Breakthrough Batteries, Investment Is Accelerating the Era of Clean Electrification

According to new Rocky Mountain Institute (RMI) research, recent rapid improvements in lithium-ion (Li-ion) battery costs and performance, coupled with growing demand for electric vehicles (EVs) and increased renewable energy generation, have unleashed massive investments in the advanced battery technology ecosystem. In addition to growing investment in technology startups, total manufacturing investment — both previous and planned until 2023 — represents around US$150 billion, or close to US$20 for every person in the world. These investments and steady advances in technology have set in motion a seismic shift in how we will power our lives and organize energy systems as early as 2030.

Forward-looking utility sector leaders and regulators will find that the potential synergies now emerging from advanced battery technology investment will require new methods of planning and analysis as well as revamping traditional business models. To get in front of this shift, energy industry players can begin by understanding the impact of the fast-dawning age of affordable battery technology. In the first of this three-part series, we explore the forces behind this growing momentum, key advances in Li-ion battery technology, and the disruptive impacts of falling costs and improving performance for electric utility leaders and others in this space.

What is Driving Momentum for Breakthrough Battery Technology?

Over the past 10 years, a global ecosystem has emerged to provide a foundation for rapid innovation and scaling of these new technologies. This ecosystem includes:

- Large and diverse private investments: Venture capital investments in energy storage technology companies exceeded US$1.4 billion in the first half of 2019 alone and have continued to increase. This money flows increasingly from acquisitions as well as nontraditional sources, including venture capital funds targeting risky and early-stage technologies, consortia of utilities targeting later-stage commercialization, and a growing number of incubators and accelerators.

- Ambitious government support: Government support for early-stage research and development (R&D) continues to drive new innovations. As countries and major cities set ambitious goals for EV adoption, programs to support domestic battery manufacturing have followed.

- Strategic alliances: A diverse array of players — vehicle manufacturers, oil and gas majors, and battery manufacturers — are forming strategic alliances with companies working on alternative battery technologies in efforts to gain a competitive edge.

- Diversifying global manufacturing investment: These incentives and the anticipated exponential growth in EV adoption have led to massive investments in Li-ion battery manufacturing capacity, which is expected to more than triple to 1.3 TWh by 2023.

These ecosystem elements work together in a self-reinforcing feedback loop: favorable public policies, additional R&D funding, new manufacturing capacity, and subsequent learning curve and economy-of-scale effects will lead to continued cost declines and exponential demand growth (Exhibit 1). As these cost and performance improvements continue to outpace forecasts, demand will expand beyond EVs and grid-tied storage to other emerging applications, setting the stage for mass adoption of advanced battery technologies.

Li-ion Will Dominate Near-Term Market Disruptions

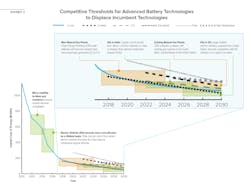

Through 2025, advances in technology and manufacturing will keep Li-ion batteries at the forefront of electrochemical energy storage markets. Analysts expect the capital cost for new battery manufacturing capacity to drop by more than half from 2018 to 2023. This, coupled with technology innovations that will continue to improve Li-ion battery performance, will drive battery pack capital costs to approach a projected US$87/kWh by 2025. These dynamics will push both Li-ion and increasingly new battery technologies across competitive thresholds for new applications — both stationary and mobile — more quickly than anticipated (Exhibit 2).

These rapid improvements and cost declines will change the economics of wholesale power markets, potentially stranding investments in new natural gas-fired power generation plants across the globe, even in cold climates, as early as 2021. In the United States alone, utilities have proposed US$70 billion of natural gas plants in the next decade. The need for these new natural gas plants can be offset through clean energy portfolios (CEPs) — optimized, least-cost combinations of wind and solar generation, energy efficiency, demand response, and energy storage that provide services matching those provided by natural gas plants. Recent analysis by the RMI on CEPs shows that this trend is likely to accelerate.

Long-Term Challenges for Li-ion

Despite the anticipated trajectory for cost and performance improvements, Li-ion batteries will not be a universal solution in all applications for advanced battery technology. Many inherent technology limitations and tradeoffs will likely persist, including Li-ion batteries’ relatively high degradation rates when rapidly or deeply cycled.

Unlike the market development pathway for solar photovoltaic (PV) technology, battery R&D and manufacturing investment continue to pursue a wide range of chemistries, configurations, and battery types with performance attributes that are better suited to specific use cases. Solid-state technology, in particular, is poised to massively disrupt the storage industry by unlocking new opportunities for cheap, safe, and high-performing batteries, including non-lithium-based chemistries.

Li-ion technologies may be outcompeted by these and other technologies based on factors like plateauing performance improvements around safety, energy density, and life cycle. For example, Li-ion batteries would need to attain 2X cycle life improvements at 100% depth of discharge to remain competitive for today’s most common grid applications. Limited cobalt supply could also constrain further cost decreases.

Moving Past a Capital Cost Focus

A related challenge for Li-ion technologies lies in the lifecycle cost implications of its limited cycle life and degradation characteristics.

In the context of grid storage, the market needs to move past making decisions on a capital cost basis (where Li-ion is projected to perform relatively well), but there are challenges to using a cost-of-service-provided approach. Transparency into this levelized cost of storage (LCOS) across different grid services is crucial for making efficient decisions on battery system selection and affordable ratemaking. Unfortunately, a lack of meaningful or verifiable data required to calculate LCOS across different battery technologies threatens to slow progress on grid-tied battery adoption.

For example, battery technologies that offer lower degradation rates (for example, flow, high temperature, or Li-ion lithium iron phosphate) could be less risky and less costly options for stacking revenue from multiple grid-tied storage use cases. LCOS needs to account for these value-stacking capabilities, but cumulative degradation and cycling costs for stacked value propositions are nascent.

Several such alternatives to Li-ion could be well suited to multiple grid-tied use cases, largely because of their respective depth of discharge capabilities, degradation rates, and lifetimes. Exhibit 3 summarizes the key performance characteristics and suitability of different battery technologies for various grid use cases.

As Li-ion battery costs and performance continue to steadily improve, ecosystem actors may be tempted to assume the long-term dominance of Li-ion batteries across applications. However, market actors should consider how to capitalize on near-term economic opportunities from Li-ion without sacrificing progress or truncating opportunities for nascent applications where new technologies are better suited.

What Comes Next?

Capturing the massive economic opportunity underlying the shift to controls and battery-based energy systems requires a forward-looking, ecosystem approach. Electric utility leaders must look ahead to understand just how quickly lower-cost batteries will accelerate the transition to zero-carbon grids.

As a next step, stay tuned for parts two and three of this three-part series, in which the RMI explores potential future grid-tied applications for non-Li-ion batteries and implications and recommendations for utility sector leaders.

For more information, read the report here.

About the Author

Charlie Bloch

Charlie Bloch is a principal, emerging solutions, at the Rocky Mountain Institute (RMI), where he leads cross-sector collaboration, strategy, and opportunity development within the global energy transition. His underlying interest is in leveraging technology to improve global prosperity and the environment through innovative finance, partnership, and business models. Charlie’s nearly 20-year career comprises a wide range of sustainability subject matter expertise, including utilities, clean energy, distributed energy resources, public water infrastructure, and alternative transportation. That background combined with a mix of consulting, corporate, governmental, and entrepreneurial roles provides a diverse perspective for fostering cross-sectoral collaboration and helping to bring innovative ideas to market.

Madeline Tyson

Madeline Tyson is a senior associate, emerging solutions, at Rocky Mountain Institute (RMI). She works on the emerging solutions team to evaluate promising nascent storage value propositions with cities on community scale solar. She has diverse expertise ranging from complex system analysis to techno-economic analysis to sustainable energy project development. She received her PhD from Arizona State University (ASU) where she explored energy system transitions through the lens of information management using agent-based models and regulatory analysis.