professional engineer after being an accomplished electrician working on numerous new buildings in Uptown Charlotte, North Carolina.

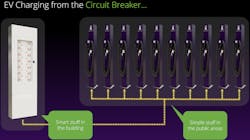

Atom Power is now completing the UL listing of their generation 3 solid-state circuit- breaker products (called Atom Switches). Their Generation 3 circuit breakers have a unique feature in that they easily transition to charge vehicles straight from the circuit breaker. But you won’t get a chance to buy one of these transformational devices immediately. “Our product that is designed to support networked electric vehicle charging in fleet depots is sold out through at least the summer,” said Kennedy.

Atom Power has thoroughly researched the market for EV charging and has concluded that high-density level 2 AC chargers cover 80% of the fleet use cases. Kennedy added: “And right now, fleet equals municipal.”

The economics of DC fast chargers versus AC level 2 chargers is partially why. Level 2 is not a monolithic rating but ranges from the 3.3 kW of my older Nissan Leaf to 19.2 kW for the top tier. For those fleet applications that have the duty cycle to accept something less than 50 kW from a DC fast charger, the price savings is fantastic.

At 240 VAC single phase, this means a hefty 80 A circuit breaker. But this is a sweet spot for Kennedy’s Atom Switch. What differentiates Atom Power’s offering is the software. Not unlike the Tesla Motors business model, Atom Power leverages the solid-state circuit breaker with software to enable applications that don’t make sense for a mechanical circuit breaker. Ten thousand breaker cycles? No issue for Atom Power. And with energy management software controlling the branch circuit, a significant recurring cost for wireless networking is eliminated.

As Kennedy explained: “One of the hidden costs of virtually all of the networked EV charging products out there is the monthly cloud services bill. We are winning by offering better technology installed with everything a fleet owner needs to electrify an entire hall filled with vehicles but at half the cost of our competition.”

That is much more than mere invention. It is innovation that we have come to expect from entrepreneurs of Kennedy’s caliber.

In Summary

The announcement of the utility-led Electric Highway Consortium is more momentum for the inexorable march to replace fossil fuel with clean energy delivered by electricity. But the details matter so, like any new technology-based innovation, there are multiple ways forward, and the best ones are still being discovered. Fast DC charging is the focus of the Electric Highway Consortium, but no one is counting out Level 2 charging as a big part of electrifying local and municipal fleets. “Owning” the branch circuit is a surprising strategy to replace molded plastic circuit breakers with solid-state, but Atom Power is moving into that space because it is realizing the holy grail of delivering a better Level 2 fleet charging solution at a lower cost.

About the Author

Michael Mazzola

Dr. Michael Mazzola is the director of the Energy Production and Infrastructure Center (EPIC) and the Duke Energy distinguished chair in power engineering systems at University of North Carolina at Charlotte. After three years in government service at the Naval Surface Warfare Center in Dahlgren, Virginia, in 1993, Mazzola joined the faculty at Mississippi State University, where he became known for his research in the areas of silicon carbide power semiconductor device prototyping and semiconductor materials growth and characterization. For 10 years, he served at the Mississippi State University Center for Advanced Vehicular Systems as the associate director for advanced vehicle systems, where he led research in high-voltage engineering, power systems modeling and simulation, the application of silicon carbide semiconductor devices in power electronics, and the control of hybrid electric vehicle (EV) power trains. In addition, he served two years as the chief technology officer of SemiSouth Laboratories, a company he co-founded. Mazzola holds a PhD in electrical engineering from Old Dominion University.