Will Challenges Stop Utilities from Getting the Private Wireless Networks They Need?

Will Challenges Stop Utilities from Getting the Private Wireless Networks They Need?

Here’s one thing most utility professionals who responded to the Black & Veatch 2019 Strategic Directions: Smart Utilities survey agree upon: The existing field area networks (FANs) they’re using for AMI and SCADA will need significant enhancements to support the digital utility of tomorrow.

Most utilities are looking for a private network solution, and nearly half want LTE – long-term evolution – networks like those serving as the foundation for next-generation, 5G wireless cellular systems. Realizing those private networks with high enough bandwidth and low enough latency may be tough, and the challenges show up in survey responses. Utilities may need to forego building their own proprietary networks and start leasing spectrum from those that already exist.

Data-driven Doings

We all know what’s behind the utility scramble to deploy systems and network upgrades. It’s distributed energy resources.

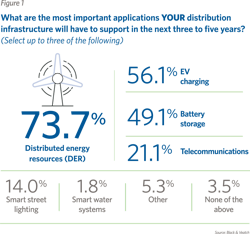

DER were by far the top application utilities are planning to support in the next three to five years, according to survey responses from utility staff. Nearly three-quarters of survey respondents cited DER in general as shaping their distribution infrastructure in coming years, while 56% named electric vehicle charging and 49% named battery storage. Both are also examples of DERs that, eventually, could someday be controlled and dispatched to support the overall power system. That’s where we’re headed.

With those DER come voltage management issues, so it’s understandable that two-thirds of respondents targeted improvements in “operational efficiency and volt/VAR management.” More than 82% wanted to “improve the reliability of the grid,” while nearly 84% said they were modernizing to “increase monitoring, control and automation capabilities.”

That will take sensors, smart controls and other digital devices at the grid edge. And, they’re coming online fast. A new report by Global Market Insights predicts that the worldwide utility IoT industry will double between now and 2024, reaching an annual US$15 billion price tag.

Achieving grid management goals is also going to take bandwidth because these grid edge devices move lots of information and move it quickly.

For instance, many utilities now are deploying distribution-level phasor measurement units (PMUs), which have been used in transmission systems for several years. Some distribution system PMUs take readings as often as every one to two cycles, which equals 30 to 60 readings per second in a 60 Hertz system such as the North American grid. The units can measure voltage, current, phase characteristics, frequency and its rate of change, switch status and more. They also have a Global Positioning System (GPS) signal embedded in them, which means that the readings can be synchronized with other readings throughout the distribution system to give grid operators a comprehensive view of grid conditions.

PMUs and all the other sensors that utilities are adding to their grids collect huge amounts of data. To this data, add in the automation signals that utilities will be sending through things such as advanced distribution management systems, fault location isolation and service restoration and voltage management technology.

Then add in the data received from drones, the signals going to and from smart street lighting systems, as well as the control signals that will likely be connected to electric vehicle charging infrastructure. It’s easy to see why 85% of survey respondents are getting by on 10 gigabits per second (Gbps) of bandwidth now, but 45% anticipate needing 20 Gbps in the future.

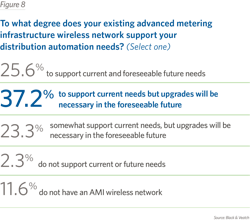

And, these are the reasons nearly 63% of respondents to the Smart Utilities survey say the existing wireless networks they’re using for AMI will need upgrades in the foreseeable future.

Private Eyed: Utilities Zone in on Private Solutions

Given these drivers, let’s examine preferences for network characteristics. It appears that survey responses reflect utility professionals’ reality more than their wishes and, maybe, their needs.

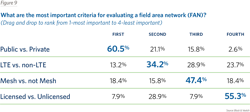

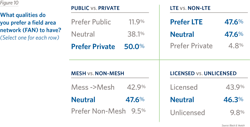

Specifically, most survey respondents are seeking a private wireless solution for their FAN. In fact, some 43% of respondents strongly prefer the private option, and 60% considered public versus private to be the most important criteria for evaluating a FAN.

Even though half the respondents prefer a private network to support their private electric operations, only roughly 8% named “licensed versus unlicensed” as their most important network selection criterion. This isn’t because they don’t really care if a network is licensed exclusively to them; it’s because the lack of private spectrum available today makes most utilities shrug off that preference and assume they’ll need to settle for an unlicensed option, not understanding the risks associated with the high costs to resolve the potential interference issues over the life of the unlicensed network.

Typically building with the future in mind, most utilities want to have a future-proof network. That’s LTE. However, a lot of the major carriers have currently consumed the majority of the spectrum, leaving utilities with little opportunity to purchase their own. Maybe that’s why only 48% said they’d prefer LTE technology, while 52% voiced a non-LTE preference. Again, this may reflect today’s reality more than it reflects the true utility wish list. Chances are, if utilities could find an LTE solution that has license spectrum and at least 10 megahertz, it would likely be a popular option.

Fortunately, it’s not out of reach, provided utilities are willing to give up the tradition of owning all their network assets and consider renting instead.

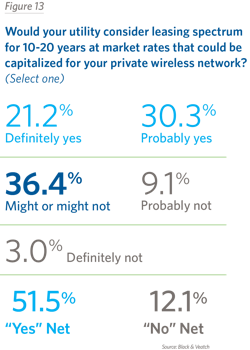

More than half – 52% – of survey respondents said they would consider leasing spectrum for 10 to 20 years at market rates that could be capitalized for their private wireless network. Although 52% say they don’t know now much spectrum they’d need, a majority will need 5 megahertz (MHz) or greater to support their grid modernization initiatives. This might be achieved through leasing spectrum long term from spectrum owners that can be capitalized if structured correctly with the network implementation.

Ultimately, new spectrum solutions will be needed because utilities must modernize their grids to accommodate DER, and they can’t modernize grids without modernizing communications. Leasing spectrum may well be the best way to make sure utility wish lists – and needs – get fulfilled.

About the Author

David Hulinsky

David Hulinsky is a utility telecom and automation director at Black & Veatch, where he provides integrated grid modernization solutions for utilities. Hulinsky focuses on advanced automation and telecommunication systems to improve the scalability, reliability and efficiency of the electric grid. He has led some of Black & Veatch’s largest turnkey grid modernization projects for leading utilities such as San Diego Gas & Electric, Hydro One, CPS Energy, The United Illuminating Company and NV Energy.