David Treichler is presenting at our our virtual event, Black Sky Hazards & Grid Resilience, November 16-17, 2021. This event is free for utilities

Anyone who flies into the Dallas/Fort Worth International Airport is struck by the sea of warehouses that touch land at both ends of the runways. Depending on when one is landing or taking off in a plane, these warehouses may have a vast number of trucks and trailers backed up to loading docks. The amount of freight moving through warehouses and logistics centers in Texas truly is astounding. According to the U.S. Bureau of Transportation Statistics, approximately 14.9% of all U.S. freight by tonnage moves in or through Texas, with Dallas and Fort Worth the common point of most major North-South and East-West interstate highways.

For Texas, home of the Permian Basin and Houston Ship Channel refineries, fueling the vast fleets of trucks hauling this freight is not a problem today. However, if — and more likely when — fleets are transitioned to electric drive, suddenly fueling takes on a new importance for electric utilities like Oncor Electric Delivery Co. LLC. Faced with this potential reality, Oncor developed a tool to enable what-if analyses based on fleet information and their transition impacts over time. The analytics tool has enabled the utility to do advance planning and be more responsive to customers who ask about fleet electrification.

Near-Term Concern

The underlying issue with fleets transitioning to electric drive is most warehouses and distribution centers have relatively light loads, generally in the range of 100 kW to 200 kW. Typically, the loads are for small office areas and lighting. If a reasonable fleet of class 6 or class 8 heavy-duty trucks — for example, 40 trucks — were to move to electric with overnight depot charging, something on the order of 9 MW could be required, depending on operational requirements. If the fleet were 400 trucks, there could be loads of 40 MW per distribution facility, again depending on operational requirements. Therein lies the problem, considering the current loads are in the range of 100 kW to 200 kW.

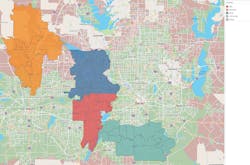

Why is this a near-term concern? When considering the density of logistics and distribution centers in the Dallas-Fort Worth area, which may or may not be the case elsewhere, multiple distribution centers easily all could be served by a single substation. What happens if eight distribution centers on the same substation (currently expecting 1.6 MW of load) replaced 10 of their diesel tractors. This would equate to 18 MW of charging load materializing in a short period of time.

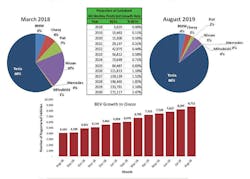

Data Points and Trends

It seems many utilities have looked at the issue of green fleets and decided — since only prototypes are in the market currently — they have time before needing to invest the time, energy and resources in analyzing how to serve possible rapid fleet transitions. However, some utilities may have overlooked one or more of the following data points and trends:

1. Most of the major original equipment manufacturers (OEMs) for fleet category trucks intend to go into production with electric versions in 2021 or prior.

2. While even the largest trucks with weight limits above 19,500 lb (8845 kg) will have only an average range of 200 miles (322 km) or so initially, trucking companies have been dealing with a shortage of drivers. The shortage is being reported by multiple sources as in the range of 50,000 to 75,000 nationally. To attract more drivers, many companies are offering shorter hauls, where a driver drops the trailer at a yard — often near a state line — and picks up another one to return to the depot. This round trip is frequently less than 200 miles, and the vehicle is at the depot overnight, where it can be charged.

3. OEMs have been looking at different charging approaches. Many operators have discussed the “overnight-at-the-depot” model, which may be able to charge using level lower kilowatt direct-current (kW DC) fast chargers (60 kW to 150 kW). However, because of the cost of the electric tractors, some OEMs believe the vehicles should not sit overnight at the depot but operate on a 24/7 strategy instead. To maximize road use, the charging periods must be much shorter. This can be achieved using a higher kW DC fast charger, so a trailer could recharge sufficiently during loading to make the next run. For utilities, the concern is some OEMs are working toward DC fast chargers at 1 MW rather than the 150-kW to 350-kW chargers currently being deployed for noncommercial charging. Depending on operational needs, the number of chargers operating simultaneously can create significant peak-hour loads.

4. A significant number of fleets are leased through third parties. These companies often acquire a full-service lease, which essentially is buying miles driven. The cost and maintenance of the vehicle is a single wrapped expense. The issue with this for utilities is recognizing when an electric truck, of whatever class, becomes $0.01/mile cheaper than diesel to operate on a life-cycle cost, the user seriously will consider beginning to change out the fleet. With the number of miles driven daily, the pennies turn into profits quickly. Depending on operational requirements, some fleets may be changed out in as little as five years while others that are lower annual mileage may go as long as 10 years.

5. Fleet transition becomes an annual incremental load increase utilities will need to plan for, as cost will drive the fleet operator to the lowest-cost solution to maximize profit.

6. The concentrations of fleets will gather in predictable places: at airports, along interstate highways — most often in proximity to intersecting interstates — and at rail intermodal sites.

7. Often substations serve both commercial and residential loads. When looking at the projected green fleet load growth on a substation, it will be important not to ignore the residential and commercial load growth on that same substation.

8. Voltage is not the sole concern of a utility serving a fleet charging depot. The design of the capacity solution must address harmonics and power quality when all chargers are employed simultaneously.

Strategic Growth Tool

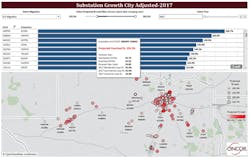

In 2018, Oncor tapped a cross-functional team to work with both the serve new and new construction management teams to build a strategic growth tool. The team chose Tableau as the visualization tool. The utility previously had geo-located its substations and populated the locations with configuration and capacity data in Tableau. For the strategic growth tool, the cross-functional team took a year to identify sources of information and data that could give utility personnel increased insight into load growth driven substation upgrades and related capital expenditure budgeting.

The primary source of data was from the Texas state demographer, which provides yearly population projections by ZIP code. While this data is helpful, by itself it does not go to the granularity needed to determine individual substation growth. As a result, Oncor obtained additional information from the Texas Water Development Board and Texas Department of Transportation to build algorithms that would provide a more granular look at growth, particularly along highway corridors.

The team also met with the North Central Texas Council of Governments to learn about a different approach the council is developing that uses satellite imagery to extrapolate growth based on emerging historical patterns. The Oncor team chose to stay with its data-driven approach rather than move to an extrapolated approach. The team that developed the Oncor strategic growth tool received an innovation award from the utility in 2019.

In the development of the strategic growth tool, it was determined green fleet impacts could be considerable and a similar tool was needed to address Oncor planning for fleet electrification and be more responsive to customers who ask about it. Returning to the point about substations carrying loads from both fleet users and residential developments in many cases, it was determined the strategic growth tool was a platform that could be enhanced to deliver the insights and information needed to do advance planning and provide initial information to customers.

Green Fleet Tool

The core team for the strategic growth tool agreed to help a smaller team consisting of three engineering interns working with the strategy and technology team. The interns came from three different disciplines, mechanical, electrical and industrial engineering. This complementary set of skills has been helpful in enabling innovative approaches to achieve the fidelity of data needed.

In developing the green fleet analytics tool, the utility needed to know where the logistics, distribution and warehouse centers are located in Texas. The team was able to identify a data layer from the North Central Texas Council of Governments locating every facility of greater than 80,000 sq ft (7432 sq m). This data layer was added to the Tableau tool developed for strategic growth.

The next task was to identify fleets. Oncor wanted the tool to identify transit, school bus and other public fleets as well as commercial green fleets. Th utility obtained a file from the Texas Education Agency that identified the composition of school bus fleets by school district. Oncor customer information was needed to gather the location of the school bus barns, so the fleets, their composition and ages could be tied to an Oncor substation. The team attempted to obtain information from various federal and state agencies, but it either found the data incomplete — and, therefore, unusable — or protected by privacy laws.

After many months of working with bad or incomplete data, that approach was abandoned. A commercial source was identified for the needed information. FleetSeek provides data on vehicles registered to owners, with the owner’s address but not necessarily the vehicle premise location. The file contains approximately 21,600 fleets in just the Oncor service area. The earlier task of installing the data layer with buildings and matching them to building owners or occupants was essential now for doing one more interpolation: estimating the size and composition of fleets at the identified locations. From there, the tool can help to predict load growth requirements at individual substations.

The primary lesson learned from this effort was that data required to profile fleets is not easily or readily available unless a utility knows where to look. This was exemplified by Oncor’s near-yearlong effort to find data suggestive of the impacts of fleet electrification. Even with the data cleansing Oncor has undertaken, the utility believes it must touch every fleet owner to validate the tool.

What Next?

To complete the green fleet tool, Oncor must extend the data matching to the entire service area. Currently, the tool is loaded mainly for the Dallas and Fort Worth area, which contains the densest concentration of facilities and fleets. Once tool is loaded for Oncor’s entire service area, validation of the data will commence, which will require contacting all fleet owners. The fleet files obtained from FleetSeek provide contact information, which will be essential for this work. This contact will enable Oncor to judge where the earliest adopters likely are located and profile the fleets to give more accurate projections of load requirements based on multiyear fleet transitions and their proximity to each other.

The final task of the initial development of the green fleet tool will be to incorporate the strategic growth projection elements from the strategic growth tool. At this point, the tool can handle robust planning, which feeds into capital expenditure planning as well as enables customer teams.

The Oncor green fleet tool is intended to accelerate the utility’s customer responsiveness by having high-level information readily available for what-if analyses based on validated insight on fleets and their transition impacts over time. Oncor has been updating studies of electric vehicle impacts on residential feeders and determined significant impacts will be point issues for the immediate future, where relatively normal investment and transformer upgrades may be needed. In some instances, reconductoring may be required where concentrations arise at the end of a radial feeder.

Planning for such requirements is within the annual efforts of Oncor’s system maintenance. On the other hand, green fleets could have significant impacts that, over time, incorporate new transmission build and significant new substation and reconductoring of service lines to serve vastly expanded loads. Because of these significant potential impacts, Oncor is anticipating and incorporating green fleets into its planning and outreach efforts.

For more information:

FleetSeek | https://fleetseek.com

Fleet Charging Requirements

Preliminary data indicates there are approximately 21,600 fleets in the Oncor service area. These include fleets of two vehicles as well as fleets of hundreds of vehicles.

- Depot overnight:

- Delivery Vans: Possibly level 2 – 240 volt 48 amp service

- Short Haul/Municipal: DC Fast Charge – 150 kW to 1 MW

- Continuous Use:

- Regional / Long Haul: DC Fast Charge: 250 kW to 1 MW

- Impact: A large depot could require between 5 – 40 MW additional load at a facility currently likely running less than 300 kW (unless A/C or Refrigerated warehouse)

About the Author

David Treichler

David Treichler is the director of strategy and technology for Oncor Electric Delivery in Dallas where he is responsible for strategic analysis supporting the growth of the enterprise. Prior to this role, he held senior roles in classified intelligence and defense systems, public education, finance and economic development. As a futurist, he has written 19 novels that seek to inform the discussion regarding how rapidly transforming technology is changing the nature of human relationships in an increasingly mediated world.