Edison International Helps Fund Battery Management Venture’s Series B

The parent company of Southern California Edison has added to its investment in a young Silicon Valley company looking to give second lives to electric vehicle batteries.

Executives with Element Energy Inc. recently announced that their three-year-old company had closed on $28 million of funding as part of their Series B raise. The financing round was co-led by Palo Alto-based Cohort Ventures and also includes contributions from fellow California-based investment firms Radar Partners and Prelude Ventures as well as LG Technology Ventures. Details of Edison International’s participation weren’t made public but the company said in its 2021 annual report to California regulators that its stake in Element is less than 5%.

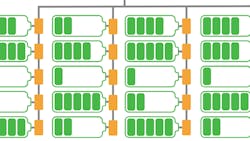

Element’s battery management system seeks to maximize the effective life of battery packs by more closely monitoring the safety and performance of individual cells. The system, officials say, eliminates stranded energy and can grow the total throughput of a pack by up to 50% over its life.

“We are thrilled to be implementing our technology at-scale with GWh, grid-connected deployments planned in 2023 and 2024,” CEO and Co-Founder Tony Stratakos said in a statement. “After 10 years of hard work and $50 million of R&D investment in developing our technology, we are taking big strides to speed the adoption of clean energy and clean transportation.”

Stratakos and his team last month also received a $7.9 million grant from the U.S. Department of Energy for a 50 MWh battery project planned to rise alongside a Texas wind power facility. And while they’re focused for now on extending the life spans of EV batteries, they also plan to over time grow Element into first-life storage systems as well as integrating its products and services directly into EVs.

Edison International’s investment arm also has acquired small stakes in electric bus maker Proterra Inc. and solar energy company Heliogen Inc., which have both gone public in the past 18 months, as well as truck electrification venture Forum Mobility and AiDash, which uses satellite imagery to help with vegetation management programs.

Element is looking to address a sliver of a rapidly-growing battery systems market: The International Energy Agency said earlier this year that grid-scale battery storage capacity grew by more than 60% in 2021 to about 16 GW and is forecast to soar to 680 GW by 2030 in the agency’s scenario of a net-zero economy by 2050.

About the Author

Geert De Lombaerde

Senior Editor

A native of Belgium, Geert De Lombaerde has more than two decades of business journalism experience and writes about markets and economic trends for Endeavor Business Media publications T&D World, Healthcare Innovation, IndustryWeek, FleetOwner and Oil & Gas Journal. With a degree in journalism from the University of Missouri, he began his reporting career at the Business Courier in Cincinnati and later was managing editor and editor of the Nashville Business Journal. Most recently, he oversaw the online and print products of the Nashville Post and reported primarily on Middle Tennessee’s finance sector as well as many of its publicly traded companies.