Utilities Rank DER as Most Important in Survey

Here’s a bit of irony: The key drivers of distribution system investments that utilities are making to modernize their grids stem from assets that utilities often don’t own: distributed energy resources (DER) such as rooftop solar arrays, electric vehicles (EVs) and battery energy storage systems.

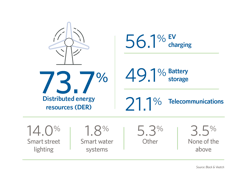

Far and away, utilities view DER as the most important application to support in the next three to five years, according to Black & Veatch’s 2019 Strategic Directions: Smart Utilities Report survey, an industry-wide poll of energy providers. Nearly three-quarters of respondents said DER will shape their distribution infrastructure going forward, followed by EV charging (56%) and battery storage (49%). This shows promise for the future of DER systems, which may someday play a role in supporting the overall power system (Figure 1).

Getting to the future state

Although the industry is on board with integrating DER, planning remains a major barrier for utilities, who have mainly managed their own assets. How do we get to this future? Do utilities need to install new transformers? New conductors? Will they need to adapt to support peak loads? Utilities will also need to consider the various assets and resources that third-party customers plan to add to the system.

Moving to this decentralized state will require a new approach and different style of planning from what utilities have done in the past, and analytics will play a starring role. Integrating analytics will allow power providers to analyze the grid through multiple lenses, including what-if scenarios, where to place asset management devices like sensors and volt/VAR equipment, and which assets can be prioritized to achieve optimal economics.

Most utilities are already researching how behind-the-meter resources impact the grid, and some are even examining how customer assets—such as smart inverters—can play a role, either by assisting with volt/VAR management or by providing additional capacity in an emergency. Other utilities are looking at how to optimize customers’ generation resources, particularly large megawatt-scale storage or microgrids. One utility recently offered to subsidize a local university if it would install DER to help reduce load on a substation and spare the utility expensive substation upgrades in the coming years.

Advanced metering infrastructure (AMI) will be integral to this effort. By collecting consumption data and power-quality metrics and feeding an analytics engine, AMI systems can help enable grid-supportive initiatives like targeted load shedding and time-based rates, which can help defer grid upgrades and investments. New AMI meters can detect voltage sags and spikes and/or frequency excursions, offering operators a whole new level of situational awareness, which in turn boosts operational intelligence.

With these benefits in mind, it’s no surprise that three-quarters of survey respondents name AMI as the top distribution automation solution planned at their utility, followed by fault location, isolation and service restoration (FLISR) technology (67 %) and advanced distribution management systems (ADMS) (62 %). These solutions — AMI, ADMS, FLISR and asset management tools — will play a critical role in collecting and delivering the data that will help utilities accommodate the most important application – DER.

Overcoming barriers to build the future

But barriers remain when it comes to implementing smart infrastructure and solutions like AMI, ADMS and FLISR. Funding constraints tied with competing priorities as top barriers to modernization (63 %), followed by regulatory hurdles (48 %) .

Analytics can help utilities overcome these investment and planning issues. And the concerns over regulations are likely tied to the uncertainty of the utility model itself. Net metering remains a sticking point, and some states (Hawaii, Indiana) have shut down the policy for good. Still, the dropping costs of solar and storage continue to make these options attractive, especially in areas where the price tag of power remains high.

Bottom line: Something must change. Nearly half of survey respondents expect their futures to be less regulated, and this uncertainty is leading to longer-term planning and expanded timelines. Historically, utilities focused on one-year rate cases – today, almost 70% of respondents implement four- to-seven-year planning horizons.

Utilities are also realizing that they need a new way to work together and are increasingly embracing cross-functional teams. Traditionally, IT and operations technology (OT) were siloed from one another, but grid automation and modernization are forcing a new convergence. Fifty-six percent of respondents say they have the CIO, IT/communications, operations, security and transmission working together.

Cross-functional teams will be critical to building the grid of the future, as it comes with a hefty price tag. More than a quarter of the survey respondents are looking at spending between US$100 million and US$200 million over the next three years, while one in five expect to top the US$200 million price tag.

That’s a considerable amount of money to spend — even more eyepopping when you consider that much of it will go toward accommodating DER that the utility won’t even own.

About the Author

Paul McRoberts

Regional Manager, Industry Mining, Metals and Cement

Paul McRoberts is president of Atonix Digital, a Black & Veatch software subsidiary. He oversees the development and deployment of the company’s suite of software products powered by the ASSET360 analytics platform. McRoberts brings both rich software development experience and an in-depth understanding of how deep data exploration is helping transform businesses through greater insight and intelligence.

Gary Johnson

Gary Johnson is sales director for Black & Veatch’s Private Networks business. An electrical engineer, Johnson is experienced in mapping the geology of oil wells in West Africa. Following his MBA, he has been involved in various aspects of the electric power industry, including, metering, generation, transmission and, for the past 20 years, private networks and utility automation.