Challenges of Building a Smart Grid Business Case

Technologists often guide a utility’s plans for grid modernization. Though that is a crucial and laudable role, it is not enough. Technologists must also build and articulate a business case for grid modernization projects that will pass muster with their enterprise executives as well as external audiences such as regulators and the public they represent.

Thus, technologists must also be familiar with their utility’s fundamental business drivers, how a technology project aligns with and supports those drivers and the financial metrics that support a positive business case.

The process begins with a holistic view of the utility organization as both a business and a technology operation – two sides of the same coin. In this brief article, I’ll discuss common business metrics relevant to technology business cases, offer a few examples of common technology projects and provide real-life cases where all these factors came together.

Key metrics

The goal of a technology business case is several-fold: to capture all hard benefits to the utility, across all operations and enterprise units, tally one-time capital and ongoing operations and maintenance costs, determine the length of the payback period and how the project may support soft benefits such as the utility’s strategy.

One result is a benefit-cost ratio (BCR) that is greater than one, reflecting greater benefits than costs. Another metric is the payback period, a metric that should make sense in light of the BCR. (A strong BCR of 3:1, for example, is undercut if the payback period is a decade or longer.)

Accounting for soft benefits that support the enterprise’s overall strategy is just as important. How does each dollar invested impact, for example, reliability indices and lower carbon emissions? Service reliability is obviously important to customers and regulators, but improving it may be difficult to quantify in dollar terms. The same goes for carbon emissions and environmental sustainability; these are desirable goals but challenging to quantify in financial metrics.

Put simply, however, enterprise executives, regulators and the public all want to see – to put it in the vernacular – “the most bang for the buck.”

A holistic view

These points sound obvious, but for decades technologists have tended to work in silos and focus on the operational needs and goals of their bailiwick in isolation. A holistic, de-siloed approach to technology projects and their business case requires a pan-organizational approach. For example, I perennially advocate that a utility become “strong” before it becomes “smart.” That means building an information and communication technology (ICT) infrastructure that will serve the utility’s current and foreseeable needs across the board. But if data communication and processing needs are assessed in silos, what works for one operational unit may not serve another. Too often, this approach leads to redundant technology projects, each with a weaker business case than if the entire organization’s needs were assessed holistically.

More than 20 years ago, Chuck Newton of Newton-Evans Research Company, Inc., surveyed over 100 North American utilities on barriers to substation automation, which provides myriad hard benefits. No technology barriers were cited by survey respondents. Instead, the barrier most frequently cited was the lack of economic justification. As substation automation frequently offers a quantifiable leap in reliability and efficiency, I’d suggest that technologists simply weren’t tallying all the benefits it offered, or in some cases, were unable to put the business case together. In my view, so little has changed in the intervening two decades that building a technology business case deserves our attention.

The SCADA/DMS business case

Any utility’s first supervisory control and data acquisition (SCADA) project typically presents easily identifiable benefits, many of which stem from the operational efficiencies of remote monitoring and control. So it was with a municipal utility in Ruston, Louisiana and another in Paducah, Kentucky. Both utilities had used dial-up modems over leased phone lines for intermittent monitoring of key distribution substation functions, so both “munis” needed to become strong – that is, build an ICT infrastructure for current and future needs – before becoming smart (for example, adding monitoring and control functions).

In Ruston’s case, the utility and a consultant tallied SCADA-related savings. [1] Broad categories included a decrease in outage duration, load management via voltage reduction to reduce peak demand, improved load balancing/decreased line losses, improved voltage profile/decreased over-voltage, automatic generation control, improved communications and elimination of leased phone lines. Another benefit, without substantial cost, accrued from Ruston’s use of the same SCADA system to separately monitor and control the town’s water and wastewater systems.

Ruston’s SCADA project proceeded, based on a BCR of 2.6:1, a payback period of only 2.5 years and significant annual savings thereafter. Ruston achieved this result by a thorough accounting of all hard benefits across the utility.

In a second case from the 1980s, the Paducah Power System (PPS) also sought to understand and quantify all hard benefits from a SCADA implementation by documenting the value of remote monitoring and control functionality. [2] PPS developed a control philosophy and listed equipment it intended to control, which included air and oil circuit breakers, load tap changers, voltage regulators, reclosing relay cut-off switches and so forth. For SCADA’s data acquisition function, PPS listed data it required and the reason for that need. Because SCADA can be implemented in various ways, PPS also determined that it sought load management functions as well as peak shaving via voltage reduction.

PPS found that three quantifiable benefits included voltage control, direct load control/demand savings and capacitor control-related savings. Soft benefits included increased awareness of system status, better decisions informed by system data and deferred capital expenditures.

Note that these two cases focus on newly acquired, first-time SCADA systems, when the business case often pencils out more easily. The business case for replacement SCADA systems is more challenging because it must assess the benefits of additional functionalities not present with the initial system.

Assessing the SCADA/EMS business case

Calculating a BCR for advanced energy management system (EMS) typically takes one of two approaches. The first method is to document the improved economics of system operation, which will yield a simple and often positive BCR. The improved economics of system operation produce significant projected savings.

When evaluating whether to add security dispatch functionalities, however, building a supporting business case becomes more complex because documenting the resulting, enhanced system reliability is difficult to value in a conventional BCR approach. One option is to assess and document the cost of customer interruptions, the other is to ascertain the value of impacts on (deferral of) capital equipment.

The use of customer outage cost savings in a benefit-cost analysis is a growing trend. These savings stem from reducing the loss of manufacturing productivity, loss of retail sales, the cost of running an uninterrupted power supply and so forth. These costs can be significant; as much as US$10-$15 per kWh savings through reducing unserved energy. A number of excellent references document these savings. [3]

The value of deferred capital transmission system expansion can be determined as well. If a utility’s goal is to at least maintain current levels of reliability, it can assess its transmission planning as if it had or had not implemented a security dispatch system and compare the two scenarios.

In an early, ground-breaking article on this topic, Ralph Masiello and Bruce Wollenberg wrote: “It appears that security dispatch has the potential to realize savings or achieve equivalent improvement in transmission capacity worth perhaps two orders of magnitude more than the incremental cost of including a security dispatch capability in an energy control [that is, management] system.” [4]

Substation automation

The desire for speedy service restoration and the need to manage operations and maintenance (O&M) budgets often drive substation automation (SA) projects. Arguably, these factors align more with business drivers than with direct operational needs. O&M costs affect utility profitability, while power reliability and quality affect customer satisfaction. With SA, reliability improvements boost customer satisfaction. No manual work is needed to reset a breaker, thus the reduction in truck rolls can be expressed in labor-hours, fuel savings and carbon emissions reductions. SA-enabled equipment condition monitoring (ECM), automatic load restoration and feeder automation support all provide additional value.

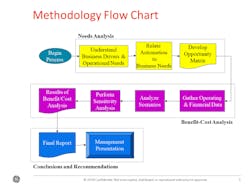

These seemingly obvious benefits must be quantified to build a credible business case for SA. The methodology flow chart in Figure 1 reveals the three key components: a needs analysis, a benefit-cost analysis and conclusions/recommendations. [5] Of course, this flow chart manages to simplify the process, but there’s nitty-gritty number-crunching behind each seemingly innocuous box.

Figure 1.

The technologist must canvass both enterprise and operations to determine the utility’s business drivers and operational needs and how the integration and automation of substation components and functions address them. How well SA addresses business drivers and operational needs must be quantified in the traditional business case metrics: a BCR, a return-on-investment (ROI) calculation, and a payback period. These metrics must capture hard benefits, which can include deferral of capital expenditures, reduction in O&M costs and increases in revenue opportunities. [6]

Some seemingly hard benefits can be difficult to nail down. For example, as already noted, improvements in reliability can be expensive to implement but difficult to calculate in terms of hard dollar benefits. Yet, avoiding fines for poor reliability indices may provide support. Or, obtaining rewards for reliability improvements in a performance-based rate-making environment is fair game. As we have seen, one trend is calculating the costs of customer outages. Yet, soft benefits that bolster enterprise strategy should be articulated as well, and those include improved public and employee safety, improved enterprise decision making and customer satisfaction.

In the early 2000s, MidAmerican Energy Co., the largest power provider in Iowa now serving 770,000 customers over 10,000 square miles, explored the SA business case. [7] MidAmerican sought substation monitoring and control functionality by using intelligent electronic devices’ (IEDs) operational and non-operational data. The utility identified other SA functions with operational benefits and the BCR for those functions, as well as how SA bolstered key business drivers. Operational benefits included online ECM, dynamic transformer ratings, adaptive relay settings, power system disturbance analysis and automatic load restoration. Key business drivers included power reliability and quality of service, cost of service, customer loyalty, enterprise access to non-operational data for reducing O&M costs and the ability to adapt to industry developments.

MidAmerican then proceeded with a validation project that automated one large substation with two transformers with limited IED integration, but solid payback numbers for utility and customer outage benefits and a smaller substation with high IED integration that could serve as a model for future expansion of SA capabilities.

Assessing Power Factor Control

To stem distribution system losses at peak load, utilities need a power factor closer to unity for greater power efficiency. Adding capacitor banks can reduce system reactive power flow and peak power losses, with improvements to feeders’ voltage profile. So, a utility may need an automated capacitor bank switching system with centralized (sees all system feeders) or substation-based control (just feeders for that SS).

United Illuminating Company (UI) in Connecticut faced this issue and chose to explore the use of a 900 MHz radio-controlled, time-of-day, PC-based system for centralized control. UI had an existing SCADA system and an existing load management system that relied on one-way VHF 174 MHz frequency with no return signal path. With load management, the utility could control customer-participants’ air conditioning compressors, furnaces, pool pumps and so forth. This “spray and pray” approach sent a one-way message to approximately 1,000 units, all with the same address, to turn off. Seven-and-a-half minutes later, a one-way, single message turned them on again. If this approach worked on sufficient numbers of end devices to shave peak load, it was considered successful.

United explored an alternative, more targeted approach of messaging capacitor banks to provide voltage support, reduce operating losses and manage peak load. The question was how to get signals to substation capacitor banks. The solution was to give each capacitor bank a unique address, so a one-way, targeted message could activate a specific capacitor bank. Then SCADA monitoring of volt ampere reactive (VAR) levels could verify that a capacitor bank had received its control message and functioned as ordered.

Between 1983 and 1993, UI reduced distribution system losses from 4.7% to 4.1%.. The utility increased distribution system capacity, reduced substation transformer losses and reduced losses in its transmission network.

The new messaging application on UI’s existing one-way radio platform cost about US$20,000. With capacitor banks providing a more efficient means of supplying mega volt ampere reactives (MVARs), fuel savings resulted, leading to an annual reduction of 11,900 MWh for US$238,000 in annual savings. UI saved another US$8,000 in reduced engineering manpower, that is, UI saved US$2.5 million over 10 years by maximizing the functionality of an existing system with a minimum investment. (How’s that for a BCR?)

A thorough review of potential economic and operational benefits from improvements in the utility’s control of reactive power flow (operational benefits) and savings in fuel costs (economic benefits) led to further action. In 1994, UI instituted a power factor control (PFC) program across its power system for considerable savings by unloading MVARs from transmission and distribution networks due to improved PFC.

One lesson here is that VAR control alone provides big opportunities for benefits, and the same goes for voltage control. In the past, these were done separately but simultaneously and their interaction could negate some of their benefits. Today, with an advanced distribution management system (ADMS), these two applications are integrated for “integrated volt/VAR control,” or IVVC.

Conclusion

Every utility investment, whichever group leads it, must look at the utility-wide benefits. This should be a management requirement, for several reasons. It avoids redundant technology adoption. It creates a stronger business case when all hard benefits are quantified. And it fosters the inevitable transition to a holistically managed, de-siloed utility that pursues holistic, organization-wide solutions. The foregoing examples of various technology projects and the issues associated with building their business case illustrate these fundamental points.

Fortunately, the power industry is beginning to respond with educational opportunities to assist technologists in their business case-building tasks. Recently, I learned of a Washington State University program designed for this purpose. If readers are aware of other such programs, I and other T&D World readers and contributors would benefit from learning about them.

Endnotes

[1] Publicly reported data culled from non-public consultant report.

[2] Massey, David M., “Evaluating SCADA Systems,” TVPPA News (Nov/Dec 1983) [Author’s note: Though some references appear dated, they illuminate business case fundamentals and remain relevant in the literature of technology business cases, which is sparse.]

[3] Wacker, G., Billinton, R., “Customer Cost of Electric Interruptions,” IEEE Proceedings (1989)919-930

Billinton, R., Pandey, M., “Reliability Worth Assessment in a Developing Country,” IEEE Transactions on Power Systems (November 1999)

Kos, P and others., “Cost of Electric Power Interruptions in the Agricultural Sector,” IEEE Transactions on Power Systems (November 1991)

Gates, J and others., “Electric Service Reliability Worth Evaluation for Government, Institutions, and Office Buildings,” IEEE Transactions on Power Systems (February 1999)

[4] Masiello, R.D., Wollenberg, B.F., “Cost-Benefit Justification of an Energy Control Center,” Paper 80 SM 534-8, presented at the IEEE Power Engineering Society Summer Meeting, July, 1980.

[5] McDonald, John D., Flynn, Byron, “Building the Integration and Automation Business Case,” GE Grid Solutions Smart Grid course, 19-21 September 2018, Niskayuna, NY

[6] Haacke, Steve and others., “Plan Ahead for Substation Automation,” IEEE Power & Energy Magazine (March/April 2003)

[7] Boutsioulis, Alex J., “Substation SCADA Automates VAR Control,” Transmission & Distribution (October 1995)

About the Author

John D. McDonald

SmartGrid Business Development Leader

John D. McDonald, P.E., is Smart Grid Business Development Leader for GE’s Grid Solutions business. John has 45 years of experience in the electric utility industry. John joined GE on December 3, 2007 as General Manager, Marketing for GE Energy’s Transmission and Distribution business. In 2010 John accepted the new role of Director, Technical Strategy and Policy Development for GE Digital Energy. In January 2016 John assumed his present role with the integration of Alstom Grid and GE Digital Energy to form GE Grid Solutions.

John was elected to the Board of Governors of the IEEE-SA (Standards Association), focusing on long term IEEE Smart Grid standards strategy. John was the Chair of the Smart Grid Interoperability Panel (SGIP) Governing Board for 2010-2015 (end of 1Q) coordinating Smart Grid standards development in the US and global harmonization of the standards. John is a member of the NIST Smart Grid Advisory Committee and Chair of its Technical Subcommittee.

John is Past President of the IEEE Power & Energy Society (PES), Finance Committee Chair of the Smart Energy Consumer Collaborative (SECC) Board, the VP for Technical Activities for the US National Committee (USNC) of CIGRE, and the Past Chair of the IEEE PES Substations Committee. He was on the IEEE Board of Directors as the IEEE Division VII Director. John is a member of the Advisory Committee for the annual DistribuTECH Conference, on the Board of Directors and Executive Committee of the GridWise Alliance and Finance Chair, Vice Chair of the Texas A&M University Smart Grid Center Advisory Board, and member of the Purdue University Strategic Research Advisory Council. John received the 2009 Outstanding Electrical and Computer Engineer Award from Purdue University.

John teaches a Smart Grid course at the Georgia Institute of Technology, a Smart Grid course for GE, and substation automation, distribution SCADA and communications courses for various IEEE PES local chapters as an IEEE PES Distinguished Lecturer (since 1999). John has published 100 papers and articles in the areas of SCADA, SCADA/EMS, SCADA/DMS and communications, and is a registered Professional Engineer (Electrical) in California, Pennsylvania and Georgia.

John received his B.S.E.E. and M.S.E.E. (Power Engineering) degrees from Purdue University, and an M.B.A. (Finance) degree from the University of California-Berkeley. John is a member of Eta Kappa Nu (Electrical Engineering Honorary) and Tau Beta Pi (Engineering Honorary), a Life Fellow of IEEE (member for 48 years), and was awarded the IEEE Millennium Medal in 2000, the IEEE PES Excellence in Power Distribution Engineering Award in 2002, the IEEE PES Substations Committee Distinguished Service Award in 2003, the IEEE PES Meritorious Service Award in 2015, the 2015 CIGRE Distinguished Member Award and the 2015 CIGRE USNC Attwood Associate Award.

John has co-authored five books and has one US Patent: Automating a Distribution Cooperative from A to Z: A Primer on Employing Technology (National Rural Electric Cooperative Association – 1999); Electric Power Substations Engineering (Third Edition) (CRC Press – 2012); Power System SCADA and Smart Grids (CRC Press – 2015); Big Data Application in Power Systems (Elsevier - 2017); Smart Grids: Advanced Technologies and Solutions (Second Edition) (CRC Press – 2018); and US Patent (9,853,448) on Systems and Methods for Coordinating Electrical Network Optimization (December 26, 2017).