The top utility regulatory trends in 2019 span from renewables dominating utility resource plans, to wildfire-related safety and liability concerns in California, to transportation electrification. A recent Advanced Energy Economy report provides useful insights into the current state of the evolving grid through the discussion of these trends:

1. Renewables Dominate Utility Resource Plans

The trend in recent years has continued toward a more advanced, clean, and flexible grid. This has largely been driven by the continued price decline in renewables. In some states, it is cheaper to build new wind and solar plants than to operate existing fossil-fuel power plants, thus renewables are dominating their long-term resource plans. As you can see in the map below, at least nine states plus Puerto Rico and D.C. have now set 100% clean energy targets.

2. The Utility Business Model

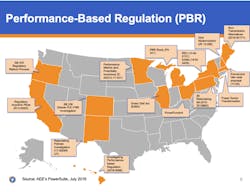

Many states are exploring changes to the traditional cost-of-service regulatory model to move toward a system that better reflects new market conditions, allows utilities to take advantage of the growing service economy, and rewards performance against established goals rather than inputs.

In addition to these efforts to rethink utility business models and regulation on a broad basis, many states have taken on specific aspects of reforming how utilities conduct their planning and operations, such as distribution system planning (see paragraph 3 below) and procuring non-wires alternatives to traditional utility investments (see paragraph 4 below).

3. Distributed Energy Resources

As Distributed Energy Resource (DER) deployment continues to grow, utilities and DER companies are seeking ways to maximize the benefits of DERs to the system, while maintaining reliability and reasonable costs for customers. New York and California have continued to refine their distribution system planning processes in 2019, while several additional states have taken steps to implement processes of their own.

4. Non-Wires Alternatives

Non-wires alternatives (NWAs) to traditional investments in transmission and distribution equipment are increasingly being looked to as viable options in several key states. The next steps to making NWAs a widespread reality is to (1) identify the areas where NWAs can meet a need at a lower cost than a traditional utility investment, and (2) develop a framework to implement and/or procure the NWA solution. Several states have made significant progress so far in 2019 including New York, Maine and California.

5. Wildfire Liability

In January, the largest investor-owned utility in California, Pacific Gas & Electric (PG&E), filed for Chapter 11 bankruptcy because of accrued liabilities resulting from the devastating wildfires of 2018. As part of the bankruptcy process, PG&E sought and received approval for $5.5 billion in financing to support operations and ongoing safety initiatives during the bankruptcy process. At the start of the year, the California Public Utilities Commission opened an investigation to determine if PG&E, as currently constituted, can provide safe electric and gas service and to review alternatives to PG&E's current management and operational structures.

The CPUC has also adopted a set of criteria and a methodology for conducting a financial “stress test” for future wildfire cost recovery. The methodology is intended to inform determinations of the maximum amount an electric corporation can pay without affecting their ability to raise money in capital markets, which could ultimately harm ratepayers or affect their ability to provide safe and adequate service.

6. Renewable Energy

As renewable energy has become more competitive on price, customers are increasingly looking for ways to not only power their operations with 100% renewable energy, but also dampen price volatility and reduce energy costs. There are several avenues for customers to increase their access to renewable energy ranging from direct access programs to renewable energy tariffs to community solar programs.

- In January, Xcel Energy in Minnesota filed for approval to expand their Renewable Connect Pilot Program (a renewable energy tariff aimed at businesses that want access to renewable energy) into a full-fledged program. Xcel stated that the pilot sold out in one year and there are more than 400 customers on a waiting list.

- In March, the California Public Utilities Commission opened a rulemaking to implement reopening of the state’s direct access (DA) program. The DA program, which has been limited to about 11% of peak load since 2010, allows retail nonresidential customers to purchase electricity service directly from competitive providers

- In May, Dominion Energy in Virginia filed an application for a 100% renewable energy tariff that would allow customers with under 5 MW of peak demand to receive 100% of their energy and capacity from a portfolio of renewable resources owned or procured by Dominion for a premium over standard service.

- In March, Florida Power & Light proposed a solar subscription program — SolarTogether. The program would give customers of all rate classes the option to subscribe to blocks of solar capacity (with no long-term commitment) from dedicated 74.5 MW solar power plants. FPL stated it has already pre-registered 200 customers, totaling 1,000 MW, for the program, mostly from commercial and industrial customers.

7. Community Choice Aggregation

Community choice aggregation (CCA) or municipal aggregation has been around for a few decades but it has risen in popularity the past couple of years, driven in large part by communities wishing to take control over how their energy is generated. The concept of CCA is fairly simple. CCAs are classified as governmental entities, most often formed by cities and/or counties, that procure power on behalf of their residents. While the CCA provides power for residents, the designated utility still provides transmission and distribution service in the area.

In California, CPUC staff estimated that by 2025 over 85% of California’s IOU retail load could be served by Community Choice Aggregators (up from about 20% today). New York also recently refined its framework to make it easier to form CCAs, which has led to several municipalities filing implementation plans. In January, the Massachusetts Department of Public Utilities (DPU) opened an investigation into improving the retail electric competitive supply market in Massachusetts, including increasing customer awareness of the competitive market and the value it can provide.

8. Transportation Electrification

The deployment of electric vehicle (EV) charging infrastructure has risen to the forefront in many jurisdictions, as improvements in technology have dramatically expanded the EV market and PUCs have continued to develop focused transportation electrification strategies.

California continues to lead on transportation electrification with 49% of the nation’s electric car sales originating in the Golden State. At the turn of the year, the California Public Utilities Commission initiated a rulemaking to provide more structure and guidance on future transportation electrification investments and to streamline the application process.

There has been no shortage of activity across the country with utility proposals or statewide investigations in Wisconsin, Missouri, New York, Vermont, Arizona, Colorado, Delaware, Iowa, Maryland, Michigan, Minnesota, North Carolina, Oregon, South Carolina and Texas.

9. Grid Modernization

The first step toward grid modernization is often advanced metering infrastructure. In May, Indiana Michigan Power took this first step by filing an application in Indiana as part of a larger general rate case asking for full smart meter deployment by 2022.

Other states are looking at grid modernization more holistically. In March, the Arkansas Public Service Commission initiated a DER and grid modernization investigation. Additionally, in the District of Columbia, six working groups with over 100 participants across industry met to work through a variety of issues facing its electric power system. The process culminated in a final stakeholder report with 32 recommendations consideration related to data, information access and alignment, non-wire alternatives, rate design, utility business model reform, customer impacts, microgrids, and pilot projects.

10. Net Metering and DER Valuation

Net energy metering (NEM) has been successful in spurring the adoption of distributed generation across the country. As net metering-eligible resources continue to decline in price, the number of NEM customers has increased, which has led to pushback in many jurisdictions. Over the past couple of years, states have taken various approaches to successor tariffs to NEM, ranging from reductions in net metering rates for exported electricity to the development of regulatory structures to more precisely value and source services from DER.

An example of the holistic approach to net metering reconsideration can be found in Connecticut, where a proceeding has been opened to study the value of DER. Other states, however, seem to be moving in a direction that may be unfavorable to future DER adoption such as in Louisiana and Idaho. In January, the Louisiana Public Service Commission Staff proposed a rule that would compensate new net metering customers at avoided cost, rather than the retail rate. In April, Idaho Power filed a petition to suspend net metering service and explore modifications to the compensation structure under its net metering program. On the flip side, New York recently made some adjustments that should provide fairer treatment for customers that have significant distributed generation facilities.

The full AEE report can be found at: https://blog.aee.net/top-10-utility-regulation-trends-of-2019-so-far

About the Author

Martha Davis

Senior Director of Content

Prior to working at T&D World and Utility Analytics Institute, Martha worked as an executive in the energy industry for about 15 years. She has held various regulatory and government affairs positions and had the opportunity to shape public policy.

Martha has a B.A. from Westminster College in Fulton, MO; completed specialized legal and public policy coursework at American University in Washington, D.C.; M.P.A. Public Affairs and M.B.A. Business Administration both from the University of Missouri. She is currently a doctoral candidate at the University of Denver where she is researching business analytics, innovation and regulation.