Forecasts Predict More Disciplined Growth Ahead for Data Centers as Power and Construction Challenges Persist

A new report from Bain & Company projects that the rapid expansion of data centers driven by generative AI is shifting toward a more measured and execution-focused phase. Despite this moderation, the industry continues to face challenges related to power availability and construction delays, according to Bain’s 2030 global data center forecast.

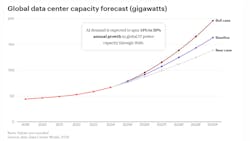

Bain’s baseline scenario — characterized by sustained AI demand, moderate scaling delays, and gradually improving power and component availability — projects global data center capacity demand will reach 163 gigawatts (GW) by 2030, double current levels.

In the United States, electricity demand from data centers could also double to 409 terawatt-hours (TWh) by 2030, with most of the increase attributed to AI-related workloads.

“We expect there will be sufficient energy supply to meet demand,” said Aaron Denman, leader of Bain’s Americas Utilities and Renewables practice. “However, power access is now the critical gatekeeper of growth. Even as GPU and construction constraints ease, more flexible and independent sources of power will be needed. As such, the behind-the-meter (BTM) power generation has become the go-to source shifting timelines and decision-making.”

Bain’s research suggests that by 2030, U.S. data centers could account for about nine percent of total national electricity consumption, more than double their current share and roughly 150 TWh above the U.S. Energy Information Administration’s baseline forecast.

Meeting this demand, Bain notes, will require close coordination between utilities, regulators, and data center operators. Near-term strategies include flexible demand programs, expanded use of battery storage, and increased reliance on BTM power sources such as natural gas, rooftop solar, or small-scale nuclear restarts. Long-term solutions will depend on grid modernization, renewable energy integration, and transmission system expansion.

Smaller, distributed data centers supported by flexible BTM generation are expected to align with the lighter power needs of AI inference workloads. However, mega data centers — with capacities of at least one gigawatt — will remain essential for training frontier models.

“The general prediction that hyperscalers would scale back investments didn’t happen in 2025. However, we are seeing more deliberate investments by hyperscalers as they scale capacity focusing more on capital efficiency and getting more selective on locations for new deployments, particularly for AI,” said Padraic Brick, co-leader of Bain’s data center perspectives.

By 2030, Bain anticipates that North America will continue to host about half of the world’s data center capacity, driven largely by hyperscaler capital expenditures. Capacity growth in Europe and Asia Pacific is expected to be supported by sovereign AI initiatives and enterprise adoption.

According to Bain, companies are increasingly prioritizing geographic flexibility, aligning their compute infrastructure with factors such as latency, data sovereignty, and energy sourcing.

Construction challenges remain a significant constraint. Developers are facing extended permitting processes, equipment lead times of eight to 24 months, and skilled-labor shortages. The most significant delays, Bain reports, come from electric utility interconnections, which can take up to five years.

Bain’s analysis identifies four key actions that can shorten construction timelines by up to a year: selecting the right markets and maintaining a portfolio of sites; adopting modular designs and prefabricated equipment; engaging cross-functional experts to optimize design and supply chains; and collaborating with suppliers to prepurchase critical equipment in bulk.

“The AI data center race is no longer just about scale. Winners are taking deliberate and careful approaches to capacity investments, while at the same time, actively securing fit-for-purpose power generation and mitigating build delays,” said Peter Hanbury, leader of Bain’s global operations work for Technology clients.