DER Marketplaces: How Can Utilities Find Their Place in Them?

The annual Black & Veatch 2019 Strategic Directions: Electric Report survey found that across the energy sector, there’s no denying the revolution of distributed energy resources (DERs), the advanced technology that generates power at or near their point of use. Illustrating a major marketplace shift as ratepayers take stock in their consumption habits and press for affordable, resilient, and sustainable power, DERs represent the electric market’s dynamic, decentralized nature.

Along with such new opportunities and challenges for the sector comes the vexing question: how big of a role will utilities play — or be allowed to play — in this DER movement that will lead to a more decentralized grid and an altered dynamic between ratepayers and providers?

There’s little debate or confusion about how much DERs have gained adoption across the United States, in large measure because of their broad applications. They come in everything from solar photovoltaic (PV) systems, fuel cells, and battery storage to combined heat and power plants, microgrids, electric vehicles (EVs), and even controllable loads such as electric water heaters and heating, ventilating and air conditioning (HVAC) systems. Some DERs are designed for residential use; others are so robust and advanced that they serve commercial and industrial needs.

And the slice of the pie is only getting bigger for DERs as the technology continues to mature and becomes more cost-effective, along the way promising to offset the need for utility-provided power.

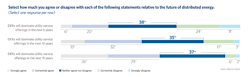

Of course, utilities are taking notice. According to the recent Black & Veatch 2019 Strategic Directions: Electric Report survey of nearly 900 electric industry stakeholders in North America, the majority of respondents see utility investment in DERs as a longer-term play, with 55% agreeing that DERs will dominate service offerings during the next decade and a half. But that’s not to say that DER penetration won’t come sooner, with a quarter of respondents pointing to the next five years and 45% looking at the 10-year window.

DER Opportunity and Regulatory Challenges

A 2017 Greentech Media report found that at least 32 million metered customers in the United States had access to a DER marketplace and 56 utilities were operating or planning a marketplace. Such marketplaces — once largely limited to energy efficiency efforts by residential customers — are growing in size and scale, offering advanced technologies such as microgrids with renewable generation and storage that can be deployed by commercial and industrial customers.

DERs are a bit like the Wild West, subject to a mix of local, state, and federal policies and tied to vastly different regulatory models: some regulators are mandating utility investment in DERs, while others enforce rules designed to limit their role. How do utilities move confidently into the DER future without a regulatory model reflective of new technologies and customer demand?

This question is clearly in play when it comes to the health of the utility business model. Nearly half of the respondents — 46% — to the Black & Veatch survey say that without updated regulatory constructs, behind-the-meter energy supply options by customers or third parties will threaten the traditional utility model. Another 43% said the threat is real if utilities fail to implement their own solutions.

Aggressive moves by utilities into the DER arena — at least for the near-term — may be muted by regulations meant to maintain competition. Concerned over utilities’ traditional ability to act as a monopoly, New York, Arizona, and other states with active DER marketplaces have either adopted or are exploring new rules that would restrict DER ownership by utilities. The intent: nurture innovation and encourage new, non-utility players to enter the field.

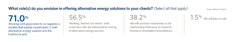

All of this brings into clearer focus the fact that regulatory engagement around DER penetration will remain critical for utilities. Black & Veatch’s survey results show as much, with the strong majority of respondents agreeing that utilities will need to work with both governments and customers to enable a future where they can reliably offer alternative energy solutions.

Taking matters a step further, nearly three-quarters of respondents prioritized the need to develop regulatory models that would enable investment in both alternative energy and the traditional grid. Slightly more than half stressed the need to work with customers behind the meter; only in this way will utilities be able to progress as they work to offer alternative energy solutions to clients.

A Tipping Point and a California Case Study

Industry observers believe many utilities, rather than being mandated to be more than merely generators or “poles and wires” companies, ultimately will embrace that transition. Clean energy targets are happening in California, New York, Michigan, and elsewhere, with legislative policies tied to sustainability goals or renewable portfolio standards moving power providers to action.

Effective deployment of DERs by utilities will require a heavy dose of planning and cost considerations that examine a range of factors, from the impact on the local distribution system and its effect on the broader regulatory ecosystem to the cost of deployment and operating and maintenance costs.

In 2017, Black & Veatch partnered with the Smart Electric Power Alliance (SEPA) to develop a case study detailing the Sacramento Municipal Utility District’s (SMUD) efforts to create an integrated DER planning process. A key finding of the report was that consumers were well on their way to outspending utilities in the adoption of solar, storage, EVs, and other DERs, making it essential for utilities to track and integrate these DERs into their planning processes. In fact, upgrades to distribution system infrastructure to support new EV-charging or other distributed infrastructure often is the longest lead-time activity in deployment project schedules. Understanding the capabilities of the existing system, upcoming DER deployments, and scheduling network upgrades is becoming more critical. The planning component is critical — not only to benefit their customers and the grid, but also because the broad adoption of cost-effective DERs will factor heavily into load growth for utilities.

DER penetration growth will require new business models to help define the cost and benefits for utilities. Would such a model include ownership and maintenance of assets? Or would it open the door to new opportunities, such as a utility partnering with a third party to leverage the utility’s existing footprint while containing costs?

In SMUD’s case, the district pursued a strategy of distributed storage to support high levels of renewable energy production by incentivizing home battery energy storage systems and deploying utility-owned battery energy storage systems through its system. While the impact of solar alone can increase ramping requirements (that is, the duck curve), the DER portfolio simulated in the SMUD study actually decreased ramping and flattened the utility’s net-load profile. The study also found that savings may not offset costs under today’s policies (SMUD’s lost revenue and program costs for most DER technologies would be larger than its cost savings on the bulk system) and that changes to rates and business models would need to be considered.

The SMUD study demonstrated the need for integrated DER analysis to identify potential problems, make utility planning processes more robust and improve utility-customer relations through better policies and programs. As we head toward a new decade — and the efficiency technologies it will put in the hands of power customers big, medium, and small — the need for DER planning and regulatory engagement has never been stronger.

Part 1 and Part 2 in this four-part series addressed utility company wish list in planning for the distributed grid and cybersecurity, maximizing opportunity while limiting vulnerabilities. Part 4 will address why utilities need more customer focus.

About the Author

Heather Donaldson

Heather Donaldson is director of Black & Veatch Management Consulting, where she is responsible for supporting clients through grid modernization, DER integration, and other transformations.

Jason Abiecunas

Jason Abiecunas is associate vice president, leading business development for the Global Distributed Energy business line at Black & Veatch. Abiecunas leads a team that delivers sustainable, resilient, and cost-effective distributed energy solutions to address a wide range of power issues and enable the company's clients to capture new business opportunities.