Can Smart Solar Keep the Sun Shining on PV?

The headline is as dazzling as a winter sunrise in the Rockies: “U.S. Solar Market Grew 76% in 2012.” In fact, last year the United States installed 3,313 MW of photovoltaics (PV), which, according to a recent Solar Energy Industry Association (SEIA) report, was a 76% hike over 2011. What’s more, for the first time in recent history, the report noted, “The U.S. market share of global installations rose above 10%.”

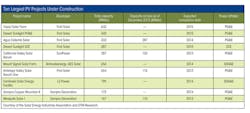

And 2013 seems to be picking up where 2012 left off. Indeed, the U.S. Department of Energy recently reported that in the first quarter of the year, 38 utility-scale PV plants, totaling 537 MW, were commissioned in the United States. While these additions represent 29% of all new generation capacity during the quarter, they do not include behind-the-meter commercial and residential rooftop PV systems, nor do they include mega projects like SunPower’s 579-MW Antelope Valley solar plants, the construction of which has just begun.

When operational, Antelope Valley, which is owned by MidAmerican Solar, will provide power to the Southern California Edison (SCE) grid. According to the SEIA, there are more than 3,000 MW of utility projects currently under construction, plus another 7,000 MW of projects with power purchase agreements in place that have yet to begin construction.

Utility-scale PV and concentrating solar power (CSP) installations in the United States now total 4.82 GW, just 0.44% of total capacity. Of course, the output of these plants as a percentage of total electricity generated is somewhat less because of the lower-capacity utilization rates of PV versus other forms of generation.

Still, when behind-the-meter systems are added, total cumulative U.S. PV and CSP installations reached 7.8 GW at the end of 2012. Great progress, certainly, but nowhere near Germany’s, where installed solar capacity is greater than 32 GW and solar energy meets approximately 25% of total demand.

It also should be noted that more than 60% of U.S. solar installations are located in just three states: California, Arizona and New Jersey. Rising along with the penetration of solar installations in those states are concerns about the impact solar power fluctuations could have on their grids. Increasingly, however, it is becoming clear that the way to ease those concerns will involve the smart grid: sensors, communications, energy storage and control systems, along with programmable inverters, which can adapt and adjust to the intermittent nature of solar energy. Call it “smart solar.”

Projects in the East

As one might expect, the largest solar PV projects in the United States are in Western states like California (2,537 MW), Arizona (1,094 MW) and Nevada (331 MW). However, the sun also shines brightly back East. According to SEIA, at the end of 2012, solar PV installations totaled 971 MW in New Jersey, 1,989 MW in Massachusetts and 196 MW in Pennsylvania.

In New Jersey, for instance, PSE&G has initiated a Solar 4 All program that will total 80 MW of PV installations. Half the program, or 40 MW, is the exact opposite of the large solar projects commonly found out West. Indeed, it consists of 12.5-sq ft (1.2-sq m) solar panels mounted on utility poles. These units — each of which is about 5 ft wide by 2.5 ft high (1.5 m by 1.5 m), weighs about 60 lb (27 kg) and generates about 235 W of electricity — benefit PSE&G in a couple of ways.

“One, it’s an asset we already own,” said Andy Powers, manager of PSE&G’s Solar 4 All program. “And two, by using vertical space on top of the pole, we save approximately 170 acres (69 hectares) of open space,” which is critical in the most densely populated state in the nation.

Centralized solar, which consists of more traditional ground-mounted solar systems, will represent the other 40 MW. These will be installed in open areas, such as brownfields, landfills, parking lot structures and warehouse roofs. About 16 MW will be installed on PSE&G property, with the remaining 24 MW installed on third-party property.

Powers notes the utility also has asked the New Jersey Bureau of Public Utilities for permission to install an additional 136 MW of solar generation. If approved, the utility will install 90 MW of PV at landfills and brownfields, 20 MW on warehouse roofs and 25 MW on parking lots. The final 1-MW installation will be a pilot project in which the utility will experiment with battery back-up systems.

Snow Not a Problem

“We have installed about 5 MW of solar over the past three years at company-owned sites,” said Fouad Dagher, National Grid’s manager of new products and energy services. This was done under the state’s Green Communities Act. “And the beauty is we used old gas manufacturing plants as the sites for solar,” he added. “We converted brownfields to greenfields.”

During this same period, he said, “We have seen an unbelievable surge in the number of applicants interested in installing solar generation in Massachusetts,” and these represent a mix of residential, commercial and municipal sources. He noted that in 2012 National Grid had approximately 1,700 applications for solar generation in Massachusetts.

“This was double what we saw in 2011 and more than triple in 2010,” he said. “This is great to see. It allows us to demonstrate that it is not always snowing in Massachusetts.”

Of course, in Massachusetts, where the Green Communities Act requires 15% of electricity to come from renewables by 2020, National Grid is well aware of the issues solar presents. Dagher said his biggest concern is that solar developers install inverters that operate to industry standards. His second biggest concern is keeping solar penetration within limits on any given circuit because “the characteristics of each circuit are different.”

When clouds appear, Dagher said, “solar output goes down rapidly, and we need to react fast to maintain stability.” Accordingly, he added, “When systems start to deviate from set points, we would like [the solar installations] to correct for it immediately or disconnect. We don’t want solar to be feeding back into the distribution system.”

No Rotating Inertia

The situation is the same in California, only more so. By 2020, 33% of all the energy provided to customers by investor-owned utilities (IOUs) in the state must be renewable, and that puts even more pressure on the IOUs to get solar right, which, of course, is easier said than done.

“While we understand our load, we no longer really understand the generation,” said Michael R. Montoya, director of grid advancement at SCE. “So, we’re doing a lot of research around solar forecasting, things that give us more confidence that the generation will be there when we need it.” However, he noted, “The grid was designed to have a lot of rotating inertia, which allows the system to absorb lots of disturbances.”

Today, things are different, said Montoya. “More and more renewables means less and less rotating mass.” He said that the very devices that convert the dc power produced by solar panels to ac for the grid may be suspect. Inverters, he said, “are designed to meet IEEE standard 1547, a standard that was adopted before anyone envisioned a high penetration of renewables. Because of that, he said, the standard itself becomes an issue because it “does not allow a few things we need as we get a higher penetration of renewables.”

For instance, he said, SCE is looking at how inverters interact with the grid, specifically how they will react to a dynamic change to the system, such as a large short circuit, and “we’re finding lots of interesting things.” Although inverters do not contribute a lot of short-circuit current, he said, “They do have some harmonic issues.” Furthermore, because inverters are constant power devices, “if you suddenly isolate an inverter-based generator, and the current goes down because load is removed, inverters increase the voltage,” said Montoya. “We’re seeing some inverters overvoltage by 210% or greater for short periods of time. That’s not good for surrounding equipment.”

Another problem: The existing inverter standard “does not allow for reactive power,” said Montoya. “When you have a big percentage of inverter-based generation, you need other sources of reactive power to push real power. Without reactive power, you can’t push real power.”

For all these reasons, SCE has become fully engaged in making the transition to solar as smooth as possible. According to Montoya, the utility has tested a majority of North American-made inverters, “and we are in the process of testing inverters made for the German market. Their standards allow for greater penetration.” All of these tests, he said, are designed to determine “what standards modifications are necessary in order for these devices to be friendly to the grid.”

Up on the Roof

When it comes to solar, utilities have three major concerns, according to Mahesh Morjaria, First Solar’s vice president for grid integration. The first, he says, is grid stability and reliability. The second is how solar generation affects daily load balancing, which is usually addressed through improved forecasting methods. The third is about how solar generation, especially with its increasing penetration, fits into their long-term resource planning.

To address utilities’ first concern, “we have built NERC-recommended capability, such as grid ride-through behavior and voltage controls, into our PV plants,” which, Morjaria added, usually operate at transmission levels. “On the other hand, rooftop solar applications do not provide such capability and create a significant concern for utilities.”

This has prompted countries like Germany, which has a large proportion of solar installations on the distribution network, to adopt regulations that ensure inverters provide grid support, said Morjaria.

Bob Stojanovic, ABB’s director of solar power North America, agrees. “It is different at the distribution level,” he said. “If you look at a given feeder or circuit, depending on the solar penetration level, you can quickly over-generate on that circuit and start feeding back into grid.”

As a consequence, Stojanovic noted, ABB is starting to see requirements for utility control of solar inverters. “It started in Germany and is working its way here,” he explained. “With that kind of control, a utility can dial down output and dial up VARs, or even potentially curtail output. These are the tools that the utilities are asking for, and it’s going to shape integration policies at both the utility-scale and distribution levels.”

According to Stojanovic, the reason behind this new desire for control is increasing solar penetration. Nobody anticipated the rate and extent of the plummeting price of PV, he explained. “Nobody knew you were going to go from $2 per watt a couple of years ago for a PV module to $0.65 or $0.70 today.”

Elie Nasr, director of utility business development at SMA America, said his company provides two models of solar inverters. The first, which is compliant with IEEE 1547 and

UL 1471, comes with no frills and “provides no grid support.” But, he said, when utilities require advanced features for large-scale solar installations, SMA can configure the same inverter to provide voltage ride-through, frequency ride-through, power factor adjustments, volt/VAR control and automatic over-frequency response.

“All this is available because it has been required under German regulations since 2008,” Nasr said. Furthermore, he added, “We can also provide open-protocol communication so that you can dispatch an inverter remotely from the control center.”

Still, he admitted, solar intermittency can be an issue for utilities, not so much when the grid is recovering from a small cloud passing over — because utilities can adjust inverter ramp rates to control recovery — but rather when broad cloud cover immediately shuts down active power. “That’s still a challenge in the industry, particularly on a specific feeder,” Nasr said.

Local Solar, Vicious Cycle

Still, there can be problems at the distribution level. As Bill Labos, director of asset reliability at PSE&G, explained it, “PV system developers need to be aware that installations in any urban environment where underground distribution is present may involve network distribution systems,” which were never designed to backfeed power to the utility source.

If the solar output exceeds the load at the facility, Labos said, “The excess power will begin to backfeed, which will cause the network protectors to open,” and the customer will lose power.

When this happens, the IEEE 1547/UL 1741-compliant inverters will shut down and the network bus will be deenergized, said Labos. At that point, all of the network protectors feeding the solar facility will have opened, and the network protector relays will have ceased to detect reverse current. Since the network bus is dead and the source feeder cables are hot, the network protectors will automatically begin to restore power to the network bus one at a time.

As soon as one network transformer and protector restores power to the network bus, the solar system begins its auto-restart sequence. Many designs will automatically allow the inverters to restore the solar system after receiving normal power for 5 minutes. At that point, the solar system will once again begin to generate and export power. The entire sequence will repeat and continue until the network protectors fail. It is during late spring and late fall weekends (for example, when no air-conditioning or heating systems are operating) that the risk of solar system backfeed is the greatest, said Labos.

PSE&G is not alone with these concerns. The California Public Utilities Commission, along with all the major California utilities, and several national laboratories are looking to develop a simplified method for determining the hosting capacity of distribution feeders to simplify the utility interconnection process for solar generation.

How Storage Might Help

“The challenge with wind and solar is not how to integrate,” said Rick Miller, senior vice president of renewable energy services at HDR Engineering, but rather it is what kind of generation can be used for grid balancing. “You need a flexible tool in the toolbox to complement wind and solar to reduce uncertainty,” he said, and that tool could be energy storage, if proper incentives for constructing storage facilities were developed.

However, until energy storage systems are perfected, curtailment of solar generation will be the default solution when lines are overloaded, and Germany, with its enormous solar penetration is a case in point. “In Germany, in 2011, wind and solar owners were paid to dump 45 GWh of generation, and, by midyear 2012, they had already been compensated for 100 GWh,” said Nadav Enbar, an EPRI senior project manager. “It’s not the most economical approach, but it’s what they feel they should be doing under the circumstances,” he added wryly. Right now, he said, Germany is flirting with funding incentives to build up energy storage, but the real push is to better manage variability on the distribution grid, and, with the new grid codes the country has in place, the Germans may not need a lot of storage.

Back in California, SCE’s Montoya noted, “We’re doing a lot of work in the storage area.” In fact, in the Tehachapi area, about 100 miles (161 km) northeast of Los Angeles — where SCE already has some 600 MW to 800 MW of wind capacity and projects a total of perhaps 4,500 MW — overloading of the 69-kV lines has led to curtailment. As such, Montoya added, it is an optimal spot to test large-battery storage, and SCE is now building an 8-MW/32-MWh lithium-ion battery energy storage facility on-site.

Some of the questions he hopes the project will answer: Can this device be used to eliminate the transmission issues the utility is seeing? Can SCE eliminate intermittency on its transmission and distribution systems? Can it use energy storage for ancillary services? And critically, how will it perform in dynamic situations (for example, where the system is changing rapidly)?

National Grid’s Dagher said his utility will be experimenting with energy storage, but he said frankly, “Energy storage today has its own challenges. You’re adding a costly and inefficient battery to a costly and inefficient renewable system. We need to learn how make them more efficient and to use them better.”

ABB has come up with an interesting wrinkle: It is working with General Motors to repurpose used electric vehicle batteries for localized energy storage. “Once they’re down to 70% of their capacity, they’re no longer suitable for electric vehicles,” says ABB’s Stojanovic, “but they can be used for localized grid storage.”

And Ionex, a California start-up, is offering utilities three different batteries with varying discharge rates — from a fairly standard 30 minutes down to just 2 minutes — in what the company’s president, Phil Roberts, calls a hybrid approach to integrating solar generation.

Learning from Germany

As noted above, with some 32.3 GW peak of installed solar capacity, Germany clearly leads the world. That’s the good news. The bad news is that the vast majority of those new PV installations are small rooftop PV systems installed on low-voltage distribution networks not designed to handle generation. As a result, despite being tied to significant generation in surrounding countries — Norwegian and Austrian hydro power, for instance — the German grid had become vulnerable to limited disruptions, including reverse power flows in both distribution and transmission networks as well as grid-stability issues involving voltage and frequency fluctuations.

Fortunately, says EPRI’s Enbar, “America and other countries can certainly benefit from Germany’s experience as an early adopter.” A key German vulnerability, he noted, is the fact that millions of PV panels — “perhaps some 10 GW of capacity” — could disconnect from the grid if the frequency exceeded 50.2 Hz (European grids operate at 50 Hz). “To avoid a catastrophic grid failure,” said Enbar, “the country made the decision to retrofit 315,000 inverters that were installed after August 2005 at a cost of €75 million to €150 million (US$100 to $200 million).”

As ABB’ Stojanovic and SMA’s Nasr noted, these retrofitted inverters, along with all new German inverters, are less sensitive to fluctuations and will not cut out as quickly as the older models. “They can ride through frequency fluctuations, and their responses can be staggered in time to minimize switching impact,” Enbar continued.

In fact, under the new German grid codes, “All new inverters are required to accept load control signals so that grid operators can signal them to curtail their operation in steps at 90%, 70% and 30%,” said Enbar. “With that kind of control, grid operators can spill solar to balance load flows without compromising the system.” Enbar also noted that the new inverters will have the ability to increase or lower reactive power “to keep the voltage up and down the line under control.”

Overall, the Germans have three approaches for controlling solar energy: local, decentralized and central. With local control, individual inverters would react automatically to local conditions. Under a decentralized approach, control would shift to distribution systems, perhaps along geographic lines, but all solar inverters in a given area would be linked to substations through smart grid communications technologies. Finally, under a centralized control strategy, all solar systems would communicate directly with a utility’s control center, where operators and computers could regulate power flows.

A Smart Solution?

As Dieter Rosenwirth and Kai Strubbe of the German technical services firm TÜV SÜD Industrie Service recently noted on RenewableEnergyWorld.com, “In the medium to long term, power consumers and generators must be connected in an intelligent grid — a smart grid. This is the only possible way to manage the growing share of intermittent energy in the grid reliably.”

Clearly, this idea has legs. For instance, EPRI was awarded a $4.4 million grant from the Department of Energy’s solar program to develop smart-grid-ready PV inverters that offer grid support and the utility communication and control links necessary to achieve a higher penetration of distributed renewables in existing distribution systems without creating operating, reliability or safety issues. National Grid, DTE Energy, Xcel Energy, Pepco, Hydro One, Great River Energy, Kansas City Power & Light and American Electric Power are collaborating on the project.

Also, to aid the installation of solar and energy storage systems, the DNP Users Group has just released a new DNP3 application note (for example, an extension to the standard) that will facilitate utility communication with and control of devices such as inverters, capacitors and other distributed energy resources equipment. According to Brian Seal, vice chair of the group and an EPRI technical executive, said, “If you think of DNP3 as a dictionary, we basically added a bunch of new words. We haven’t changed the protocol.”

Without an open communications standard for solar equipment, manufacturers would be forced to develop their own proprietary languages, Seal explained. “That can work fine as long as there are not many different brands,” he added. But, with DER, there is a huge diversity of equipment and manufacturers, and the situation could rapidly become unmanageable, “so it was a good time to get a standard way to connect with those systems before we have high numbers.”

Distribution systems also are the focus of research at the California Institute for Energy and Environment (CIEE).

Alexandra von Meier, co-director, electric grid research at CIEE, said, “The problem is that distribution systems were designed with no thought to intermittent generation.” Small amounts of renewables can be tolerated by utilities, she said, but, with the higher penetration of wind and solar, it has become impossible to ignore power, quality and capacity issues that intermittency presents.

There is no question that monitoring is absolutely necessary to find out exactly what those impacts are. That said, distribution systems “are a tougher nut to crack,” added von Meier. “Along with cost issues, much greater precision is required” than with transmission systems. “So, our philosophy here is to leapfrog SCADA and go right to phasor measurement units (PMUs).”

Accordingly, the CIEE is working with California-based Power Standards Lab (PSL) under an Advanced Research Project Agency grant to deploy micro synchrophasors. Von Meier said that these are similar PMUs used on transmission systems, but they offer more precise angular resolution — less than a tenth of a degree — and a much lower installed cost. The micro PMUs are based on PSL’s PQube technology and should be capable of simultaneously measuring phase angles, capturing power disturbances and recording precision power flow.

SCE’s Montoya seems to agree with a smart solar approach, but his focus includes transmission. With all the Western states, two Canadian provinces and Baja California connected in one massive bulk power grid, “We need a coordinated effort to ensure intermittency from renewables does not put the transmission system at risk,” he said.

As a result, “We’re doing a lot of things, including looking at sychrophasor technology, wide-area monitoring and controls, and adapting protection relays to different conditions based on intermittency. There’s a lot of complexity, and we’ve got a lot to do in a short period of time,” Montoya said.

Tom Key, EPRI’s technical leader for renewable and hydro power, seconded Montoya’s concerns. He believes that Germany provides a lesson for U.S. utilities and regulators. In Germany, the growth of solar happened so fast, in large part because it was mandated by the government and feed-in tariffs were so generous. “There really was no time for utilities to connect in the best way,” Key said.

When problems developed, the government created a national grid code to keep things under control. “[German] utilities were totally left out of the solar business,” Key noted. “That’s really an important message. Utilities need time to engage so that doesn’t happen here.”