COVID-19 Crisis Reveals Turbulent Future for US Electricity Markets

Decreased electricity consumption during the COVID-19 crisis is revealing dramatic changes ahead for electricity markets as ratios of renewable energy generation again approach today’s levels, according to leading global flow battery company, Invinity Energy Systems.

California, which draws a large part of its energy needs from renewable sources, has recently seen daily near-zero electricity market prices as supply outstrips demand and dramatic increases in price just hours later. This highlights the important role that energy storage can play, absorbing renewable energy when it is in abundance and deploying that energy when grid loads are at their peak. This capability will allow more renewable generation to be deployed, while ensuring that existing markets continue to function efficiently and effectively.

This evidence is becoming clear at a critical moment for the energy transition, after the US Energy Information Administration (EIA) revealed that renewable generation is set to outpace coal generation in the US for the first time ever. While this achievement is at least partly due to a reduction in demand caused by the COVID-19 pandemic, the current market situation in California shows what a low-carbon, high-renewable future may hold.

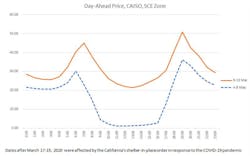

This impact becomes clear when comparing compare day-ahead pricing curves in the California wholesale market for March (pre-COVID-19) and May (shown in the following graph). The distinctive “duck curve” caused by daytime solar generation is visible in both, but the reduction in demand during the COVID-19 crisis has yielded an unprecedented number of hours per day with near-zero electricity pricing.

Is this radical “duck curve” the shape of things to come? California’s energy regulators believe so, and to that end have recently launched a solicitation to fund long-duration storage to meet the state’s 2045 mandate for electricity sector decarbonization. The rapid decommissioning of coal-fueled generation and ever-increasing levels of renewables means the solutions for that future are already beneficial today. Flexible storage assets, such as flow batteries, can ensure consumers have access to low-cost, low-carbon electricity by absorbing mid-day renewable oversupply and delivering clean, low-cost energy into the evening peak.

Matt Harper, Chief Commercial Officer at Invinity said: “2020 was already set to be a milestone year for the energy transition in the US, and we can see that COVID-19 has dramatically accelerated that shift. It is a historic moment which is being matched globally, as renewable generation records are set around the world.

“California’s changing supply and demand dynamics can clearly be seen in the current market, and this price volatility is only going to increase as more of the State’s energy needs are supplied by clean, renewable sources. These past few weeks are highlighting the huge opportunities for Invinity’s industrial scale, highly economical storage solutions to reinforce the shift to green energy.”

Invinity Energy Systems was formed in April this year following the merger of two leading flow battery firms, Avalon Battery and redT. This transatlantic merger has created a worldwide leader in the vanadium flow battery space with a global market footprint and a near-term focus on the North American energy storage market.

Vanadium flow batteries will play a crucial role in supporting the energy transition. Excelling at heavy-duty, stationary, high-utilization applications, they are ideal for storing and releasing energy on demand from industrial scale solar generation, delivering more flexible, more valuable low-carbon energy projects. Applications like this demand energy storage capable of delivering hours of power every day for decades; this heavy duty cycle is well suited to flow battery technology, part of the reason the market for this technology is expected to exceed $4.25 billion by 2028.

Vanadium flow batteries (VFBs) are seen as one of the foremost competitors to existing lithium-ion technology and possess a number of key competitive advantages in terms of performance, duration and lifetime over the incumbent technology. Persistent concerns around lithium-ion safety and raw material sourcing practices also present opportunities for non-flammable, sustainably-sourced alternatives, of which vanadium flow batteries are a contender.