How Mature Are We in Engaging Customers in New Ways?

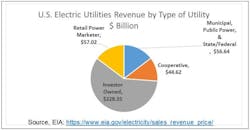

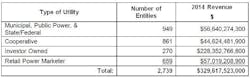

How mature are we, as an industry, when it comes to our efforts to engage with customers in new ways? One measure of interest is available in some cold hard numbers-- the level of revenue from electricity sales by retail power marketers. While the associated number of customers is still relatively low, the electric revenue of retail power marketers in the last fully reported year now exceeds of the total for municipal or cooperative utilities, per the chart below, derived from EIA data:

Another measure of interest is the ongoing growth in Distributed Energy Resources (DERs). DER trends matter because they are in the process of changing our world—nothing less.

Several key needs come to the forefront:

- We need to elevate and share the insights and struggles of those who are actually doing real work enabling integration of DERs on the grid;

- We need to provide actionable analyses and views that help inform our path forward, with a reliable foundation, one that aligns the horizontal of what’s next with the vertical of our ideals;

- We need a foundation that stays balanced. One as tech-savvy as it is market savvy. One that will make as much sense from an engineering economics perspective as from a policy, customer-centric, and regulatory one.

Consider this fact:

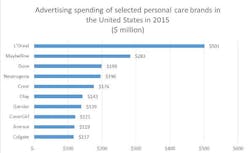

More is spent annually in the U.S. on advertising 10 popular personal care brands ($1.9 billion) than what is spent by all U.S. electric utilities, combined, on advertising.

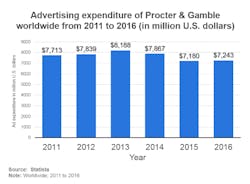

Proctor & Gamble’s overall advertising budget, shown below, has been averaging between 7.7% and 8.1% of the company’s recent annual revenue, which has ranged between $89 billion and $102 billion over the last four years.

How does P&G’s spending 8% of revenue on advertising compare to electric utility rates of ad spend? The average utility spends 20 times less!

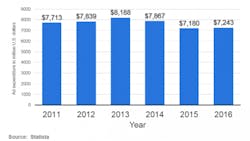

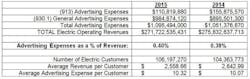

Yes. The 201 utilities reporting to FERC last year showed total electric revenue of $271 billion yet their total advertising spend was just $1 billion:

We can adjust these results and create a rough estimate based on the distribution of utilities in the U.S. overall, per the recent EIA data summarized below:

The 201 large utilities reporting to FERC represent 69% of total U.S. electric sales revenue. A sampling of meeting minutes and reports from a number of munis and cooperative utility reports shows similar levels of advertisement related spending. In addition, the same analysis for historic data from FERC between 1996 and 2013 shows little change.

The muni and coop spend, along with indirect advertising through fees to national or regional organizations as well as sales and customer related expenses that may indirectly involve some goodwill being created, could perhaps double or even quadruple these figures, but even if we made these figures ten times larger, they’d still be ten times too small to do much—we are talking about addressing 100 million electric utility customers, and annually, the debate is not about whether we should double or triple the current one dollar per customer, but whether multiplying by ten or twenty will do.

The complexities of retail markets involve a share of risk which some large IOUs may have been wise to steer away from, while others in more favorable markets may have managed well by working through subsidiaries that have been embracing it. Consider the size of some of the big players in the Retail Power Marketer segment. Each of the following eleven Retail Power Marketers reported more than $1 billion in U.S. electric sales revenue to EIA last year:

Retail Power Marketers Reporting

More than $1 billion in Annual U.S. Sales:

- Constellation NewEnergy

- TXU Energy Retail

- Direct Energy Business

- Reliant Energy Retail Services

- First Energy Solutions Corporation

- Just Energy

- Suez Energy Resources North America

- Noble Americas Energy Solutions

- Direct Energy

- Constellation Energy Services

- Ambit Energy Holdings

- Consolidated Edison Solutions

How do such companies compare when it comes to their spend on advertising? While it is not an apples-to-apples comparison, and not all such companies are publicly traded, data from the Annual Report of one of them (Just Energy—per page 91 of this link) showed a 19% spend on Sales and Marketing in its FY 2015 ($225 million out of a $3.8 billion revenue figure).