The electric power industry is expected to experience as much as a tripling of electricity demand by 2050. Further electrification of energy end uses, data center growth, and reshoring of manufacturing could all contribute to this trend. But while this new load could bring additional revenue, preparing for it could challenge the power sector in an increasingly complex and often resource-constrained environment. New policies, technologies, and market innovations could help the industry navigate these challenges.

For example, three challenges currently confronting the electric power industry are resource adequacy, water risk, and capital constraints.

Resource adequacy

In recent years, the North American Electric Reliability Corporation (NERC) has issued seasonal warnings that as much as two-thirds of North America could risk energy shortfalls during periods of extreme summer demand or peak winter conditions. Rising electricity demand could combine with increasingly extreme weather and other trends to increase reliability risk if not addressed. These trends include increasingly variable output as the generation mix incorporates more renewables and distributed energy resources, continued retirement of baseload coal- and gas-fired plants, and delays bringing renewable generation and storage projects online.

To help address this risk, the power industry can consider a variety of approaches, including:

- Adding generation capacity

- Expanding transmission capacity

- Increasing regional/interregional coordination and electricity transfers

- Deferring baseload or peaker plant retirements

- Deploying utility-scale storage

- Harnessing EVs and other DERs, including flexible load programs

- Implementing virtual power plants (VPPs)

- Improving distribution system planning (DSP)

- Integrating DSP with Integrated Resource Planning (IRP)

The last three approaches are among those gaining traction recently. VPPs, which typically consist of distributed generation, storage, demand resources controlled by software, or all of these resources, could be well-suited to help meet electricity demand spikes. Improving DSP and integrating it with the forward-looking planning currently applied to the bulk electricity system in utilities’ IRP is another approach that companies are considering. Such an integrated grid-planning model would seek to more accurately forecast load and enable cost-effective solutions to address future capacity needs. Utilities can use new tools and technologies such as advanced analytics and AI to handle more of the complex data sets that would be required.

Water risk

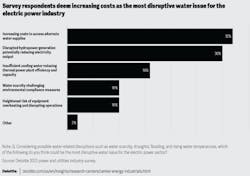

Extreme heat and drought conditions increasingly threaten to disrupt power sector operations. The American West is drier than it’s been in 1,200 years and researchers expect it to get hotter and drier. Prolonged drought conditions can reduce hydroelectric output, decrease thermal plant efficiency and output, raise carbon emissions, and potentially lead to plant shutdowns. In a recent Deloitte Power and Utilities Industry Survey, respondents selected increasing costs as the most disruptive water issue for the electric power industry, followed by disrupted hydroelectric output, reduced thermal plant efficiency, environmental compliance challenges, and equipment overheating.

Approaches the electric power sector can consider to mitigate growing water risk include:

- Improved technology: US power generation water intensity fell about 29% from 2015 to 2021, with the shift away from coal-fired plants to less water-intensive combined-cycle gas plants.

- Renewables growth: While solar and wind generation capacity has been growing rapidly, the plants do not rely on cooling water.

- Sustainable water strategies: Power plants can use brackish water, greywater, or recycled water for cooling, rather than freshwater.

- Increased water scrutiny: The industry is increasingly monitoring water stress and incorporating water risk into financial disclosures.

Capital constraints

Power and utilities sector capital expenditures reached new heights in 2023 and will likely continue rising. S&P estimates its sample group of large energy utilities spent nearly $171 billion in 2023, up more than 18% YoY, and projected to rise further in 2024 to 2025 (S&P Global Market Intelligence). Costs are mounting to upgrade and modernize the grid, harden it against severe weather, prepare for rising demand, and source more renewable energy. Interest rates and inflation could continue to boost costs this year. But after a 25% average residential customer bill increase over the last five years, utility regulators may be more likely to challenge and limit utility customer rate increases than previously. Therefore, even with increasing sales, utilities may choose to explore alternative funding sources.

To fund the robust capital programs often required to upgrade, modernize and decarbonize the grid, in an environment where rate hikes may be limited, electric companies are exploring alternative sources of cash. For example, many companies are harnessing savings from operational efficiencies, often gained through technology deployment. Some have been selling non-regulated assets such as solar and wind plants, or non-core gas distribution assets. Many are tapping into the grants, loans and tax credits provided by the Inflation Reduction Act and Infrastructure Investment and Jobs Act. And others are innovating within their business models, such as by planning to install residential storage systems to bolster resiliency in lieu of larger infrastructure projects.

Generative AI could be a powerful tool for addressing core industry challenges

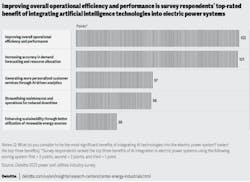

The power sector is on the verge of entering a transformative era, led by generative AI, a subset of artificial intelligence that has the potential to eventually help address core power industry challenges. Generative AI creates new content in the form of text, code, voice, images, videos, and processes. This technology is already being used within the industry to improve customer engagement, reliability, affordability, efficiency, sustainability, and health and safety (Deloitte analysis). According to Deloitte’s Power and Utilities Industry Survey, respondents most value the ability of AI to help improve overall operating efficiency and performance.

In 2024 and beyond, generative AI and other large language models (LLMs) are expected to expand the industry’s capabilities to handle tasks such as complex data analysis, pattern recognition, forecasting, and optimization. This could enable new solutions to some of the core challenges.

Jim Thomson, vice chair, US Power, Utilities & Renewables leader, and principal, Deloitte Consulting LLP.